Year: 2020

Premarket Trading Watch List: $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY, Fauci and more.

Premarket Trading Watch List

Good morning Traders,

With stocks to watch and trades in play, on day trade alert side I’d like to see TL (diagonal trendline) on $OSTK break for a run. Also the overhead horizontal resistance on $AKBA for a run. We got the $IQ yesterday and first part of $OSTK and $AKBA. Check your charts sent out.

Congrats to $MARK longs, I didn’t get it but here’s your key resistance.

Your resistance mark on $MARK should be 200 MA on weekly (pink) just over 3.00 per beach side video last night #daytrading #premarket https://t.co/Xh0NxErgbn pic.twitter.com/xnpXlMEC4W

— Day Trading Alerts (@DayTrade_Alert) May 12, 2020

On swing trade alert side resistance over head near on $SPY model and $AAPL chart models. Of course we’re swing trading $AKBA and $OSTK also. Managing many others, nothing specifically yet today for new entries, after oil reports API EIA we expect more swing trade positioning / entries. $VIX and $OVX are on close watch for long starts soon-sh (see Sunday Swing Trade $STUDY Webinar video for more). There are countless plays on watch and many in play right now.

Also the $NTRA break out set-up is super interesting here, really strong yesterday – also see the weekend $STUDY videos for this and chart model sent out on Swing Trade Alert feed.

Oil trading alerts Sunday overnight and Monday were super quiet for both myself and EPIC V3.1.1, however, I expect this to change at latest after API could be sooner, for now see hourly for range trade – it’s a range trade because of the time cycle rounding the trajectory per model.

We do have Fauci speak today so go easy.

Will be in live room and will get on mic if active trade starts.

Beach Side Video from yesterday with some comments to above trading.

Beautiful day🙏🌴 $AKBA $IQ $OSTK $AAPL $MARK $$TLRY $GLD $SLV $BTC $$SPY $VIX $TSLA Trade size P&Ls Sunday Swing $STUDY

and more https://t.co/AAfsJkiPq3— Melonopoly (@curtmelonopoly) May 11, 2020

Any questions let me know!

Curt

Article Topics; premarket, stocks, commodities, watchlist, $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY

Crude Oil Trading Strategies: Sell-Off in to Oil Futures Settlement – 190 Point Snap-Back Trade w/Video #OOTT $CL_F $USO $USOIL

How to Trade an Oil Price Sell-Off in to Futures Settlement at 2:30 PM EST for Reversal.

This Reversal (Snap-Back) Crude Oil Trade Provided a 190 Point Range for Our Oil Trading Room Traders.

One of the best ways to increase your oil trading profit is with reversal trading. Crude oil can be difficult to trade, so knowing where reversals in price are likely to occur (support areas of charting) greatly helps a trader with winning trade signals.

A Warning! In a reversal trade it is important to manage your stops, bias, trade size in accordance to your account size.

The example below is of a 30 contract size (possible) oil trading account used by our software EPIC V3.1.1.

I personally didn’t take the trade because I was tired and I had a few other reasons. But it cost me some excellent profit because the price of oil then reversed and rallied near 200 ticks – it would have been a great win for me.

Some of our traders in our oil trading room did get the win so that was great, so I learned a lesson for next time.

The biggest lesson being that when EPIC V3.1.1 alerts an oil trade and the signal is “in-play” it is best for me to get with it and take the trade because the software has been winning non stop since it’s “black swan” code updates.

The oil charts below are models developed by our trading team that are proprietary to our oil trade alert and trading room members, however, if you know how to properly chart conventionally you can also take advantage of this set-up.

Let’s start with the set-up for the possible reversal trade on the one hour chart model. The one hour oil chart suggests that a turn in price, or a topping, is near (refer to the curved grey arch on the chart).

More specifically to this trade set up, the yellow trend lines (algorithmic trend lines) provide for a possible area on the charting for intra-day support in a possible sell-off scenario in to futures settlement at 2:30 PM on Thursday May 7, 2020.

The alert went out to the oil trading room and trade alert feed as follows;

You can see on the oil chart below that price was crashing at 12:18:17 EST time (or 12:18 PM) so the possible set-up for a bounce after oil settled at 2:30 PM was setting up.

If you’re thinking of swinging crude oil for a bounce, we’re getting closer to support areas.

Intra-day time cycle on crude oil is 1:45 P.M. for a possible bounce (reversal), careful with expecting VWAP to hit with some funds turning short.

