Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday October 24, 2018.

In this premarket trading edition: Earnings, #EIA, Oil, $WTI, Gold, $GLD, Silver, $SLV, Volatility, $VIX, $TSLA, $MCD and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 24 – Lead trader booked for main trading room for market open 9:30 AM, 12:00 PM mid day review and futures trading this evening 6:00 PM (as available and as market demands).

- Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- https://twitter.com/curtmelonopoly/status/1054318666878238720

- Main live trading room – 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- What’s New / Work in Progress:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November for each of the seven trading models and swing and daytrading – 8 in total to be announced (online only).

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

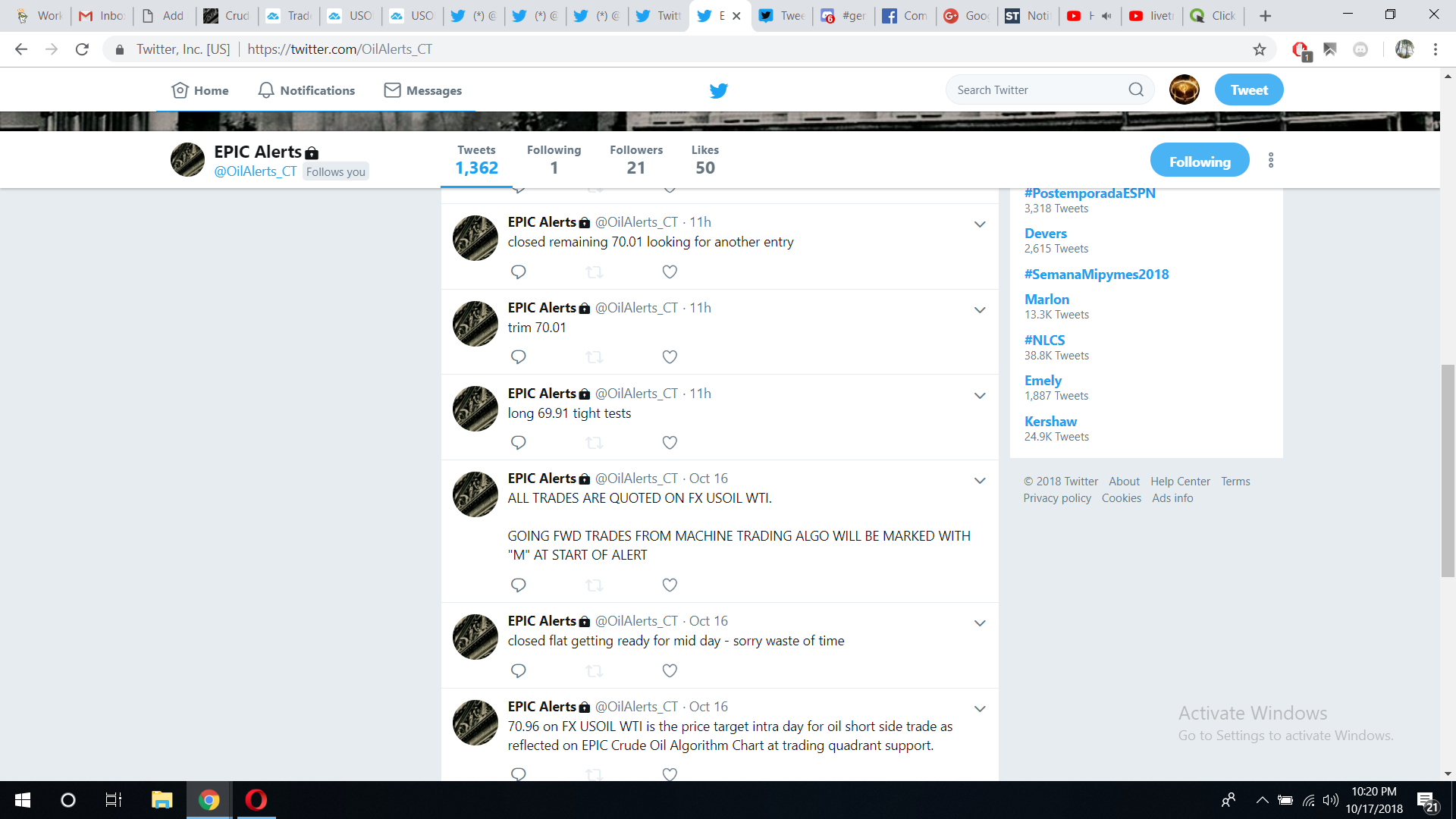

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

October 24 Trading Plan: It’s all about oil $WTI $CL_F today, then it will be about GOLD $GLD, SILVER $SLV, VIX $VIX and SP500 $SPY for me thereafter. Watching the TESLA $TSLA play and MCDONALDS $MCD very close. Everything else will be reviewed on swing trading report due out today.

