Tag: $ESPR

Swing Trading Special Report Series (Part E) Thurs Nov 29 ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT …

Compound Trading Swing Trade Report Thursday November 29, 2018 (Part E).

Swing Trading Signals and Stock Picks In this Issue: ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT … .

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part E of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were covered at the last Trade Coaching Boot Camp. Part A of this swing trading special series can be found here, Part B of the swing trade report here, Part C of the swing trading report and Part D here.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports..

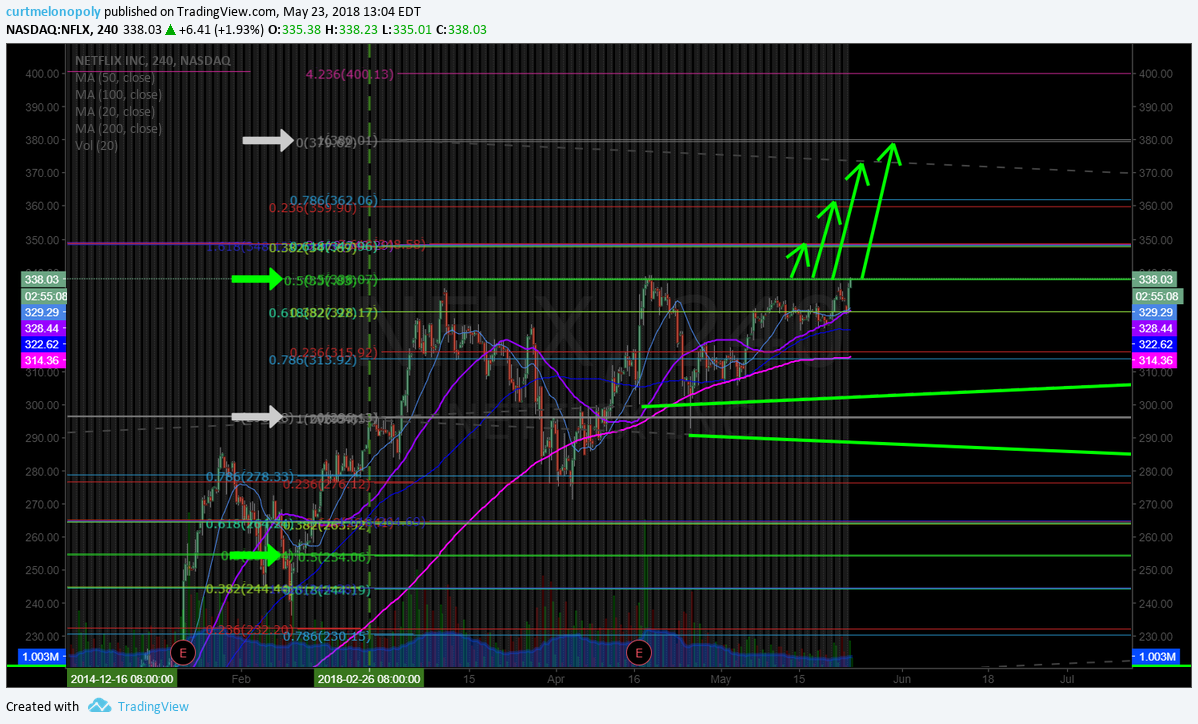

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSIS, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 14 – Swing Trading Special Report Sun Oct 14 (Part A) FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Current Swing Trading Signals and Stock Charts.

AUTOHOME (ATHM) Trading 80.56 with resistance 84.50 after bounce on weekly chart $ATHM #swingtrading

How to Trade ATHM:

Resistance and pull back is likely at TL (red) or bottom of trading box. Pull back could see target lower of current price.

A breach above trading box resistance is long and failure is short.

7 Winning Stocks to Buy in November for 2019 $ATHM $TSLA #swingtrading https://finance.yahoo.com/news/7-winning-stocks-buy-november-154329054.html?soc_src=social-sh&soc_trk=tw

AUTOHOME (ATHM) MACD turn up on the weekly chart after support found at trading box for a strong reversal $ATHM #swingtrading

There is a trajectory trend line resistance (red) near overhead price – longs should watch for that and then the trading box resistance.

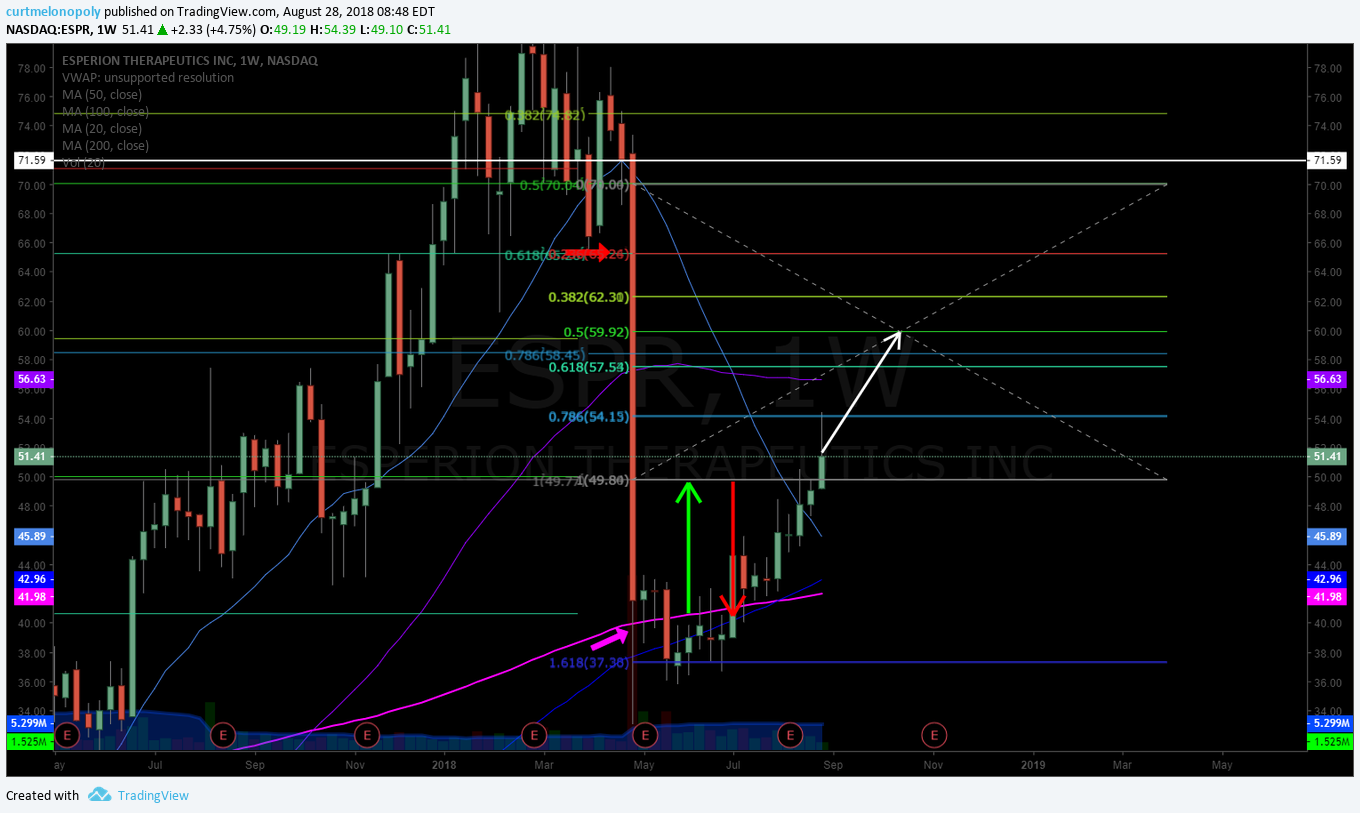

ESPERION (ESPR) Above 53.00 targets 50 MA then mid range on trading box 58.35. $ESPR #swingtrading

A failure of resistance test sees the lower target in trajectory. Above 53.00 targets 50 MA then mid range on trading box 58.35.

