Category: Crude Oil Day Trading

Crude Oil Trading | Strategies, Alerts, Charts, Algorithm, Trading Room, P&L | Premium | Sept 29, 2019

Crude Oil Trade Report Sept 29, 2019.

Trade Strategies for Crude Oil (CL) Day Trading, Trend and Swing Trading. Intra-Day, Daily, Weekly, Monthly Time-Frames.

The CL trade strategies that include alerts, charts, algorithm models, signals, price targets and guidance included below are suitable for actionable mechanically executed trading and are also the models our coding team reference for our crude oil machine learning trade development.

You will find below a well developed, time-tested proven rules based system for crude oil trading that is one of the best available. You have to use all the models together as a structured system of trade for it to work to your best advantage.

With each chart model we may include “best-use” trade strategy notes and/or “rules-based trade indications” for your consideration. The oil trading room is your best resource for real-time learning.

For perspective, review historical reporting on our blog and the various videos we have published to the Compound Trading YouTube channel.

Much of the structured model discipline developed in our system is similar in concept as discussed in this video; Mathematician Who Cracked Wall Street.

Our “How to Trade Crude Oil” Recommendations.

Crude oil price moves within structured areas (ranges) of trade represented on charting on various time frames (different time cycles of trade).

The structure oil price moves within (the range of price) can be one minute charting (and more recently some machine trade is as low as 15 second time-frame) timing through to monthly charting.

Time-frame set-ups / strategies below are charted as conventional chart set-ups and/ or algorithmic chart set-ups (structures).

Understanding and having each chart time-frame at your immediate access (both conventional and algorithmic) will increase the probability of profitable trading.

You will find in reviewing the raw recorded video feed or in attending the live oil trading room that in the morning a lead trader will often review on mic the various levels of support and resistance on various oil trade time-frames on the charting to establish my most probable areas of trade for my strategy of trade. The lead trader will also check with all the chart time-frames prior to entering a daytrade at various times through the day.

Our use of this proven crude oil trading system (and obviously the use of our V3 machine learning software executing to this system) has provided an oil trade win-rate above 90% and currently we are returning over 148% ROI per year (win rate and ROI vary depending on time frame and version of software).

When multiple time-frames agree to support or resistance areas on the charting this becomes your highest probability area of trade execution, we have found this to be one of the best oil trading strategies.

Sizing trades appropriate to your trading account, probability of support or resistance (multiple oil chart time-frames in agreement) and time frame for each set-up is a positive strategy.

Using the correct chart time-frame specific to your trading strategy is critical. Generally, the lower (smaller) the time frame the less predictable the support and resistance areas (or structure) of the chart will be. However, the larger time-frames (monthly, weekly, daily) may also have significant “slippage” but the primary structure will often remain intact.

Generally, the idea is to enter your positions based on the structure for the specific time frame you are wanting to trade referencing the other time frame support and resistance or range within the trend. The basic method is to understand the range of trade and execute trade long bias when price is near support for the appropriate time frame / structure and the opposite is true for short trades.

Our staff use the thirty minute model structures (range within trends) most often for primary areas of support and resistance trading signals referencing all other time-frames in their trading strategy. More recently the 60 minute time-frame (view simple algorithmic model below) is being used by our staff as it provides a wider view of the current structure of oil trade.

Trade positions should be significantly biased to the trending range of trade. For more information about trend identification for trading various time-frames refer to this article on Investopedia; Multiple Time Frames Can Multiply Returns.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

The recently released white paper about EPIC v3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

If you have questions about the models below please email us at compoundtradingofficial@gmail.com.

Not all charts are updated every week and some concept or test charts are added or deleted on occasion.

Be sure to check the time-stamp of each chart below as the preparation of charts and/or models can take days prior to publication and distribution of this report.

If you are a new client that would like to review historical reports that are still locked on the blog from public view please email the office with your request and we will send you recent report credentials for unlocking reports for review.

Please note, chart links that support the models below are now distributed specific to each user or small group of users. If you are using more than one device to access the charting, to avoid disruption of service, please email us a simple / general description of those devices to assist in controlling dissemination.

EPIC Crude Oil Algorithm Model. 30 Minute Oil Chart Structure.

The EPIC algorithm model chart below is a proprietary structure that has been back tested sixty months on thirteen time-frames. The model represents the most probable areas of support and resistance in oil trade within this specific time-frame.

This (the EPIC 30 Minute Oil Algorithm Chart Model) is our most proven oil trading structure / strategy.

The levels noted on the EPIC model are to be used as important areas of consideration for support and resistance (trade signals) for your trading strategy when using conventional charting set-ups / structures and/or other algorithmic charting.

Resistance and support areas on the thirty minute oil trade structure chart are at each line on the algorithmic chart. The primary areas of support and resistance are;

- Outer quadrant walls / also used as channel support and resistance (orange dotted diagonal lines), the half way point between each is often an executable buy or sell trigger in trade (not shown on model below),

- Mid channel line for uptrend and down trend (white dotted diagonal),

- Mid quad horizontal (not marked but is at the mid point of the quad),

- Fibonacci levels (various horizontal colored lines),

- Historical areas of support and resistance (purple horizontal).

- The intra-week swing trading range is from thick horizontal gray line to the next (commonly becomes a pivot area of trade).

- The important historical diagonal trend-lines (conventional trend lines) are represented on the chart as thick white lines.

- Also of note are the price targets for Tuesday 4:30 PM (API), Wednesday 10:30 AM (EIA) and Friday 1:00 PM (Rig Count). The Tuesday and Wednesday targets hit significantly more often than the Friday target (red circles with red or green vertical dotted lines intersecting).

- At times other indicators are added to the chart such as important trend lines “in play”, moving averages and more.

The video at this link explains How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, #OIL, #Trading, #Algorithm, #OOTT as does this video Oil Trading Room – How to Use EPIC the Oil Algorithm Model Chart June 21 #OIL #OOTT and this Webinar 1: EPIC the Oil Algorithm.

When conventional crude oil charting coincides (or agrees) with the EPIC algorithmic model support and resistance this is then considered a significant buy or sell trigger (signal) for crude oil trade.

Be aware (at minimum) of the primary support and resistance areas on the larger time-frames (lower time frames are not as critical) – in this instance (when trading the 30 min time frame) the 1 hour, 4 daily, weekly and monthly charting should be considered when sizing your trades.

30 Minute EPIC Algorithm Crude Oil Trade Charting Model.

EPIC 30 Min Crude Oil Trading Algorithm 911 PM Sept 29 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Per recent;

EPIC 30 Min Crude Oil Trading Algorithm 810 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

15 Second Oil Day Trade Chart Model – Concept Model in Testing.

The 15 second chart model below has Fibonacci structures, horizontal and diagonal as well as the cloud and a chart bot for buy and sell signals.

This model allows for the discipline of symmetrical price extension moves to be measured easily as the chart has grid type features.

All levels are in test phase so use the model with care.

You can shut off the cloud and/or chart bot if either distract you.

This model is likely to change many times before we are done.

15 Second Crude Oil Trading Chart Model (day trading) Sept 29 1047 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

One Minute Oil Day-Trading Time-Frame Chart Model. Ideal for Intra-day Crude Oil Trade.

How to trade oil on one minute charting time-frame “best use” rules-based trading:

The one minute oil chart time-frame is one of the best for day-trading crude oil.

The one minute oil trading chart time-frame model provides for pinpoint trade entry, sizing and exit points for day-trading oil.

It is also used for squeeze scenarios in oil day trading. The main range is between the red / blue areas with thicker dotted white lines. The range is considerably more predictable in a squeeze scenario.

In a non squeeze scenario the one minute chart is best used as a grid tool for measuring day trade extensions in price. Refer to lead trader, trading room videos, reports, Discord server previous trading days, trade coaching for how to trade intra-day with one minute oil trading model using price extensions on the grid to your advantage. This is a considerable edge if you learn how to utilize this method.