The chart below and guidance provided to subscribers was also that at 1:45 PM a time cycle intra-day was possibly at an inflection point (or peak / bottom) and this was reason to be on high alert.

Screen capture of oil trading alert feed telling oil trading room position started.

Then at 2:44, so 14 minutes after crude oil officially settled for the day the alert went out that we were opening our trade position long at 8/30 size at 24.67 and the screen image below shows some of the other alerts and comments as the trade was going well and in a winning position.

Long 8/30 24.67 FX USOIL WTI trade on CL — EPIC.

Screen capture image of oil trading room when I alerted the trade position opened and discussing trading strategies.

One of the things we do in the oil trading room is provide charting and as much trade strategy guidance for our subscribers as possible.

This image below is a screen shot of the Discord room where we’ll chatter and share ideas and there is also a live mic and charting trading room where I walk our traders through the trades on voice broadcast live and share the charts we are using – both run at same time..

If the trade works, the price target would be Friday 3:00 PM EST ish for 29.00 ish.

The guidance provided to the trading room after we entered the trade was the price targets and time of the targets possibly coming in to affect. The chart below shows an arrow that provides our traders with a trajectory of trade should the plan being working.

The crude oil one hour chart with symmetry time cycles has been an amazing model, working very well, details on video.

The image below shows the 1 hour algorithmic model and the symmetries in crude oil trade, time cycles and price targets. The reference to “the video” is that we record all trading sessions and make them available to our subscribers for $STUDY and review.

The Live Oil Trading Room Raw Video Feed

At 1:12:40 on the video timer is where the oil trade starts, you can see and hear the actual trade guidance for the signals I am providing our traders as the trade sets-up.

There isn’t a lot of trade guidance on mic because much of it was provide in advance in the trading room and on alert feeds, but you can idea of how it works in the trading room on the video. There is also a time stamp at near bottom right of screen in the video on the chart itself.