What’s Next for Esperion Therapeutics’ Cholesterol-Lowering Drug https://finance.yahoo.com/news/apos-next-esperion-therapeutics-apos-134400073.html?soc_src=social-sh&soc_trk=tw

CALITHERA BIOSCIENCES (CALA) Trading 4.78, over 200 MA targets 6.50, 8.50, 10.50. Under targets 2.75 $CALA #swingtrade

New Research: Key Drivers of Growth for AxoGen, Spirit Realty Capital, e.l.f. Beauty, Minerva Neu… #swingtrading $CALA https://finance.yahoo.com/news/research-key-drivers-growth-axogen-131000388.html?soc_src=social-sh&soc_trk=tw

APTEVO (APVO) Took out lower price target perfectly 4.90 to 3.30, trading 2.40 intra targets 3.30 in a bounce #swingtrading

APTEVO (APVO) If it turns it targets 3.30 first. Support at 2.10, 1.80, 1.40 #swingtrading

Aptevo Therapeutics (NASDAQ:APVO) Receives New Coverage from Analysts at LADENBURG THALM/SH SH.

MOMO Inc. (MOMO) Near trend line support from previous lows on high watch for a bounce with ER in 6 days #swingtrading #tradealerts

If it gets a turn the resistance points are 31.50, 33.30, 35.30, 37.30 (corresponding with lower, mid, upper trading boxes).

The recent sell-off points to a significant snap back trade when this gets going again.

Is the Options Market Predicting a Spike in Momo (MOMO) Stock? #swingtrading $MOMO https://finance.yahoo.com/news/options-market-predicting-spike-momo-133801632.html?soc_src=social-sh&soc_trk=tw

GRIDSUM (GSUM) continues its slide and NASDAQ listing hearings, a bounce could be powerful. $GSUM #OnWatch

Gridsum Announces Nasdaq Stay Request Granted https://finance.yahoo.com/news/gridsum-announces-nasdaq-stay-request-110000138.html?soc_src=social-sh&soc_trk=tw

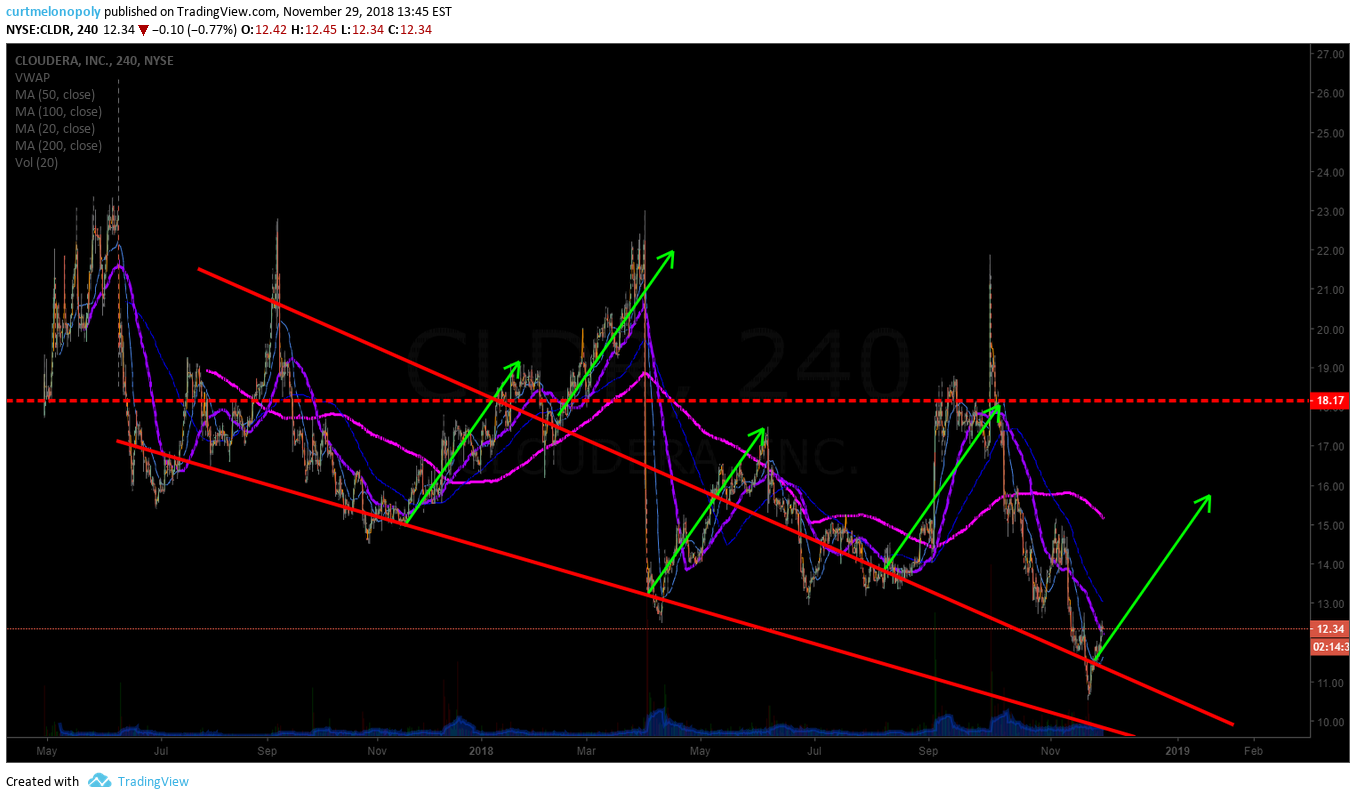

CLOUDERA INC (CLDR) If it gets a bounce post earnings price target 15.76 Jan 11 2019 $CLDR #swingtrading #earnings #symmetry

Will Cloudera, Inc. (CLDR) Report Negative Earnings Next Week? What You Should Know #swingtrading $CLDR #earnings https://finance.yahoo.com/news/cloudera-inc-cldr-report-negative-153003165.html?soc_src=social-sh&soc_trk=tw

FIT – review previous posts for charting structure. It isn’t one we are going to look at trading this quarter.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT

PreMarket Trading Plan Mon Oct 29: Earnings, Oil, $TSLA, $AAPL, $RHT, $IBM, $ESPR …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday October 29, 2018.

In this premarket trading edition: Earnings, Oil, $TSLA, $AAPL, $RHT, $IBM, $ESPR and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development Work in Progress:

- Platform Expansion This Week – Nominal Intermittent Down Time Expected: 1. We are integrating web mail servers with machine trading api’s for our clients, this may cause intermittent downtime for email [email protected] – use [email protected] if you experience issues. 2. We are moving our main fiber line – expect full trading room platform downtime for up to 30 mins.

