An Insider’s Look at Daytrading Crude Oil – Against The Machines | Live Trade Alerts Guidance by our Lead Trader in Oil Trading Room

Tonight when I sat down to my trading desk I didn’t intend to trade crude oil, but I knew that our lead Computer Scientist Jeremy had been tracking some machine liquidity sweepers in oil futures and indices markets since earlier Tuesday April 28, 2020.

So I was ready for anything.

We’ve been watching the crude oil machine order flow in the markets for the last 12 hours or so – since the AI’s showed up in flow earlier on EPIC IDENT software.

The machine programs have been slowly taking hold of the intra-day oil trading structure more and more over the course of the day on each time frame from 15 second micro daytrading charting time-frame through to 1 minute, 5 minute and 60 minute time-frames that I will show you below.

Anyway, when I sat down for my daily market prep $STUDY session I realized the machines were firing long in to some price targets on the 60 minute oil chart time-frame structure. I knew that our software wouldn’t start trade executions yet (it needs a certain amount of machine order flow to support its bias and start triggering).

If you haven’t read the EPIC V3 Crude Oil Machine Trading White Paper yet you can read about the rule-set instructions it fires trades to here: White Paper Updated Dec 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading.

So I knew the machines in crude oil futures trade were / are firing long in to a price target for Thursday 1:00 PM based on the 1 hour oil charting time-frame (from that specific algorithmic model). So I took the trade before I finished my first coffee.

By the way, we trade when the machine flow is in the markets because it becomes unfair for the competitors, in other words, our win rate skyrockets because we have intelligence the average oil day-trader does not have (unless they are employing high-end machine intelligence).

Below is one example, I just closed out the day-trade in crude oil futures you will see here.

I provide what I can (I can only show you so much) but what you will see below are the screen images from the oil trading room and oil trade alerts feed and algorithmic trading chart models that represent our machine trade for some of the time-frames. The guidance I provided the oil trading room and oil trade alert feed are included.

If you read this document carefully…

You will notice if you read this document carefully that I explained to the trading room what the machines would do in advance of it actually happening. On each time frame of trade we know what the decisions are algorithmically for the machine order flow.

I explained to the trading room what the machines would do in advance of it actually happening.

The charts below from the trade alerts and oil trading room are time stamped in the top left hand corner of the image .

I hope you enjoy the disclosure, here it is;

First the earlier trade set-up strategy commentary and guidance from the oil trading room earlier in the day discussing the upcoming time cycle in crude oil and machine order flow identified in markets.

Crude oil trading structure suggests decision for leg up or down prior to Thurs 1200 EST PM #oiltradingroom

Oil trading room commentary, discussion about oil strategy call that worked and order flow identified.

JeremyToday at 10:19 AM

That was the strongest progressive order flow in the recent lows we have seen yet, likely machine programs in that rally. Time cycle for Thur 12:00 PM EST looks like the inflection (sometime prior). EPIC V3.1.1 was very close to firing, next rally we would expect programs to start.

Curt MelonopolyToday at 10:19 AM

Nice, thanks J

JeremyToday at 11:53 AM

Those SPY blocks from this morning you may see on social media people talking about, the machine programs coincide on CL progressive blocks. Same entity(s) likely.

Curt MelonopolyToday at 11:55 AM

thanks J

And one of my best oil trade alerts this week was here;

luisitoToday at 1:45 PM

Looking for a possible bounce from 10.00 area to 13.00s, trading 11.24 and dropping. FX USOIL WTI

@Curt Melonopoly amazing call

Curt MelonopolyToday at 1:45 PM

well thanks @luisito i’ll take what i can lol

we’re just watching this order flow now in to settlement because there were some sweepers in earlier today CL and SPy

luisitoToday at 1:47 PM

Curt: is a 400 ticks call. 100 down, 300 up.

Oil trading room commentary, discussion about oil strategy call that worked and order flow identified #oiltradingroom

Curt MelonopolyToday at 1:48 PM

ha ya, hopefully the next is better, if we get follow through above the earlier blocks we should see 19.46

have to see if the sweeper push it

Curt MelonopolyToday at 2:32 PM

As expected: Moderate above VWAP in to settlement, reflects market action & order flow, API and EIA then likely reversal to 19.40s, we’ll watch and see if the sweepers return. Should see EPIC (I know I’ve said it last week but structure needs to be there and it seems were there)

Very technical move in crude oil, post EIA should provide exceptional trading opportunity, structure returning fast.

