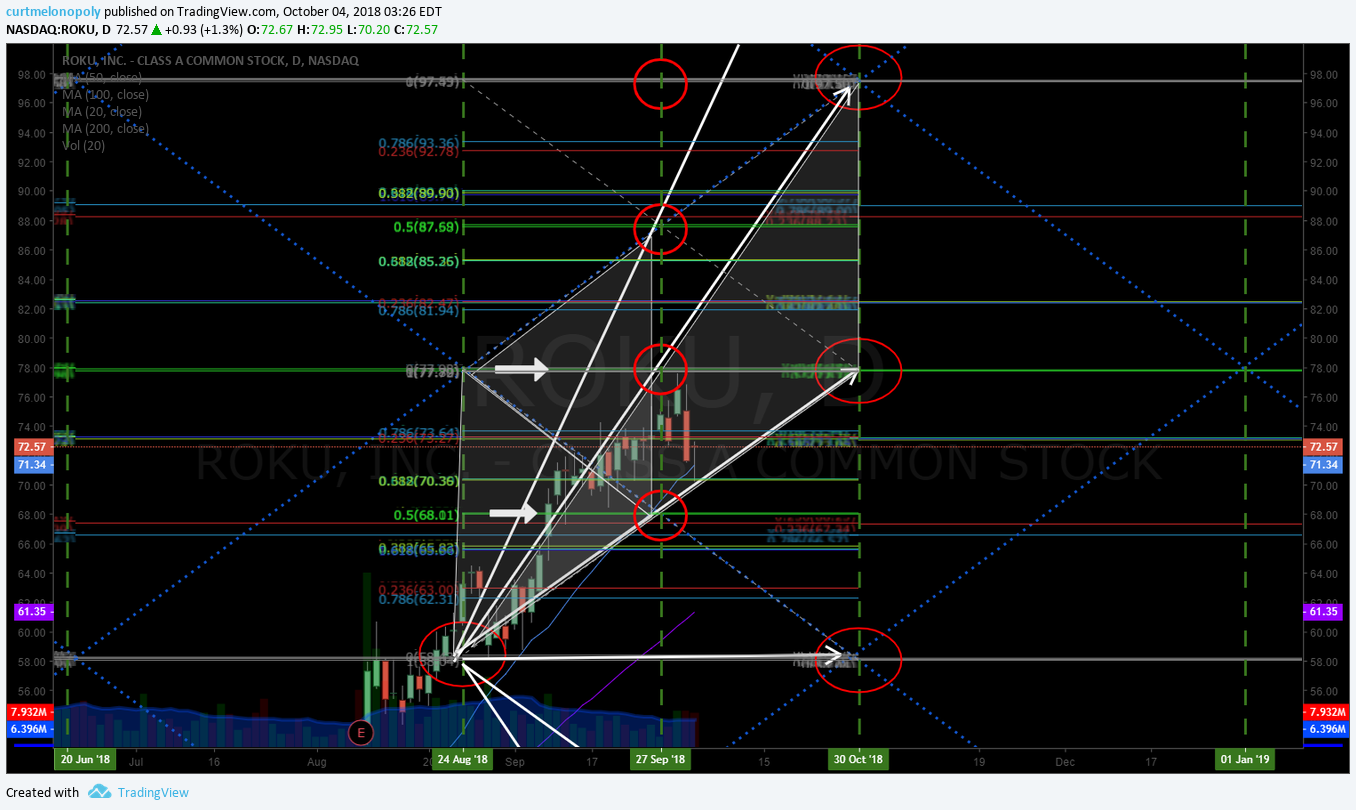

Tag: $ROKU

Swing Trade Set-Ups (Earnings) Part 6 : $ROKU, $ETSY, $MCD, $QQQ, $VIX, $X, $TEUM, $ARWR, $AU, $GC_F … #swingtrading #ER

Swing Trading Strategies, Alerts, Charts, News. August 22, 2019…

Below are Swing Trade Set-Ups Currently On Watch $ROKU, $ETSY, $MCD, $QQQ, $VIX, $X, $TEUM, $ARWR, $AU, $GC_F…

Earnings Season Swing Trade Positions Reporting Special Notes:

This report was written earlier in premarket but due to internet work crew the distribution was delayed until now.

Aug 22 – On Aug 19 we entered $QQQ long in low 187s, it hit 189.23 yesterday and we have a 197s price target in to Sept 9 week. On the 16th we added to the Gold short (2nd position) 1512.29 and it is trading at time of writing 1497.90. On August 12 we entered long $OSTK and got quickly stopped for a 4% loss on a starter position on some CEO news that sent the stock tumbling, one of our few losses lately. The $TEUM trade went well 2.60 – 3.60 and we’re looking at other entries soon. $MRO swing trade set-up has been flat thus far (post alert). The VIX time cycle has been spot on and we’ll be looking for longs in to the week of Sept 9 in advance of Oct 21 week time cycle peak. The $AU and $ARWR trades were / are outstanding performers and we continue to work with / have on watch because both should be considerable trades again soon. $AU long on other side of Sept 9 going in to Oct 21 and $ARWR adds to long position at key support areas. $DXY we are still watching for a short cycle, $SPY we didn’t long in to Sept 9 and chose $QQQ instead, $BTC we are watching for a possible bullish run on the other side of Sept 9 week. Other considerations are below.

Over the next few weeks the number of set ups to be sent out is expected to increase because of the Sept 9 and Oct 21 time cycle inflections nearing.

Per recent;

July 31 – We entered a new swing trade yesterday in TESLA that is doing excellent, closed the AMD swing trade prior to earnings which was a great call because it lost a lot of value after earnings were posted after market, are trading the Crude Oil move that seen a huge gain after the swing trade alert was issued and today we look at National Oilwell Varco, Trex and Chegg after they had larger than normal earnings price moves.

We’re also working on time cycle trades for SPY, VIX, Gold, Silver, DXY, BTC and more than we will report on soon.

Per recent;

July 22 – Below are some equities in focus this week with earnings, the follow- up reports on deck deal with other earnings focus equities and time cycles for the indices and specific instruments we focus on (GOLD, SILVER, VIX, SPY, OIL, US DOLLAR, BITCOIN).

Per recent;

Over the coming days we will be re-visiting all recent swing trade set-ups, alerts and trades in progress to reconcile the trades in advance of earnings and prepare for the new on other side of each new set up from earnings reports. This will involve a significant number of posts, trade alerts, mid day reviews in the trading room and videos that our members will receive a copy of.

Executing your swing trading strategy with our charting reports and live alerts involves using the key support and resistance areas of the charting, time cycle peaks, trajectory of trade and conventional indicators such as MACD cross-over and Moving Averages.

Alerts are not always issued at each add or trim to positions because that is simply not possible so you do have to manage your trade.

In many instances a clear swing trade strategy is laid out in the newsletter and/or videos so that you can manage the swing trade according to your risk threshold and account size.

