Tag: time cycles

How To Swing Trade Stock Time Cycles: STONECO Trade Review, Part 1 #swingtrading #timecycles

Swing Trading Structured Charting Stock Time Cycles for Predictable Wins and Significant Gains. Part 1.

The STONECO (STNE) Trade Provides an Excellent Opportunity for a Tutorial on How to Swing Trade Stock Time Cycles.

Time cycles are through-out the financial markets, indices, sectors, equities (stocks), commodities, currencies, crypto and in every corner of the financial markets.

- One of the single most considerable trader “edges” we have in our tool kit are time cycles.

- Stock time cycles allow for a trader to gain a better probability edge.

- Time cycles in stock trading allow a trader to better time entries and exits in a trade, time trades and establish appropriate size risk.

The STONECO trade example provides swing traders with a clear idea of how this swing trading strategy works.

In Part 1 we look at the the trade executions, the entries and profit taking areas of trade.

In Part 2 (Premium User) we will look at how exactly traders can replicate our success in this specialized area of swing trading expertise. How to chart the structure of the stock, choosing the best time-frame for the trade, time cycles, advanced Fibonacci Retrace levels and chart modeling, sizing your trade, exits and entries, risk management and more.

Okay, lets look at the trade itself first:

Finding a systematic trading process provides a trader’s edge. The more a trader has, the better. Learn to play the game better, achieve better returns.

Life is like a game of cards. The hand you are dealt is determinism; the way you play it is free will.

Jawaharlal Nehru

Life is like a game of cards. The hand you are dealt is determinism; the way you play it is free will.

Jawaharlal Nehru

— Melonopoly (@curtmelonopoly) June 18, 2020

Below is a tweet I sent out today that includes screen shots of the swing trade alert feed of the charting and alerts for exits and entries in this time cycle trade.