Diagonal channel / trend lines may or may not be included with this chart, if so, they are recent trend lines of importance for day-trading levels also.

Again, be sure to reference other oil chart time-frames to ensure your highest probability of trade success (when two or more time-frames agree your success in trade – probability of winning, will go up significantly).

One Min Crude Oil Trading Model (day trading grid) Sept 29 927 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

One Minute Crude Oil Trading Model (day trading) Sept 2 842 AM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

5 Minute Charting.

Also used for day-trading crude oil, the five minute chart time-frame is a key area of trade (signal) for oil day traders.

The five minute oil trading strategy chart below includes a form of an Elliot impulse 5 wave component for when oil is predictably trading intra-day on this time frame. The diagonal sloping up-trending green lines can be used as support and resistance decision areas.

Intra-day time cycle peaks can also easily be identified and important with trade execution timing and size considerations. The vertical lines are time cycle peaks / inflections. Depending on intra day trend you will find half-time to be also of importance and even quarter time.

Here also, on the 5 minute model symmetrical price extensions within the structure of the model are key to levels of support and resistance in each wave of price within intra-day trading structure.

5 Min Crude Oil Trading Time-Frame Chart Model 1028 PM Sept 29 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

5 Minute Crude Oil Trading Time-Frame Chart Model 849 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

15 Minute Charting.

The 15 minute trading time-frame helps oil traders see a larger picture than the 1 and 5 minute time-frames.

The algorithmic chart model below is an abstract model that has a number of indicators within its structure. It helps oil traders determine areas of inflection, time cycles, channels and various other trends within oil trade.

When you get to the 30 minute, 60 minute, daily, weekly and monthly chart models further down in this report you will find we return to more conventional chart structures for wider time-frame strategy perspective.

15 Minute Crude Oil Trading Time-Frame Chart Model 1245 M Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

15 Minute Crude Oil Trading Time-Frame Chart Model 855 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

30 Minute Charting.

The thirty minute crude oil trading time-frame charting is critical for oil traders. The 30 min chart below is in addition to (complimentary to) the EPIC 30 Minute model above.

It is a noisy chart with many trend-lines (red, black are primary), price extensions (green arrows), time cycle inflections (blue dotted vertical), Fibonacci levels and more. It is more a “work-sheet” than it is a specific structured model. Because of this it becomes important for daytraders to reference regularly. We send updates to our subscribers on a regular basis, this allows for our clients to identify with short term trend channels and trends.

The key areas of support and resistance on the chart below are noted with thicker lines. The thicker the line in the chart the more important it is for your trading strategy and consideration for trade.

30 Minute Crude Oil Trading Time-Frame Chart Model 804 PM Sept 29 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

30 Minute Crude Oil Trading Time-Frame Chart Model 908 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

60 Minute Charting.

The 60 minute oil chart model below is a much cleaner and more simple model that references key support and resistance decisions for crude oil trade on the sixty minute time-frame.

The way to use this trading signal is for key areas of support and resistance on a weekly trend / reversal thinking strategy. Because the model is so clean and charts a larger structured time-frame, the levels indicated on the chart model should be considered heavily within trading strategies for the trader.

No oil day trader or swing trader should go with-out considering this chart before executing short term or mid term timing of trades.

The model includes time cycle peaks (vertical lines), quadrant support and resistance (diagonal Fibonacci trend-lines) and horizontal Fibonacci support and resistance.

60 Minute Crude Oil Chart Model 131 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

60 Minute Crude Oil Chart Model 924 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil

Daily Charting.

The daily oil chart time-frame provides a larger structure to consider. The diagonal Fibonacci lines are important as are the mid quad horizontal lines. The moving averages (especially the 200 MA) should be considered in your trade strategy. The MACD is a common indicator on the daily oil chart for forward positioning and trend bias.

The most recent daily model is a busy chart with many trend-lines and such (first chart below) and then the simpler “Keep It Simple” Daily Chart is also included below. The more simple Keep It Simple Daily chart model is excellent for trade strategy perspective.

Daily Crude Oil Chart Model Swing Trade Range 139 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Daily Crude Oil Chart Model with Fibonacci Channels 143 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Daily Crude Oil Chart Model with Fibonacci Channels 656 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Keep it Simple Daily Crude Oil Chart 156 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Keep it Simple Daily Crude Oil Chart 858 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil

Weekly Charting.

The weekly charting below should be used for perspective and/or or swing trading crude oil.

Keep it Simple Weekly Crude Oil Chart 201 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Keep it Simple Weekly Crude Oil Chart 707 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Monthly Charting.

The monthly oil charting below is similar to the weekly charting in that it provides a simple perspective for primary support and resistance in crude oil trade for your strategy. You will find that oil is currently trading mid-range within its current structure, caution is warranted at mid range. The 200 day moving average is well above so if opportunity to trade long at the chart support occurs this would be a sound strategy for oil traders within this current set-up.

Keep it Simple Monthly Crude Oil Chart 206 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Keep it Simple Monthly Crude Oil Chart 709 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Crude Oil Trading Room, Profit and Loss, Trade Alerts, Special Reports, Trading Strategies and More.

Recently we have written a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles below at the “Crude Oil Trading Academy” link videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are serious about learning how to trade oil you will find that the report you are reading, along with the various articles below and review of the live trading room (specific to around the times of trade) that your oil trading returns and win rate will increase significantly.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Trading Room, Futures, Strategy, Signals, Alerts, USOIL, WTI, CL_F, USO

Follow:

White Paper Updated Dec 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

85%+- Returns: Real-World Trade Performance and Why ROI Is Expected to Grow.

December 29, 2019 2:35 PM EST EPIC v3 Oil Trading Software Update.

Updates for this document series can be found here:

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

Draft white paper outlining key reasons EPIC v3 oil futures machine trading software outperforms conventional trading methods:

- Lightening Fast Decisions. EPIC crude oil trading software executes trades to over 8700 weighted decisions instantly. The instructions provided within the architecture is growing daily. A human trader cannot make decisions as quickly, cannot process the data required for most intelligent trading probabilities and cannot execute trades as precisely.

- Algorithmic Chart Models. The EPIC software includes over thirty proprietary algorithmic chart models and the catalogue is growing. The algorithmic models have been designed, tested and refined in real-world trade for over 3 years by a team of day traders, each with over 20 years of experience. The oil trading models represent all time-frames from 15 second to monthly time-frames of trade. The algorithmic models have been back-tested to sixty months historically.

- Conventional Charting. The software includes conventional charting structures on all time-frames, also back-tested sixty months.

- Common Trade Set-Ups. Included in the software are common trade set-ups that oil day traders implement. This is dynamic and additions are made regularly to the software code reflecting current structured trade set-ups.

- Order Flow. EPIC IDENT™ is data-driven order flow intelligence in real-time to achieve best outcomes.The software includes and executes to a proprietary order flow identification system that tracks behavior (specifically isolating other market machine liquidity) and weighs identified entities and historical trade patterns to its trade decisions (instructions). EPIC IDENT™ increases its intelligence as it gathers data intra-day specific to liquidity flow, historical patterns, time of day, volatility, various preferences, latency, rejects and more. The method is similar to back-testing charting, however, the process is real-time. In short the software is looking for “fingerprints” within market liquidity. We cannot back-test 60 months as with charting but back-testing from date of software inception is possible.

- Time Cycles. Time cycles are within all algorithmic and conventional trading model structures, order flow also has identified time cycles and other time cycle events such as weekly reporting in oil markets such as API, EIA and rig counts. Additionally there are time-of day market time cycles around the world. Time-cycles are included in the software architecture.

