Learning How to Swing Trade with Structured Technical Analysis Provides Better Win Rate, More Confidence in Your Trading and Delivers Higher Rate of Return.

Many financial social media traders comment to our charting as having too many lines or being too complicated (especially on Stock Twits). This is not only a flawed perspective but also why few traders win over time. It is also why we make a living (we being the traders on the winning side of the ledger).

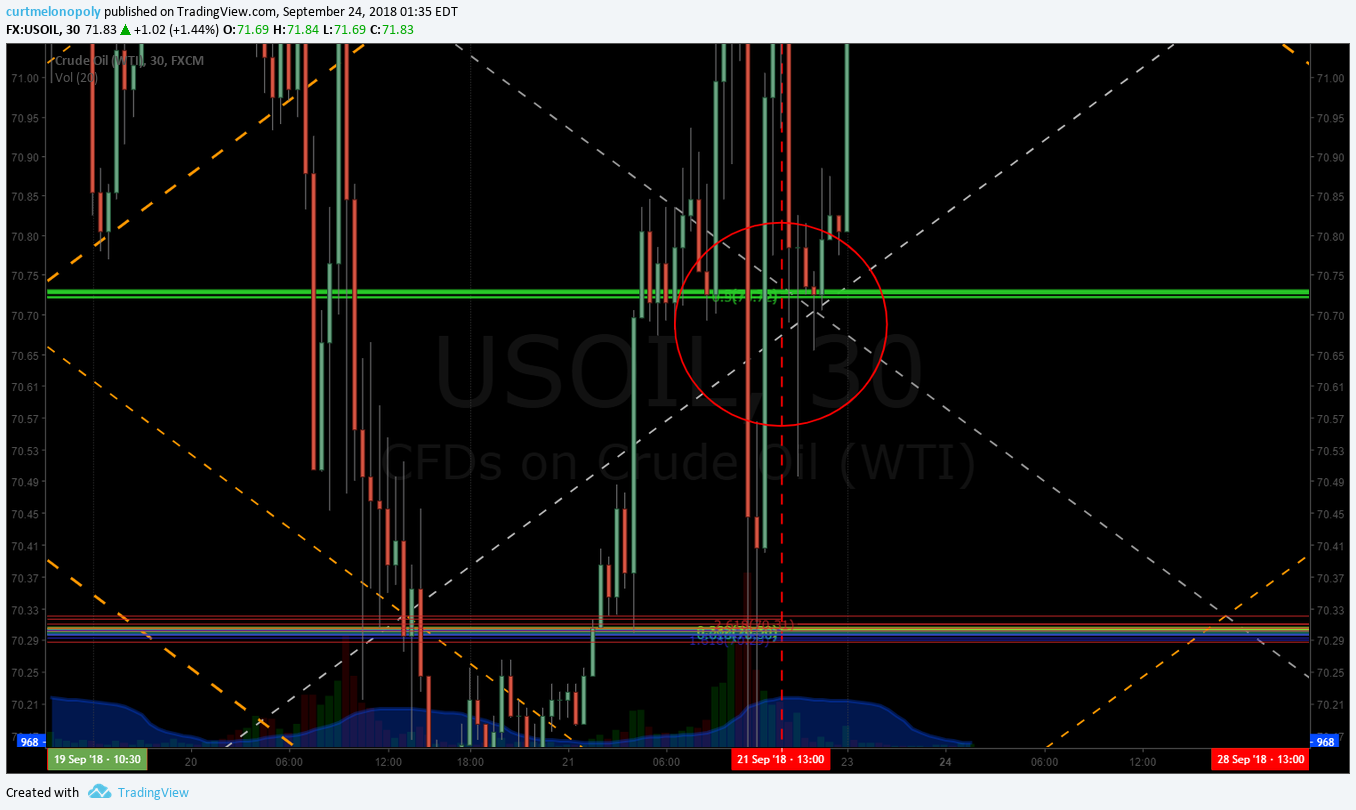

In today’s stock market the number one thing a trader can do to increase their win rate and return in each swing trade (or even intra-day trading) is to first accept the reality that machine liquidity is growing exponentially and then learn how the machines are programmed to trade.

In today’s stock market the number one thing a trader can do to increase their win rate and return in each swing trade (or even intra-day trading) is to first accept the reality that machine liquidity is growing exponentially and then learn how the machines are programmed to trade.