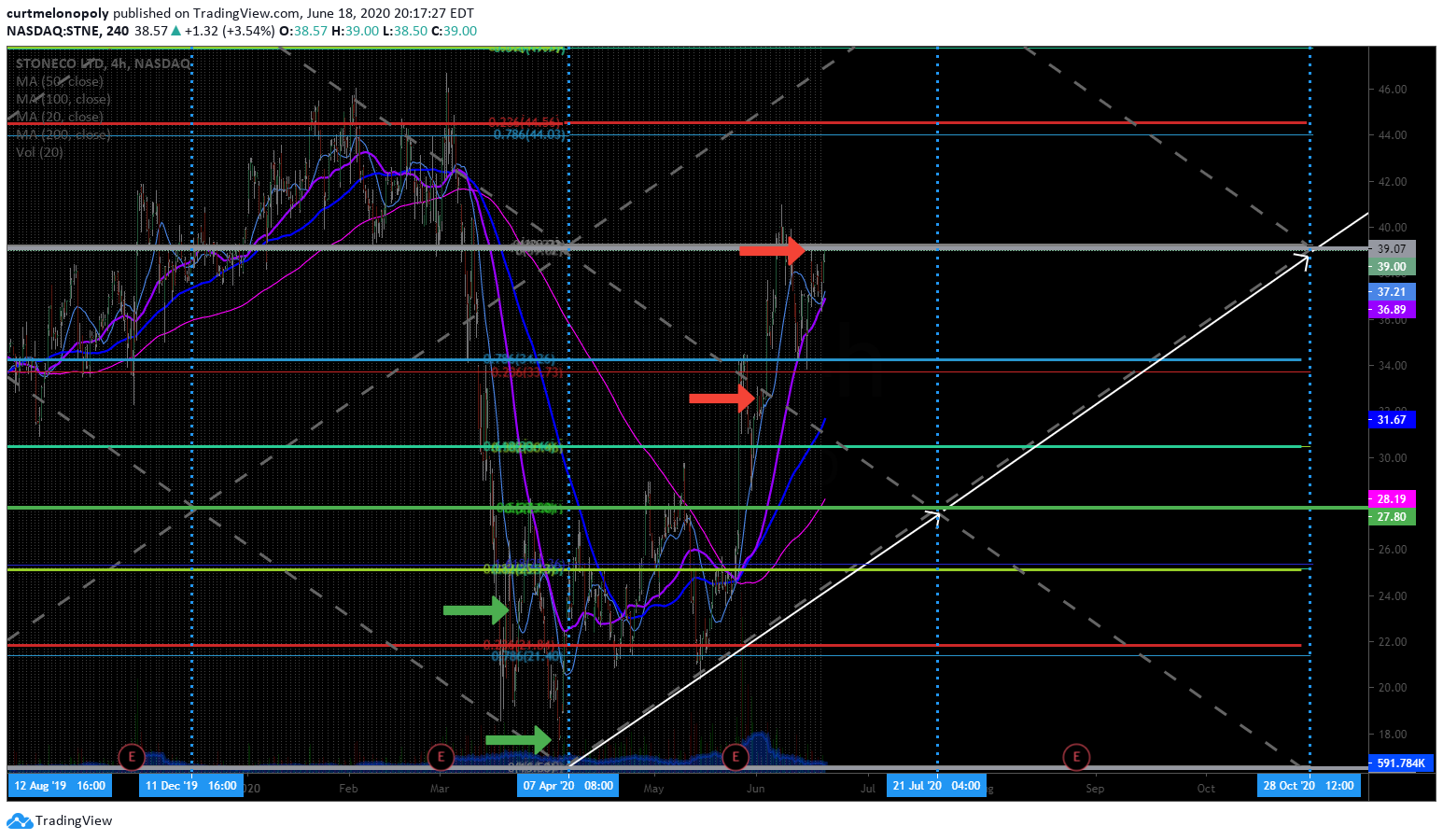

What #timecycle #swingtrade looks like on structured model.

Vertical blue lines are time cycle peaks.

Long IN SIZE & added IN SIZE in to time cycle sell off (blue vertical, trading fear) while others panic.

Near double $STNE time cycle trade

Alerts & charting

What #timecycle #swingtrade looks like on structured model.

Vertical blue lines are time cycle peaks.

Long IN SIZE & added IN SIZE in to time cycle sell off (blue vertical, trading fear) while others panic.

Near double $STNE time cycle trade🎯🏹🔥

Alerts & charting👇 pic.twitter.com/nlOqqKDqrx

— Melonopoly (@curtmelonopoly) June 19, 2020

“Long in SIZE” means that I entered this trade and ADDED to the trade in size. 4/10 sizing (20% on the initial entry and 20% on the adds) for me is massive. This means I was 40% in this trade long of what my maximum trade size tolerance was, most trades

I don’t get above 30% because I am a position trader within the structure of the financial instrument. I need room to get out of the trade if it goes against me.

How? I know where the next support is. If I’m in a trade 30% size I can amp up my size on a very short term at the next support say another 30% for a bounce back to my entry and clear out. If that leg support doesn’t bounce or hold then I need to exit the swing trade. This is how I win a significant percentage of swing trades, I manage size and I know the playing field of trade (the structure of the stock chart support and resistance).

You can see in the swing trade alerts in the above tweet with screen shots that my first entry didn’t hold and the trading price of the stock continued down. This is an example of sizing properly, managing risk and knowing your charting structure to win big.

My second entry, “the adds” were as price was collapsing in to the peak timing of THE TIME CYCLE (see blue vertical line).

The sell off was the COVID fear sell off and we were managing over 60 equity swings so the alerts weren’t the most clear, however, we do and did provide other reporting, swing trade $STUDY sessions and various other subscriber guidance. The screen shots of the swing trade alert feed provided are just some examples.

As the trade started to go my way I started to trim profits and today trimmed profits to the point of only having 5% of my original size left because a key area of the stock structure is where trade was post market today.

