The First In A New Article Series Intended to Simplify What We Have Learned For The Oil Trader To Use as Actionable Strategies to Increase Win Rate and ROI When Manually Executing Crude Oil Trades.

For Near 3 Years Now We Have Transparently Shared Our Successes and Failures in the Development of Oil Machine Trading Software.

First, For The Benefit of a Wider Than Normal Audience That This Article Is Being Transmitted To, Allow Me To Share Some of Our History.

Understanding a. Where We Have Come From, b. Where We Are Now and c. Where We Are Going Next is Important. Then We’ll Get In To The First Oil Trading Strategy Article.

A. A Brief History of Where We Come From.

As Stated, For Near 3 Years Now We Shared Our Trading and Software Development Journey Real-Time With Our Crude Oil Trading Community (in a Live Trading Room). We Recorded Live Every Minute Of Our Trading and We Also Endeavored to Share Our Findings Via Various Blog Articles, Alerts, Webinars, Coaching and Videos.

Sharing The Details of Our Journey Was Not Easy. It Was Difficult To Find Time to Reconcile Findings In Such a Way That Would Would Be Easily Transferable to Our Community. The Day-to-Day Trading Live in The Room, Alerting Trades, Coding Software, Writing Articles, Coaching etc all Real-Time While in Our Own Discovery Process Was… Lets Just Say A Tad Crazy.

It Also Wasn’t Easy To Share What We Were Learning in a Way That Would Be Easily Understood and Actionable For Our Clients, Not To Mention Knowing When The Next Phase in Development Would Be Successful or Challenging (Having Us Profitable Or Not).

We Set Out In The Beginning To Be Transparent and We Have Held to That Mandate All the Way Through The Process.

And Now, We Know What Works and Does Not Work And We Begin a Real Journey to Share Our Findings. The Goal is to Share This in the Most Succinct and Simple Way Possible – to Make our Findings “Actionable” For The Average Trader.

Our Story Reveals Secrets Not Commonly Available That Can Help Day Traders Form Proper, Simple, Structured Oil Trading Strategies That Will Increase Your Win Rate, Returns and Lower Risk.

We are Acutely Aware There Are Hundreds of Oil Trading Strategies That Succeed or Fail. The Strategies We Will Share Are Structural in Nature. In Other Words, The Lessons We Learned About The Structure Of Oil Trade and Order Flow Will Help With Any Other Oil Trading Strategies You Are Employing.

Here in The First Article of Its Kind and With a Series of Near Future Planned Informational Articles, Webinars and Select Media Broadcasts, We Endeavor to Summarize and Simplify The Most Important Takeaways for You, The Oil Trader.

B. Where We Are Now.

Recently, we launched real-world testing of version 4 EPIC oil trading software (after running versions 1, 2 and 3 successfully) only to have it (v4) exemplify (once again) the volatility that new version machine trade software deployment encounters.