- ROI Trajectory “Game”. The software has a “game” element in that it is designed to continue its most recent ROI trajectory (or return to its trajectory of ROI should it have a draw-down period). In other words, if the trajectory of ROI is for example 100% and it draws-down to 80% it then will “weigh” trade decisions more to the most probable trade set-ups until the ROI trajectory is returned. It also will push its decision “weight” to exceed the current ROI trajectory to establish a better ROI to which it is then “obligated” to maintain and correct to, hence the expectation that the ROI will continue to improve over time. This is the “machine learning” component of development. We are finding that the software is discovering increasingly more creative ways to “game” the ROI return trajectory. This Sept 4, 2019 document details an insider look at this topic within development. Edited Sept 5, Draw-Down Oil Daytrading Session: Question and Answer Review | EPIC V3 Crude Oil Machine Trading Software.

Combined, these advantages enable the EPIC v3 Crude Oil Trading software to outperform conventional trading methods.

Introduction.

The world of public market trade is rapidly changing. It is estimated (depending on source) that over 80% of crude oil futures are not traded by humans and are now traded by machine.

Machine trade may be simple bot style software, high-frequency software or more sophisticated architecture as with the EPIC v3 class of algorithm.

Our team commenced the oil trading software development journey four years ago with algorithmic chart model development. From day one we employed computer scientists to work with us on a daily basis to build software emulating our trading methods.

Over time the software started to win more trades than our traders and today we rely almost solely on the software to execute trades. We simply “tweak” the software at each trade sequence to improve performance.

EPIC v3 software is our 3rd generation oil trading software. EPIC v1 tested returns at about 20% per annum, EPIC v2 at 40% per annum and EPIC v4 architecture was too aggressive for our risk threshold. We settled on EPIC v3 about ten weeks ago and have been refining its code trade by trade since.

The current EPIC v3 win-rate consistently comes in at +-90% per trade sequence (variable by +-7%).

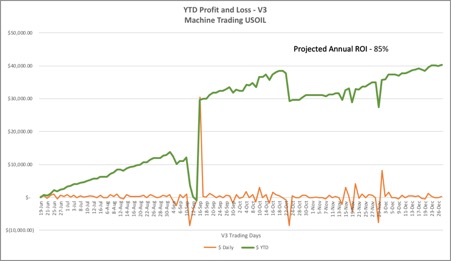

The current EPIC return is projected at 85% per year (and has been as high as 140%) – based on real world performance (audited trades available) and is expected to increase over time. The current period of time spans approximately six months and includes hundreds of trade executions (nearing thousands).

For December 27, 2019 Profit & Loss Daily =$331. YTD +$40,275. Projected $84,973 or 85% Per Annum. EPIC v3 Oil Machine Trade 100k Sample Account (live video, time stamped alerts, v3 audited P&L available) #OOTT $CL_F $USOIL $WTI $USO #oiltradingroom #oiltradealerts

https://twitter.com/EPICtheAlgo/status/1211013973329485824

For October 4, 2019 Profit & Loss Daily +$1,838. YTD +$34,218. Projected $140,331 or 140% Per Annum. EPIC v3 Oil Machine Trade 100k Sample Account (live video, time stamped alerts, v3 audited P&L available) #OOTT $CL_F $USOIL $WTI $USO #oiltradingroom #oiltradealerts

Account Size – ROI and Draw-Down Volatility.

The smaller the account size traded the more difficult it is for the software to limit risk to down-side and provide optimum returns, however, most recently considerable advancements in the software should limit the draw-down with smaller accounts considerably.

The software is designed to trade within a sequence of trade within structures or set-ups. As the oil market price changes, the software trading logic uses all the different data to update the decision tree utilizing the instruction rule-set.

You can imagine this as a dot plot process similar to the game “go” – not exactly, but the concept helps to visualize how the software plots a sequence plan for trade.

The “ebb and flow” of regular oil market trade allows opportunity for the software to plot a plan of trade within a sequence, the larger the account the more dots can be plotted (trades can be “bite sized” entries within an “ebb and flow”).

The sample account size for the purpose of this document is at the smallest range, being 100,000.00. A 1,000,000.00 account would expect approximately half the volatility / draw-down exposure and up to 50% more return. A 10,000,000.00 account would be considerably more stable to draw-down risk and potential returns and so on.

Draw-down Protocol.

During any particular 24 hour trading period the EPIC v3 software protocol (as of October 6, 2019 updates) expects on average draw-down no more than as follows;

- Account size and average 24 hour drawdown 10,000,000.00 = 1.5 %, 1,000,000.00 = 3%, 100,000.00 = 6%, 50,000.00 = 12%, 25,000.00 = 24%.

Hard stop architecture is also available, however, the annual expectation of returns would be significantly less than represented in the current real-world trade example above.

Real-World Trader / Investor Use.

In real-world examples the EPIC v3 oil trading software is being used daily by oil traders as an additional indicator and / or as an auto trading mechanism.

Examples include the Compound Trading Group live oil trading room (live broadcast of trades via voice and charts), live alert service via Twitter and Discord private server feeds and regular Oil Trading Reports that include algorithmic and conventional chart structures and guidance.

Additionally, SOVORON™ uses our data flow to integrate to their platform. SOVORON™ ‘Algorithmic machine trading of your personal Crude Oil Futures exchange account’. See www.sovoron.com for information.

Architecture of API Trade.

EPIC v3 software is designed to be deployed remotely – accessing an account and executing trades. This provides the account holder with ultimate control. The account holder grants the software access and the software executes machine trades to the account. The account holder can turn on or off access at any time. Architecture provides opportunity for decentralized platform integration.

Documentation.

Video. Our team traders and engineers have live video recording of the trading sessions with EPIC v3 software within a trading room environment.

Trader and Developer Repository. We provide guidance to our subscriber (paywall) clients in a Discord private server (charts and trade set-up explanations) in a real-time environment. The private server acts as a repository for our developers and our trading service (paywall) clients.

Live Trade Alerts. All trades have been broadcast over mic in a live trading room (recorded as mentioned above) and most have been alerted by way of text instruction to the Discord private server and/or private Twitter feed for time-stamped evidence.

Broker Accounts. The EPIC v3 trades are real-world trades and as such broker profit and loss statements can be made available.

Client Reporting. We provide regular reporting to our trading service clients (paywall) that explains the process of execution by the software. Examples of the guidance provided, trade alerts issued, Discord private server discussions and live trading room video can be found in this document (which is one of many published) Daytrading Crude Oil in Oil Trading Room: 6 Trades, 6 Wins. How We Did It | Alerts, Strategies, Video, Charts. This document provides a standard update document provided to our clients Protected: Crude Oil Trading Report Strategies | Alerts, Signals, Charts, Algorithms, Trading Room, P&L | Premium | Sept 2, 2019 use password CLTRADER.

Conclusion.

This paper outlines the opportunity that change in machine trade within global finance markets presents.

Competitors within the machine trade industry are becoming more and more refined / successful – the best in class are assumed to be winning a larger portion of proceeds.

The most significant immediate challenge developers face in machine trade within financial markets is building a product that can win within a prescribed threshold of stability limiting down-side and yet over-perform conventional trading methods.

Soon thereafter the challenge becomes competing against “like-kind” machine trade peers and being best in class.

It is our expectation that fewer and fewer competitors will achieve more of the proceeds (as a whole of trade in public markets) at an exponential rate, which does provide urgency to development and deployment.

The EPIC v3 trading software achieves consistent, predictable and very adaptable architecture that provides exceptional ROI potential.

Business Inquiries.

For information about oil trade alerts, oil trading room and oil trade reporting contact Compound Trading Group at compoundtradingofficial@gmail.com.