- Oct 29 – Lead trader booked for main trading room for market open 9:30 AM, 12:00 PM mid day review and futures trading this evening 6:00 PM (as available and as market demands).

- Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- https://twitter.com/curtmelonopoly/status/1054318666878238720

- Main live trading room – 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- What’s New / Work in Progress (week of Oct 29 we expect to clear this WIP list):

- Machine trading signals to be fed in to main trading room starting mid to late week of Oct 29.

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November for each of the seven trading models and swing and daytrading – 8 in total to be announced (online only).

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

October 29 Trading Plan: Watching. Looks like a bounce in equity markets possible. Watching.

October 24 Trading Plan: It’s all about oil $WTI $CL_F today, then it will be about GOLD $GLD, SILVER $SLV, VIX $VIX and SP500 $SPY for me thereafter. Watching the TESLA $TSLA play and MCDONALDS $MCD very close. Everything else will be reviewed on swing trading report due out today.

October 23: Notes per below remain in play. New position long in Silver is working from 14.63’s as a swing trade, oil short in to open yesterday worked, watching for an intra-day bounce possible in to open in oil and then down likely. Gold has a bounce as does VIX as I expected in to this time cycle. Momentum daytrading is very dangerous right now. Watching some swing trades in equities (forming a report right now and I’ll release it today).

Considering a long term (6 months or more) swing trade in $MCD soon. Long.

$VIX up more than double since we were alerting time cycle run #premarket.

October 22: I have a new position in Silver in 14.63’s long that may get some pressure but there is a plan to add at support below. Earnings season may help equities some here near term – but it is dubious.

I will continue chewing around the edges of this crude oil sell-off at support areas for a reversal to the retracement and try and get a decent short position also when I can at upside resistance. Serious, serious pressure here in oil trade BUT support areas for possible reversal are starting to hit now on various charting time-frames and structures – BUT that doesn’t mean it will reverse. It reverses when it reverses, trade the indicators not bias.

Watching NFLX, SQ, ROKU, SHOP, FEYE very close right now and swinging them all. TSLA trade yesterday went great, still holding 25% on the swing side. Today is all about OIL with EIA.

PSTG has an upgrade I’m watching also.

I am leaning toward equity markets possibly holding up in to end of Oct early Nov, Gold Silver Crypto likely pressure in to that time frame, Oil likely pressure in to that time frame and VIX also. And then end of Oct early Nov that should switch.

This is a leaning bias – a general outlook. However, I do see significant risk that could trigger volatility at any time here. But generally equity markets should hold to that late Oct early Nov with VIX GOLD SILVER OIL under pressure and then the opposite should turn toward mid Dec time cycle peak. See the most recent oil trading strategies video.

I know I’ve been promising the remaining model reports for some time, last night we ran the machine trading tests on EPIC and it is working so I can leave the staff to that and now start getting the reporting out. The software development part of our biz I have to admit has been a challenge to our time.

It’s difficult to explain in short how complicated software development is with machine trading launch. But we’re learning to manage it. We’re in it to win it – we won’t give up and we’re making serious progress, that’s the bottom line.

Looking for possible short term sell off in oil with a spike in VIX, Gold, Silver and then markets should levitate for short term bringing VIX Gold Silver Crypto soft and then reversal again and again and rinse and repeat to mid December 2018 minimum.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 8:55 AM: US Dollar $DXY trading 96.32, Oil FX $USOIL ($WTI) trading 67.44, Gold $GLD trading 1229.56, Silver $SLV trading 14.65, $SPY 268.92 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6333.50 and $VIX trading 23.1.

Momentum Stocks / Gaps to Watch:

Blue Apron shares soar 18% after announcing availability through Walmart’s http://Jet.com

IBM To Buy Red Hat In $34B Deal, IT Stocks Surge https://benzinga.com/z/12581762 $IBM $RHT $CRM $SPLK $WDAY $AKAM #swingtrading https://www.benzinga.com/news/18/10/12581762/ibm-to-buy-red-hat-in-34b-deal-it-stocks-surge

Stocks making the biggest move premarket: IBM, RHT, HSBC, BLMN, FDC & more

Stocks making the biggest move premarket: IBM, RHT, HSBC, BLMN, FDC & more https://t.co/4alpz6GIVd

— CNBC International (@CNBCi) October 29, 2018

News:

$TSLA Ballie Gifford Willing to Throw More Money Behind Tesla $TSLA if Needed – The Times @Street_Insider

$AAPL Initial Apple (AAPL) iPhone XR Sales Weak, Trims Production Estimates – Rosenblatt @Street_Insider

$ESPR Esperion stock surges 15% on late-stage results for cholesterol drug. https://www.marketwatch.com/story/esperion-stock-surges-15-on-late-stage-results-for-cholesterol-drug-2018-10-29?mod=BreakingNewsSecondary

Dicerna’s stock set to soar after licensing, research collaboration with Eli Lilly.

China Regulator to Propose 50% Cut to Car Purchase Tax https://www.bloomberg.com/news/articles/2018-10-29/china-regulator-is-said-to-propose-50-cut-to-car-purchase-tax.

$JAZZ Announces FDA Approval of Xyrem for the Treatment of Cataplexy or Excessive Daytime Sleepiness in Pediatric Narcolepsy Patients.

$TSRO Announces Achievement of ZEJULA Prostate Cancer Development Milestones by Janssen. $18M milestone payment. $JNJ.

$MLNT Announces Positive Top-Line Results in Phase 3 Trial of Baxdela (delafloxacin) for Treatment of CABP.

$PRQR Receives Exclusive Worldwide License for IONIS-RHO-2.5 for Autosomal Dominant Retinitis Pigmentosa. $IONS.

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

#earnings for the week

$FB $AAPL $BABA $GE $IQ $MA $BIDU $EBAY $CHK $XOM $EA $TEVA $GM $UAA $TNDM $BP $SPOT $ON $FDC $ADP $CVX $KO $AMRN $SBUX $X $ABBV $PFE $FIT $PAYC $YNDX $OLED $ABMD $WTW $ANET $WLL $LL $FEYE $DDD $RIG $SNE $KEM $NWL $STX $BAH $FTNT

http://eps.sh/cal

#earnings for the week$FB $AAPL $BABA $GE $IQ $MA $BIDU $EBAY $CHK $XOM $EA $TEVA $GM $UAA $TNDM $BP $SPOT $ON $FDC $ADP $CVX $KO $AMRN $SBUX $X $ABBV $PFE $FIT $PAYC $YNDX $OLED $ABMD $WTW $ANET $WLL $LL $FEYE $DDD $RIG $SNE $KEM $NWL $STX $BAH $FTNThttps://t.co/r57QUKKDXL https://t.co/w6cD7uO3t7

— Melonopoly (@curtmelonopoly) October 29, 2018

#earningsseason calendar

$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAY

#earningsseason calendar$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAYhttps://t.co/r57QUKKDXL https://t.co/exPTAW20yW

— Melonopoly (@curtmelonopoly) October 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

Crude oil 4 hour chart. Trendlines. FX USOIL WTI $CL_F $USO #Oil #trading #chart #OOTT https://twitter.com/EPICtheAlgo/status/1056884532408926208

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade pic.twitter.com/M4NDXkdoMi

— Melonopoly (@curtmelonopoly) October 29, 2018

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

On the daily oil chart price ended the week right above the 200 MA and above the primary pivot marked on the chart.