You can see in the chart below the time cycles, the key horizontal Fibonacci levels for support and resistance, the diagonal Fibonacci trend lines and the entries (marked in green arrows) and the exit areas of the swing trade (marked with red arrows).

I encourage anyone that wants to learn how to increase their win rate swing trading (or even day trading) and returns on trades to increase your Profit and Loss to learn how to trade time cycles.

The power of these structured swing trade set ups we are working with can’t be understated

2x – 10x wins with high probability & managed process to protect downside. And we’re coding it too.

Do your DD, review the alert feed and see for yourself.

#SwingTrading $VERI

The power of these structured swing trade set ups we are working with can't be understated 🎯🏹🔥

2x – 10x wins with high probability & managed process to protect downside. And we're coding it too.

Do your DD, review the alert feed and see for yourself. #SwingTrading $VERI pic.twitter.com/g7hYaNjmeW

— Melonopoly (@curtmelonopoly) June 18, 2020

An example of time cycles in volatility is in the article below, we are currently writing a series of time cycle articles for our swing trade members to learn how this trading strategy can increase profitability significantly.

In Part 2 we unpack exactly how this trading strategy works – technical analysis and charting the structure of the stock, trading time-frames, time cycles, advanced Fibonacci Retrace levels, sizing, exits and entries, risk management and more.

As always, if you have any questions reach out anytime compoundtradingofficial@gmail.com.

Peace and best.

Curt

Current List of Available P&Ls (remaining dates are in progress now to be released soon):

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trades.

- Swing Trading Alert Profit Loss – Annualized ROI 1543.93% Feb 1-Feb 21, 2020. $200,000.00 – $230,051.00 #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trading Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics: Swing Trading, Time Cycles, Stocks, How To, Trade, Alerts, Charting

Volatility Time Cycle Code Break 2020/21 Update (Part 1) $VIX $VXX $OVX $UVXY $TVIX #swingtrading #timecycles

Volatility (VIX) Market Time Cycle Update for 2020/21. Part 1 – A Review of Recent Volatility History.

Volatility time cycles affect the financial markets globally. Our time cycle work focuses on Volatility as a foundation and our trading in other key instruments reflects this. Other key instruments are SP500 $SPY $SPX, Crude Oil $CL_F $USO $USOIL, Gold $GC_F $GLD, Silver $SLV, US Dollar $DXY $UUP, Bitcoin $BTC.

We also weigh our stock swing trading (position trading) heavily on our time cycle work in Volatility.

In recent months and years our time cycle work has predicted the primary volatility spikes in markets with uncanny accuracy, this has significantly bolstered our Profit & Loss in Volatility trading, commodities, stocks and crypto.

This series of chart model updates and guidance provides the most recent code break updates for Volatility and the other instruments of trade listed above. First lets look look at Volatility (VIX).

Volatility (VIX) Index last peaked in a primary time cycle trading in the low 80’s between March 7-17 2020. It was trading below 20.00s for sometime prior and then volatility spiked.

This presented our trading team and subscribers the opportunity to add to our long positioning in $VXX (short term volatility) and $OVX (oil volatility) in advance of the spike. It also allowed for us to prepare for a significant market sell-off. We closed all long positions in equities four days prior to the SP500 starting it’s COVID sell – off. We had opportunity to the short in size equities such as MasterCard (MA), Nike (NKE), WYNN RESORTS (WYNN) and many more for significant gains.