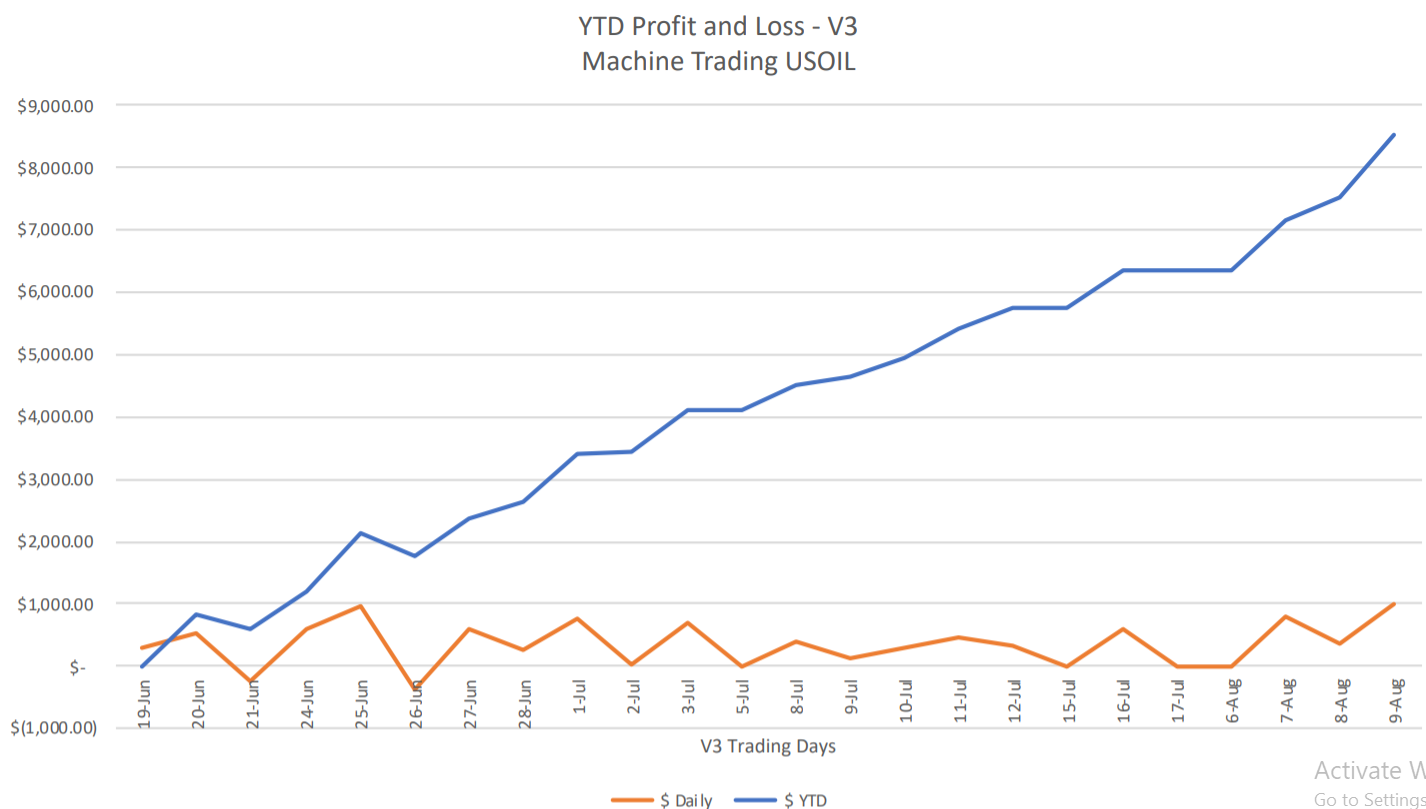

Prior to the launch of v4 our version 3 oil trade software had proven in real-world testing that it would perform at a rate of return of about 83% per year (which would get better over time as the machine “learned” – the most recent results are closer to 94% per annum).

So needless to say, we were excited about the “next”.

But as we’ve learned over and over again… the “next” can challenge comfort zones in many ways – you could refer to this as our trading risk management threshold – software development and deployment style.

Deployment of version 4 brought volatility that once again exceeded our “risk threshold”. In short, “real world testing” is more about testing our human “risk threshold” or comfort level than it is about whether the software would eventually perform as planned, after all, it does have to be “birthed” and then “learn” and then fly.

But we just weren’t “comfortable” with having to endure the process of the machine software known as version 4 to “learn” and become profitable. Version 4 was a much more aggressive architecture than version 3. So anyway, in short, we abandoned version 4 and returned to the proven version 3. We won’t be returning to v4.

So on Monday August 5, 2019 at 11:00 PM EST we announced the return to v3 and it was “re-born”. It took a day for it to run its start up systems and then started firing trades and has been again profitable since.

“For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts.”

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts pic.twitter.com/bPJVI49MIL

— Melonopoly (@curtmelonopoly) August 11, 2019

C. Where We Are Going Next (Near Term).

The first day was a quiet day for the v3 software reboot – the action started to come online in day two.