If you struggle to establish a trading strategy with the information provided on our reporting, videos and alerts then some trade coaching is recommended to get you started.

Part 6 Earnings Swing Trades:

I have included Part 5 below for perspective, for parts 1 – 4 in this earnings season refer to recent premium member reports.

ROKU Inc (ROKU)

ROKU Inc (ROKU) has been trading bullish in channel since Dec 21 2018, looking for long blue sky positions for in to Sept 9 week $ROKU

Stop Worrying About Roku Stock’s Valuation #swingtrading $ROKU https://finance.yahoo.com/news/stop-worrying-roku-stock-valuation-122715703.html?soc_src=social-sh&soc_trk=tw

MCDONALDS (MCD)

MCDONALDS (MCD) I like long on other side of Oct 21, likely short at top of channel and long in to Oct 21 $MCD #swingtrading

At this point my bias is not in stone so at channel resistance and channel support I will look at the price relative to timing and make a decision.

3 Blue-Chip Dividend Stocks to Buy as Bond Yields Fall & Global Worries Rise https://finance.yahoo.com/news/3-blue-chip-dividend-stocks-192907901.html?soc_src=social-sh&soc_trk=tw #swingtrading $MCD

UNITED STATES STEEL CORP (X)

UNITED STATES STEEL CORP (X) As price nears lower end of range on weekly I can’t help but consider a long soon $X #swingtrading

U.S. Steel plans to lay off hundreds of workers in Michigan https://finance.yahoo.com/news/u-steel-plans-lay-off-213610778.html?soc_src=social-sh&soc_trk=tw

ETSY INC (ETSY)

ETSY (ETSY) I really like this pull back set up for a long in to price targets on chart model $ETSY #swingtrading

ETSY long premarket 55.75 for trade price targets and trajectory in charting https://twitter.com/SwingAlerts_CT/status/1164459394882572289

Etsy CEO: Q2 Was A ‘Breakthrough’ Quarter #swingtrading $ETSY https://finance.yahoo.com/news/etsy-ceo-q2-breakthrough-quarter-192514678.html?soc_src=social-sh&soc_trk=tw

Per recent;

Part 5 Earnings Swing Trades:

#earnings for week

$NVDA $BABA $WMT $CSCO $JD $CGC $GOLD $SYY $AMAT $TLRY $M $GOOS $JCP $AAP $EOLS $TSG $STNE $AZRE $LK $TME $ERJ $CSIQ $YY $HUYA $NINE $DE $TDW $CRNT $HYGS $QD $TPR $BRC $BEST $PAGS $VFF $NTAP $RMBL $CACI $BE $CWCO $NEPT $A #swingtrading

#earnings for week$NVDA $BABA $WMT $CSCO $JD $CGC $GOLD $SYY $AMAT $TLRY $M $GOOS $JCP $AAP $EOLS $TSG $STNE $AZRE $LK $TME $ERJ $CSIQ $YY $HUYA $NINE $DE $TDW $CRNT $HYGS $QD $TPR $BRC $BEST $PAGS $VFF $NTAP $RMBL $CACI $BE $CWCO $NEPT $A #swingtrading https://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) August 12, 2019

OVERSTOCK (OSTK)

OVERSTOCK (OSTK) Long in premarket post ER for a possible 50% + trade, watch further model reports soon. #swingtrade $OSTK #tradealert

Why Overstock.com’s Stock Jumped 17% Today https://finance.yahoo.com/news/why-overstock-com-apos-stock-171100193.html?soc_src=social-sh&soc_trk=tw

WALLMART (WMT)

WALLMART (WMT) Likes to trade the channels on this model, after earnings it should be a channel trade in the model either way, on watch $WMT #ER

Walmart, Alibaba and some big-name pot companies keep earnings season rolling #swingtrading #ER $WMT $BABA https://on.mktw.net/2Mggc0v https://twitter.com/swingtrading_ct/status/1160861625760583681

Marathon Oil Corporation (MRO)

Swing Trading Alerts

@SwingAlerts_CT

Swing entry starter long in $MRO did trigger in 12.80s, set up will be on weekend report..

9:28 AM · Aug 9, 2019 https://twitter.com/SwingAlerts_CT/status/1159818732329414657

Marathon Oil’s Drilling Machine Delivers Another Profit Gusher in Q2 #swingtrading $MRO

Marathon Oil's Drilling Machine Delivers Another Profit Gusher in Q2 #swingtrading $MRO https://t.co/8TgfJ0zCHu

— Swing Trading (@swingtrading_ct) August 9, 2019

Marathon Oil Risk Reward for this Swing Trade is Very High. The Set-Up is Good at Support, Lets See How a Starter Works Out #swingtrading $MRO

A simple swing trade strategy here; trade is near multi area supports with good earnings season sentiment, risk-reward is significantly in favor of bulls, if it fails exit the trade early and re-enter later. Remember, you can always re-enter.

Arrow Pharmaceuticals (ARWR)

Swing Trading Alerts

@SwingAlerts_CT

Arrow Pharmaceuticals (ARWR) Another double return swing, start trims in to 30.00. Nice trade from 15s. Let a bit run. $ARWR #swingtrading

https://twitter.com/SwingAlerts_CT/status/1159653769744920576

Looking For Growth? Take A Look At These Biotechnology Stocks #swingtrading $ARWR (link: https://www.investors.com/news/technology/biotech-stocks-best-biotech-companies-to-invest-in/) investors.com/news/technolog… vi

Looking For Growth? Take A Look At These Biotechnology Stocks #swingtrading $ARWR https://t.co/Oci9VUsUsp vi

— Swing Trading (@swingtrading_ct) August 9, 2019

Arrow Pharmaceuticals (ARWR) was a great swing trading, however, let it come down to channel support now before re entering long $ARWR #swingtrade

Swing Trading Alerts

@SwingAlerts_CT

AngloGold Ashanti (AU) Near double, if you haven’t already in to time cycle peak, time to take some profits add longs mid way to Oct 21 cycle #swingtrading #Gold $AU

https://twitter.com/SwingAlerts_CT/status/1159469811396685824

Curtis Melonopoly

@curtmelonopoly

While Gold $GLD $XAUUSD $GC_F did get some range for the bulls, we hammered down long on AngloGold Ashanti (AU) $AU for near a double #swingtrading #Gold

While Gold $GLD $XAUUSD $GC_F did get some range for the bulls, we hammered down long on AngloGold Ashanti (AU) $AU for near a double #swingtrading #Gold

— Melonopoly (@curtmelonopoly) August 8, 2019

AngloGold Ashanti (AU) Near double, if you haven’t already in to time cycle peak, time to take some profits add longs nearing Oct 21 time cycle in Gold #swingtrading #Gold $AU

PARTEUM CORP (TEUM)