Read: Machines now dominate stock trading and it’s having unexpected consequences https://www.businessinsider.com/machines-dominate-stock-trading-and-its-having-unexpected-consequences-2017-6

And truthfully, it isn’t hard to learn how to swing trade (or day trade) along with the best in the stock market – those that are increasingly controlling how a stock trades (or commodity, currency, etc).

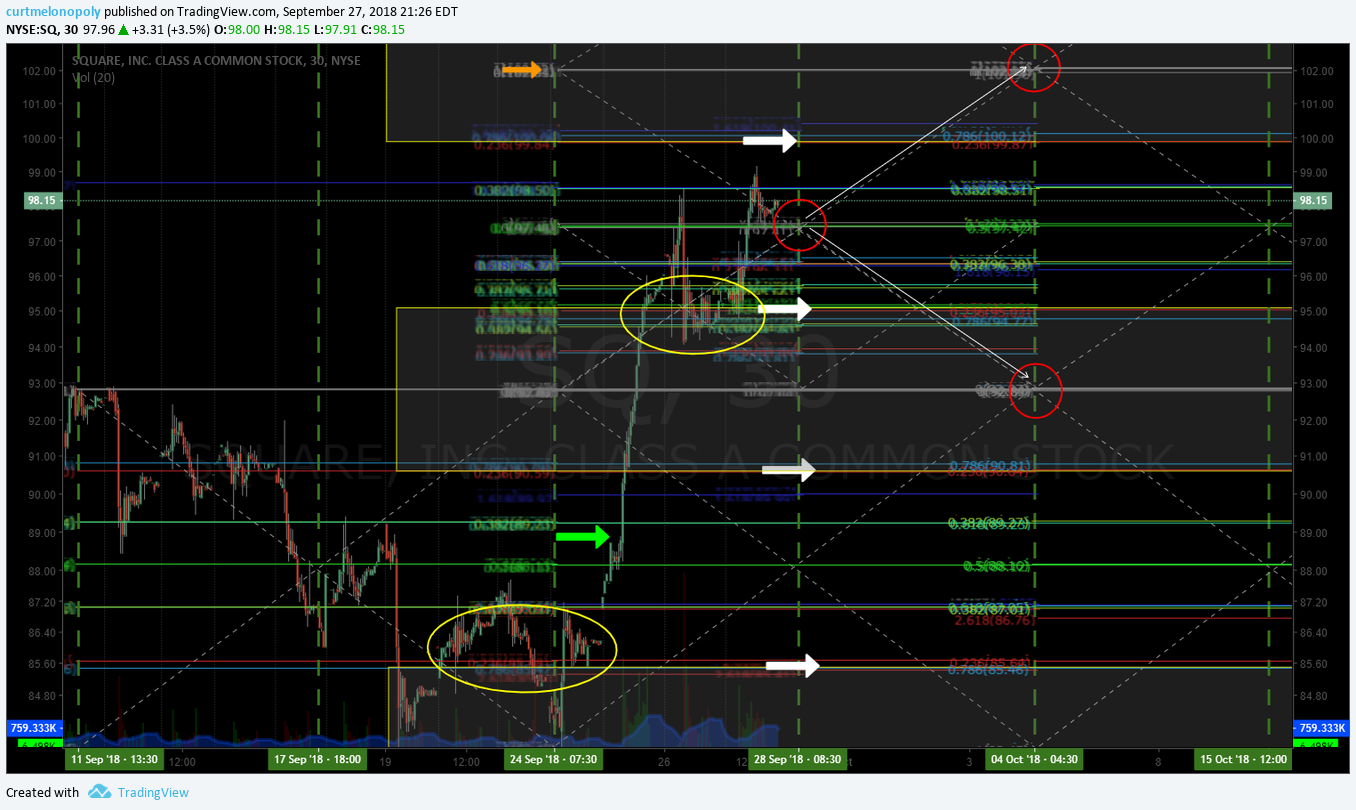

The structure of the trading instrument (in the example below with $SQ – a stock) is the key to success in swing trading.

When you know the structure of the stock (represented on a chart) you then know more than 90% of your competitors (the other traders that are competing against you). Why? Because they are simply too lazy, ignorant of how it works or just don’t treat their trading as a business.