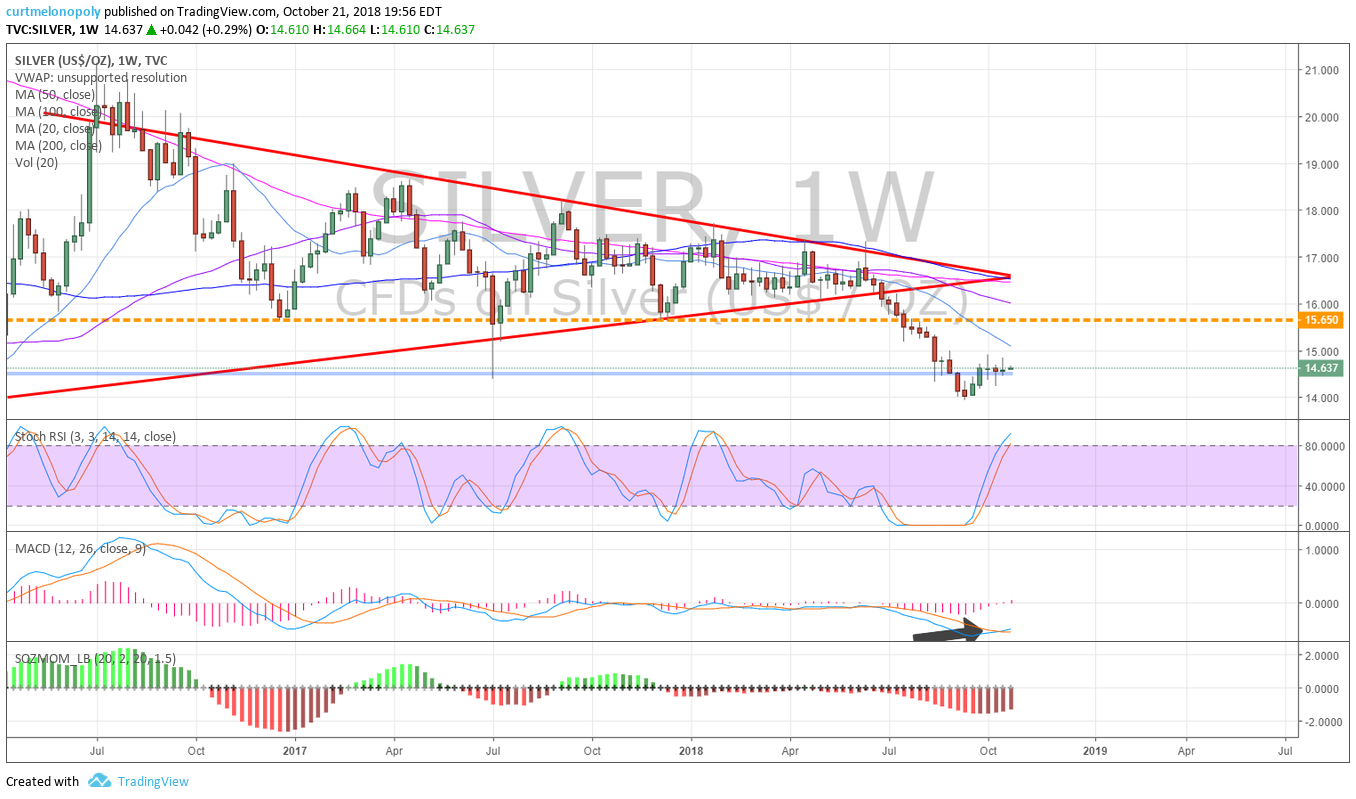

October 23: Notes per below remain in play. New position long in Silver is working from 14.63’s as a swing trade, oil short in to open yesterday worked, watching for an intra-day bounce possible in to open in oil and then down likely. Gold has a bounce as does