For information about automated machine trading platforms contact our agent representative Richard Regan as follows:

CONTACT US

Email richr@sovoron.com

Phone 1-849-861-0697

Follow

document revised September 24, 2019 9:22 PM EST

document revised October 6, 2019 2:00 PM EST

document revised December 29, 2019 2:35 PM EST

Others in this document series can be found here:

- December 10, 2023: EPIC Update: v6.1.1 Machine Learning Trade Software – Final Protocol Real World Results

- June 3, 2023: EPIC v4.1.1 Crude Oil Machine Trade Software White Paper | June 3, 2023

- March 28, 2022: EPIC v3.3 Crude Oil Machine Trade Software White Paper | March 28, 2022 Update

- January 7, 2021: EPIC v3.1.5 Crude Oil Machine Trade Software White Paper | Updated January 11, 2022 w/ Trade Execution Data

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

- December 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

Article Topics; Crude, Oil, Trading, Algorithm, Machine Learning, DayTrading, Futures, EPIC, Trade Alerts, Oil Trading Room, $CL_F $USO

Edited Sept 5, Draw-Down Oil Daytrading Session: Question and Answer Review | EPIC V3 Crude Oil Machine Trading Software

Summary Review – Answers For Questions Received About EPIC V3 Draw-Down in Oil Trading Room Today.

Please Note: There is an edit revision below that includes a question and answer session for Sept 5, 2019 that provides significantly more detail.

As the trading day progressed and we broadcast our trades in the live oil trading room today we received a number of questions by way of email and direct message. Below is an oil trading room review summary.

We did not have time to respond to the questions during the trading day as we were working with the machine trading software (coding).

Today the software had a larger than normal draw-down shorting against a rally in crude oil trade. Below is the daily profit and loss chart.

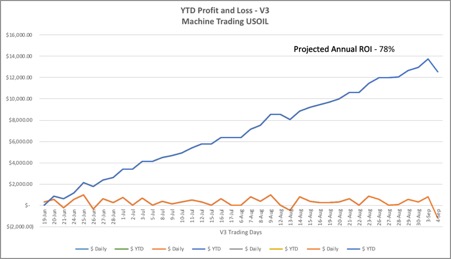

For September 4, 2019 Profit & Loss Daily -$1,205 YTD +$12,559 Projected $77,696 or 78% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts

The sequence the software was triggering trades to was a new sequence. When a new sequence activates the first go-round is often a loss, albeit normally less than today’s.

On the second or third go-round you will find that the software will win and continue to win better each time or it simply will not re-engage that same sequence.

The draw-down amount will normally be less as I mentioned, however, draw-downs will occur.

Nevertheless, the EPIC v3 crude oil trading software is extremely stable for a number of reasons, below are some of those reasons.

- If you look at the ROI trajectory for the software you will find that when draw-downs occur that the software will self-adjust its risk threshold to maintain the minimum trajectory.

- The software catalogs its trading set-ups, some set-ups it near never loses, some rarely, some not so rare. The point is, the software is coded to self adjust its minimum achieved ROI trajectory (correct it) as needed. In other words, it is coded to correct its minimum achieved trajectory by way of risk-threshold. To be more clear, it will be sure it self adjusts (wins) and how it is coded to do that is to bias its trade executions to its more probable set-ups.

- Its current ROI trajectory is between 80% – 90% approximately, you will see the software self-adjust its trade executions to more probable set-ups until that minimum trajectory is returned.

- Each time the trajectory is returned to the minimum average it will engage higher risk to learn trade set-ups. This process will continue and repeat over and over again. Over time the trajectory should increase on average as a result.

- The risk threshold of v3 vs v4 is much less aggressive (draw-downs and gains are considerably less volatile) and days like today will be few and far between because (as explained above) it will self-adjust back to the minimum ROI trajectory via the most probable trade set-ups of which it has some now that literally it very never loses if at all. It can rely on the catalog of those set-ups to adjust.

I can’t stress enough that the v3 software is not anywhere near similar in aggressiveness to the v4 version. This version is coded to avoid volatility, avoid large draw downs, and self adjust its risk threshold via high probable set-ups to snapiback to its minimum ROI trajectory as needed.

Watch the software over the next number of days and you will see it return to its minimum average trajectory and then you will see it take new sequence trade set-ups and the process will continue to repeat over and over.

If the software did not have trade set-ups (sequences) that it wins at near 100% of the time none of the above would apply.

Any questions about the detail of code architecture feel welcome to send us questions anytime so we can publish responses for our stakeholders to review as needed.

Below is an update. After the original blog post was released we had a few more questions come in that I would add answer to below. What I have done is copy and pasted the conversation below.

September 5 2019 Update: Oil Trading Room Review: Question and Answers EPIC V3 Software Protocol

[6:54 PM, 9/4/2019] Question: I still don’t understand that in some of the big moves the software fires opposite to the direction of the move but something we can talk about on Saturday

[7:22 PM, 9/4/2019] Answer: easy answer

[7:22 PM, 9/4/2019] Answer: if you look at the chart the price has come way off

[7:22 PM, 9/4/2019] Answer: software had order flow right

[7:23 PM, 9/4/2019] Answer: execution of sequence needs tweaking

[7:23 PM, 9/4/2019] Answer: same as when it gets the bottoms in sell offs, it used to struggle with that

[7:23 PM, 9/4/2019] Answer: as far as why it didn’t trigger with the rally….

[7:24 PM, 9/4/2019] Answer: thats simple too

[7:24 PM, 9/4/2019] Answer: order flow is random in a rally like that, it will near never trigger mid rally in rally’s induced by news, no predictable order flow data

[7:24 PM, 9/4/2019] Answer: short covering and retail daytrader trade causes the majority of the rally, no structure

[7:25 PM, 9/4/2019] Answer: so the key is it triggering on the predictable wins to maintain ROI trajectory and as time goes on slowly learning other set ups

[7:25 PM, 9/4/2019] Answer: i should have put this in the original blog post report

[7:26 PM, 9/4/2019] Answer: i will do an addendum / update report

[7:27 PM, 9/4/2019] Question: I understand why it would not fire in the big moves because of lack of structure and order flow

[7:27 PM, 9/4/2019] Question: I just don’t understand why when there is a big move down it is firing long and when there is a big move up it fires short

[7:27 PM, 9/4/2019] Answer: we tried to code a trajectory trade sequence for rally’s on news but we couldn’t get the code, too random

[7:28 PM, 9/4/2019] Question: Yes that makes sense to me

[7:28 PM, 9/4/2019] Answer: because its catching the end of the move to turn the other way, next in the code is to get it to hold some size through the reversal

[7:29 PM, 9/4/2019] Answer: the essence of the development right there, step one is code the reversal step two code the middle of the move, the middle is much more complicated to code

[7:30 PM, 9/4/2019] Question: Ahhh okay

[7:31 PM, 9/4/2019] Answer: the order-flow at the reversal is where the trading edge is…. seeing the order-flow pattern of the other machine liquidity on the IDENT program starting to turn for the reversal, thats why the machine trade software nails near 100% of the turns up in price on intraday trade after a sell off, but to get the sell-off you have to get the reversal like it was trying to do today and then you’re golden

[7:31 PM, 9/4/2019] Question: Okay yes I understand that now

[7:31 PM, 9/4/2019] Answer: its all about being able to get the reversal first, thats where the predictability is

[7:32 PM, 9/4/2019] Answer: once you have the sequence for the reversal then you can start on the middle core of the trade, we have the sell off reversal perfected and now we’re working on the middle of the move

[7:32 PM, 9/4/2019] Answer: the reversal after a rally to the short side still needs work, they’re different (reversal at top and reversal at bottom intraday)

[7:34 PM, 9/4/2019] Answer: without the reversal right its impossible to get the rest, the reversal is where you have to plant your trade, start your trade for high win rate probability, nothing else provides a high probability scenario that can be duplicated time after time

[7:34 PM, 9/4/2019] Answer: hope that helps

[7:34 PM, 9/4/2019] Question: Yes I get that now

[7:34 PM, 9/4/2019] Answer: good questions for the report update, doesn’t hurt to share