MCDONALDS (MCD) Daily Chart. Break-out test in play $MCD #premarket #swingtrading

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Silver Weekly Chart has a MACD turn up possible, watching for a possible run up Oct 21 756 PM #Silver #Algorithm $SLV $USLV $DSLV

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD pic.twitter.com/JNfF5U9u7L

— Rosie the Gold Algo (@ROSIEtheAlgo) October 21, 2018

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Crude Oil Trading Strategy with Trend-Lines on Weekly Chart.

TESLA (TSLA) At trading box range support EOD Friday, in a bounce it targets 280.34 Nov 20, 2018 $TSLA #swingtrading

ARROWHEAD PHARMA (ARWR) MACD turned down but over 200 MA and channel support. On watch for adds to trade. $ARWR #swingtrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Bolsonaro wins

-Trump campaigns

-Merkel to quit

-Markets mixed

-U.K. budget

https://bloom.bg/2Rnxgk2

HEDGE FUNDS have boosted short positions in NYMEX WTI by +42 million bbl to 65 million bbl between Aug 28 and Oct 23:

HEDGE FUNDS have boosted short positions in NYMEX WTI by +42 million bbl to 65 million bbl between Aug 28 and Oct 23: pic.twitter.com/ZY7fdcsanp

— John Kemp (@JKempEnergy) October 29, 2018

Get ready for greater instability as end of global QE will have significant implications for global markets. Central Banks no longer cushion markets, Mohamed El-Erian says. https://www.bloomberg.com/view/articles/2018-10-29/ecb-confirms-it-will-end-unusual-measures-buttressing-markets …

Get ready for greater instability as end of global QE will have significant implications for global markets. Central Banks no longer cushion markets, Mohamed El-Erian says. https://t.co/t497AutsdH pic.twitter.com/pW9SJhlbYK

— Holger Zschaepitz (@Schuldensuehner) October 29, 2018

Ray Dalio usually states that asset classes outperform cash over the long run, and it’s very rare to have cash do well unless it’s a depression.

@jpmorgan chart shows almost all asset classes with negative YTD returns, first time in 40 years.

Ray Dalio usually states that asset classes outperform cash over the long run, and it’s very rare to have cash do well unless it’s a depression.@jpmorgan chart shows almost all asset classes with negative YTD returns, first time in 40 years. pic.twitter.com/nx9y8odjNz

— Tiho Brkan (@TihoBrkan) October 29, 2018

COT update covering hedge funds positions and changes in the wk to Oct. 23: #Oil sold again with #gold, #coffee and #sugar in demand #OOTT https://www.home.saxo/insights/content-hub/articles/2018/10/29/cot-oil-sold-again-with-old-coffee-and-sugar-in-demand …

COT update covering hedge funds positions and changes in the wk to Oct. 23: #Oil sold again with #gold, #coffee and #sugar in demand #OOTT https://t.co/AhiDEN7M9t pic.twitter.com/FihPfiG9Ec

— Ole S Hansen (@Ole_S_Hansen) October 29, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $RHT $DRNA $DCIX $TOPS $PXS $GNW $CREG $MNGA $BRZU $SEED $SGYP $TXMD $PBR $GRFS $YNDX

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Apple stock rises after Jefferies initiates at buy.

First Analysis Sec upgrades $HIIQ from Outperform to Strong Buy, target price to $65 http://99wallstreet.com/ratings/stock/HIIQ/ ….

Credit Suisse Starts United Utilities Group (UU:LN) $UUGRY at Outperform.

Tate & Lyle Plc (TATE:LN) $TATYY PT Raised to GBp725 at Jefferies.

(6) Recent Downgrades:

$CAT Lowered @ Stifel to $142.00.

Greenbrier Companies $GBX PT Lowered to $62 at Stifel.

Cargotec Oyj (CGCBV:FH) $CYJBF PT Lowered to EUR34 at Credit Suisse.

USA Truck $USAK PT Lowered to $30 at Stifel.

Gardner Denver Corp. $GDI PT Lowered to $32 at Stifel.

Varonis Systems $VRNS PT Lowered to $80 at RBC Capital.

Hartford Financial Services $HIG PT Lowered to $58 at RBC Capital.

$MRTX upgraded to Buy from Neutral at Guggenheim. PT $65.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, Earnings, Oil, $TSLA, $AAPL, $RHT, $IBM, $ESPR

PreMarket Trading Plan Tues 28: $ESPR, $BOX, $AFMD, $STAF, $ABIL, $DSW, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Tuesday August 28, 2018.

In this edition: $ESPR, $BOX, $AFMD, $STAF, $ABIL, $DSW, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Tuesday Aug 28:

- Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets).

- Between now and Sept 14 I will only be in the live trading room when I notify members (on email, Twitter, Discord). We are processing all the new algorithm models, upgrading all swing and algorithm newsletters, and preparing the content for the Sept 14-16 Trade Coaching event. In other words, we’re reconciling everything for our members over the next 2.5 weeks so that everything is updated, upgraded and distributed on schedule. Alerts will continue to go out on feeds and will also be upgraded to the new models. We will regularly be in member side Discord trading chat rooms as normal also.

9:25 Market Open – access limited to live trading room members12:00 Mid Day Trade Review – access limited to live trading room membersAny other live trading sessions will be notified by email.The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.Link: https://compoundtrading1.clickmeeting.com/livetradingPassword: **** (email for access if you do not have it, password changes will be emailed when changed only)For membership access, options here: https://compoundtrading.com/overview-features/

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

For those asking, wkly report distribution starts early Sun evening & continues through the wk starting w/Oil, Crypto, SPY, Swing and others. Reports are becoming size-able w new platform developments and as such they will flow on rotation Sun-Sat wkly.

https://twitter.com/CompoundTrading/status/1033822317057650688

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest move premarket: TIF, BBY, DSW, AAPL, SBUX & more –

Stocks making the biggest move premarket: TIF, BBY, DSW, AAPL, SBUX & more – https://t.co/hXoALAgx0L

— Melonopoly (@curtmelonopoly) August 28, 2018

Market Observation:

Markets as of 8:11 AM: US Dollar $DXY trading 94.75, Oil FX $USOIL ($WTI) trading 68.90, Gold $GLD trading 1213.51, Silver $SLV trading 14.92, $SPY 290.26 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 7010.00 and $VIX trading 12.0.

Momentum Stocks / Gaps to Watch: $AFMD $STAF $ABIL $DSW $LSCC $ATAI $CRON $BILI $TLRY

4 Stocks To Watch Today: AMD, CGC, COOL, VSTM

4 Stocks To Watch Today: AMD, CGC, COOL, VSTM – https://t.co/ukliOJOrl9

— Investing.com Stocks (@InvestingStockz) August 28, 2018

30 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12268396 $AFMD $STAF $DSW $BRKS $TMDI $TIF $TTPH $AKCA $IONS $MITK $BBY

30 Stocks Moving In Tuesday's Pre-Market Session https://t.co/dGUi6SGV7i $AFMD $STAF $DSW $BRKS $TMDI $TIF $TTPH $AKCA $IONS $MITK $BBY

— Benzinga (@Benzinga) August 28, 2018

News:

DSW to close its smallest #retail banner in Canadian marketplace $DSW https://bit.ly/2LxbWVV

UK’s NICE rejects $GILD’s CAR-T cancer cell therapy as too expensive https://cnb.cx/2MYUIoQ #biotech

Sears’ stock rockets after expansion of ship-to-store Amazon tire program.