VIX as I expected in to this time cycle. Momentum daytrading is very dangerous right now. Watching some swing trades in equities (forming a report right now and I’ll release it today).

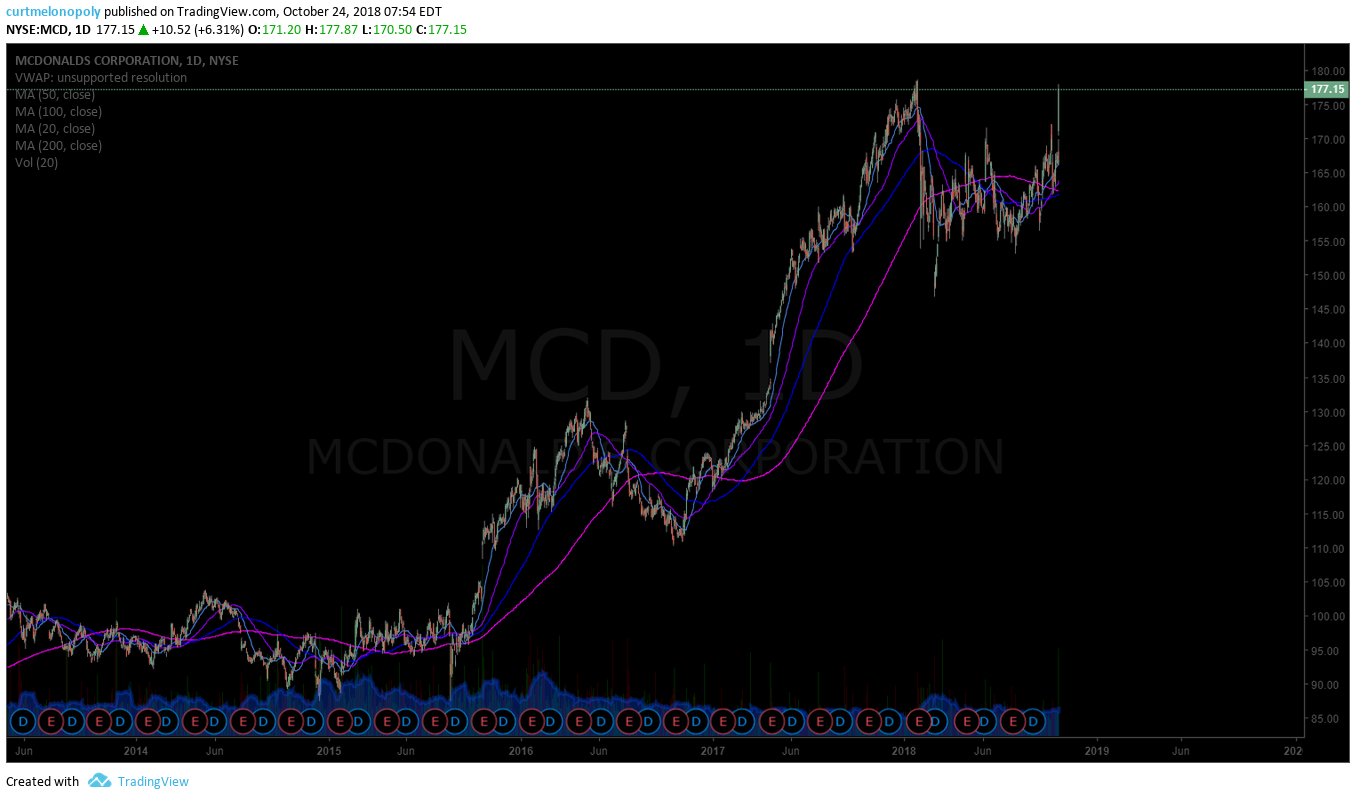

Considering a long term (6 months or more) swing trade in $MCD soon. Long.