Below, and in near-future articles is where we pick up the story and we will use real-world trading in the live oil trading room to explain as clearly and simply as possible strategies oil day traders can employ to compete with the best of the best.

Each day I will take the oil trading action from the day in the oil trading room and oil trading alerts and post an article specific to the rules the software used to execute the trades with simplicity top of mind when writing the articles.

Traders that study these articles will have the benefit of video recordings of our traders in the oil trading room describing the trades we are manually executing to assist the software developers in “tweaking” the version 3 EPIC software.

The articles will also include various charting (conventional and algorithmic), oil trade chat room trade set up guidance notes from our traders, various articles, informational webinars, select media broadcasts and much more. Some of which will be made available to the general public and some behind our pay wall (subscriber premium material).

When we complete this informational series of articles we will have completed our oil trading development mandates and then go on to the next and the next (in terms of our wider development goals)…

For now, our goal here is to publish approximately one oil trading article per day with video, host one public informational webinar per week (email us at compoundtradingofficial.com to register for the next webinar), post continued v3 daily P&Ls to our social feeds, and have documented all actionable trade strategies within 60 days.

As stated above, much of this will be public facing and yet other information (the more proprietary) will be made available only to our premium subscribers .

The articles in this series will be sent to the mailing list – so get on it now click here.

Now, Lets Get to The First Lesson in Oil Trade Strategies – Trading With Version 3 With The Lead Trader in The Live Oil Trading Room.

Each article will include at least one lesson (or at least one rule that is included in the software trading rule set).

This first article will be from the oil trading room last Friday, and I will try to catch up the other days from last week at some point soon and as of Monday I’ll be posting each trading day’s action daily.

Here’s how our trading day on Friday went down;

Trading Crude Oil Break Outs.

Trading break-outs (break-ups & break-downs) outside of the most recent trading range is not easy. The reason is simple, you don’t know where the new range of trade will be and you don’t know if it is a true beak-out that will hold.

Our rule set has much more predictable trading set-ups to trade than what we seen on Friday, but lets start here because this was the most recent trading day and future posts will highlight the more predictable set-ups.

All our trades on Friday were winners, I think the v3 software has won every trade since it was rebooted last week and thus far I think it has only had one red day (for 0.02% draw-down).

Trade Sizing, Range Of Trade, Holds & Stops.

Under our v3 protocol, breaks in the price of oil to the current range are traded lightly in terms of sizing and any trade positions are held with tight stops.

In other words, until the new trading range develops, size of trade is to remain small and stop orders need to be considerably rigid because if the break up or down in price does not hold and form a new trading range you do not want to be left holding the bag (a losing position).

If you are caught holding a bag it is important for it to be a small size bag. Our v3 protocol mitigates this also with the ability to determine intra-day bottoms and size in to the next trade to relieve the small losing position when needed. But this is always a very small position if held and is only held intra-day.

In our general informational material about our v3 software vs. v4 this is one of the primary differences in architecture. Version 4 rule-set had holds on a much wider range (you could say a swing trading range) and v3 only holds within the intra-day range as verified by recent trade.

Please Note: When I state absolutes like “v3 only holds” as above, be sure to consider that our software has over 4400 rules that are weighed against each other, so absolutes are not reality, but for the simplicity of our goal here I will often explain rules of trade as absolute.

If you focus on trading range you will find it much more predictable than trading break-outs and break-down in price.

Anyway, before the break-out occurred on Friday we were posting guidance to the oil trade chat room server on Discord and the private member twitter alert feed.

We were also in the live oil trading room stating that trade was likely to break out Friday.

We also provided various immediately applicable guidance to our members specific to resistance and support on the most applicable time frames referencing chart models that our members could refer to.

Below is the morning trading guidance we posted to the crude oil chat room server (Discord private server is used for alerts service along with Twitter feed, alerts are available as a stand alone service or within the bundle with reports and oil trading room access).