[7:35 PM, 9/4/2019] Question: You want to get the top of the rally

[7:35 PM, 9/4/2019] Answer: what happens in the middle is too random so if you get the top of a rally or the bottom of a sell off for the reversal and get your size in place then you have the trend to make the next turn

[7:36 PM, 9/4/2019] Question: But what is telling the software it is at the top when it really isnt and so it keeps firing short when the rally has not ended. That’s what I wanted to understand

[7:36 PM, 9/4/2019] Answer: its the bottoms and tops that have clear predictability, hence why we have the near 100% win rate on sell off reversals, but the rally tops are a different sequence that we’re working on

[7:37 PM, 9/4/2019] Answer: it was firing in to the top today, it nailed the top of the rally, it was firing 56.12 to 56.50, and then it came off to 55.90, its the same as the sell off bottoms, it trades them the same way, same concept, different sequence

[7:38 PM, 9/4/2019] Answer: that wasn’t the problem

[7:38 PM, 9/4/2019] Question: That makes sense. Because I remember you working on the bottoms of the sell off and now have that nailed

[7:38 PM, 9/4/2019] Answer: the problem is the sequence that it uses to gain size at the top and hold for the sell off reversal after the rally is the challenge we were working on

[7:38 PM, 9/4/2019] Answer: the sequence at tops is different than at bottoms

[7:39 PM, 9/4/2019] Question: Yes that makes sense to me

[7:39 PM, 9/4/2019] Answer: we have the bottom sequence perfected for the turn up after the sell-off, in that scenario we are now working on the sizing so that it holds some in the reversal rally

[7:39 PM, 9/4/2019] Answer: but the secret is this…

[7:40 PM, 9/4/2019] Answer: the only way the code wins near 100% of the time, the only way that is possible is at the reversals, reversal of a rally or reversal of the sell off

[7:40 PM, 9/4/2019] Answer: thats how the others that are winning have done it, we can see it in the order flow, its precise and repeatable over and over again

[7:41 PM, 9/4/2019] Answer: the middle of the move isn’t that way, it is random

[7:41 PM, 9/4/2019] Question: Okay I understand much better now

[7:42 PM, 9/4/2019] Answer: so if you have an ROI trajectory at say 85% and your code is nailing every bottom the only way to increase the ROI is to nail the tops or get your size better at bottoms for more profit in the move

[7:42 PM, 9/4/2019] Answer: so slowly we’ll work on nailing the tops for reversals and slowly work on holding more size when we’ve nailed the bottom reversals to increase ROI

[7:43 PM, 9/4/2019] Answer: when we lose as we develop those scenarios those trades won’t trigger (the software learning will stop) and the predictable set ups only will trigger to keep the 85% ROI at minimum (or whatever the ROI trajectory is at)

[7:44 PM, 9/4/2019] Answer: we have more than just the bottom reversals after a sell off in the ammo, but i think you get my point

[7:44 PM, 9/4/2019] Answer: there’s daytrading set ups it triggers to all the time, small wins intraday

[7:44 PM, 9/4/2019] Question: Makes sense

[7:45 PM, 9/4/2019] Answer: its just that today was a mathematically very large rally to which you see a larger than average loss, thats why i know that scenario will be very few and far between, very rare

[7:46 PM, 9/4/2019] Question: Yes that was an unusually large move in price

[7:46 PM, 9/4/2019] Answer: so its about risk management when it goes wrong and when it does the software / development team stopping the learning and software only trades what we know wins until trajectory of ROI is back in play (returned to its regular trajectory)

[7:46 PM, 9/4/2019] Answer: 3 days of trading and the previous ROI trajectory will be back at 85% – 90% and then as it learns the trajectory will turn up because the software now has more set-ups to trigger on that it wins consistently, at current level it is maxed out at about 90% ROI so it needs to add to its catalog of set-ups to increase ROI trajectory, the learning is where you will have short term draw-downs

[7:46 PM, 9/4/2019] Question: Yes that’s good

And remember, if you are struggling with your trading and need some trade coaching go to our website and register as needed.

Email me as needed compoundtradingofficial@gmail.com.

Best and Peace,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Oil Trading Newsletter (Member algorithmic and conventional charting).

Oil Trading Alerts (Private Twitter feed and Discord server).

Oil Trading Room (Bundle: newsletters, trading room, charting and real-time trading alerts).

Commercial / Institutional Multi User License (For professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, profit loss, coding, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL

Daytrading Crude Oil in Oil Trading Room: 6 Trades, 6 Wins. How We Did It | Alerts, Strategies, Video, Charts

The Report Below Shows You Exactly How We Day Trade Crude Oil and Win Well Over 90% of Our Trades With EPIC V3.

The thing we have learned using the EPIC v3 Oil Trading Strategy (rule-set for daytrading crude oil) is that it is highly stable, predictable, maintains a high win rate and provides a low stress environment to achieve an excellent return on equity.

Below are the details from today’s trading session, hopefully this will help you improve your trading skill-set.

Included in this Article;

- Live Oil Trading Room raw video footage (I alert our day trades by voice over microphone),

- Technical Analysis (Charts) we used to establish the reversal area of trade in oil (most probable low of day price),

- Oil Trade Alert private feed (Twitter) and Discord private oil trade chat room where we share alerts, guidance, charting and more.

The EPIC v3 system for day-trading crude oil by far provides one of the best oil day-trading system results you will find. We have subscribed to many oil trading rooms and alert services out there (most) and have researched the returns the best funds are obtaining. EPIC’s v3 protocol is by far (as of today’s date) maintaining the best oil day-trading win rate percentage and best ROI we can find.

If you study the system and implement it as intended you will win.

You have to study the strategies, really know the methods, practice executing the trades and preferably be present in the oil trading room receiving guidance from us as you are trading or at minimum receiving the trade alerts via Discord and/or Twitter private member feed.

Private Member Discord Oil Trade Chat Server (used for alerts, charting, guidance, etc).

Below are screen capture images from the oil chat room server showing you what charts were shared with alert comments. The live oil trading room voice broadcast guidance provides our day-traders with significantly more strategy detail.

First the day-trades as they occurred today:

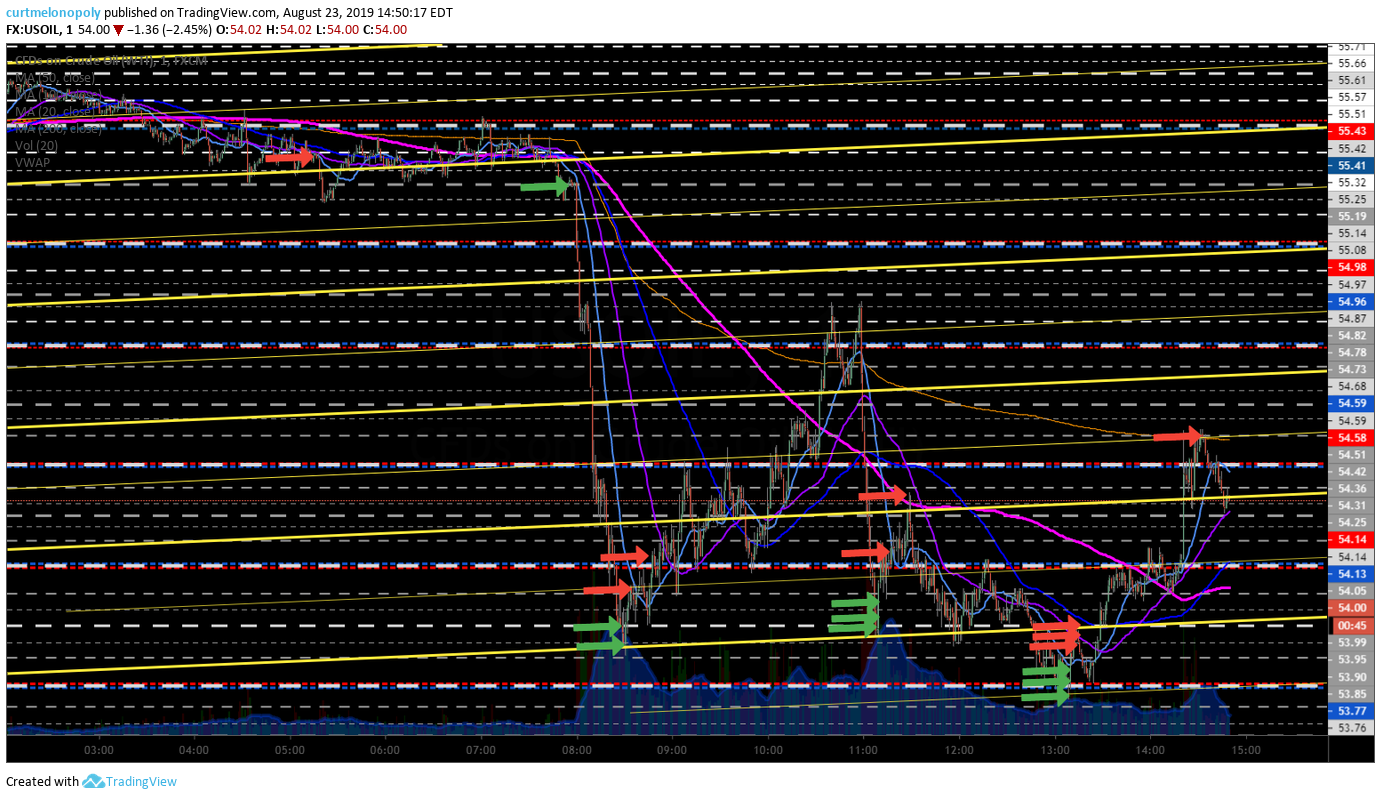

The trades you see below were executed because we knew that we were near the low of day and that a price reversal was very probable.

You will find that once we know the most probable area of trade on the day that is the low of day then we have a system of trading long in sequence on the 1 minute chart time frame using the other chart models as a guide also.

The five minute charting, 15 minute, 30 minute and 60 minute chart time-frames are all used.

Again, the video from the trading room footage will provide the most detail but the trade alerts, guidance and and charting revealed below will help you along some also.

The key is to not hold too much that you can’t correct your positioning through additional entries and / or surrendering a small loss if required to then enter another long position at the next support (when oil is selling off intra-day).

It is vital that you do not hold a long trade of any significant size in an intra-day sell-off, this will cause significant draw-downs to your account. You can always exit and take another trade if you protect your down-side.

Another key is holding enough in the reversal so that you can slowly release size as the reversal trade is occurring (something we are working on with the EPIC v3 software).

Curt MelonopolyToday at 7:50 AM

Preferred buys 53.76 trading 54.04 intra day.

Long 1/10 53.75 tight stops

Sell 1/10 53.93 hold 0

Curt MelonopolyToday at 9:50 AM

Long 1/10 53.18 and 1/10 53.35 from earlier test caution tight stops on structured range accumulation trade

Sold 1/10 53.30 holds 1/10

Curt MelonopolyToday at 10:02 AM

Long 1/10 53.08 add holds 2

Sold 1/10 53.21 holds 1/10

Curt MelonopolyToday at 10:13 AM

Software has a 52.92 add 1/10 long but won’t hold if this range breaks down. Holds 2/10 long.

Curt MelonopolyToday at 10:44 AM

Close 1/10 53.23 holds 1

Curt MelonopolyToday at 10:53 AM

Decent structure here

Close 53.42 hold 0/10 nice win

Exactly How We Established The Most Probable Low of Day Oil Price for The Reversal Trade To Win 6 out of 6 Day-trades Explained Below.

The technical analysis (charting) you see in the screen shots from the live trading room are oil trading models that are part of our system. Because crude oil is now widely traded by machines the models are highly predictable and structured, there is a system (rule-set) for planning your trade strategy.

In addition to the chart models (conventional and algorithmic) we also use our proprietary order flow software system (IDENT) which is simply a software code that identifies patterns in order flow much like we do as traders in charting.

Curt MelonopolyToday at 11:12 AM

Channel support machine line area on EPIC 30 Minute Algorithmic Model

10:30 time cycle inflection low on 5 minute model and quad wall support

Channel support hit on 30 minute model

How The Price Targets Are Established on the One Minute Oil Trading Time-Frame For Long Trades.

Once you have nailed the bottom area of intra-day trade (LOD) with your long trade positioning, the next challenge in daytrading crude oil is determining your price targets for trimming long positions and/or closing your positions all together.

One method we use (and our software is coded to) is symmetry as it relates to structured symmetry on the various algorithmic models on various time-frames. Below (and in more detail in the oil trading room video) I show our daytraders how to use the one minute oil chart time-frame symmetry to determine areas for price target upside extension for long trades.

Curt MelonopolyToday at 11:33 AM

software closed that sequence on 1 min symmetry (see arrow)

Curt MelonopolyToday at 12:02 PM

Video explains the reversal price target extensions based on 1 minute symmetry

Lead Trader Forward Oil Trade Guidance in Trading Room. Technical Analysis Suggests Further Downside Price Pressure Possible on Charting.

After the win it is important to know where you are going next, the trading strategy continues with forward looking support and resistance. Below is some of my technical analysis specific to the daily, weekly and monthly charting time frames.

Daily implies 51.45 low before decent bounce at TL

Weekly channel support 46.21 so lots of caution warranted

Monthly 47.00 area is support, again lots of caution trading 53.19

Miscellaneous other lead trader technical analysis in oil trading room and status of oil machine trading software development and alerts.

Curt MelonopolyToday at 1:14 PM

We’re watching 1:30 time cycle for possible mid intra-day time cycle inflection (possible high of day), trading 53.61 and we have possible HOD around 53.80 – .90 Time cycle on 5 min model runs 12:00 – 3:00 EST

Curt MelonopolyToday at 2:15 PM

Short 53.92 1/10 tight stops

Covered 53.87 1/10 still in HF mode, may re short it

Curt MelonopolyToday at 2:32 PM

Nice move through the quad on the daily reversal, slowly teaching the software to gain more of these moves, its a slow process one tweak at a time

developing a low risk trade sequence to gain accumulated size at the intra-day bottoms has been the priority, that was tricky enough, but slowly one step at a time we’ll get the full range coded, software up well today just on the bottom reversal trades so we’re happy, but the range will be a game changer

the larger the account the easier the sequence becomes to capture the whole move also

Screen image of private member private oil trading alert feed with trades as alerted through the day.

Below are the time stamped trade alerts from our private member oil trading alert feed and screen shots of the feed.

EPIC Alerts

@OilAlerts_CT

·

10h

Close 53.42 hold 0/10 nice win

EPIC Alerts

@OilAlerts_CT

·

10h

Curt MelonopolyToday at 10:44 AM

Close 1/10 53.23 holds 1

EPIC Alerts

@OilAlerts_CT

·

10h

Curt MelonopolyToday at 10:13 AM

Software has a 52.92 add 1/10 long but won’t hold if this range breaks down. Holds 2/10 long.