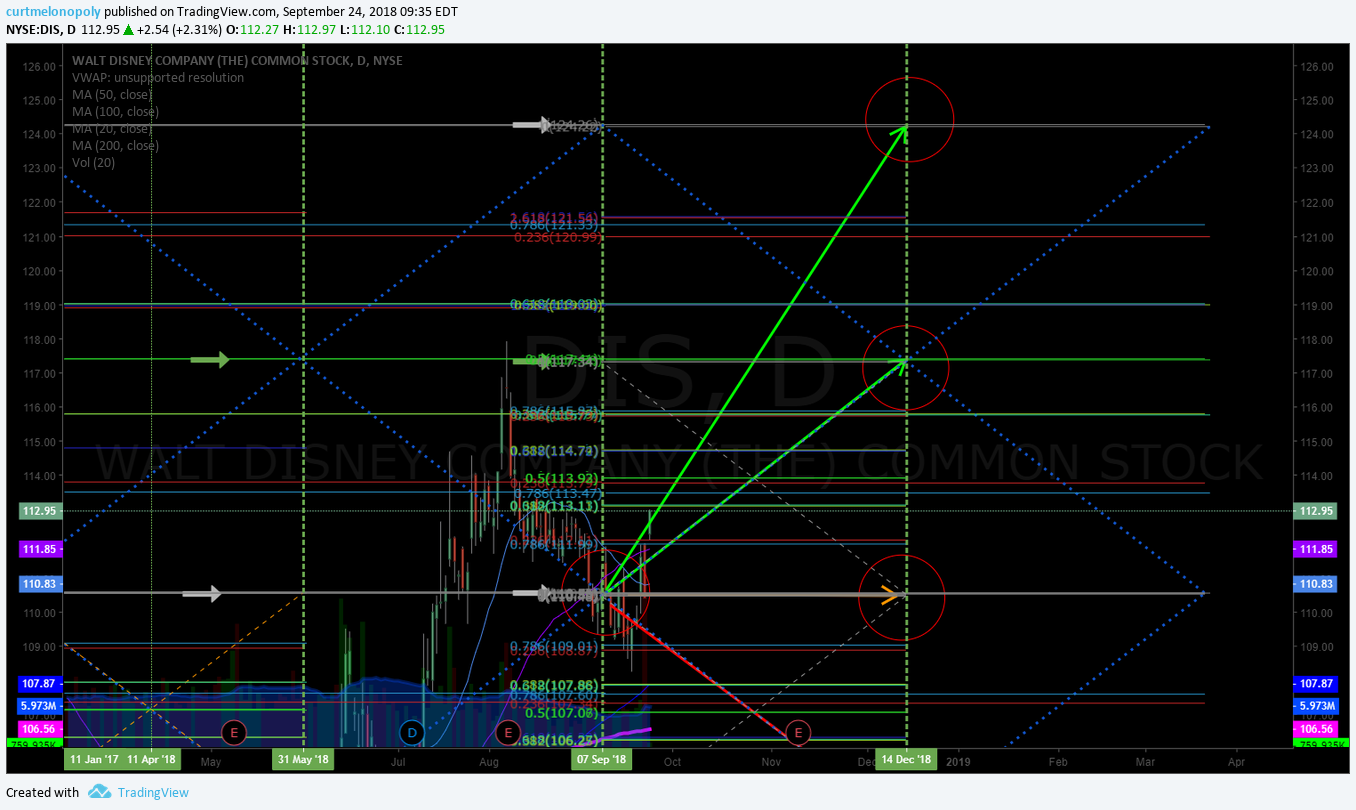

When you learn how to trade with a structured chart this can also be used to leverage returns otherwise not possible for options traders and fundamental trading. Options traders can take advantage of time cycles for example. Fundamental traders can use the charting structures to better time their initial trade entries, closing trades with better precision and it will also help traders with sizing and adding to or trimming trade positions.