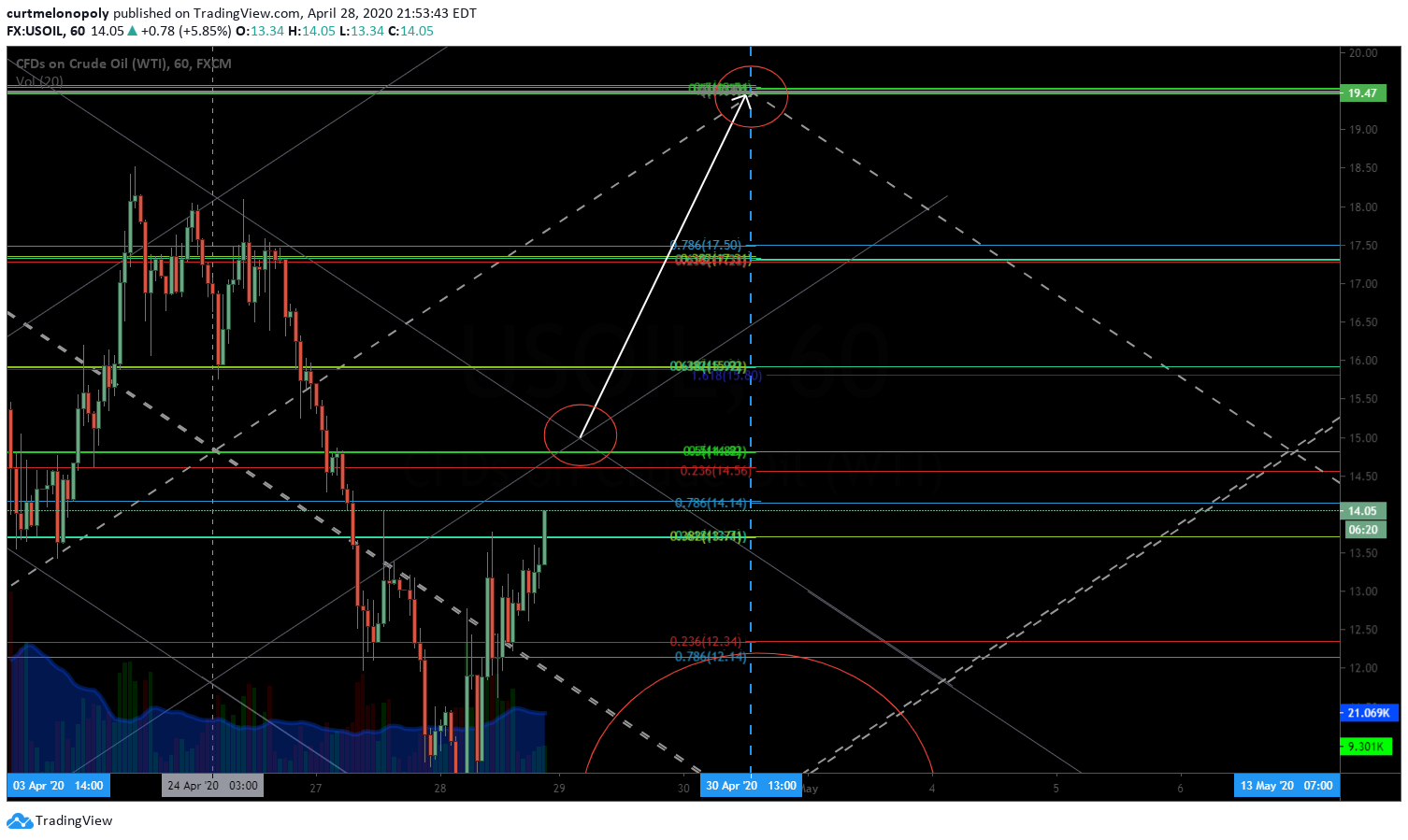

If the machine bulls get their way, 19.47 Thursday 100 PM is the mark, 600 ticks, trading 13.56, 1 hr firing clean #oiltradealerts

Oil Trading Room alerting first trade entry – I’m going to go with this tight stops 1-10 13.59 long. #oiltradingroom

I’m going to go with this tight stops 1/10 13.59 long. Likely fails but I’m going to try and build above 13.56. So I’ll close under go above around that pivot. Quoting FX USOI WTI traded on CL.