Swing Trading Alerts

@SwingAlerts_CT

PARTEUM CORP (TEUM) trading 3.60 from 2.60 trade alert, considering ER it’s time to take profit along the way $TEUM #swingtrade #earnings

https://twitter.com/SwingAlerts_CT/status/1158321103418351616

Pareteum Joins Russell 3000 Index https://finance.yahoo.com/news/pareteum-joins-russell-3000-index-100000783.html?soc_src=social-sh&soc_trk=tw

Pareteum Announces Second-Quarter 2019 Financial Results https://finance.yahoo.com/news/pareteum-announces-second-quarter-2019-200500905.html?.tsrc=rss

PARTEUM CORP (TEUM) the trade alert to exit at 3.60 from 2.60 trade alert buys worked, now watch for channel support buys $TEUM #swingtrade #earnings

And finally, be sure to watch our trade alerts on our alert feeds and in live trading room. If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Swing Trade and Day Trading Reports (charts can be brought down to Day Trading time frame):

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, Earnings, $ROKU, $ETSY, $MCD, $QQQ, $VIX, $X, $TEUM, $ARWR, $AU, $GC_F

PreMarket Trading Plan Thurs Oct 18: OIL, $PTI, $ECYT, $NFLX, $TSLA, $SQ, $ROKU, $SHOP, $FEYE, $WTI, $VIX, $SPY, $BTC …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Thursday October 18, 2018.

In this premarket trading edition: OIL, $PTI, $ECYT, $NFLX, $TSLA, $SQ, $ROKU, $SHOP, $FEYE, $WTI, $VIX, $SPY, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 18 – Lead trader booked for main trading room for market open 9:30 AM, 12:00 PM mid day review and futures trading this evening 6:00 PM (as available and as market demands).

- Main live trading room – 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- What’s New / Work in Progress:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November for each of the seven trading models and swing and daytrading – 8 in total to be announced (online only).

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Sept 17 – Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 12 – XENETIC BIOSCIENCES INC How to Trade XBIO Snap-back Swing Trade. $XBIO #swingtrading #tradealert

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

October 18 – I will continue chewing around the edges of this crude oil sell-off at support areas for a reversal to the retracement and try and get a decent short position also when I can at upside resistance. Serious, serious pressure here in oil trade BUT support areas for possible reversal are starting to hit now on various charting time-frames and structures – BUT that doesn’t mean it will reverse. It reverses when it reverses, trade the indicators not bias.

Notes per recent remain:

Watching NFLX, SQ, ROKU, SHOP, FEYE very close right now and swinging them all. TSLA trade yesterday went great, still holding 25% on the swing side. Today is all about OIL with EIA.

PSTG has an upgrade I’m watching also.

I am leaning toward equity markets possibly holding up in to end of Oct early Nov, Gold Silver Crypto likely pressure in to that time frame, Oil likely pressure in to that time frame and VIX also. And then end of Oct early Nov that should switch.

This is a leaning bias – a general outlook. However, I do see significant risk that could trigger volatility at any time here. But generally equity markets should hold to that late Oct early Nov with VIX GOLD SILVER OIL under pressure and then the opposite should turn toward mid Dec time cycle peak. See the most recent oil trading strategies video.

I know I’ve been promising the remaining model reports for some time, last night we ran the machine trading tests on EPIC and it is working so I can leave the staff to that and now start getting the reporting out. The software development part of our biz I have to admit has been a challenge to our time.

It’s difficult to explain in short how complicated software development is with machine trading launch. But we’re learning to manage it. We’re in it to win it – we won’t give up and we’re making serious progress, that’s the bottom line.

Notes per recent remain.

Looking for possible short term sell off in oil with a spike in VIX, Gold, Silver and then markets should levitate for short term bringing VIX Gold Silver Crypto soft and then reversal again and again and rinse and repeat to mid December 2018 minimum.

Notes per recent…. this remains.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Notes from last trading day (Friday) premarket:

TESLA on watch in lower area of recent range, likely take a short term swing trade in TSLA today – long.

Gold, Silver and others I have now and I’m doing final edits. To be distributed over next day or two. Letting the set-ups firm up and start trading them again possibly as of Sunday night futures.

Likely start trading Bitcoin XBTUSD and VIX in to next week now also in to mid Dec time cycle.

SPY got a bump in premarket with jobs numbers, as with others above likely trading that aggressive in to time cycle peak mid Dec also come next week.

Oil in a small pull back but expect bullish trend to continue next week.

Market Observation:

Markets as of 7:58 AM: US Dollar $DXY trading 95.65, Oil FX $USOIL ($WTI) trading 71.48, Gold $GLD trading 1224.20, Silver $SLV trading 14.53, $SPY 279.56 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6435.00 and $VIX trading 18.2.

Momentum Stocks / Gaps to Watch:

25 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/12526683 $PTI $YECO $ECYT $TTS $ACOR $PX $AA $STLD $ACRS $SEE $TXT $GPS $LNN $URI

News:

Tesla signs $2 billion deal with Shanghai government, will open a plant with an annual capacity of 500,000 cars #swingtrading $TSLA

Tesla signs $2 billion deal with Shanghai government, will open a plant with an annual capacity of 500,000 cars #swingtrading $TSLA https://t.co/uklgqJcKVX

— Swing Trading (@swingtrading_ct) October 18, 2018

Saudi Arabia and Russia have opened the oil taps, just as they promised. Here’s a full rundown of OPEC+ output in September https://bloom.bg/2yKj7pa #Oil #OPEC #OOTT

https://twitter.com/EPICtheAlgo/status/1052897254087032832

A Turkish newspaper accuses a Saudi security official close to Crown Prince Mohammed bin Salman over the disappearance of #JamalKhashoggi, as Washington keeps up its cautious stance.

A Turkish newspaper accuses a Saudi security official close to Crown Prince Mohammed bin Salman over the disappearance of #JamalKhashoggi, as Washington keeps up its cautious stance https://t.co/IATK6lSgx8

— AFP News Agency (@AFP) October 18, 2018

Northrop wins $697M defense contract https://seekingalpha.com/news/3398434-northrop-wins-697m-defense-contract?source=feed_f … #premarket $NOC.

InfraREIT’s stock set to rally after merger deal with Sempra Energy’s majority owned Oncor https://www.marketwatch.com/story/infrareits-stock-set-to-rally-after-merger-deal-with-sempra-energys-majority-owned-oncor-2018-10-18?mod=BreakingNewsSecondary.

Endocyte stock pops 50% on $2.1 bln Novartis acquisition.

$APOP Cellect Biotechnology (APOP) Reports Positive Results of Orthopedic Treatment Using ApoGraft on Enriched Stem Cells Derived from Fat Tissues.

$QURE Announces Development of a Highly Potent, Next-Generation Promoter for Liver-Directed Gene Therapies.

Recent SEC Filings / Insiders:

Recent IPO’s:

Software company SolarWinds lowers price range for planned IPO to $15 to $16 a share.

Canada’s Aurora Cannabis stock to start trading on the NYSE Oct. 23

https://twitter.com/MarketsTicker/status/1052886615293607938

Earnings:

Philip Morris shares jump 2.9% premarket after earnings top estimates.