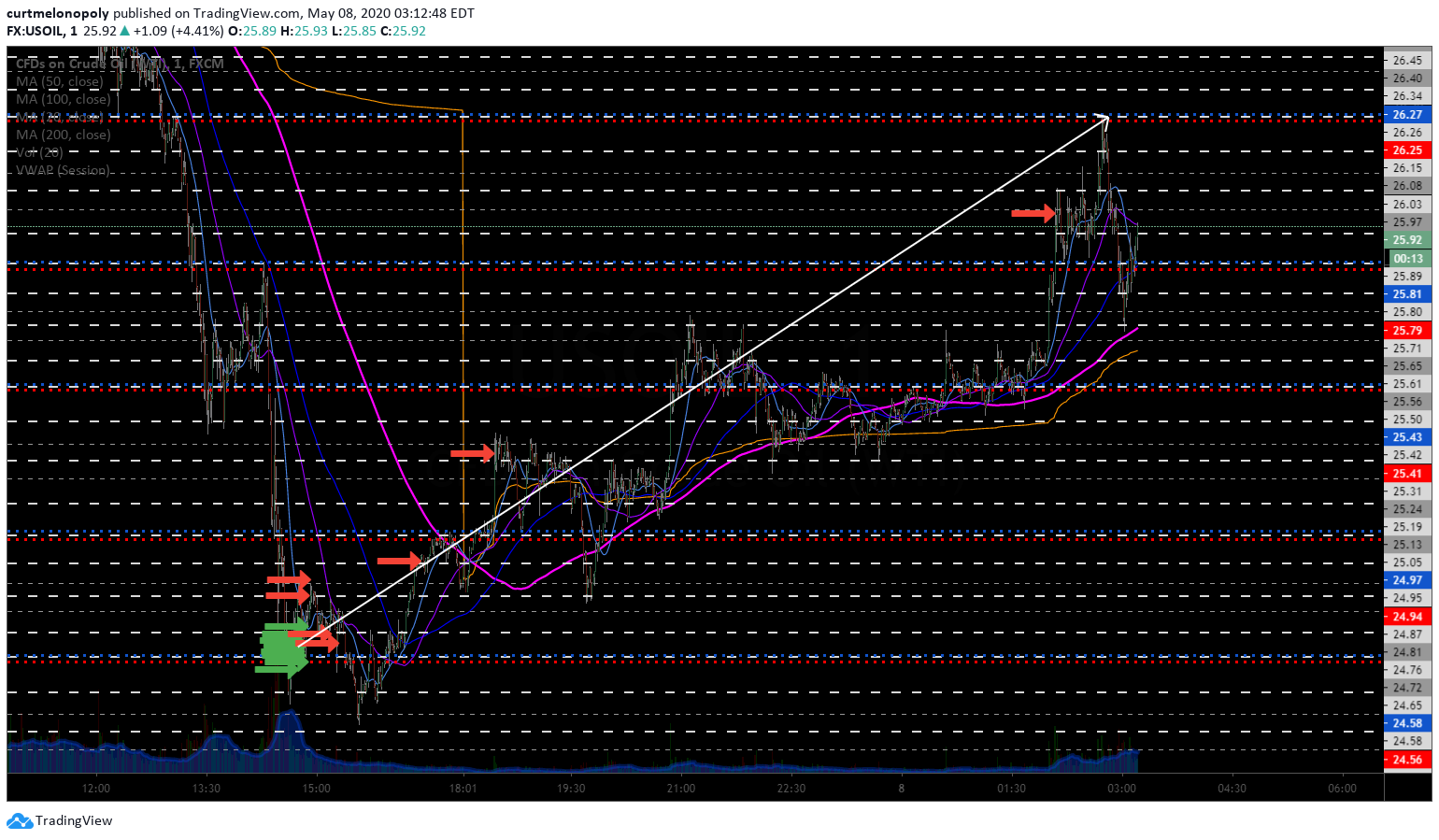

The Chart Below Shows Trade Long Entries (green arrows) and Take Profit Areas Selling (red arrows).

Crude Oil Trade Alerts dot plotted on 1 minute grid chart of EPIC V3.1.1 trade from oil trading room earlier today.

The trade on the 60 min symmetrical time cycle model (white arrow), long position after sell-off in to daily settlement.

The reversal trade works really well for oil traders as long as you manage the trade size according to your account size and be sure to stop out if you are on the wrong side of the trade.

Oil can trend down or up for weeks so staying on the wrong side of an oil trade can cost you your whole trading account.

So if you know your areas of support on the most dominant time frames (in this instance the 1 hour charting) and you execute your long trade after it looks like the sell-off has stopped then it becomes simply managing the ebb and flow of trade according to your personal style thereafter.

BUT IF IT FAILS, my best suggestion to you is to close the trade sooner than later.

I’ve also written other articles on intra-day reversal oil trades – they are more in-depth and a tad technical, but if you want to dig deeper in to this topic here are a few recent articles:

- Buying Support in to the Plunge During Crude Oil Intra-Day Sell-Off | Oil Trading Room Video, Alerts, Strategy.

- 134 Ticks in 1 Hour (Post EIA). Crude Oil Trading Tips: A Simple Intra-Day Reversal Strategy..

My tweet summarizing the oil trade on my personal Twitter feed (shows alert screen shots);

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn’t follow… EPIC got it Direct hitFireBow and arrow I didn’t – in hindsight, likely cause I was tired. Good lesson.

#OTTT $CL_F $USOIL $WTI #OilTradeAlerts

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn't follow… EPIC got it 🎯🔥🏹 I didn't – in hindsight, likely cause I was tired. Good lesson. #OTTT $CL_F $USOIL $WTI #OilTradeAlerts #MachineTrading pic.twitter.com/bcNUzTTER5

— Melonopoly (@curtmelonopoly) May 8, 2020

In the tweet below, I was explaining that oil traders would want to be focusing on trades that are on the outside extreme ranges in price.

The reason for this is that oil recently rallied off lows and we have a time cycle and price targets that see oil topping near – term. When oil starts to top or bottom in a wider time-frame it is then best to trade the range of trade on lower time-frames (such as the 1 minute, 5, 15 or 30 minute charting) until the larger trend is formed.

Oil traders, they’ll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

Oil traders, they'll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

— Melonopoly (@curtmelonopoly) May 6, 2020

So that’s the reversal snap-back trade in crude oil futures that you can either consider as a day trade or an intra-week swing trade. There are of course many other considerations we use (our software has over 9000 rules in its instructions), but for the purposes of a human trader, the above article should help get you started.

We endeavor to develop the best winning oil trading alerts and oil trading room service for oil traders.

Any questions please send me a note via email [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; oil, strategies, reversal, trade, swing trading, day trading, crude oil, oil trading room, oil trading alerts.