Aspen Insurance’s stock jumps after Apollo buyout deal valued at $2.6 billion.

DSW Inc. shares soar 18% premarket after earnings blow past estimates.

Best Buy’s stock drops after profit and revenue beat, but downbeat earnings outlook.

Your Tuesday morning Speed Read:

– Monday a judge dismissed a shareholder lawsuit against Tesla over Model 3 production $TSLA

– Starbucks’ Pumpkin Spice latte released today, its earliest debut ever $SBUX

– Pres. Trump tweets Google search has been “rigged” against him $GOOGL

Your Tuesday morning Speed Read:

– Monday a judge dismissed a shareholder lawsuit against Tesla over Model 3 production $TSLA

– Starbucks' Pumpkin Spice latte released today, its earliest debut ever $SBUX

– Pres. Trump tweets Google search has been "rigged" against him $GOOGL— Benzinga (@Benzinga) August 28, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

BJ’s shares surge 6% premarket after earnings beat.

Tiffany’s stock soars after earnings and sales beat, raised outlook.

#earnings for the week

$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBA

http://eps.sh/cal

#earnings for the week$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBAhttps://t.co/r57QUKKDXL https://t.co/bvDhbgW1NZ

— Melonopoly (@curtmelonopoly) August 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

Great wash-out trade in progress from our swing trading platform… ESPERION (ESPR) . Long ads from our previous 49.11 buy side alert. Target reached and now targets 59.90. $ESPR #swingtrading #daytrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

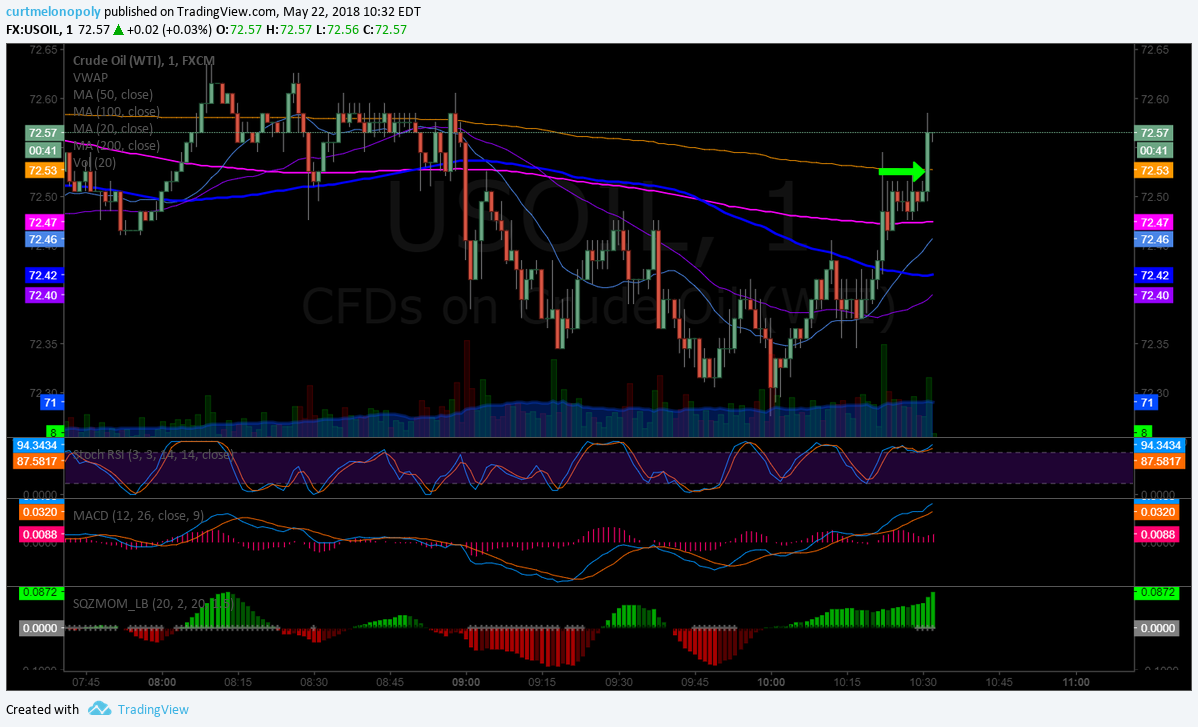

The 11 min trade $USOIL $WTI $CL_F #premarket #oil #nonstop #OOTT

The 11 min trade $USOIL $WTI $CL_F #premarket #oil #nonstop #OOTT pic.twitter.com/z4BLWWsDlK

— Melonopoly (@curtmelonopoly) August 28, 2018

and we closed at the red arrow $USOIL$WTI $CL_F #oil #OOTT @EPICtheAlgo and we’re not done.

and we closed at the red arrow $USOIL$WTI $CL_F #oil #OOTT @EPICtheAlgo and we're not done. pic.twitter.com/hnjtFYhpyK

— Melonopoly (@curtmelonopoly) August 28, 2018

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT pic.twitter.com/DrhjjCB9Hh

— Melonopoly (@curtmelonopoly) August 27, 2018

Oil Daily Chart. MACD cross up bullish testing underside of 50 MA. Aug 26 1030 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-U.S.-Mexico deal

-May tries to ease Brexit worries

-China growth seen slowing

-Markets quiet

-Oil developments

https://bloom.bg/2MYte2W

#5things

-U.S.-Mexico deal

-May tries to ease Brexit worries

-China growth seen slowing

-Markets quiet

-Oil developments https://t.co/Q7eHdqeHuT pic.twitter.com/baGogJIfQB— Bloomberg Markets (@markets) August 28, 2018

Bitcoin Surges Above $7,00 to a Three-Week High –

Bitcoin Surges Above $7,00 to a Three-Week High – https://t.co/oJwNIGEj9Z

— Investing.com News (@newsinvesting) August 28, 2018

The Week Ahead: Best Buy, Foot Locker Look To Extend Retail’s Rally https://benzinga.com/z/12262296 $AEO $BBY $FL $TTPH $CRM $BA $AKCA

The Week Ahead: Best Buy, Foot Locker Look To Extend Retail's Rally https://t.co/ysR2WAbHql $AEO $BBY $FL $TTPH $CRM $BA $AKCA https://t.co/XaWJxPYXCI

— Melonopoly (@curtmelonopoly) August 28, 2018

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT pic.twitter.com/eErfrbj3Kk

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April pic.twitter.com/KSIvqrmgKc

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AFMD 162%, $STAF 41%, $DSW $ABIL $BRKS $SHLD $CHFS $EGLT $CRON $NVIV $BILI $LSCC $ATAI

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $RH $COTY $XLNX $WMGI $EL $FMS $FBIZ $EL $RPAI $REG

(6) Recent Downgrades: $AMAT $LRCX $CTRL $SBGL $HMY $MITK $NEWT $DDR

Benchmark downgrades Mitek after management departures https://seekingalpha.com/news/3386093-benchmark-downgrades-mitek-management-departures?source=feed_f … #premarket $MITK

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $ESPR, $BOX, $AFMD, $STAF, $ABIL, $DSW, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY

Swing Trading Report (Mailing List Edition): Earnings Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Special Earnings Season Swing Trading Report and Video for July 24, 2018 (Part B).