Travelers’ profit, revenue and written premiums all rise, beat expectations.

Blackstone third-quarter profit beats estimates amid market rise –

Blackstone third-quarter profit beats estimates amid market rise – https://t.co/0S5hw6Eruu

— Investing.com News (@newsinvesting) October 18, 2018

#earningsseason calendar

$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAY

#earningsseason calendar$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAYhttps://t.co/r57QUKKDXL https://t.co/exPTAW20yW

— Melonopoly (@curtmelonopoly) October 17, 2018

#earnings for the week

$NFLX $BAC $GS $UNH $CLF $PYPL $IBM $JNJ $LRCX $DPZ $BLK $MS $PGR $ISRG $SCH $GWW $CSX $AA $ABT $WGO $JBHT $NUE $SLB $HON $CMA $BX $SKX $KMI $PG $ASML $AXP $URI $TSM $URAL $PLD $FHN $ETFC $INFY $PM $STI $USB $TXT $ERIC $BBT $CREE

#earnings for the week$NFLX $BAC $GS $UNH $CLF $PYPL $IBM $JNJ $LRCX $DPZ $BLK $MS $PGR $ISRG $SCH $GWW $CSX $AA $ABT $WGO $JBHT $NUE $SLB $HON $CMA $BX $SKX $KMI $PG $ASML $AXP $URI $TSM $URAL $PLD $FHN $ETFC $INFY $PM $STI $USB $TXT $ERIC $BBT $CREEhttps://t.co/r57QUKKDXL https://t.co/IZ2INc9jBn

— Melonopoly (@curtmelonopoly) October 15, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

Crude oil lines on 4 hour chart $CL_F $USO $UWTI $DWTI $UCO $SCO $UWT $DWT#Oil #OOTT https://twitter.com/EPICtheAlgo/status/1052900369003622401

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

Our swing trade that started in premarket yesterday couldn’t have been better timing with SEC mins after then this… $TSLA Tesla’s stock jumps after Elon Musk discloses plan to buy $20 million worth of shares

Our swing trade that started in premarket yesterday couldn't have been better timing with SEC mins after then this… $TSLA Tesla's stock jumps after Elon Musk discloses plan to buy $20 million worth of shares https://t.co/lvBf2QhYTm

— Melonopoly (@curtmelonopoly) October 17, 2018

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

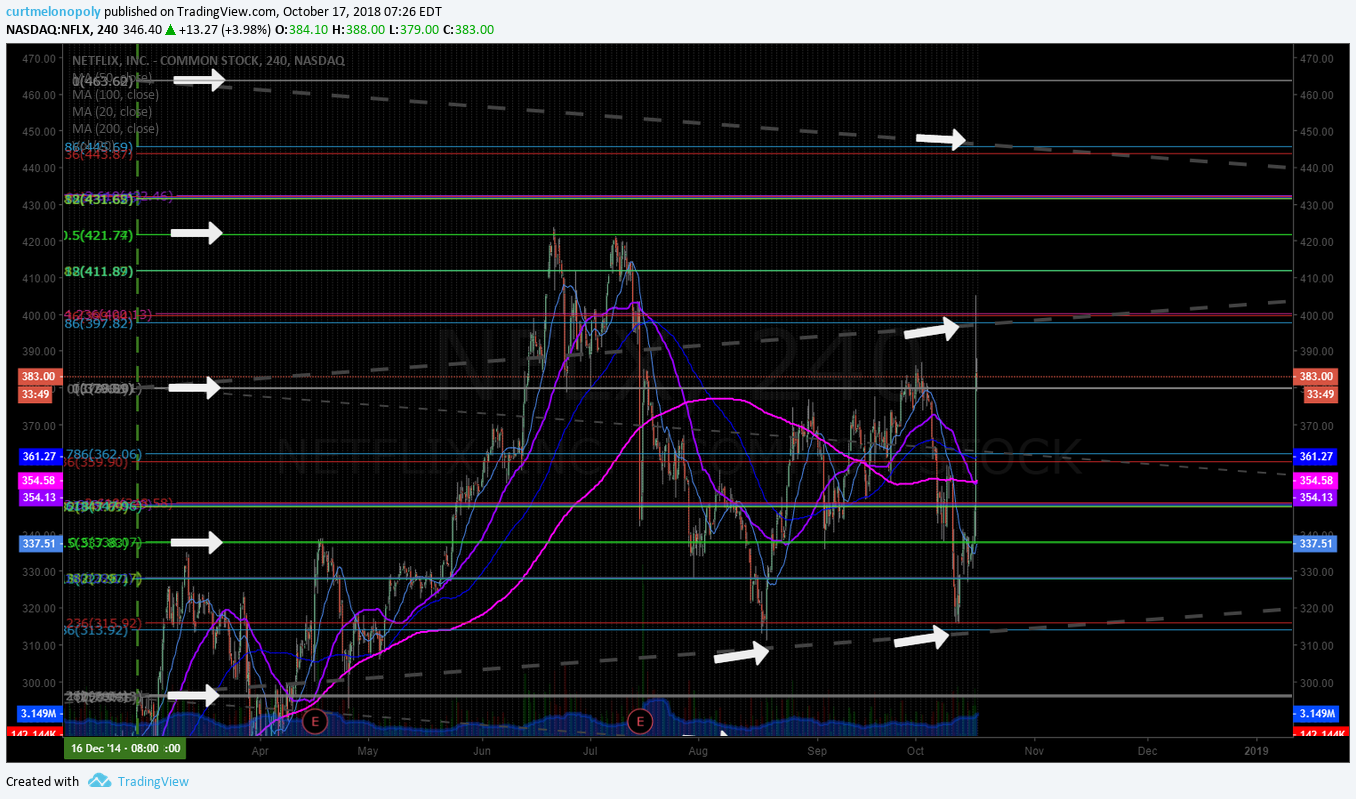

NETFLIX (NFLX) up premarket on earnings, key resistance points to watch if trading this move $NFLX #swingtrading #earnings #upgrades

SQUARE (SQ) blowing through resistance points in move, over 81.40 targets 83.40 85.40. $SQ #swingtrade #tradealerts

FIREEYE (FEYE) long bounce working toward upper price targets in to earnings, watch resistance points for trims #swingtrade $FEYE

SHOPIFY (SHOP) bounced at top of trading box, resistance 154.00 earnings 8 days, over 156 long targets 166 then 177 $SHOP #swingtrading #earnings

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Crude Oil Trading Strategy with Trend-Lines on Weekly Chart.