Post Market Trading Review May 5, 2020 – My First YouTube Attempt “The World is Opening Up Again”

Post Market Wrap Up Trading Day Comments “The World is Opening Up Again”

#daytrading #swingtrading #oiltrading

RE: Post market report with VIDEO covering trade reviews on day trading, swing and oil trading alert feeds, Volatility, Oil, SPY, GOLD, SILVER, BITCOIN, APPLE, TESLA, AMAZON, TWITTER, FACEBOOK, PAGER DUTY, CHEGG, OVX, GOOGLE and more.

My first post market review on cell phone recorded on YouTube, tomorrow I’ll try the camera on my phone sideways and see if I can get a larger field of view, if not maybe I’ll hobble around with my GoPro in future.

I’ve just been shooting these videos on Twitter but I’ll start to post them to Twitter, YouTube Facebook etc. Show folks where I am in my travels while I do a quick Market Wrap Up each day after our day trading session in the trading room. Sorry about the wind.

So it looks like the world is opening up, Florida was looking normal again, busy place now again.

In my trader premarket trading note this morning could see the run up coming on the day so I sent out a second premarket guidance note before market open.

We had the move dialed in and were ready for a great day of daytrading and swing trade positioning and management of booking profits.

Market Outlook

We got the bounce today we were looking for, we expected markets Monday to be soft and Tuesday to bounce and we got it.

Swing trade alert feed below shows guidance comments Monday morning toward general intra day outlook;

“General market view – I just surveyed the best 10 traders I know, all agreed on equities – watching only (likely pop Tuesday), I am concerned about possible drop in AMZN symmetry and on oil bullish to 25 – 30, trading 22.23 FX USOIL WTI.”

https://twitter.com/SwingAlerts_CT/status/1257326486056558593

Crude Oil

Oil trade is on a tear, we had alerted to the swing trade and oil trade alerts feed we were expecting the next leg up for 25.00 – 30.00 and it hit 26.62 today (so far) on FX USOIL WTI. API is on deck next here with EIA tomorrow.

Crazy bullish run. We seen a few day trade set-ups today, I got one at regular USA market open and the second set-up alerted to the oil trade alerts feed was a prime set-up.

I wrote an article on the oil day trade set-up (click here) based on a 200 MA buy trigger on the one minute chart, that ended up being the best intra-day buy / continuation point in oil. The price of oil rallied 147 points to a high of day at time of writing 26.62 and looks like it is about to break higher. The article has screen shots of the oil trade alert feed and charting and a step by step how to trade the strategy.

Alert from the oil trade alert premium feed below:

“On the 1 min time frame 25.15 200 MA is attractive test for a crude oil day trade pop up scalp – trading 25.68. #oiltradealerts.”

Tech Leaders

Apple, Intel, Twitter we’re doing well in on our Swing Trading Alerts platform (members can refer to the charts).

Facebook, Google and Amazon I’ve sat out. I’ve always done well in all three but Amazon has a symmetry issue for a possible sell off in to beginning of September that I don’t like and the Tech leaders have other geo political black swan potential that I outlined in detail on the Swing Trading Alert Premium feed that our subscribers should review.

I may still take trades in $FB $GOOGL $AMZN but any of the tech leaders I will hold only with hard stops, again, the explanation is on the swing trade alert feed.

Gold, Silver, Bitcoin.

The swing trades, alerts and chart models have been running well in Gold, Silver and Bitcoin.

Bitcoin is stronger because of the BTC specific halving event and the 1200.00 cheques from the Fed.

Silver continues to struggle, I’ve explained to members – I think the most recent explanation for this expectation for Silver was on the weekend Swing Trading $STUDY videos, I go in to an explanation there. Silver is on the first of four videos from that $STUDY session.

And Gold is expected to be moderately strong and continue to trade well within the structure chart model that has been on point for many months.

Again, look at weekend $STUDY videos for details, charts and trading plan(s) for Bitcoin, Gold and Silver.

Volatility $VIX $OVX

Volatility is getting close to support / but triggers, we have a plan to accumulate in to the end of August 2020 that the Sunday Swing Trade $STUDY videos review.

A warning toward volatility surprises between here and election. Volatility, tech leaders and the whole market.

Miscellaneous Other Swing Trades.

TESLA I am shorting at key resistance points. This is my current nemesis.

CHEGG has been a payday swing trade over and over, today was quite a run up.

Pager Duty (PD) swing trade has been decent.

TGTX swing trade paid big on my 10% remaining runner today.