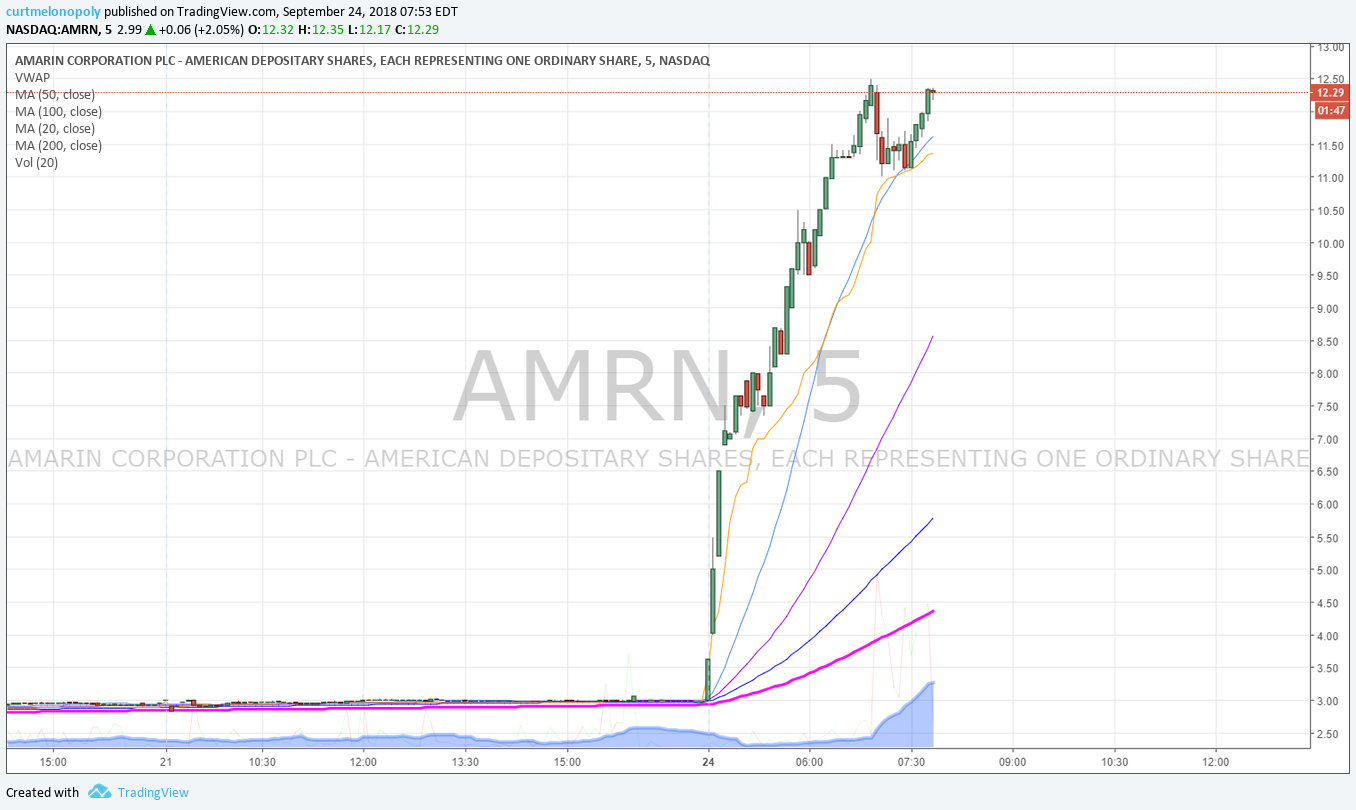

It doesn’t matter what your trading style is, every single trader can use structured swing trading to increase their win rate, increase trading confidence and increase returns on each trade. Even traders that use very specific trade set-ups for day trading can benefit from structured trading knowledge.