Crude Oil Daily Chart, MACD crossed down with trade testing mid pivot Oct 15 1244 AM FX $USOIL $WTI $USO $CL_F #OIL #chart

TESLA (TSLA) At trading box range support EOD Friday, in a bounce it targets 280.34 Nov 20, 2018 $TSLA #swingtrading

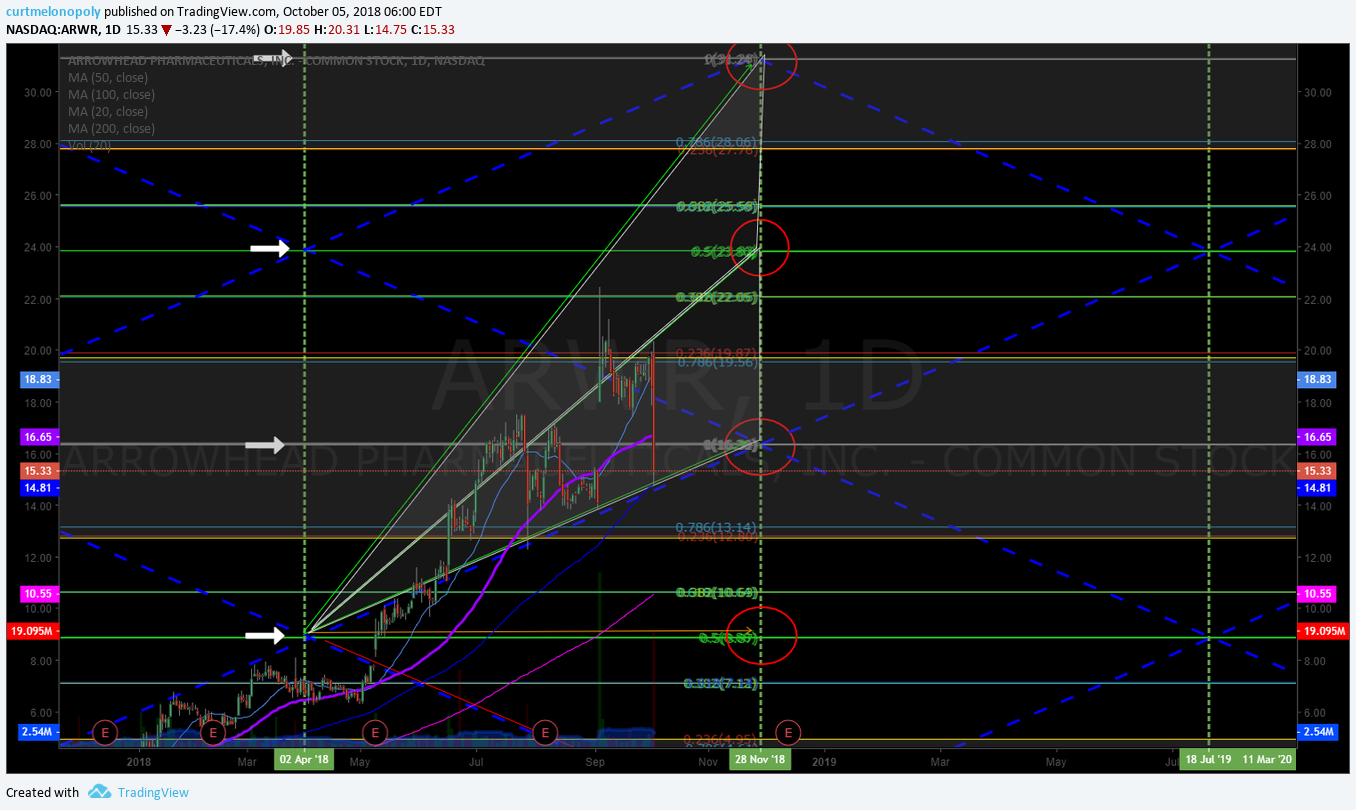

ARROWHEAD PHARMA (ARWR) MACD turned down but over 200 MA and channel support. On watch for adds to trade. $ARWR #swingtrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

Crude oil trade alert entry and exit shown on an oil chart.

SP500 (SPY) Under pressure, careful with trajectory inflection lines (red) when trading long $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade #Daytrade

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Bonds drop on minutes

-China shares, yuan lower

-No Brexit deal

-Markets mixed

-Data due

https://bloom.bg/2J7W50s

#5things

-Bonds drop on minutes

-China shares, yuan lower

-No Brexit deal

-Markets mixed

-Data duehttps://t.co/zFHU3xaE5D pic.twitter.com/lGktSpMZ0Z— Bloomberg Markets (@markets) October 18, 2018

Peak Blockchain and Stablecoin Drama.

The Daily: Peak Blockchain and Stablecoin Drama https://t.co/Y4qWrS9aFE

— Crypto the BTC Algo (@CryptotheAlgo) October 18, 2018

#Gold Prices Flat on Hawkish Fed Minutes –

#Gold Prices Flat on Hawkish Fed Minutes – https://t.co/TJbnHAfF98

— Investing.com News (@newsinvesting) October 18, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PTI $ECYT $YECO $CCCL $JMU $ATAI $ERIC $PX $AA $DWT $DGAZ $HMY $CDTI $AU

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $NTRS $GIII $PTI $GLNG $UAL $USB $UBSH $NKE $NVDA $NTRS $KEYS $TXN $NXPI

Nike’s stock gains after Oppenheimer turns bullish, citing an aggressive move into digital

(6) Recent Downgrades: $WING $YUM $ENLK $GPS $TOL $PHM $NVR $DAN $SEE $NSC $CNI $UNP $ADI $MXIM $TER

Gap’s stock sinks after J.P. Morgan turns bearish, citing sales weakness and margin pressure

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, OIL, $PTI, $ECYT, $NFLX, $TSLA, $SQ, $ROKU, $SHOP, $FEYE, $WTI, $VIX, $SPY, $BTC

PreMarket Trading Plan Wed Oct 17: EIA, Oil, $WTI, $NFLX, $TSLA, $SQ, $ROKU, $SHOP, $FEYE, $VIX, $SPY, $BTC …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday October 17, 2018.

In this premarket trading edition: EIA, Oil, $WTI, Earnings, Market Guidance in Trading Plan Section, $NFLX, $TSLA, $SQ, $ROKU, $SHOP, $FEYE, $VIX, $SPY, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 17 – Lead trader booked for main trading room for market open 9:30 AM, 10;30 EIA, 12:00 PM mid day review and futures trading this evening 6:00 PM (as available and as market demands).

- Main live trading room – 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- What’s New / Work in Progress:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November for each of the seven trading models and swing and daytrading – 8 in total to be announced (online only).

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 15 – Protected: Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Protected: Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – Protected: How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 3 – Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Watching NFLX, SQ, ROKU, SHOP, FEYE very close right now and swinging them all. TSLA trade yesterday went great, still holding 25% on the swing side. Today is all about OIL with EIA.

PSTG has an upgrade I’m watching also.

I am leaning toward equity markets possibly holding up in to end of Oct early Nov, Gold Silver Crypto likely pressure in to that time frame, Oil likely pressure in to that time frame and VIX also. And then end of Oct early Nov that should switch.