Apple (AAPL) had a big day, we continue to do very well with Apple swing trades, the model is very precise that we use.

Many more.

Daytrading Alert Feed.

Looking to get that new day trading alert feed rocking because I want maxed out Swing Trading positioning for personal best returns in the next two time cycles in the markets in to end of August, through election and thereafter. Basically I want to be able to size in to themes in to the election and the best way to do that is to have the swing trading models all firing also on a daytrading time-frame for the highest possible return on the trades.

How About that Mortality Rate?

anyone know the morbidity rate on the first? https://t.co/FIPO18DOdI

— Melonopoly (@curtmelonopoly) May 5, 2020

The End of the World Didn’t Happen!

Looks like it wasn’t the end of the world after-all (at least not this round), so I’m going to get some new free diving gear this weekend and start hitting it deep again next week. A pic of my front yard below a friend sent me today.

“The only place where I can find true silence 🐚💦 #illbebacksoon”. Stay safe, stay curious. The pristine waters of Dominican Republic will be waiting for you.

📸: @georgina_monti📍 Cabarete pic.twitter.com/8A4gm6vAHH

— Dominican Republic (@GoDomRep) May 5, 2020

2020 Trader’s Summit.

The minute we’re all off lock down I will be announcing our 2020 trader’s summit. Don’t miss this event in Cabarete Dominican Republic. This is 3 days of 12 hours a day deep study and trading with myself and our lead trader group.

Members get first pick on the in person seats (10). Price is 1999.00 and current members will be discounted 50%. If you can’t make it you can attend online (25 person maximum).

Sunday Swing Trade $STUDY Sessions.

Do not miss these swing trade study sessions, for 100.00 we serve up 10 session blocks of 4 hours of weekly deep trade set-up study. If you don’t 10x 100x or more return on that investment you should quit trading.

Weekly Sunday Swing Trade $STUDY Webinars 7-11 PM.

Prepare for Trading Week Set-Ups (Trades On Watch).

100.00/10 Weeks (40 hrs of study) members 50.00. Video provided if you can’t attend live.

$CL_F $USO $WTI $SPY $VIX $GLD $GC_F $SLV $BTC $USD $DXY

Weekly Sunday Swing Trade $STUDY Webinars 7-11 PM.

Prepare for Trading Week Set-Ups (Trades On Watch).

100.00/10 Weeks (40 hrs of study) members 50.00. Video provided if you can't attend live.https://t.co/OjnmpDlIvJ$CL_F $USO $WTI $SPY $VIX $GLD $GC_F $SLV $BTC $USD $DXY

— Swing Trading (@swingtrading_ct) May 3, 2020

Written reports will be out tonight for the follow up on the Sunday Swing Trading $STUDY session. Also new set ups, chart models and trading strategies coming for other new trades in play.

And don’t forget, pins can be pulled and likely will – stay awake and use stops if need be (see screen shots in tweets below)

Peace and best ,

Curt

I didn't just tell u a false flag was coming right before it came.

I didn't just tell u they would pull pins on financial markets right before they did.

I didn't just tell u COVID19 math was wrong day 1.

I have told u many things in advance, with timing.

🎯🏹🔥#timecycles

— Melonopoly (@curtmelonopoly) April 19, 2020

Dec 19 call for pins to be pulled, last time cycle published, Feb 13 out of long positions 90% (publicly) then we hammered down short $NKE $WYNN $MA etc..

Why is this important?

For a victory lap? How bout truth.#Timecycles, market instrument structure.

Natural law.

🎯🏹🔥 pic.twitter.com/sV4NgPrcqs

— Melonopoly (@curtmelonopoly) April 5, 2020

Article topics; post market, market, review, trades, day trading, swing trading, oil trading, alerts, Volatility, Oil, SPY, GOLD, SILVER, Bitcoin, APPLE, TESLA, AMAZON, TWITTER, Facebook, Pager Duty, CHEGG, OVX, GOOGLE

One of The Best Crude Oil Day Trading Strategies – 200 MA One Minute Chart Time Frame #OOTT $CL_F $USO $USOIL

How to Day Trade the 1 Minute Oil Chart Using the 200 MA for Support and Symmetry for Resistance.

A Simple Step by Step Intra Day Trading Guide from our Oil Trading Room and Alerts Service.

Below are my top trading rules (steps I take in my strategy) when daytrading crude oil on the one minute time-frame. It has worked for me over the years and I am sure you will find it a highly profitable way to day-trade oil.