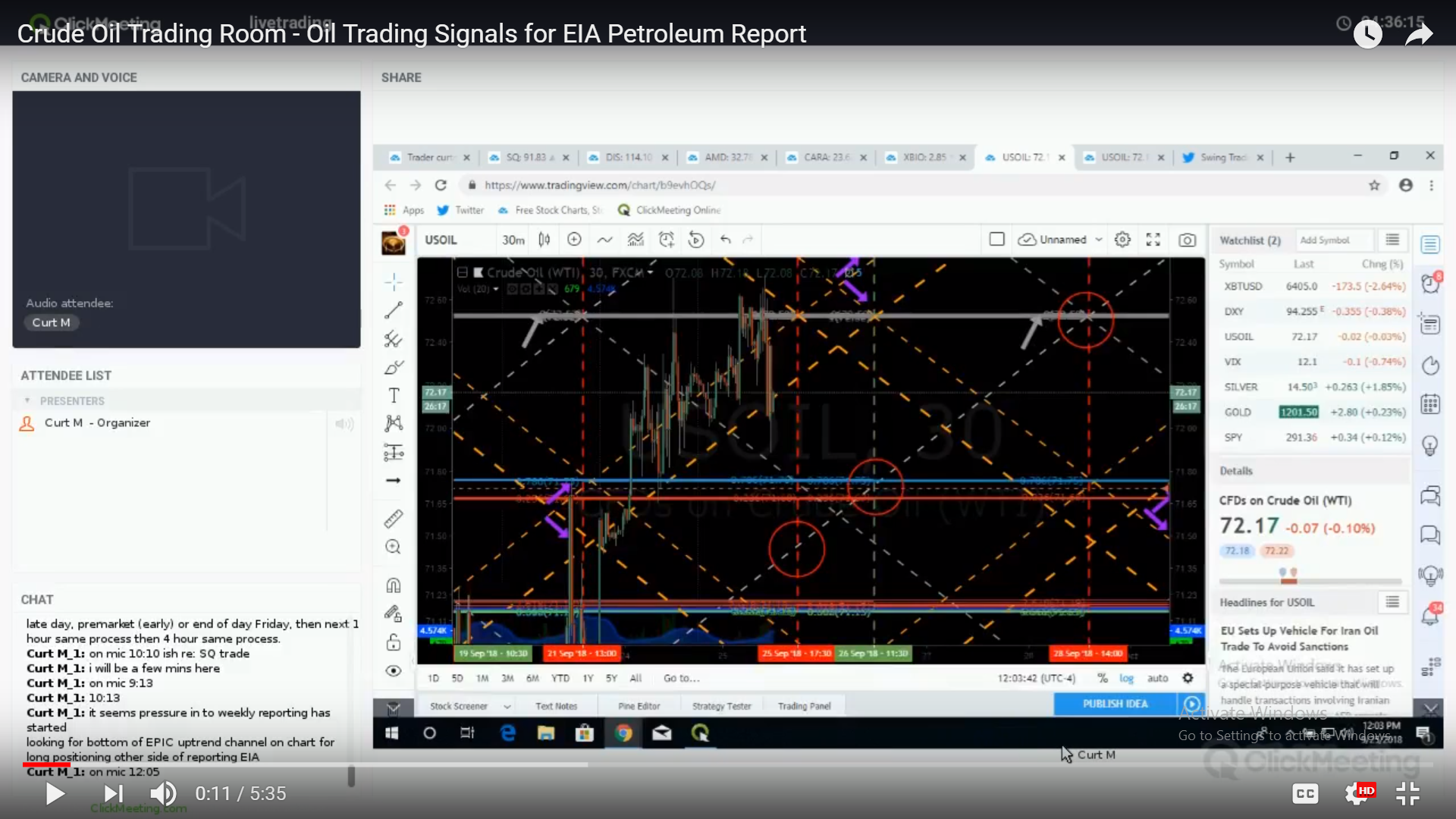

Below I will use my recent swing trade entry in Square (SQ) as a study example. I publicly traded Square in our trading room and recorded the trade. This is a good example because the stock broke out hard the day I entered my swing trade and there were very specific reasons for my entry point. I explain that below and also explain what my swing trading plan is going forward.

Below is the chart for Square (SQ) and the link to the live chart on Trading View.

Below the chart I explain the technical indicators that determined my entry point in Square for my swing trade, where I will consider adding and trimming my position, where the important support and resistance points are and more.

Swing Trading. How to Swing Trade Using Technical Analysis. $SQ Trade Example #swingtrading

Below is a list of important technical analysis specific to this swing trade and charting:

- The Initial Long Entry.

- The initial reason Square (SQ) was on watch this morning that I entered the swing trade is because there was an upgrade to 125.00 by a well known analyst: Why Instinet Analyst Dan Dolev Is So Bullish on Square https://www.bloomberg.com/news/videos/2018-09-25/why-instinet-analyst-dan-dolev-is-so-bullish-on-square-video

- The entry at 89.00 was not by random (shown with a green arrow), when price was higher on the 30 minute candle than the previous candle high in a bullish intra-day momentum – this is the primary reason for my entry in this swing trade.