In this Edition: OIL, $WTI, $SPY, $DXY, $CELG, $RIOT, $ARWR, $GTHX, $EXTR, $EDIT, $IPI, $MBRX, $SOHU, $PDLI, $ESPR, $LPSN, $XOMA and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

The Mid Day Trade Set-Ups Video:

Trade set-ups on this video; OIL, $WTI, $SPY, $DXY, $CELG, $RIOT, $ARWR, $GTHX, $EXTR, $EDIT, $IPI, $MBRX, $SOHU, $PDLI, $ESPR, $LPSN, $XOMA and more.

Mid Day Chart Swing Trading Set-ups July 24, 2018 Summary:

July 24 Swing Trading Special Earnings Season Report (mailing list version) that will become the premise for our next major entries.

Stocks reviewed on this 2nd video in the series for earnings: OIL, $WTI, $SPY, $DXY, $CELG, $RIOT, $ARWR, $GTHX, $EXTR, $EDIT, $IPI, $MBRX, $SOHU, $PDLI, $ESPR, $LPSN, $XOMA.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

This is from June 24 report cycle (last time these equities were reported to members) and now reviewed July 24, 2018. Members can refer to that report for charting to reference in the video (if not included below).

OIL $WTI – Looking for a sizeable entry at decision on the resistance on-deck trading 68..81. Waiting on the decision either side of resistance.

$SPY SP500 – Near target hit in time frame from yesterday’s video alert long trigger over 281 ish and came close to price target 282.46. Missing most bullish target but close. 283.80 next resistance, then 285.24. Intra day support 281.10 main support 278.64 for quad trading range Aug 2. 289.07 Aug 2 bullish scenario targets 294.25 then 299.53 in the model.

US Dollar $DXY – main pivot 94.54 in this structure and trading intra day just above. 96.50 – 97 is upside bullish target if price gets over light blue downtrending TL line. Trading channels are also discussed on video as is lower support.

$CELG – 87.84 resistance at quad wall (down trending TL Fibonacci) upside targets if it runs 86.12 88.70, 91.60 96.10 July 25. Earnings in two days.

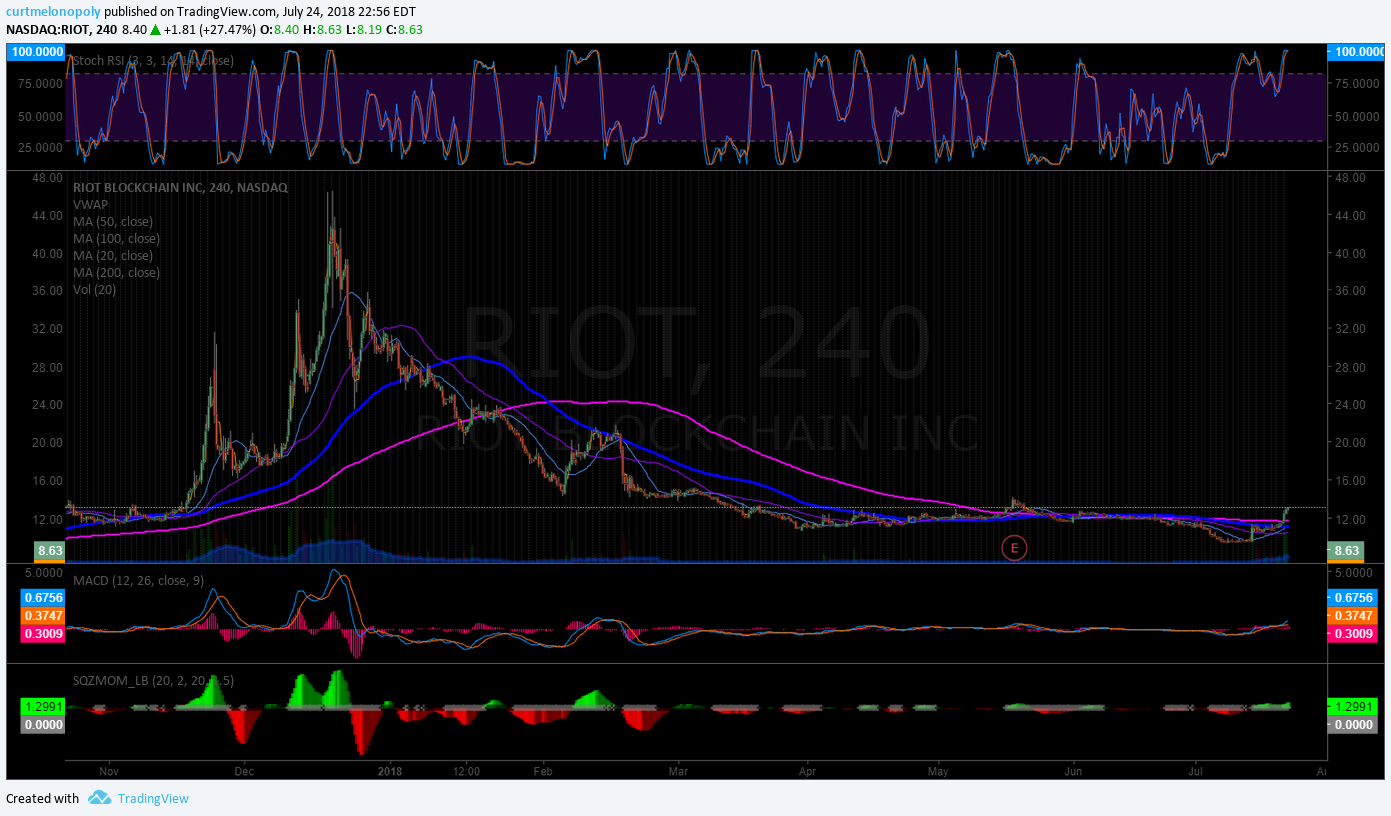

$RIOT – entries 7.30s to 7.60s ish today and released on its way up in to the 8s. Fantastic day trade. Swing trading most bullish price target resistance 9.70s.

$ARWR – Earnings 14 days trading 16.61 intra day, took a first 30% sizing trade on a swing long a little higher on the day. 16.25 main support. Will add on pullbacks at supports discussed in video. Low 20s is the price target range. Trading plan scenarios for upside and downside trade are discussed on video and sizing for each scenario.

$GTHX – Trade is at mid quad primary range resistance so a decision is near. 49.01 is buy side trigger if it holds on any given day at close. Main support 44.40 in structure. Pull back buy triggers are discussed on video.

$EXTR – Indicators are up but Stoch RSI is really high, short side alert worked, Sept 5th 7.16 lower price target in sell-off, support test at 8.49 trading 8.78. Earnings 15 days. If it gets bullish 9.29 resistance with 9.95 bullish target Sept 5 and I would be very cautious.

$EDIT – Algorithm model trade is predictable hitting price targets through the channel. Intra sitting on mid quad support and 200 MA. Channel in chart. Symmetry is excellent. Downside support is 30.53 quad wall intra, 28.00 support in sell off and 25.55 support. 27.93 price target Sept 29 in a downside. Trading plan discussed in video and how it should trade through the channel.

$IPI Intrepid Potash – 200 MA upside resistance on weekly chart. Would be nice to see MACD down and turn for an entry. Alarming chart for a possible breach of 200 MA to upside.