1. The Price Trend of Trade is Your Friend.

- If you are going to day trade oil long be sure oil is in a rally. In this case oil has been rallying for a number of days and today oil price continued to rally. In this instance, the trend is on your side so it is obvious that your highest probability day trades scalping crude oil futures will be long buy entries.

- Today’s News – Stock market live updates: Dow up 400, oil rallies 18%, Norwegian dives 18% https://www.cnbc.com/2020/05/05/stock-market-today-live.html

2. Price Dropping in to The 200 MA on One Minute Oil Chart.

- Chart from the Oil Trading Room and Alerts feed shows the set-up intra day for the 200 MA scalp, “On the 1 minute time frame 25.15 200 MA is attractive test for a crude oil day trade pop up scalp – trading 25.68. #oiltradealerts” The white arrow on the chart points to the 200 MA on the 1 minute time-frame (200 MA in pink).

On the 1 min time frame 25.15 200 MA is attractive test for a crude oil day trade pop up scalp – trading 25.68. #oiltradealerts

3. Execute Your Long Trade when Price Hits the 200 MA (Moving Average).

- The screen image capture of the oil trading alerts feed show oil price bouncing off the 200 MA signal, day trade is now in play.

- “Nice 40 point move on that crude oil daytrade set up on the 1 minute time frame, I didn’t take it, first extension resistance here. #oiltradealerts”

The screen image capture of the oil trading alerts feed show oil price bouncing off the 200 MA signal, day trade is now in play. #oiltradingalerts

4. Take Profit as You – Go Based on Your Trading Plan.

- Oil trading room live image below shows first price target hit, symmetrical price extensions, and a point to trim profits in your long trade scalping crude oil #oiltradingroom

Oil trading room live image shows first price target hit, symmetrical extensions, and a point to trim long scalp #oiltradingroom

5. Technical Analysis Helps Plan Your Oil Trading Strategies.

- Below is a one minute oil chart with symmetrical price extension price targets so our oil traders know where to trim profits along the way while daytrading oil.

Your 3 steps of symmetrical extension resistance points for this day trade in oil #oiltradealerts

6. Use an Oil Trading Strategy – A Plan.

- The image capture of oil trading room shows the 3 price targets for our trading strategy with this trade intraday #oiltradingstrategies

- At point of writing this article, the move on this oil trade alert intra-day is now 80 points, this is a fantastic day trade strategy for oil traders. Knowing where your price targets are and knowing how to measure the symmetry for price extension price targets will really help your strategy.

The image capture of oil trading room shows the 3 price targets for our trading strategy with this trade intraday #oiltradingstrategies

Technical indicators or signals really help retrieve more profit in each trade and also help with your winning percentage of trades.

There are many other signals that you can use for any oil day trade, including the trade outlined in this article. Some of the other indicators or trade signals include order flow, time of day, resistance and support on larger time frames such as the 5 minute, 15 minute or 30 minute chart time-frames and many more.

The price extensions in this article are part of a proprietary one minute oil trading grid model that our machine trading uses. There are many ways to set your price targets, some use conventional charting methods and some algorithmic (or proprietary models as in this instance).

Hopefully this tutorial on using the one minute oil chart 200 MA as a signal for day trading (scalping) trades has helped. It is an intra-day strategy that has worked for me in my trading time and time again.

You should find implementing this simple crude oil intra day trading strategy that your win rate and returns will excel.

If you liked this article there is another day trading oil strategy article I wrote here.

Oh, and by the way, while I am finishing up writing this article oil is getting near the upper price target for this day trade and I just alerted the oil trading room and our alert subscribers to take profits. Nice Trade!

My goal is to build the best oil trading room and oil trading alerts service in the world for oil traders – obviously a tall order, but we’re getting there one step at a time.

Any questions please send me a note via email [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; day trading, crude oil, 200 MA, 1 minute time frame, strategy, chart, symmetry, oil trading room, oil trading alerts, simple, intraday, trading strategy

Premarket Note

Good morning traders,

“Although tide has lifted nicely on most of swing portfolio, just haven’t got my timing right on oil swings yet, we’re winning there, but not like we should.”

https://twitter.com/SwingAlerts_CT/status/1257652431250436097

Well we got the pop we were looking for, markets hot around the world overnight and in premarket.

The swing trade alerts and day trading alert feeds are busy.