The one minute support (pivot) I am speaking about (white arrow), but they have to clear 1 hour resistance on previous chart. #oiltradealerts

Hoping my long position sees a bit of a squeeze in oil futures here in to 1030 PM EST time cycle peak on 5 min timeframe #oiltradealerts

I marked the price targets for intra day machine route bias to the 19.47 price target Thursday. See chart. #oiltradealerts

Screen capture of actual oil trade alert from private member feed – 14.19 is the next resistance trading… #oiltradealerts

14.19 is the next resistance trading 14.05 so i may close 14.18 area and see if we pull back and then go again.

Bulls are taking some profit at 14.04 recent double top area of price, so we’ll see how this shapes up or down #oiltradealerts

Based on the first symmetrical extension on the 1 min your new pivot is approx 13.74, so if bulls are firing on 1 min this should hold.

If your 1 min symmetrical pivot support doesn’t hold then look to 5 min 20 MA for bulls to go or not in to 1030 timing #oiltradealerts

Screen capture image of oil trading alert private feed where I close the oil trade for a win and explain decisions #oiltradingalert

Screen shot image captured of actual oil trading room discussion from lead trader and guidance for trade plan #oiltraderoom

I am going to let them go from here without me and on a pull back (likely after time cycle peak) then I will re-enter long for the next leg up.

I got a 58 point move there on that time cycle, symmetrical set-up s I’m happy with that considering time of day.

I may have made the right decision, if 13.94 fails then likely they don’t make the resistance break 14.19 on crude oil hourly.

I got my bullish extension on 1 min symmetrical move as planned, lets see if I get a pull back, still time n to 1030 time cycle for more #oiltradealerts

You can see how the squeeze is occurring in crude oil in to the time cycle at 1030 PM as it did at 730 PM #oiltradealerts

I may have made the right decision, if 13.94 fails then likely they don’t make the resistance break 14.19 on crude oil hourly. #oiltradealerts

Over 14.19 in crude oil trade on FX USOIL WTI 14.56 then 14.80 are your next intraday resistance #oiltrading #daytrading

You can see how bulls in oil trade are firing off the trajectory arrow toward the price targets I’m alerting, when it fails watch out #oiltradealerts

Bulls only have 5 prime minutes left (10 total) and trajectory for 14.56 price target comes in at 1057PM so they need a squeeze #oiltradealerts

They have 4 minutes left to 5 min candle expiry, at 1035 if price target not hit the advantage goes to bears short term #oildaytrading

At 103230 they are firing off half time on 5 min candle decision half range pivot support, if it fails they likely fail here #oiltradealerts

At turn of 1035 PM 5 min candle first signs of break down are appearing #machinetradingoil

If the break down continues, the first real buy trigger for the bulls again is 200MA on 1 min likely at 1100PM #daytradingcrudeoil

Here’s your 200 MA price hit on the crude oil 1 minute time frame, just below is vwap and 1 min range support #oildaytrading

And now the pinch between the 20 MA to upside of price and 200 MA support lower than price for a decision #oiltrading #technicalanalyis

I am sure you can see from the trade action in the oil futures markets how it is best to have machine trade intelligence on your side if you are going to trade crude oil.

My goal is to build the best oil trading room and alerts service in the world for traders, it is a large task, but the hardest part of our mission is done, we can trade with the best machines in the world now. The rest should be easier.

Any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Part 2 of this article here: “Excuse Me, While I Kiss The Sky”. Part 2 Insider’s Look at How We Daytrade Crude Oil (w/ real-time alert screen shots from oil trading room).

Part 3 of this article here: BOOOM! Price and Time Exactly as Predicted Days in Advance | Part 3 – How We Daytrade Crude Oil #OOTT $CL_F $USOIL $WTI $USO

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; oil, daytrading, oil trade alerts, oil trading room, crude oil, futures, trade, strategy