This is a leaning bias – a general outlook. However, I do see significant risk that could trigger volatility at any time here. But generally equity markets should hold to that late Oct early Nov with VIX GOLD SILVER OIL under pressure and then the opposite should turn toward mid Dec time cycle peak. See the most recent oil trading strategies video.

I know I’ve been promising the remaining model reports for some time, last night we ran the machine trading tests on EPIC and it is working so I can leave the staff to that and now start getting the reporting out. The software development part of our biz I have to admit has been a challenge to our time.

It’s difficult to explain in short how complicated software development is with machine trading launch. But we’re learning to manage it. We’re in it to win it – we won’t give up and we’re making serious progress, that’s the bottom line.

Curt

Notes per recent remain.

Looking for possible short term sell off in oil with a spike in VIX, Gold, Silver and then markets should levitate for short term bringing VIX Gold Silver Crypto soft and then reversal again and again and rinse and repeat to mid December 2018 minimum.

Notes per recent…. this remains.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Notes from last trading day (Friday) premarket:

TESLA on watch in lower area of recent range, likely take a short term swing trade in TSLA today – long.

Gold, Silver and others I have now and I’m doing final edits. To be distributed over next day or two. Letting the set-ups firm up and start trading them again possibly as of Sunday night futures.

Likely start trading Bitcoin XBTUSD and VIX in to next week now also in to mid Dec time cycle.

SPY got a bump in premarket with jobs numbers, as with others above likely trading that aggressive in to time cycle peak mid Dec also come next week.

Oil in a small pull back but expect bullish trend to continue next week.

Market Observation:

Markets as of 7:18 AM: US Dollar $DXY trading 95.09, Oil FX $USOIL ($WTI) trading 71.48, Gold $GLD trading 1226.09, Silver $SLV trading 14.67, $SPY 280.02 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6431.00 and $VIX trading 17.9.

Momentum Stocks / Gaps to Watch: $VTVT $PLAG $UPL $SPEX $OGEN $MNGA

31 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12519204 $VTVT $OGEN $NFLX $WGO $LRCX $MCO $UAL $AAL $DAL $CREE $IQ $IBM $FMS $BLNK $YGYI $TACO

World stocks extend rise after blockbuster U.S. earnings #earnings #premarket

https://twitter.com/CompoundTrading/status/1052515836710146049

News:

Netflix has parlayed subscriber growth into huge gains for investors. https://www.bloombergquint.com/business/netflix-crushes-estimates-renewing-faith-after-july-letdown … #SwingTrading $NFLX #earnings

Netflix has parlayed subscriber growth into huge gains for investors. https://t.co/UiFDod8mWT #SwingTrading $NFLX #earnings

— Swing Trading (@swingtrading_ct) October 17, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

#earnings for the week

$NFLX $BAC $GS $UNH $CLF $PYPL $IBM $JNJ $LRCX $DPZ $BLK $MS $PGR $ISRG $SCH $GWW $CSX $AA $ABT $WGO $JBHT $NUE $SLB $HON $CMA $BX $SKX $KMI $PG $ASML $AXP $URI $TSM $URAL $PLD $FHN $ETFC $INFY $PM $STI $USB $TXT $ERIC $BBT $CREE

#earnings for the week$NFLX $BAC $GS $UNH $CLF $PYPL $IBM $JNJ $LRCX $DPZ $BLK $MS $PGR $ISRG $SCH $GWW $CSX $AA $ABT $WGO $JBHT $NUE $SLB $HON $CMA $BX $SKX $KMI $PG $ASML $AXP $URI $TSM $URAL $PLD $FHN $ETFC $INFY $PM $STI $USB $TXT $ERIC $BBT $CREEhttps://t.co/r57QUKKDXL https://t.co/IZ2INc9jBn

— Melonopoly (@curtmelonopoly) October 15, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

NETFLIX (NFLX) up premarket on earnings, key resistance points to watch if trading this move $NFLX #swingtrading #earnings #upgrades

SQUARE (SQ) blowing through resistance points in move, over 81.40 targets 83.40 85.40. $SQ #swingtrade #tradealerts

FIREEYE (FEYE) long bounce working toward upper price targets in to earnings, watch resistance points for trims #swingtrade $FEYE

SHOPIFY (SHOP) bounced at top of trading box, resistance 154.00 earnings 8 days, over 156 long targets 166 then 177 $SHOP #swingtrading #earnings

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Crude Oil Trading Strategy with Trend-Lines on Weekly Chart.

Crude Oil Daily Chart, MACD crossed down with trade testing mid pivot Oct 15 1244 AM FX $USOIL $WTI $USO $CL_F #OIL #chart

TESLA (TSLA) At trading box range support EOD Friday, in a bounce it targets 280.34 Nov 20, 2018 $TSLA #swingtrading

ARROWHEAD PHARMA (ARWR) MACD turned down but over 200 MA and channel support. On watch for adds to trade. $ARWR #swingtrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

Crude oil trade alert entry and exit shown on an oil chart.

SP500 (SPY) Under pressure, careful with trajectory inflection lines (red) when trading long $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade #Daytrade

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

De-Dollarisation continues. #China has cut US Treasury Holdings for a third straight month. Beijing reduced ownership by another $6bn to lowest level in >1yr.

De-Dollarisation continues. #China has cut US Treasury Holdings for a third straight month. Beijing reduced ownership by another $6bn to lowest level in >1yr. pic.twitter.com/FI7RmNTJcu

— Holger Zschaepitz (@Schuldensuehner) October 17, 2018

This chart suggests that S&P500 has to fall 20% as CenBank liquidity will dry up. (Chart via Standard Chartered)

This chart suggests that S&P500 has to fall 20% as CenBank liquidity will dry up. (Chart via Standard Chartered) pic.twitter.com/DwvMXIhMnI

— Holger Zschaepitz (@Schuldensuehner) October 17, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $VTVT $EARS $NFLX $APHB $NURO $NMM $LRCX $UAL $AAL $ROKU $AKRX $AMAT $DAL $ASML $PLUG

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $PSTG $NTAP $UAL $DAL $ALL $CSTR $WDAY $ANET $AKRX $NMM $LOGI $ANET $DPZ

(6) Recent Downgrades: $LOW $HD $SLCA $CVIA $SND $HCLP $NFLX $WBC $VMC $MLM $CNHI $TACO $SALT $BLK $ACHC $KBH $OC $LLEX $NK $IBP

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, EIA, Oil, $WTI, $NFLX, $TSLA, $SQ, $ROKU, $SHOP, $FEYE, $VIX, $SPY, $BTC

Swing Trading Special Report Sun Oct 14 (Part A) FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ.

Compound Trading Swing Trade Report Sunday October 14, 2018 (Part A).

Swing Trading Signals and Stock Picks In this Issue: FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ.

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part A of this special swing trading report covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were recently covered at the Trade Coaching Boot Camp. Basically we are consolidating all the most recent swing trade strategies in to a few reports prior to earnings season kicking in. After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports (we have one for swing trading pot stocks, we are working on a financials report and an energy special report currently).