The most applicable charting in this instance were the 5 minute, 15 minute, 30 minute and daily algorithmic chart models.

Note: By “most applicable” I am saying that these particular charts were recently being respected most, by oil trade action, of the various models available. We have numerous algorithmic chart models and conventional charts provided in reporting to members to draw on when providing guidance for their daily trading strategy. Our job is to refer to those that which recent oil trade action has most responded to (or price has respected support and resistance areas on the charts).

Also specifically to the information below, the preferred buy triggers are areas of support that provide high probability for bounce trades intra-day should price actually not break-out. A significant part of the v3 trading rules applies to key areas of support intra-day that liquidity in oil markets that are machine traded are most likely to trigger large buy programs to.

Curt MelonopolyLast Friday at 8:10 AM

Preferred buys on 15 min model; 51.83, 52.02, 52.29, 52.78 trading 53.11 intra day

Preferred buys on EPIC 30 min model; 51.88, 52.49, 52.74. Main resistance 53.65, 54.31, 54.43

Curt MelonopolyLast Friday at 8:25 AM

Top of range on daily 53.94 (uptrending TL on model) if held, over that is break-out / divergent. Trading 53.21. Order flow says it can happen. Trading 53.24.

Preferred buy trigger on 5 min model. 52.70 9:30 AM at inflection of time cycle running 8:00 AM – 11:00 AM

JeremyLast Friday at 8:38 AM

Order flow and volume since Thurs / internals say break to upside probable.

First Oil Trade of the Day – Break Out Trade, A Quick Bullish Trade to Range of 1 Minute Chart Model

Normally we can alert our trades to the alert feeds on Twitter and Discord, but on Friday we were only alerting live in the main oil trading room because trade action and the break out were developing very quickly and there was no time to type the alerts.

Now I will point out quick I sometimes try and do my part on my public facing Twitter feed, I did warn the shorts the night prior of this action setting up because we knew there was accumulation in order flow that started the day prior.

Curtis Melonopoly

@curtmelonopoly

Careful shorties #OOTT $CL_F

Careful shorties #OOTT $CL_F pic.twitter.com/Dr4P4Dv991

— Melonopoly (@curtmelonopoly) August 8, 2019

Curt MelonopolyLast Friday at 9:07 AM

Software got that with 1/10 only now out happened too fast to alert typing, was alerted in live room

cradle of the quad

Curt MelonopolyLast Friday at 9:35 AM

@Jen 54.32 – 54.48 1/10 traded thanks

in trading room yes

Below is the screen capture from the oil chat room showing the Daily Chart Model resistance that trade hit and the cradle of the EPIC Oil Algorithm resistance that trade hit.

Oil algorithmic charting showing the range of trade for the premarket trade – daily and 30 min charts in oil chat room.

Lessons From Oil Trade #1 (Break-Out) in Oil Trading Room:

- Trade Size – This is a break out trade so trade size was 1/10 size. The v3 protocol is small like this, version 4 would have sized this trade larger.

- One Minute Model Structured Range, Upside Resistance Broke – Trade was executed long above the one minute model support / resistance and trade was closed as the next resistance on the one minute model was hit. This was also recent intra-day break of trading range – THIS IS IMPORTANT. Also, if you were confident in the new range holding you could size 2/10 or more and release some at top of one minute trading range and hold some to see if the one minute support held on pull back. Our v3 software will do this if order flow shows a high probability and low risk to such.

- Resistance on Chart Models – A key resistance on the EPIC Crude Oil Algorithm chart model was hit as was the trading resistance on the daily chart. This provided further reason to exit or trim the long trade.

- Time of Day, Premarket, Momentum – Look at the time of day of the trade. Premarket trade action is critical to watch for a general direction in to regular US market open. Also important are the key times, in premarket the 15 minute and 30 minute candles are critical. This was a 9:00 AM 30 minute candle momentum trade.