$VIX up more than double since we were alerting time cycle run #premarket.

October 22: I have a new position in Silver in 14.63’s long that may get some pressure but there is a plan to add at support below. Earnings season may help equities some here near term – but it is dubious.

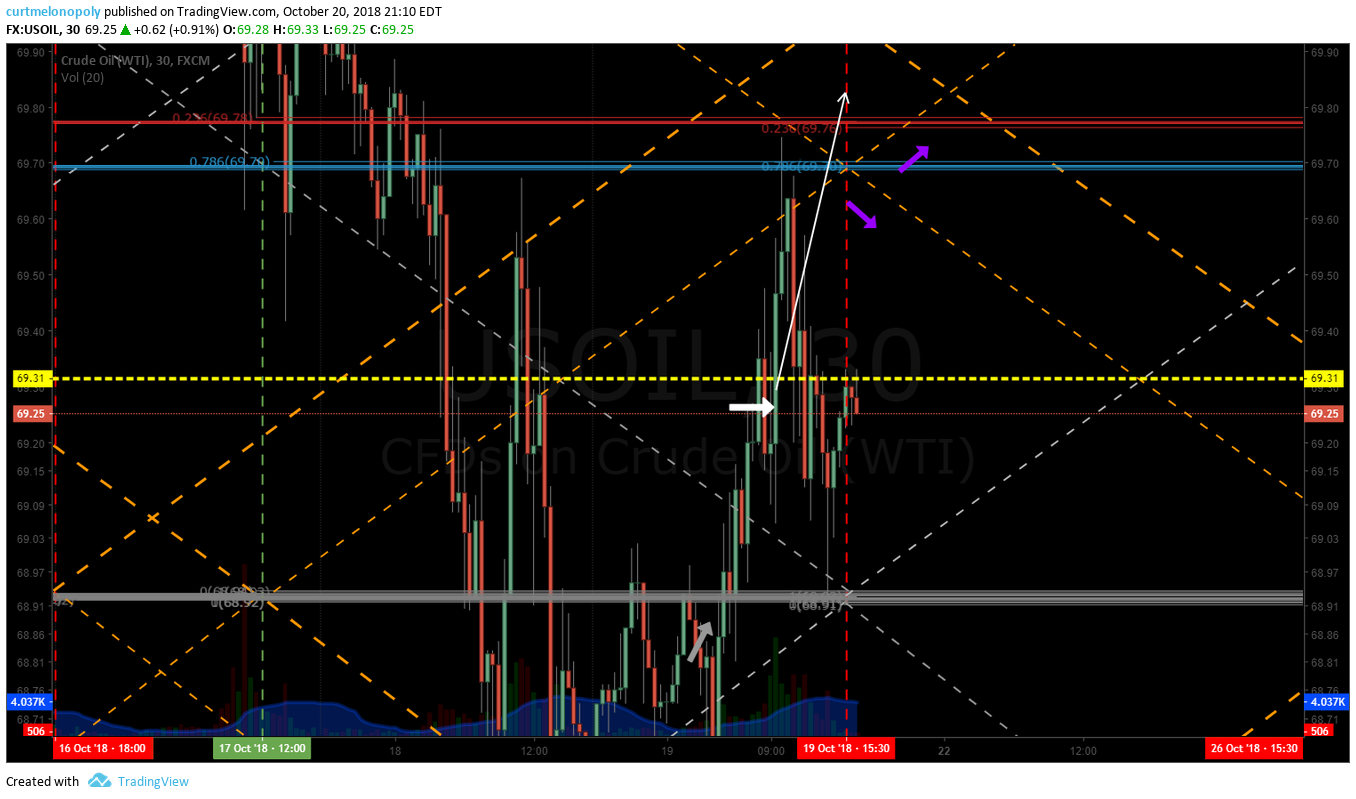

I will continue chewing around the edges of this crude oil sell-off at support areas for a reversal to the retracement and try and get a decent short position also when I can at upside resistance. Serious, serious pressure here in oil trade BUT support areas for possible reversal are starting to hit now on various charting time-frames and structures – BUT that doesn’t mean it will reverse. It reverses when it reverses, trade the indicators not bias.

Watching NFLX, SQ, ROKU, SHOP, FEYE very close right now and swinging them all. TSLA trade yesterday went great, still holding 25% on the swing side. Today is all about OIL with EIA.

PSTG has an upgrade I’m watching also.

I am leaning toward equity markets possibly holding up in to end of Oct early Nov, Gold Silver Crypto likely pressure in to that time frame, Oil likely pressure in to that time frame and VIX also. And then end of Oct early Nov that should switch.

This is a leaning bias – a general outlook. However, I do see significant risk that could trigger volatility at any time here. But generally equity markets should hold to that late Oct early Nov with VIX GOLD SILVER OIL under pressure and then the opposite should turn toward mid Dec time cycle peak. See the most recent oil trading strategies video.

I know I’ve been promising the remaining model reports for some time, last night we ran the machine trading tests on EPIC and it is working so I can leave the staff to that and now start getting the reporting out. The software development part of our biz I have to admit has been a challenge to our time.