Last #timecycle we sold off longs 4 days b4 turn down, hammered short Mastercard $MA, WYNN $WYNN, NIKE $NKE etc & long $VIX $OVX at lows when hardly anyone was positioning same, then covered shorts in to turn, long $BA etc recent rally (check dates) #timecycles #swingtrading

Last #timecycle we sold off longs 4 days b4 turn down, hammered short Mastercard $MA, WYNN $WYNN, NIKE $NKE etc & long $VIX $OVX at lows when hardly anyone was positioning same, then covered shorts in to turn, long $BA etc recent rally (check dates) #timecycles #swingtrading pic.twitter.com/BpVaQW8cxQ

— Melonopoly (@curtmelonopoly) March 25, 2020

$OVX spiked from the 20.00s to 330.00s and even flashed in to the 500.00s. We were adding long positioning in $OVX in the 20.00s and selling as the price spiked in to 330.00s. We didn’t hold to the 500.00s. We also had opportunity to profit from $VXX in the volatility run-up.

There were many other trades around this time cycle that benefited our performance greatly. Look for our Profit and Loss Statements soon to be release (posted to the main page of www.compoundtrading.com).

More recently there was a volatility mid cycle inflection that seen VIX start to rise June 8 from low 20s to mid 40s over a week.

The inflection points between significant cycle peaks are areas of possible spikes. We recently adjusted for this possible inflection and it paid dividends, nothing like the primary March 2020 time cycle spike, but paid us and helped adjust various other swing trade holdings.

I have been reporting to our members for some time that this season of time cycles (2020 – 2025) would see significantly more volatility within volatility, a compression of time cycle duration(s) and viciousness of the cycle peaks. The most recent “inflection” is evidence of the compressed timing of cycles (volatility within volatility cycles and the time between spikes).

Even the most recent Volatility $VIX inflection was a decent trade with $VXX spiking in to 45.00s from high 28.00s and the primary cycle seen 13.00s to 78.00s, not bad.

Most recent $OVX Crude Oil Volatility started to spike in March from 20.00s to 330.00 and then really hit end of April in to 500s. #swingtrading $OVX

During the last time cycle we we buying oil volatility on every dip at near bottoms knowing where the time cycle peak was, $OVX was in the 20’s and rocketed in to the 300s fast, we didn’t hit that by coincidence. Our $VIX model is clear, the cycles are very clear. #timecycles

During the last time cycle we we buying oil volatility on every dip at near bottoms knowing where the time cycle peak was, $OVX was in the 20's and rocketed in to the 300s fast, we didn't hit that by coincidence. Our $VIX model is clear, the cycles are very clear. #timecycles pic.twitter.com/SZ8vzMQwRg

— Melonopoly (@curtmelonopoly) April 1, 2020

So this is an example of how the primary volatility indicator $VIX time cycles can be used for other related market instruments and also why it is important to have the time cycle models for the other instruments you trade as well, in this instance crude oil. What a trade that was.

We also use $TVIX and / or $UVXY on short time frames right in to the time cycles. Instruments you do not want to hold.

$TVIX up 41% today, pays HUGE to know your Time Cycles, also protects your ass ets knowing the time cycles $VIX #volatilitytrading #timecycles

$TVIX up 41% today, pays HUGE to know your Time Cycles, also protects your ass ets knowing the time cycles $VIX #volatilitytrading #timecycles pic.twitter.com/oTfy2E2lem

— Melonopoly (@curtmelonopoly) June 11, 2020

So that is a review of what has happened in volatility so far in 2020 and next we need to look at what’s next in volatility trading and develop our trading strategies for volatility and related instruments.

Part 2 (premium) article for Volatility $VIX time cycles will provide the charting models, time cycle dates for primary volatility time cycles, inflection dates on watch, compressed volatility within volatility dates, support (buy zones) with timing and resistance selling zones with price targets for the dates within the cycles going in Q3 and Q4 2020 and then in to 2021.

The most recent Swing Trading Sunday $STUDY Webinar session on June 14, 2020 had a dedicated segment on volatility time cycles so in part 2 we will start with that video and then start to break open all of the trading strategies for volatility going forward.

There will be historic opportunities in these large time cycle between 2020 – 2025 as I have been saying for a number of years, do not waste it! This is a life changing season of trade for traders.

Part 2 of this article is available here for members:

As always, if you have any questions reach out anytime compoundtradingofficial@gmail.com.