$MBRX – Main pivot 2.46 has held and this is a fantastic short each time it gets in that area of resistance.

$SOHU – Long long term trend is down, MACD trending down, earnings on deck in 6 days. Iffy chart, I would be cautious with this one.

$PDLI – Short side worked, we never did see buy trigger hit in dump, resistance areas for upside 2.92 3.05 3.21. Earnings in 12 days. Over 200 MA I may be interested in a trade.

$ESPR – Wash-out was an okay trade set up, MACD is about to turn up on the weekly structure, Stoch RSI is turned up. It is above 200 MA. Looking better. 49.60 main resistance trading 43.35. 20 50 MA weekly will be next resistance after 49.60. Trade trigger over 44.63 is a serious look.

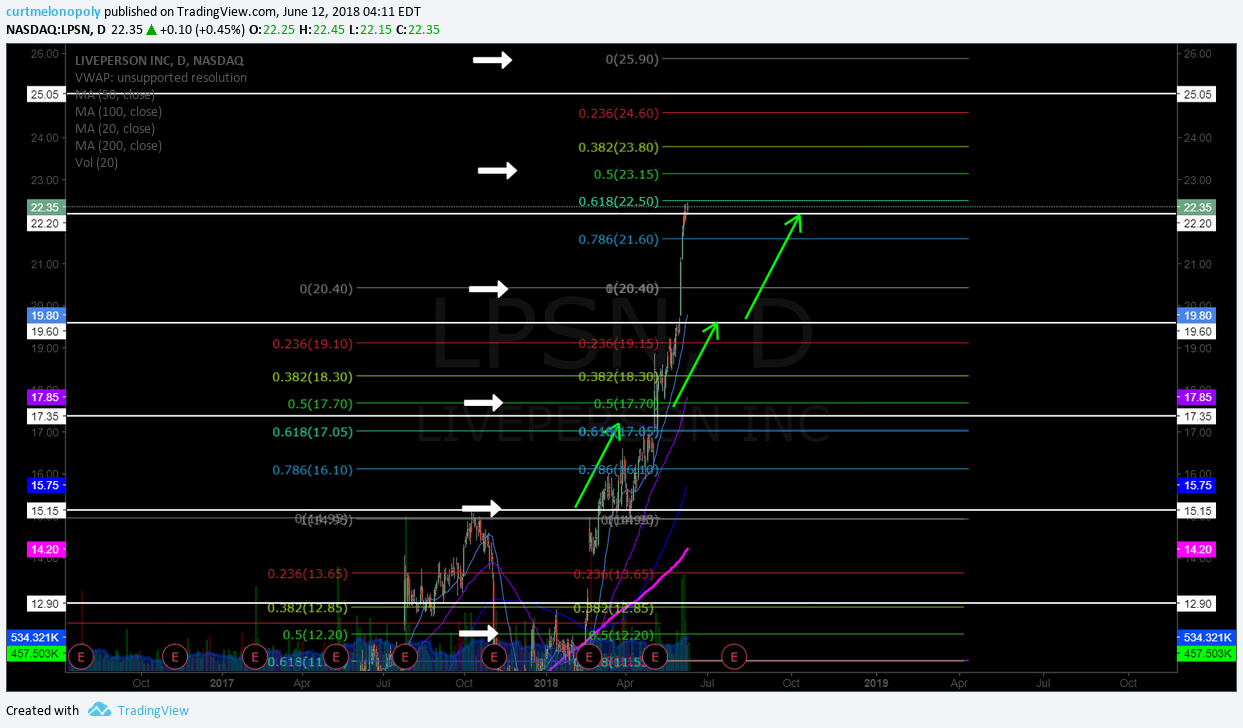

$LPSN LivePerson – Indicators are all up, earnings in 8 days, bulls have bought in to earnings, main resistance 25.10 ish and support around 20.40 and trading 24.35 intra. Watching for a break over 25.10 ish. Not interested in a pull back buy unless it got to 20 MA. Watch the main resistance 25.90. Mid pivot main 23.50 (trading right above intra day).

$XOMA – Trade below bottom target, trading at main pivot intra day, not sure which direction it will take. Likely see some upside but unsure, 26.70 is main buy zone consideration. Will review then.

Charts and Chart Links for Member Version Only

(Mailing list versions that may be made available from time to time do not include charting or chart links).

For charts that are not included below but are on the video, members can refer to most recent swing trading report that has the chart and/or chart link.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me:

Swing Trading Report (Members): Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Special Earnings Season Swing Trading Report and Video for July 24, 2018 (Part B).

In this Edition: and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

The Mid Day Trade Set-Ups Video:

Trade set-ups on this video; OIL, $WTI, $SPY, $DXY, $CELG, $RIOT, $ARWR, $GTHX, $EXTR, $EDIT, $IPI, $MBRX, $SOHU, $PDLI, $ESPR, $LPSN, $XOMA and more.

Mid Day Chart Swing Trading Set-ups July 24, 2018 Summary:

July 24 Swing Trading Special Earnings Season Report (member version) that will become the premise for our next major entries.

Stocks reviewed on this 2nd video in the series for earnings: OIL, $WTI, $SPY, $DXY, $CELG, $RIOT, $ARWR, $GTHX, $EXTR, $EDIT, $IPI, $MBRX, $SOHU, $PDLI, $ESPR, $LPSN, $XOMA.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

This is from June 24 report cycle (last time these equities were reported to members) and now reviewed July 24, 2018. Members can refer to that report for charting to reference in the video (if not included below).

OIL $WTI – Looking for a sizeable entry at decision on the resistance on-deck trading 68..81. Waiting on the decision either side of resistance.

$SPY SP500 – Near target hit in time frame from yesterday’s video alert long trigger over 281 ish and came close to price target 282.46. Missing most bullish target but close. 283.80 next resistance, then 285.24. Intra day support 281.10 main support 278.64 for quad trading range Aug 2. 289.07 Aug 2 bullish scenario targets 294.25 then 299.53 in the model.

US Dollar $DXY – main pivot 94.54 in this structure and trading intra day just above. 96.50 – 97 is upside bullish target if price gets over light blue downtrending TL line. Trading channels are also discussed on video as is lower support.

$CELG – 87.84 resistance at quad wall (down trending TL Fibonacci) upside targets if it runs 86.12 88.70, 91.60 96.10 July 25. Earnings in two days.

$RIOT – entries 7.30s to 7.60s ish today and released on its way up in to the 8s. Fantastic day trade. Swing trading most bullish price target resistance 9.70s.

$ARWR – Earnings 14 days trading 16.61 intra day, took a first 30% sizing trade on a swing long a little higher on the day. 16.25 main support. Will add on pullbacks at supports discussed in video. Low 20s is the price target range. Trading plan scenarios for upside and downside trade are discussed on video and sizing for each scenario.

$GTHX – Trade is at mid quad primary range resistance so a decision is near. 49.01 is buy side trigger if it holds on any given day at close. Main support 44.40 in structure. Pull back buy triggers are discussed on video.

$EXTR – Indicators are up but Stoch RSI is really high, short side alert worked, Sept 5th 7.16 lower price target in sell-off, support test at 8.49 trading 8.78. Earnings 15 days. If it gets bullish 9.29 resistance with 9.95 bullish target Sept 5 and I would be very cautious.