It’s difficult to explain in short how complicated software development is with machine trading launch. But we’re learning to manage it. We’re in it to win it – we won’t give up and we’re making serious progress, that’s the bottom line.

Looking for possible short term sell off in oil with a spike in VIX, Gold, Silver and then markets should levitate for short term bringing VIX Gold Silver Crypto soft and then reversal again and again and rinse and repeat to mid December 2018 minimum.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 8:55 AM: US Dollar $DXY trading 95.95, Oil FX $USOIL ($WTI) trading 66.90, Gold $GLD trading 1229.05, Silver $SLV trading 14.69, $SPY 273.40 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6435.00 and $VIX trading 20.7.

Momentum Stocks / Gaps to Watch: $ESEA $PLAG $VBIV $TRVG

20 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12556095 $PLAG $TRVG $NEO $ALXN $TRPX $STM $IRBT $TXN $SIX $OC $T

News:

Recent SEC Filings / Insiders:

Recent IPO’s:

Your Wednesday morning Wake Up Call:

IPO lockup expirations today for:

– Goosehead Insurance $GSHD

– Smartsheet $SMAR

– DocuSign $DOCU

What will insiders do? How will the market respond? 🤔

Your Wednesday morning Wake Up Call:

IPO lockup expirations today for:

– Goosehead Insurance $GSHD

– Smartsheet $SMAR

– DocuSign $DOCUWhat will insiders do? How will the market respond? 🤔

— Benzinga (@Benzinga) October 24, 2018

Earnings:

#earnings for the week

$AMD $AMZN $MSFT $GE $SNAP $TWTR $GOOGL $T $INTC $BA $CAT $V $HAL $SHOP $F $MCD $LMT $HAS $CELG $VZ $AAL $UPS $MMM $NOK $KMB $LAGN $CMG $PETS $FCX $CY $GRUB $GILD $WDC $BIIB $PII $STM $RTN $NOW $IRBT $AMTD $SALT $TXN $UTX $SIRI