Some positioning this morning I sent out to swing trading feed, some day trades in play, oil have to get my swing timing right and I would expect lots of oil daytrades remainder of week.

Will be in live trading room at open and on mic if active trade.

Should have the swing reporting, updated P&Ls, and oil reporting out tonight.

New themes should take hold here now, obviously the chosen few ($MSFT for example) through to singularity are leading in tech (however, in many we see a possible flash crash so we’re light in the ones we are in) – we’re looking for better opportunities than the mass trend leaders.

Looks like a major run to end of Aug in play with possible pins pulled by far left extreme as only risk (think COVID as an example).

$IWM Russel 2000 looking more attractive as a way to spread around some risk and possible rotation over the hill somewhat, starter in there this morning.

$TGTX too bad in the long term swing ebb and flow I didn’t have more size but I’m letting the 10% run for now that I do have.

man…. was playing the swing on this for a long time for decent returns, but recently was trimmed out profits 90%, so i have a runner of 10% left, oh well, profit is profitDirect hitFireBow and arrow #swingtrading $TGTX

man…. was playing the swing on this for a long time for decent returns, but recently was trimmed out profits 90%, so i have a runner of 10% left, oh well, profit is profit🎯🔥🏹 #swingtrading $TGTX https://t.co/slSw48gFOL

— Melonopoly (@curtmelonopoly) May 5, 2020

TG Therapeutics Announces Positive Topline Results from the UNITY-CLL Phase 3 Study Evaluating… $TGTX #premarket #daytrading

TG Therapeutics Announces Positive Topline Results from the UNITY-CLL Phase 3 Study Evaluating… $TGTX #premarket #daytrading https://t.co/WZHPphWAfb

— Day Trading Alerts (@DayTrade_Alert) May 5, 2020

$SPY sizing up (adds) to long, if you stayed in $CHGG swing now is the time to consider serious trims or exit (was up 17% this morning last I checked), TESLA $TSLA will add to my high risk short at resistance area(s) noted, watching $VIX and $OVX for long positioning adds through this cycle, Pager Duty $PD and $IBB trimming out longs, $CUTR trimmed starter (insider play) profits, and lots more going on.

Any questions shoot me a note anytime.

Curt

And from the 4:49 AM Premarket Note to Trader’s this morning (in case you missed it)

Looks like the markets are happier today as expected.

I am still a tad concerned about the symmetrical drop possible on Amazon noted yesterday that would come in at its low 3rd week of September – but unlikely it occurs as the markets should run in to the broad time cycle (remain bullish in trajectory to end of Aug time cycles). Speaking generally, this is what it seems. Review $STUDY webinar videos.

Oil seems a tad ahead of itself this morning so hopefully we get some pull back for more rally. See symmetrical trajectory on 1 hour charting.

Gold pulling back a bit here makes sense. Looking for long ads on supports per Sunday Study video (Silver also).

Bitcoin 9036.00 strong makes sense in to its event and while broad markets rally.

Volatility should get crushed further in to and near buy points starting.

Generally speaking watch the weekend STUDY videos, levels are all there.

Should be an active day of trade.Hopefully things pull in a bit for about 7:30 AM and then we can start entries for a day rally, will advise.

Thanks

Curt

PS – And if you’re not attending the weekly Swing Trade Sunday $STUDY sessions you are doing yourself a disfavor in my opinion, last week was loaded with set-ups and each week as we go through to this end of this time cycle the trading set-ups will get more clear and the returns greater. Historic trader opportunities in to the election.

Weekly Sunday Swing Trade $STUDY Webinars 7-11 PM.

Prepare for Trading Week Set-Ups (Trades On Watch).

100.00/10 Weeks (40 hrs of study) members 50.00. Video provided if you can’t attend live.

Weekly Sunday Swing Trade $STUDY Webinars 7-11 PM.

Prepare for Trading Week Set-Ups (Trades On Watch).

100.00/10 Weeks (40 hrs of study) members 50.00. Video provided if you can't attend live.https://t.co/OjnmpDlIvJ$CL_F $USO $WTI $SPY $VIX $GLD $GC_F $SLV $BTC $USD $DXY

— Swing Trading (@swingtrading_ct) May 3, 2020

https://compoundtrading.com/product/swing-trading-webinar-sun-mar-1-pl-review-how-each-trade-was-identified-and-executed-charting-trades-on-watch/

$CL_F $USO $WTI $SPY $VIX $GLD $GC_F $SLV $BTC $USD $DXY