Peace and best.

Curt

Current List of Available P&Ls (remaining dates are in progress now to be released soon):

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trades.

- Swing Trading Alert Profit Loss – Annualized ROI 1543.93% Feb 1-Feb 21, 2020. $200,000.00 – $230,051.00 #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trading Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, time cycles, volatility, $VIX, $VXX, $OVX, $UVXY,, $TVIX

Market Report: Premarket $TSLA, $BA, $AAPL, $INTC, FOMC, API Crude Oil, EIA, Oil Trade Alerts, $CL_F, $USO, Swing Trading, Day Trading, Time Cycles

Market Update: Premarket Trading

Morning traders,

Monday was quiet for us, most of the portfolio rising, some trimming of profits of course, best swing run in our history.

The Boeing $BA trade below is an example of the time cycle we’ve had on the swing trading platform:

What a great trade, more than a double in Boeing $BA from 107s to 231s, holding some profit runner 🎯🏹🔥

#swingtrading

What a great trade, more than a double in Boeing $BA from 107s to 231s, holding some profit runner 🎯🏹🔥#swingtrading pic.twitter.com/mnsoSxstIY

— Melonopoly (@curtmelonopoly) June 8, 2020

Still have many profit runners and new positions start over the next 7 or 8 trading days for the cycle in to end of August – watch the swing trade alerts feed for new positions as we come out of this time cycle inflection.

$AAPL $INTC – Apple announcing Mac chips at WWDC – Bloomberg https://seekingalpha.com/news/3581457-apple-announcing-mac-chips-wwdc-bloomberg?source=tweet #swingtrading

$AAPL $INTC – Apple announcing Mac chips at WWDC – Bloomberg https://t.co/RA5Kzcr8zy #swingtrading

— Swing Trading (@swingtrading_ct) June 9, 2020

Today is soft so far, except some highly speculative day trader stocks $IDEX $IZEA $EYES $AQMS etc wow. Watching close.

Going to short TESLA $TSLA to the moon and back when the time is right

“I would like to be able to get more money to buy more

@Tesla

actually,” says legendary investor Ron Baron. $TSLA

"I would like to be able to get more money to buy more @Tesla actually," says legendary investor Ron Baron. $TSLA pic.twitter.com/sCt9dr4mDu

— Squawk Box (@SquawkCNBC) June 9, 2020

We’re in live trading room, EPIC oil trading software active so the live oil trading alerts are also, likely some day trades firing in to open and swing trading reporting coming today with a number of set-ups, time cycle inflection last week this week so we’ll see how that goes.