#earnings for the week$AMD $AMZN $MSFT $GE $SNAP $TWTR $GOOGL $T $INTC $BA $CAT $V $HAL $SHOP $F $MCD $LMT $HAS $CELG $VZ $AAL $UPS $MMM $NOK $KMB $LAGN $CMG $PETS $FCX $CY $GRUB $GILD $WDC $BIIB $PII $STM $RTN $NOW $IRBT $AMTD $SALT $TXN $UTX $SIRI https://t.co/r57QUKKDXL https://t.co/4ZnvQ7L3g5

— Melonopoly (@curtmelonopoly) October 20, 2018

#earningsseason calendar

$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAY

#earningsseason calendar$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAYhttps://t.co/r57QUKKDXL https://t.co/exPTAW20yW

— Melonopoly (@curtmelonopoly) October 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

MCDONALDS (MCD) Daily Chart. Break-out test in play $MCD #premarket #swingtrading

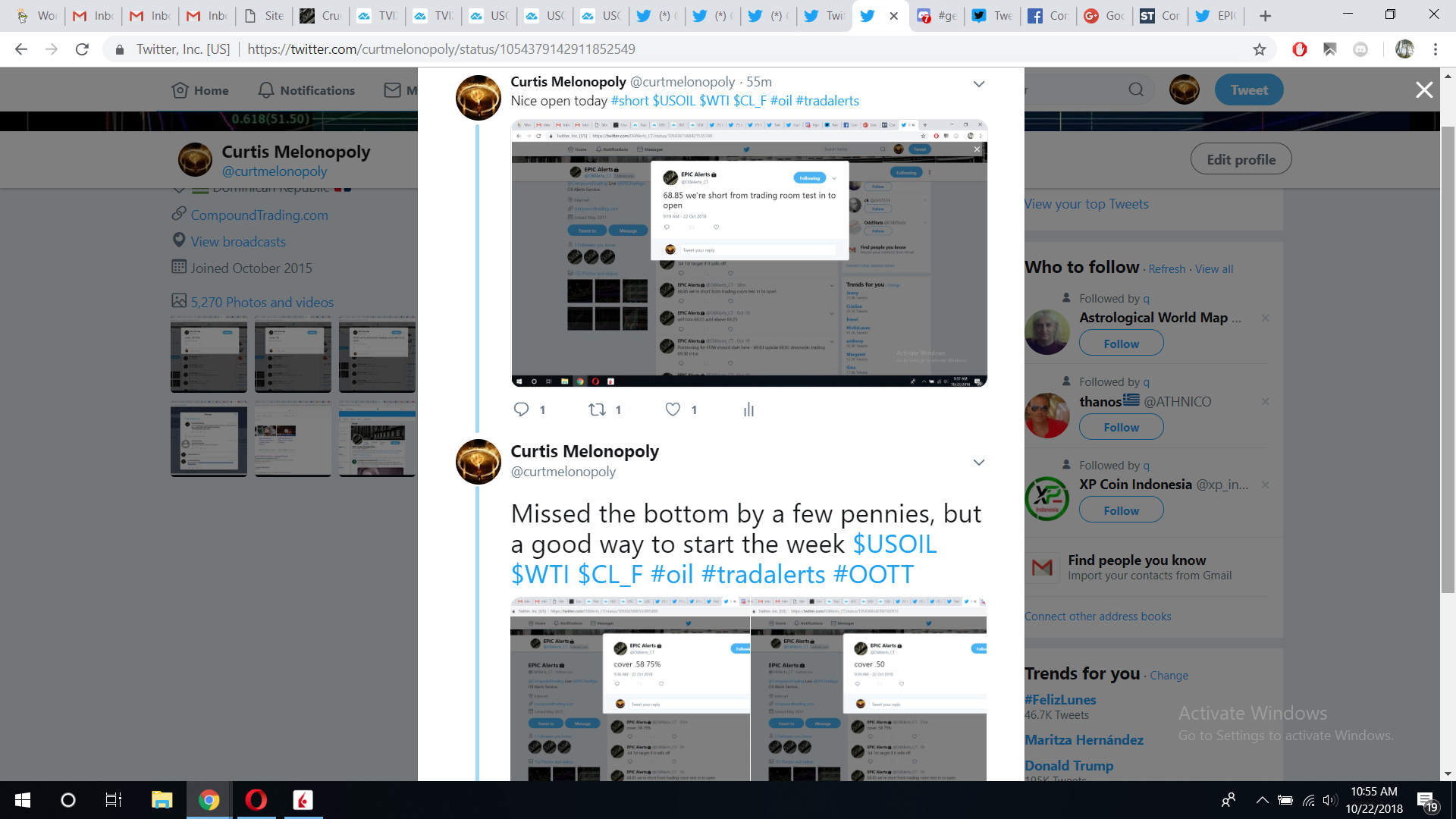

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Silver Weekly Chart has a MACD turn up possible, watching for a possible run up Oct 21 756 PM #Silver #Algorithm $SLV $USLV $DSLV

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD pic.twitter.com/JNfF5U9u7L

— Rosie the Gold Algo (@ROSIEtheAlgo) October 21, 2018

Crude oil lines on 4 hour chart $CL_F $USO $UWTI $DWTI $UCO $SCO $UWT $DWT#Oil #OOTT

https://twitter.com/EPICtheAlgo/status/1052900369003622401

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Crude Oil Trading Strategy with Trend-Lines on Weekly Chart.

Crude Oil Daily Chart, MACD crossed down with trade testing mid pivot Oct 15 1244 AM FX $USOIL $WTI $USO $CL_F #OIL #chart

TESLA (TSLA) At trading box range support EOD Friday, in a bounce it targets 280.34 Nov 20, 2018 $TSLA #swingtrading

ARROWHEAD PHARMA (ARWR) MACD turned down but over 200 MA and channel support. On watch for adds to trade. $ARWR #swingtrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

Crude oil trade alert entry and exit shown on an oil chart.

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