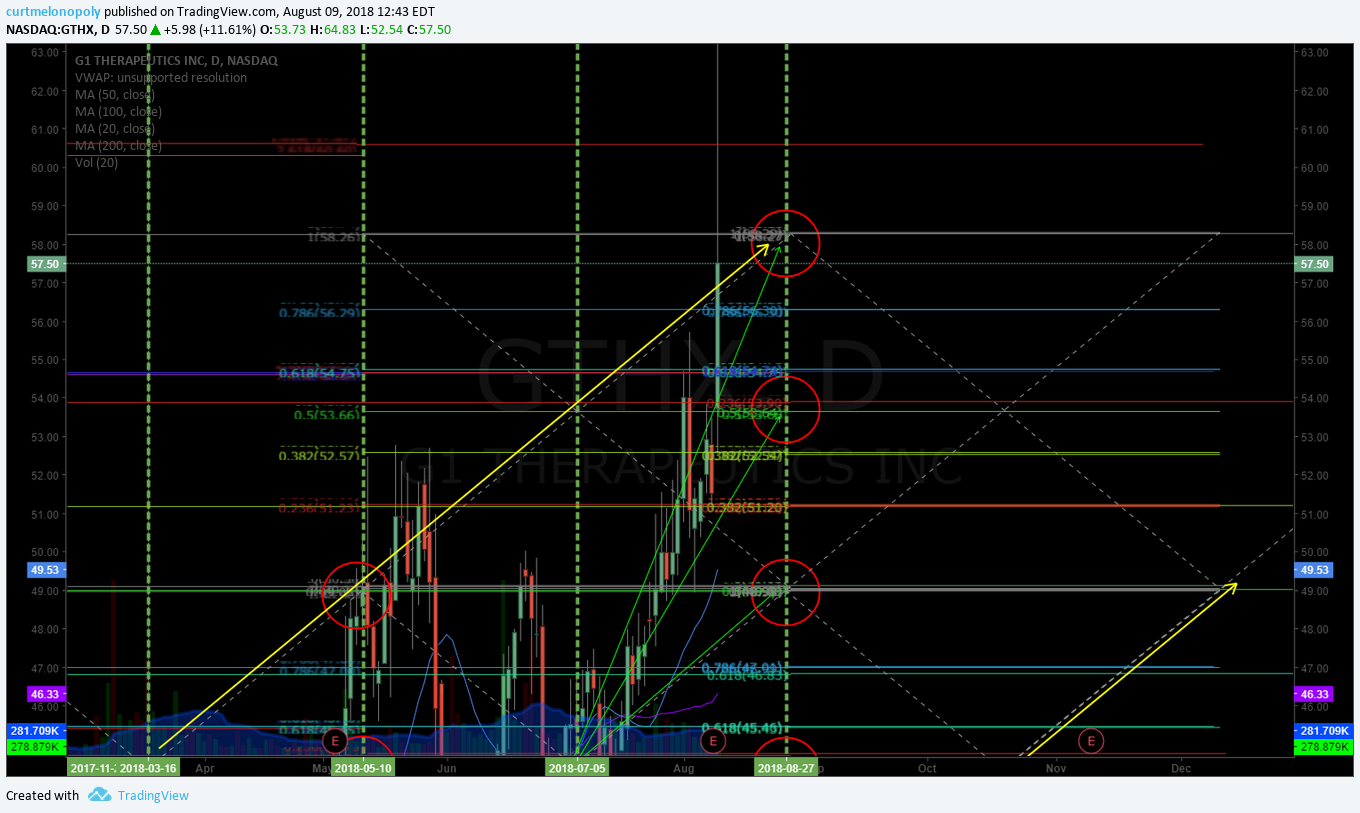

Swing trading set-ups in this short series of reports over the few weeks will provide charting and trade signals for the following equities; FEYE, ROU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSI, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Password “tradingrules” Oct 8 – Protected: Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Password “HEREWEGO” Oct 7 – Protected: How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Password “TRIM” Oct 4 – Protected: Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Password “VIX” Oct 2 – Protected: Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Password “oiltrade” Oct 3 – Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Password “89” Sept 26 – Protected: Trade Alerts | Day Trade & Swing Trades (w / video) Trading Square $SQ, $DIS, $NFLX, $AMD, OIL, $FB, $GOOGL and more.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Current Swing Trading Signals and Stock Charts.

FIREEYE (FEYE) Trading 16.68, on 200 MA support, mid quad key support 16.22, with MACD turned down – key bearish signal. #swingtrade $FEYE

Key resistance trade signal is at 19.24 on this chart with key support trade signal for FEYE at 13.05. The MACD turned down on the daily chart is a bearish signal but price is above 200 MA and above primary support for the range (mid quad horizontal Fibonacci line) at 16.18.

Under 16.18 is a short to a possible price target of 13.05 Dec 3, 2018.

Above 16.18 is a long to a possible price target of 19.32 Dec 3, 2018.

Indecisive trade will see 16.18 range Dec 3, 2018.

No current trader bias for the FEYE trade set-up – indecisive, but recent trajectory does suggest 19.32 Dec 3, 2018 as long as price holds 16.18 and 200 MA.

Fireeye Inc.: “Fireeye’s right. We just spoke to Fireeye. Unfortunately, Fireeye’s business is connected with North Korea, Russia and China, and those three guys are still coming at us with everything they have. That’s why I like Fireeye.” Cramer’s lightning round Published 7:07 PM ET Wed, 10 Oct 2018 Updated 7:25 PM ET Wed, 10 Oct 2018 https://www.cnbc.com/2018/10/10/cramers-lightning-round-buy-becton-dickinson-literally-tomorrow.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

https://twitter.com/swingtrading_ct/status/1051529749590360065

ROKU (ROKU) trading 60.41, MACD turned down bearish signal, above 200 MA with support 58.20, price targets in report $ROKU #swingtrading

The MACD turned down is a considerably bearish signal, the 200 MA on ROKU chart is at 45.69 so it could easily see some considerable downside. However, the algorithmic channel support (first possible, at yellow uptrending line) is at 53.82 and trade recently bounced well off that area. I will be watching the channel support area for a possible trade long pending the general market sentiment near-term.

Near term support is also at 58.20 (mid quad Fibonacci support) and range support (trading box) is at 53.50. Range resistance on ROKU chart is at 63.16.

If downward pressure ensues then 48.49 Oct 30, 2018 time cycle is probable and even 38.40 is possible.

If market sentiment turns up and trade in ROKU turns up then 68.11 is most likely Oct 30 and 78.00 possible but far from probable.

Indecisive trade scenario sees 58.00 range Oct 30, 2018.

No current trade bias, however, as with others (considering the market sell-off last week) I will be watching general market sentiment going forward for a trade either way in ROKU.