EPIC Alerts

@OilAlerts_CT

·

11h

Sold 1/10 53.21 holds 1/10

EPIC Alerts

@OilAlerts_CT

·

11h

Curt MelonopolyToday at 10:02 AM

Long 1/10 53.08 add holds 2

EPIC Alerts

@OilAlerts_CT

·

11h

Sold 1/10 53.30 holds 1/10

EPIC Alerts

@OilAlerts_CT

·

11h

Curt MelonopolyToday at 9:50 AM

Long 1/10 53.18 and 1/10 53.35 from earlier test caution tight stops on structured range accumulation trade

EPIC Alerts

@OilAlerts_CT

·

13h

Sell 1/10 53.93 hold 0

EPIC Alerts

@OilAlerts_CT

·

13h

Long 1/10 53.75 tight stops

EPIC Alerts

@OilAlerts_CT

·

13h

Curt MelonopolyToday at 7:50 AM

Preferred buys 53.76 trading 54.04 intra day.

Live Oil Trading Room Video.

Please note: The video below is a raw feed only of the oil trading room for the whole day-trading session (we run the live video feed from approximately 7:00am to 5:00pm EST). To listen to comments by the lead trader that contain specifics to his/her oil trade strategy / thinking as he/she and/or the software are trading and sending out alerts, look at the time stamp on the oil trade alert, chart, trading room screen capture image etc in this or any other report and correlate that to the video and go to that part of the video.

Oil Trading Profit and Loss.

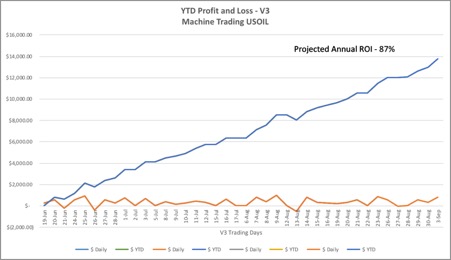

For September 3, 2019 Profit & Loss Daily +$796 YTD +$13,764 Projected $86,619 or 87% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts

For September 3, 2019 Profit & Loss Daily +$796 YTD +$13,764 Projected $86,619 or 87% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts pic.twitter.com/jrIEz8xxbk

— Melonopoly (@curtmelonopoly) September 3, 2019

How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching.

If you are struggling with your trading and need some trade coaching go to our website and register for a minimum 3 hours.

And if you’re really serious about learning how to trade crude oil to achieve our consistent v3 win rate and returns, review this particular oil trading room video from today.

Refer to the technical analysis charting and alerts time stamps and cross-reference the timing with the video time stamp and listen to the guidance in the oil trading room. Specifically the analysis of how we established the low range on the day is important. If a daytrader knows with confidence that intra-day trade is near a bottom then he/she can start to execute long trades in a systematic sequence to build size to garner better and better return on the day.

Email me as needed compoundtradingofficial@gmail.com.

Best and Peace,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Oil Trading Newsletter (Member algorithmic and conventional charting).

Oil Trading Alerts (Private Twitter feed and Discord server).

Oil Trading Room (Bundle: newsletters, trading room, charting and real-time trading alerts).

Commercial / Institutional Multi User License (For professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, strategy, alerts, trading room, technical analysis, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL

Crude Oil Trading Report Strategies | Alerts, Signals, Charts, Algorithms, Trading Room, P&L | Premium | Sept 2, 2019

Crude Oil Trade Report Sept 2, 2019.

Trade Strategies for Crude Oil (CL) Day Trading, Trend and Swing Trading. Intra-Day, Daily, Weekly, Monthly Time-Frames.

The CL trade strategies that include alerts, charts, algorithm models, signals, price targets and guidance included below are suitable for mechanically executed trading and are also the models our coding staff reference for our crude oil machine learning trade development.

You will find below a well developed, time-tested proven rules based system for crude oil trading that is one of the best available. You have to use all the models together as a structured system of trade for it to work to your best advantage.

With each chart model we may include “best-use” trade strategy notes and/or “rules-based trade indications” for your consideration.

For perspective, review historical reporting on our blog and the various videos we have published to the Compound Trading YouTube channel.

Much of the structured model discipline developed in our system is similar in concept as discussed in this video; Mathematician Who Cracked Wall Street.

Our “How to Trade Crude Oil” Recommendations.

Crude oil price moves within structured areas (ranges) of trade represented on charting on various time frames (different time cycles of trade).

The structure oil price moves within (the range of price) can be one minute charting (and more recently some machine trade is as low as 15 second time-frame) timing through to monthly charting.

Time-frame set-ups / strategies below are charted as conventional chart set-ups and/ or algorithmic chart set-ups (structures).

Understanding and having each chart time-frame at your immediate access (both conventional and algorithmic) will increase the probability of profitable trading.

You will find in reviewing the raw recorded video feed or in attending the live oil trading room that in the morning I will often review on mic the various levels of support and resistance on various oil trade time-frames on the charting to establish my most probable areas of trade for my strategy of trade. I will also check with all the chart time-frames prior to entering a daytrade at various times through the day.

Our use of this proven crude oil trading system (and obviously the use of our V3 machine learning software executing to this system) has provided an oil trade win – rate well above 90% and currently we are returning over 80% ROI per year.

When multiple time-frames agree to support or resistance areas on the charting this becomes your highest probability area of trade execution, we have found this to be one of the best oil trading strategies.

Sizing trades appropriate to your trading account, probability of support or resistance (multiple oil chart time-frames in agreement) and time frame for each set-up is a positive strategy.

Using the correct chart time-frame specific to your trading strategy is critical. Generally, the lower (smaller) the time frame the less predictable the support and resistance areas (or structure) of the chart will be. However, the larger time-frames (monthly, weekly, daily) may also have significant “slippage” but the primary structure will often remain intact.

Generally, the idea is to enter your positions based on the structure for the specific time frame you are wanting to trade referencing the other time frame support and resistance or range within the trend. The basic method is to understand the range of trade and execute trade long bias when price is near support for the appropriate time frame / structure and the opposite is true for short trades.

Our staff use the thirty minute model structures (range within trends) most often for primary areas of support and resistance trading signals referencing all other time-frames in their trading strategy. More recently the 60 minute time-frame (view simple algorithmic model below) is being used by our staff as it provides a wider view of the current structure of oil trade.

Trade positions should be significantly biased to the trending range of trade. For more information about trend identification for trading various time-frames refer to this article on Investopedia; Multiple Time Frames Can Multiply Returns.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

If you have questions about the models below please email us at compoundtradingofficial@gmail.com.

Not all charts are updated every week and some concept or test charts are added or deleted on occasion.

Be sure to check the time-stamp of each chart below as the preparation of charts and/or models can take days prior to publication and distribution of this report.

If you are a new client that would like to review historical reports that are still locked on the blog from public view please email the office with your request and we will send you recent reports to review.

Please note, chart links that support the models below are now distributed specific to each user or small group of users. If you are using more than one device to access the charting, to avoid disruption of service, please email us a simple / general description of those devices to assist in controlling dissemination.

EPIC Crude Oil Algorithm Model. 30 Minute Oil Chart Structure.

The EPIC algorithm model chart below is a proprietary structure that has been back tested sixty months on thirteen time-frames. The model represents the most probable areas of support and resistance in oil trade within this specific time-frame.

This (the EPIC 30 Minute Oil Algorithm Chart Model) is our most proven oil trading strategy.

The levels noted on the EPIC model are to be used as important areas of consideration for support and resistance (trade signals) for your trading strategy when using conventional charting set-ups / structures and/or other algorithmic charting.

Resistance and support areas on the thirty minute oil trade structure chart are at each line on the algorithmic chart. The primary areas of support and resistance are;

- Outer quadrant walls / also used as channel support and resistance (orange dotted diagonal lines), the half way point between each is often an executable buy or sell trigger in trade (not shown on model below),

- Mid channel line for uptrend and down trend (white dotted diagonal),

- Mid quad horizontal (not marked but is at the mid point of the quad),

- Fibonacci levels (various horizontal colored lines),

- Historical areas of support and resistance (purple horizontal).

- The intra-week swing trading range is from thick horizontal gray line to the next (commonly becomes a pivot area of trade).

- The important historical diagonal trend-lines (conventional trend lines) are represented on the chart as thick white lines.