Check my feed history when I scream from rooftops since I came on Twitter. That’s all I’ll say. They stealin’ from ur mind. You gotta know how that part works to make a living at it. Take the lumps but conquer your mind and get back up. #nevergiveup #freedomtraders Back to work.

Check my feed history when I scream from rooftops since I came on Twitter. That's all I'll say. They stealin' from ur mind. You gotta know how that part works to make a living at it. Take the lumps but conquer your mind and get back up. #nevergiveup #freedomtraders Back to work.

— Melonopoly (@curtmelonopoly) October 24, 2018

Stock/Bond Indicator Testing 36-Year Support!

Stock/Bond Indicator Testing 36-Year Support! https://t.co/qlDiDR22PR pic.twitter.com/ArkDLgyegA

— Chris Kimble (@KimbleCharting) October 24, 2018

Gold Prices Edge Up Amidst Weakening Asian Shares https://finance.yahoo.com/news/gold-prices-edge-amidst-weakening-082100216.html?soc_src=social-sh&soc_trk=tw …

Gold Prices Edge Up Amidst Weakening Asian Shares https://t.co/ZZeOGHrP1q via @YahooFinance

— Rosie the Gold Algo (@ROSIEtheAlgo) October 23, 2018

Volatility time cycle coming in to peak July 23, 2018. May be time to have a look on the regular $TVIX $UVXY $VIX #volatility

Volatility time cycle coming in to peak July 23, 2018. May be time to have a look on the regular $TVIX $UVXY $VIX #volatility pic.twitter.com/lKOJwGSALd

— Melonopoly (@curtmelonopoly) May 23, 2018

Long term investors should be re-balancing risk soon imo #economy #investing #eyesontheroad

Long term investors should be re-balancing risk soon imo #economy #investing #eyesontheroad

— Melonopoly (@curtmelonopoly) May 23, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ESEA $PLAG $TRVG $TTNP $GLBS $TRPX $SLS $DCIX $TROV $TOPS $BA $DDD $FCX $SIRI $TSLA $P

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, #EIA, Oil, $WTI, Gold, $GLD, Silver, $SLV, Volatility, $VIX, $TSLA, $MCD