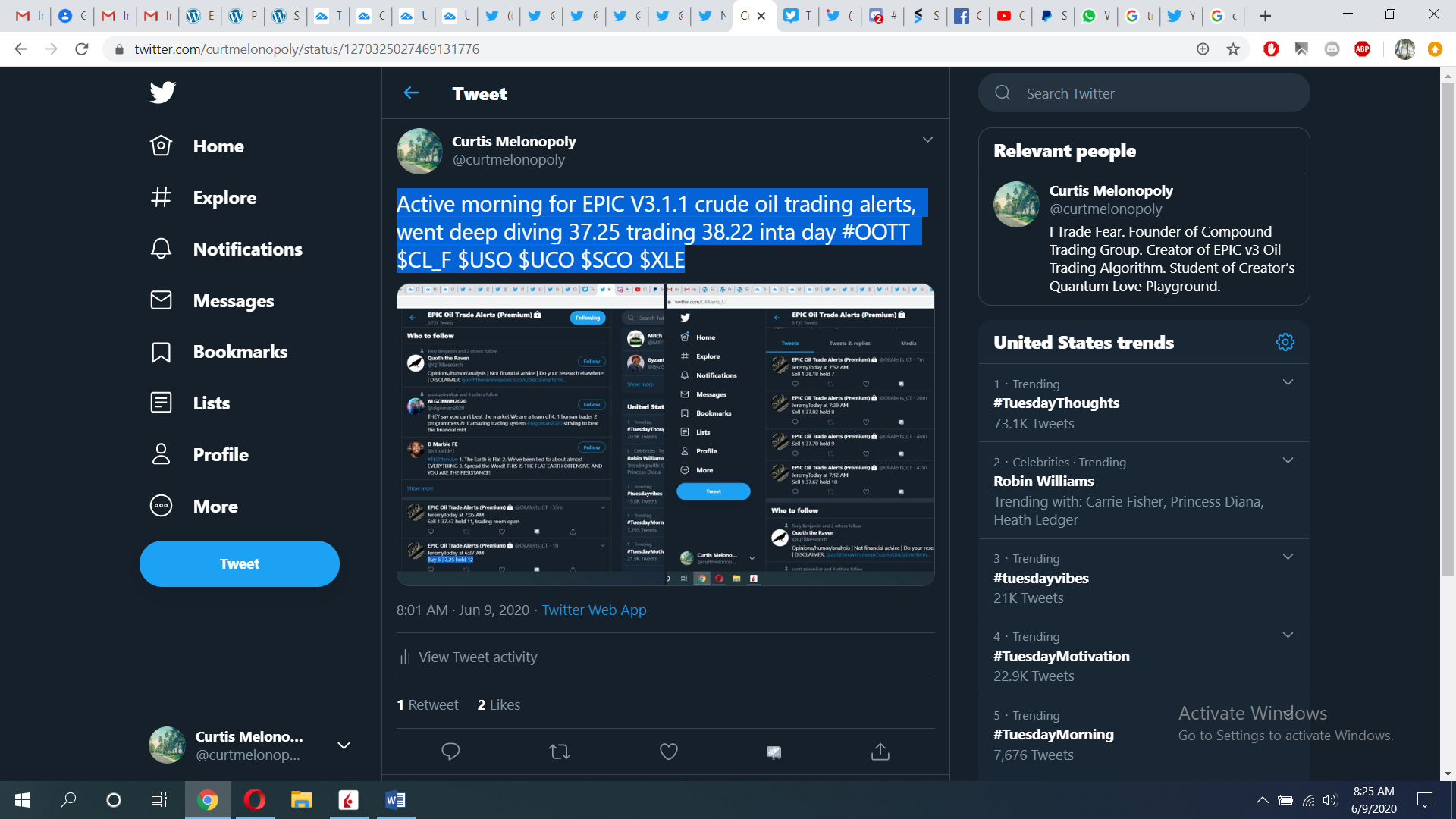

Active morning for EPIC V3.1.1 crude oil trading alerts, went deep diving 37.25 trading 38.22 inta day #OOTT $CL_F $USO $UCO $SCO $XLE

Active morning for EPIC V3.1.1 crude oil trading alerts, went deep diving 37.25 trading 38.22 inta day #OOTT $CL_F $USO $UCO $SCO $XLE pic.twitter.com/CLLa0TseqW

— Melonopoly (@curtmelonopoly) June 9, 2020

Oil down on stronger dollar, oversupply concerns https://reut.rs/2Ygx7DV #OOTT $CL_F $USO $USOIL Thread https://twitter.com/davidgaffen/status/1270322515047481346

https://twitter.com/EPICtheAlgo/status/1270328242520670211

Some on schedule:

FOMC

FOMC decision: What to know in the week ahead

https://twitter.com/CompoundTrading/status/1270322725735804928

8:55

Redbook

10:00

Wholesale Trade

JOLTS

4:30

API Crude Oil Data with EIA 10:30 Wed

LIVE: President

@realDonaldTrump

holds a news conference

LIVE: President @realDonaldTrump holds a news conference https://t.co/qfXa9nMlTD

— The White House 45 Archived (@WhiteHouse45) June 5, 2020

Thanks

Curt