- My entry to the trade was above a key support at the mid quad support (I noted an example with an orange arrow on the chart).

- As mentioned above, trade was bullish intra-day. Long in strength is smart, in an up market trading long in strength is a high probability win.

- I had to take the initial trade three times before price stuck. The live video from the day trading room shows this.

- My entry was taken above a trading box area on the chart (shown in yellow boxes on chart). The top of the box will provide decent support.

- Here is a screen shot image of the actual swing trading alert issued to members:

-

Screen shot of Swing Trading Alerts feed on Twitter alerting the Square swing trade entry at 89.00

-

- Price Consolidation.

- The price consolidation areas are marked on the chart with yellow circles. In both instances marked on the chart, trade in Square (SQ) was consolidating above the trading box (which is bullish because support held). I didn’t add to the trade at the second consolidation area because I was hoping for a larger retracement in stock price.

- Charting Support and Resistance.

- The important support and resistance areas on the Square (SQ) chart are identified with white arrows – they correspond with the top and bottom of each trading box area on the chart. Consolidation at the top support is a key area to add to your swing trade.

- The mid area of the trading box is where the mid quad charting pivot is, this is the half way point in trade on the chart in the trading box. This is at times used as key support in trade for continuation of the trend in price.

- The various horizontal lines on the charting are Fibonacci related. These are to be used for intra-day support and resistance considerations of trade.

- The various diagonal trend lines (gray dotted) are Fibonacci trend lines. These are also support and resistance areas of the chart specific to the trend in trade.

- Price Targets. Time cycles.

- The red circles are the most likely price targets that correspond with time cycle peaks in the time-frame of the chart that are represented with vertical dotted green lines on the chart.

- Trading Plan Forward.

- I am currently awaiting an intra-day wash-out or retracement (also called a pullback trade set-up) that is larger than would be normal – an anomaly (an entry in a wash is ideal because you get the benefit of a snap back in price to secure your add to the trade). This typically occurs in profit taking scenarios. If there is no other reason then time of day or time of week is the best scenario. Typically over the lunch hour trade is soft and tends to come off or end of week late Friday afternoon. However, if trade is really strong in to end of day on Friday this is a strong indication that Monday the following week the stock is likely to run up again.

- I will trim the trade each time price approaches the next resistance level at the bottom of the next trading box.

This article’s focus was to how to swing trade the actual chart, but doesn’t explain how to chart the structure on your own.

To learn how to chart technical analysis for structured trading see the links below that provide options for further learning.

The swing trade charting in this article – so that you can swing trade with confidence, can be learned in a number of ways:

- There are many videos on our You Tube Channel, they are raw video and not packaged as clean presentations, but if you have the patience to sort through raw video from our trading room there is a lot of learning material for free there https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w

- We have a master class series of about 20 hours of video that you can purchase for 1499.00 (at this point available only by emailing us [email protected]) and you can request the 30% discount code at the time you email.

- The other way is that we recorded the last Trade Coaching Boot Camp – this video series is about 20 hours and retails for the same price 1499.00 (also available only at this point in time by emailing) and has a 30% discount code also.

- You can also attend one of trading boot camps, the next ones will be announced soon on our website, there is a one day online boot camp planned for early November specifically for learning how to swing trade also by the way.

- Our private trade coaching is available (done online via Skype). The starter package is 399.00 for 3 hours.

- Or join our day trading room for 999.00 per month (a serious trading room for the serious trader only).

You can take advantage of our swing trading set-ups the following ways:

- Our swing trading alerts service is here: Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

- Our swing trading newsletter service is here: use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

- Or the bundled swing trading alert and newsletter service is here at 149.00 per month.

Further Reading and Videos:

Investopedia: Introduction to Swing Trading.

Compound Trading Group: How to Swing Trade Like the Pros and Win Most Trades.

Click here for the mid day swing trading review that has the Square trading plan review https://www.youtube.com/watch?v=DMFHJ8ki9nY&list=PLTeUfxpy0iabJdqXpy5aBVa3dd1DdGLLz

Anything else I can do to help you swing trade better please let me know.

Thanks,

Curtis