- Also of note are the price targets for Tuesday 4:30 PM (API), Wednesday 10:30 AM (EIA) and Friday 1:00 PM (Rig Count). The Tuesday and Wednesday targets hit significantly more often than the Friday target (red circles with red or green vertical dotted lines intersecting).

- At times other indicators are added to the chart such as important trend lines “in play”, moving averages and more.

The video at this link explains How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, #OIL, #Trading, #Algorithm, #OOTT as does this video Oil Trading Room – How to Use EPIC the Oil Algorithm Model Chart June 21 #OIL #OOTT and this Webinar 1: EPIC the Oil Algorithm.

When conventional crude oil charting coincides (or agrees) with the EPIC algorithmic model support and resistance this is then considered a significant buy or sell trigger (signal) for crude oil trade.

Be aware (at minimum) of the primary support and resistance areas on the larger time-frames (lower time frames are not as critical) – in this instance (when trading the 30 min time frame) the 1 hour, 4 daily, weekly and monthly charting should be considered when sizing your trades.

30 Minute EPIC Algorithm Crude Oil Trade Charting Model.

EPIC 30 Min Crude Oil Trading Algorithm 810 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

One Minute Oil Day-Trading Time-Frame Chart Model. Ideal for Intra-day Crude Oil Trade.

How to trade oil on one minute charting time-frame “best use” “rules-based” trading:

The one minute oil chart time-frame is one of the best for day-trading crude oil.

The one minute oil trading chart time-frame model provides for pinpoint trade entry, sizing and exit points for day-trading oil.

It is also used for squeeze scenarios in oil day trading. The main range is between the red / blue areas with thicker dotted white lines. The range is considerably more predictable in a squeeze scenario.

Diagonal channel / trend lines may or may not be included with this chart, if so, they are recent trend lines of importance for day-trading levels also.

Again, be sure to reference other oil chart time-frames to ensure your highest probability of trade success (when two or more time-frames agree your success in trade – probability of winning, will go up significantly).

One Minute Crude Oil Trading Model (day trading) Sept 2 842 AM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

5 Minute Charting.

Also used for day-trading crude oil, the five minute chart time-frame is a key area of trade (signal) for oil day traders.

The five minute oil trading strategy chart below includes a form of an Elliot impulse 5 wave component for when oil is predictably trading intra-day on this time frame. The diagonal sloping up-trending green lines can be used as support and resistance decision areas.

Intra-day time cycle peaks can also easily be identified and important with trade execution timing and size considerations. The vertical lines are time cycle peaks / inflections. Depending on intra day trend you will find half-time to be also of importance and even quarter time.

5 Minute Crude Oil Trading Time-Frame Chart Model 849 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

15 Minute Charting.

The 15 minute trading time-frame helps oil traders see a larger picture than the 1 and 5 minute time-frames.

The algorithmic chart model below is an abstract model that has a number of indicators within its structure. It helps oil traders determine areas of inflection, time cycles, channels and various other trends within oil trade.

When you get to the 30 minute, 60 minute, daily, weekly and monthly chart models further down in this report you will find we return to more conventional chart structures for wider time-frame strategy perspective.

15 Minute Crude Oil Trading Time-Frame Chart Model 855 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

30 Minute Charting.

The thirty minute crude oil trading time-frame charting is critical for oil traders. The 30 min chart below is in addition to (complimentary to) the EPIC 30 Minute model above.

It is a noisy chart with many trend-lines, time cycle inflections, Fibonacci levels and more. It is more a “work-sheet” than it is a specific structured model. Because of this it becomes important for daytraders to reference regularly. We send updates to our subscribers on a regular basis, this allows for our clients to identify with short term trend channels and trends.

The key areas of support and resistance on the chart below are noted with thicker lines. The thicker the line in the chart the more important it is for your trading strategy and consideration for trade.

30 Minute Crude Oil Trading Time-Frame Chart Model 908 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

60 Minute Charting.

The 60 minute oil chart model below is a much cleaner and more simple model that references key support and resistance decisions for crude oil trade on the sixty minute time-frame.

The way to use this trading signal is for key areas of support and resistance on a weekly trend / reversal thinking strategy. Because the model is so clean and charts a larger structured time-frame, the levels indicated on the chart model should be considered heavily within trading strategies for the trader.

No oil day trader or swing trader should go with-out considering this chart before executing short term or mid term timing of trades.

The model includes time cycle peaks (vertical lines), quadrant support and resistance (diagonal Fibonacci trend-lines) and horizontal Fibonacci support and resistance.

60 Minute Crude Oil Chart Model 924 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil

Daily Charting.

The daily oil chart time-frame provides a larger structure to consider. The diagonal Fibonacci lines are important as are the mid quad horizontal lines. The moving averages (especially the 200 MA) should be considered in your trade strategy. The MACD is a common indicator on the daily oil chart for forward positioning and trend bias.

The most recent daily model is a busy chart with many trend-lines and such (first chart below) and then the simpler “Keep It Simple” Daily Chart is also included below. The more simple Keep It Simple Daily chart model is excellent for trade strategy perspective.

Daily Crude Oil Chart Model with Fibonacci Channels 656 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Keep it Simple Daily Crude Oil Chart 858 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil

Weekly Charting.

The weekly charting below should be used for perspective and/or or swing trading crude oil.

You will notice oil is currently trading / trending in a down channel but is currently supported by the 200 day moving average and the stochastic RSI indicator is turned up. A possible trend reversal is in play here now, watch the MACD closely – it is currently “flat”.

Keep it Simple Weekly Crude Oil Chart 707 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Monthly Charting.

The monthly oil charting below is similar to the weekly charting in that it provides a simple perspective for primary support and resistance in crude oil trade for your strategy. You will find that oil is currently trading mid-range within its current structure, caution is warranted at mid range. The 200 day moving average is well above so if opportunity to trade long at the chart support occurs this would be a sound strategy for oil traders within this current set-up.

Keep it Simple Monthly Crude Oil Chart 709 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Crude Oil Trading Room, Profit and Loss, Trade Alerts, Special Reports, Trading Strategies and More.

Recently we have written a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles below at the “Crude Oil Trading Academy” link videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are serious about learning how to trade oil you will find that the report you are reading, along with the various articles below and review of the live trading room (specific to around the times of trade) that your oil trading returns and win rate will increase significantly.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Trading Room, Futures, Strategy, Signals, Alerts, USOIL, WTI, CL_F, USO

Follow:

Buying Support in to the Plunge During Crude Oil Intra-Day Sell-Off | Oil Trading Room Video, Alerts, Strategy

7:49 AM EST Friday Crude Oil Started Sharp Intra-Day Sell-Off Dropping 200 Points in 40 minutes. We Went Long Live in Oil Trading Room and Alerting Buys in To Sell-Off and Nailed the Low Price and High Price of Day.

In the article below (one of the most important we have written) we detail the oil day trading strategy, trade positions (mapped on a chart) we executed short and long, screen capture images of oil trade alerts feed, technical charts, strategy comments, and live oil trading room raw video.

The Strategy Set-Up.

Thursday night going in to Friday morning (in CL futures trade) we alerted members by email and oil trade chat room (Discord server) there was a high probability of a significant sell-off coming in the over-night futures trading session (in to regular US market open). It was a channel resistance and symmetry set-up.

Oil did plunge in to the early morning on USA-China Trade War Escalation;

Oil plunged on trade-war escalation https://finance.yahoo.com/news/oil-plunges-trade-war-escalation-190000557.html?.tsrc=rss.

This set-up strategy we had been alerting to our members for some time as the trading channel resistance on the 30 minute chart time-frame was being challenged by oil bulls.

The key point is that there was also a significant algorithmic chart model symmetrical set-up developing, hence the alerts and trade guidance in the oil trade room (broadcast by voice).