It Will Be Awhile Longer Before Roku Stock Stops Falling $ROKU #swingtrading https://finance.yahoo.com/news/awhile-longer-roku-stock-stops-164144120.html?soc_src=social-sh&soc_trk=tw

It Will Be Awhile Longer Before Roku Stock Stops Falling $ROKU #swingtrading https://t.co/eXH2rfci5p

— Swing Trading (@swingtrading_ct) October 14, 2018

SHOPIFY (SHOP) Trading under 200 MA under main range pivot support is bearish with channel support test near $SHOP #swingtrading

With earnings in 11 days I am watching SHOPIFY very close here to see how trade handles the prospective algorithmic charting channel support area on chart (yellow up-trending line on chart below). If that line fails 116.22 is probable price target for Jan 10, 2019 swing trade with 92.01 possible and 67.59 price target not likely but there.

In a bullish scenario (a turn above the 200 MA with MACD turned back up on daily chart) targets 166.27 probable and 190.89 in a break-out scenario (not likely but definitely possible if the market sentiment turns risk off again).

The trade signal short is the channel support and the trade signal long is MACD down with 200 MA upside breached.

What Should Investors Expect When Shopify Reports Earnings? $SHOP https://finance.yahoo.com/news/investors-expect-shopify-reports-earnings-190000338.html?.tsrc=rss

The future looks bright for Shopify. As e-commerce continues to capture an even greater percentage of retail, the company is positioned to reap even further gains over the years and decades to come. Investors should take a long-term view, however, as the stock price will continue to be volatile. Brace yourself for the wild ride to continue when the company reports on Oct. 25.

What Should Investors Expect When Shopify Reports Earnings? #swingtrading #earnings $SHOP https://t.co/dJJrVM1dRI

— Swing Trading (@swingtrading_ct) October 14, 2018

ARROWHEAD PHARMA (ARWR) MACD turned down but over 200 MA and channel support. On watch for adds to trade. $ARWR #swingtrading #tradealerts

I am currently in a swing trade position (starter size) and will look to add to the swing long at the 200 MA support if trade hits that mark this week (I was hoping it was going to hit end of week last week on late Friday afternoon trade but it didn’t quite get there).

If trade breaks the 200 MA to the downside then 8.90 price target is in play for November 28, 2018 time cycle completion (which is also at the algorithm chart model prospective channel support – yellow line on chart).

The most important support trade signal in near term trade (this week) is that trade closed Friday right near the trading box support range in the 12.65 range. If ARWR sees a bounce then 16.25 is in play for Nov 28th.

Here’s Why Arrowhead Pharmaceuticals (ARWR) Skyrocketed Almost 30% in September #swingtrading $ARWR https://finance.yahoo.com/news/apos-why-arrowhead-pharmaceuticals-skyrocketed-195800224.html?soc_src=social-sh&soc_trk=tw

Here's Why Arrowhead Pharmaceuticals (ARWR) Skyrocketed Almost 30% in September #swingtrading $ARWR https://t.co/oZJf02WuO7

— Swing Trading (@swingtrading_ct) October 14, 2018

TESLA (TSLA) At trading box range support EOD Friday, in a bounce it targets 280.34 Nov 20, 2018 $TSLA #swingtrading

MACD on daily chart is turned down, but TESLA stock trades somewhat eradic in normal course of trade. The range is the most important consideration and I have TESLA on high watch for a significant bounce here. The trading range is fairly consistent and as long as maret sentiment doesn’t completely plummet near-term I’ll likely take a trade for a bounce to upper price target at 279.56 Nov 20, 2018, trading at close Friday 258.78.

As Tesla continues to ramp up production in the fourth quarter, “we can expect the brand to continue to gain ground on the luxury leaders”

Tesla (TSLA) sales in the U.S. are gaining on BMW and other luxury car makers $TSLA https://on.mktw.net/2EhlMge.

Tesla (TSLA) sales in the U.S. are gaining on BMW and other luxury car makers #swingtrading $TSLA https://t.co/rypKnG8zL8

— Swing Trading (@swingtrading_ct) October 14, 2018

ALLERGAN (AGN) swing trade couldn’t be going any better, add to long at 200 MA or channel support, trim at resistance points $AGN #swingtrading #chart

With earnings in sixteen days and AGN presenting soon (see news article below), trade near 200 MA support – I will consider adding to my position there if it looks to be holding and pending market sentiment, if not I will surely add at algorithmic charting model channel support on the chart as noted below.

Allergan (AGN) To Present Data From 13 Abstracts At The 2018 American Society For Dermatologic Surgery $AGN … https://finance.yahoo.com/news/allergan-present-data-13-abstracts-201500714.html?soc_src=social-sh&soc_trk=tw

Allergan (AGN) To Present Data From 13 Abstracts At The 2018 American Society For Dermatologic Surgery #SwingTrading $AGN … https://t.co/dMM6aw6sVq

— Swing Trading (@swingtrading_ct) October 14, 2018

CRONOS (CRON) above 10.25 buy signal for upside price target, below 8.40 short to price target. $CRON

If trade stays in trading box short at resistance in 10.25 range long at 8.40 range for a bounce in trading box. However, it looks like it could turn here. This is a 240 minute chart and not a daily chart for lower time frame trading.

Also of note, the MACD on 240 min chart just turned back up and the Squeeze Momentum indicator flashed green in last 4 hours of trade on Friday.

3 Cannabis Companies Making Headlines in October #swingtrading $CRON #PotStocks https://finance.yahoo.com/news/3-cannabis-companies-making-headlines-144500687.html?soc_src=social-sh&soc_trk=tw

3 Cannabis Companies Making Headlines in October #swingtrading $CRON #PotStocks https://t.co/uaqaKk1ip5 v

— Swing Trading (@swingtrading_ct) October 14, 2018

SQUARE (SQ) above 74.00 targets 78.64 next. Resistance at 76.27 and 82.27 if in upside trade. $SQ #swingtrade #tradealerts

I really like this trade set-up long again. If markets get momentum this could see a decent upside return. Careful with the resistance areas noted and also note that the chart model is “rough” and needs some work, but good enough to provide signals for an upside swing trade here.

2 Great Stocks That Just Went on Sale SQUARE (SQ) #swingtrading $SQ https://finance.yahoo.com/news/2-great-stocks-just-went-112200807.html?soc_src=social-sh&soc_trk=tw

2 Great Stocks That Just Went on Sale SQUARE (SQ) #swingtrading $SQ https://t.co/X8bmMcr6nr

— Swing Trading (@swingtrading_ct) October 14, 2018

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, Signals, Alerts, FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ

PreMarket Trading Plan Fri Oct 5: $ARWR, $GPRO, $TSLA, $FEYE, $SPY, $SHOP, $ROKU, OIL, $VIX, $BTC …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Friday October 5, 2018.

In this premarket trading edition: $ARWR, $GPRO, $TSLA, $FEYE, $SPY, $SHOP, $ROKU, OIL, $VIX, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 5 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars or when Lead Trader is not available.

- Scheduled this week:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 3 – Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)