$EDIT – Algorithm model trade is predictable hitting price targets through the channel. Intra sitting on mid quad support and 200 MA. Channel in chart. Symmetry is excellent. Downside support is 30.53 quad wall intra, 28.00 support in sell off and 25.55 support. 27.93 price target Sept 29 in a downside. Trading plan discussed in video and how it should trade through the channel.

$IPI Intrepid Potash – 200 MA upside resistance on weekly chart. Would be nice to see MACD down and turn for an entry. Alarming chart for a possible breach of 200 MA to upside.

$MBRX – Main pivot 2.46 has held and this is a fantastic short each time it gets in that area of resistance.

$SOHU – Long long term trend is down, MACD trending down, earnings on deck in 6 days. Iffy chart, I would be cautious with this one.

$PDLI – Short side worked, we never did see buy trigger hit in dump, resistance areas for upside 2.92 3.05 3.21. Earnings in 12 days. Over 200 MA I may be interested in a trade.

$ESPR – Wash-out was an okay trade set up, MACD is about to turn up on the weekly structure, Stoch RSI is turned up. It is above 200 MA. Looking better. 49.60 main resistance trading 43.35. 20 50 MA weekly will be next resistance after 49.60. Trade trigger over 44.63 is a serious look.

$LPSN LivePerson – Indicators are all up, earnings in 8 days, bulls have bought in to earnings, main resistance 25.10 ish and support around 20.40 and trading 24.35 intra. Watching for a break over 25.10 ish. Not interested in a pull back buy unless it got to 20 MA. Watch the main resistance 25.90. Mid pivot main 23.50 (trading right above intra day).

$XOMA – Trade below bottom target, trading at main pivot intra day, not sure which direction it will take. Likely see some upside but unsure, 26.70 is main buy zone consideration. Will review then.

Charts and Chart Links for Member Version Only

(Mailing list versions that may be made available from time to time do not include charting or chart links).

For charts that are not included below but are on the video, members can refer to most recent swing trading report that has the chart and/or chart link.

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

Celgene (CELG) trading 86.81 with earnings in one day at quad wall resistance over mid quad support $CELG

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.

Swing Trading Report Tues June 12 (Part B) $EDIT, $SENS, $LPSN, $ITCI, $GTHX, $EXTR, $ESPR, $PDLI, $IPI more.

Compound Trading Swing Trading Stock Report (with Buy Sell Signals on Select Chart Set-Ups) Tuesday June 12, 2018 (Part B).

In this Edition; $EDIT, $SENS, $LPSN, $ITCI, $GTHX, $EXTR, $ESPR, $PDLI, $IPI, $XOMA, $SOHU and more.

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

This swing trading report is Part B of one in five on rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be programmed in to our charting for attendees to the live trading room and alerts will flash on screen in the trading room. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you form a swing trade plan that suites your time frame. If you need private coaching use our contact page and send me a note or email [email protected] and we’ll contact you (sometimes there is a short waiting list).

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up (set-up) that signal a trade long entry or an exit. In our case we rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Using the real-time charts – as chart links are made available below, click on link and open viewer. To open a real-time chart beyond the basic “viewer” click on the share button at bottom right (near thumbs up) and then click “make it mine”. To remove indicators at bottom of chart (MACD, Stochastic RSI and SQZMOM) double click chart field area and double click again to return the indicators to the chart.

Newer updates below in red for ease.

Recent Compound Trading Videos and Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage

$ARRY – ARRY Biopharma

June 4 – ARRAY Biopharma (ARRY) Continues to trade between important buy sell triggers on model (Fib mid quads) $ARRY #swingtrading #chart

It did in fact get a bounce (per last report and I missed execution) and now is testing upside resistance at 17.29. 17.29 holds and 18.40 is the main price target / resistance.

The downside scenario is a support test at 15.76 then 15.54 and 13.44.

The range and predictability in this model is decent so I will try and get an entry on over 17.29 or a failure.

Also of importance, the MACD appears to be ready to turn (this is a weekly chart so it is significant structure so if MACD does turn then bias is clearly bullish). Also of note, the Stochastic RSI recently turned up from near bottom. My bias is long for now.

Key FDA Events in June Investors Need to Watch Out For $VRX $ARRY $GWPH $MERK #FDA https://finance.yahoo.com/news/key-fda-events-june-investors-195607348.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

ARRAY Biopharma (ARRY) Real-Time Chart Link:

April 25 – $ARRY down draft scenario from last report playing out almost exactly as charted, we will see if we get bounce here.

13.48 holds it targets 18.41 June 17. And if it doesn’t price targets 8.48 June 17.

My bias is to upside target.

$ARRY News: Is There An Opportunity With Array BioPharma Inc’s (NASDAQ:ARRY) 32% Undervaluation?

https://finance.yahoo.com/news/opportunity-array-biopharma-inc-nasdaq-123942473.html?.tsrc=rss

Mar 11 – $ARRY 18.39 mid quad resistance test has to pay out for direction prior to charting shorter time frames for trade – slightly bearish right now.

$ARWR – Arrowhead Pharmaceuticals

June 4 – Arrow Pharmaceuticals (ARWR) Chart. Monthly 200 MA resistance overhead at 17.17 trading 10.92. Bullish bias. $ARWR #swingtrading

It seems logical to me that trade will test the upside 200 MA on the monthly chart again. I refer to this resistance because a clear trading model isn’t established yet (working on it).

Arrowhead Pharmaceuticals to Present at Upcoming June 2018 Conferences

Arrow Pharmaceuticals (ARWR). Daily chart simple model seems to suggest over 10.63 targets 16.32 Nov 26 2018 $ARWR #swingtrading

April 25 – $ARWR trading 6.52 the chart structure is still in play. Watching for an upside move.

Arrowhead Pharmaceuticals to Webcast Fiscal 2018 Second Quarter Results https://finance.yahoo.com/news/arrowhead-pharmaceuticals-webcast-fiscal-2018-200100257.html?.tsrc=rss

Mar 11 – $ARWR testing a series of previous highs on weekly chart w Stoch RSI MACD SQZMOM trend up #swingtrading

This is one of those trades / charts that isn’t easy to set a specific rice target on – the chart history has many scenarios if previous / historical highs break to upside. One way to trade it is long on an uptrend day with a stop set and let it ride the test. The risk reward to bullish side is significant if it breaks the previous highs. All indicators suggest a significant sized move.

$CDA – CareDx

June 4 – CAREDX (CDNA). Trade did get the new all time highs expected. Extended now and entry very difficult. $CDNA #swingtrading

I did also go over this likely scenario on the mid day review videos but I did not execute as I was really busy at the time with other more structured trades. Will watch for a pull back to previous highs and see if we get a bounce near there for a swingtrade.

April 25 – $CDNA very bullish since last report and likely pull back to new all time high (most probable scenario)

Olerup QTYPE® Receives CE Mark Certification https://finance.yahoo.com/news/olerup-qtype-receives-ce-mark-120000842.html?.tsrc=rss

$NAK – Northern Dynasty Minerals

June 4 – Northern Dynasty Minerals (NAK) Chart – Trending toward lower price target .28 Jul 18, 2018. $NAK #swingtrading

April 25 – $NAK gone to sleep. Trading .94 above 96.73 targets 1.496, 1.862 July 18. Under targets .28 July 18. #trading #pricetargets