Live Oil Trading Room Video

On the live oil trading room video the alert for oil trade #1 on the day starts at 1:22:22 on the video timer and at 8:59 AM EST on the time at bottom right of screen with a notice to live trading room that positive order flow indicates a long trade break out set-up building. Over the next few minutes the trigger is activated (I’m concerned at this point about getting too many traders thinking to bullish because break outs are tough, however, I do announce the long trade at 1/10 size). Price target on the day 53.87 is discussed, trading 53.11 at this point of trade in live oil trading room.

You can see on the trading room video the price of oil come off to the 5 min model support and bounce (typical right before a break our for price to come off and then go).

At about 1:30:00 on the video you will see price pressing the resistance on the next upside trading quadrant on the EPIC Oil Algorithm model.

Lessons From Trade # 2 in Break Out.

At approximately 1:57:30 on the video timer we’re executing long again at 54.32 – 54.48.

- Continuation, Intra-day Trend/Strength – There was continuation in the break out.

- Resistance Breaks – Price was up over 1 minute range resistance for the long. Price was up over the 30 minute range resistance, and the horizontal historical resistance (yellow).

- Close Trade at Range Resistance, You Can Always Re-Enter if Price Continues Bullish – Trade was closed as price entered resistance on the 30 minute model.

- Break Out Trade Size Should Be Small – Trade was small at 1/10 size because this is a break out and there is no guarantee the intra-day range developing would hold. Larger size in more appropriate in predictable range trading intra-day.

Lessons From Trade # 3 in Break Out.

At about 3:40:40 on the video we have triggered a trade in $CL_F long 1/10 at 54.31. Here again with tight stops pending order flow.

This was a high frequency order flow battle area intra-day in the break-out area of oil trade in the markets on the day

The time cycles intra day had us expecting more pressure on price that did not occur so when the HFT’s in the market started to trade it stronger we entered with them. This is not a set up that will help the every day oil trader to a great degree unless you were in the trading room with us and understood every detail of the set up as described, not a trade for the beginner.

It was a winning trade, but not the easiest. Most day trades with oil break outs are not what I would describe as easy. At issue, again, is that you don’t want to get caught holding a bag in a failed break out.

The video does go through various other more advanced signals we use as the trade of oil progresses intra-day.

At 3:35:27 on the video you can see buys come in to intra-day crude oil trade in the trading room and the reversal starts.

Trading Rule-Set Lessons:

- Positive Order Flow – Buy side order flow started strong as price entered the range of the 1 minute model support (the range is marked with blue/red/white horizontal lines clustered). We wanted a buy trigger lower but considering the bullish action on the day this was the reversal point.

- Double Bottom Support – Buy side order flow started strong as price entered the double bottom intra-day range.

- Progressive Increasing Volume – Progressive volume was obvious.

- Close at Resistance – At 4:00:50 approximately on video recorder timer we close the long trade at resistance on the one minute oil model at the trendline resistance. The timing was perfect for exit also based on intra-day time cycle frequencies (intra-day time cycle frequencies as it relates to trading this day are not what I will explain in this post, in short that specific discipline in our rule-set takes considerable experience). Nevertheless, clear resistance was hit and on the video you will hear me count down to the time cycle completion and a perfect hit to resistance and exit of the long trade.

On the video at 3:35:27 you can see buys come in to intra-day crude oil trade in the trading room and the reversal starts.

Screen shot below of oil trading room live trade alert – we close the long trade at resistance on the one minute oil model at the trendline resistance.

There were other miscellaneous trades on the day (all winners) but considering the complexity of signals on this day (considering it was a break out early structure) I think I will leave it there. I would rather focus these posts on the most predictable and easily executable trades for our oil traders to learn.

The next post I will do tomorrow (Monday) evening after we’re done trading for the day.

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com and remember that I am doing an oil trading information webinar once a week for now on (covering our software status and trading techniques) so email me if you would like to attend this next one – you will need a special link and access code to attend.

Thanks,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Since the end of December when the price of nearby NYMEX crude oil futures fell to a low at $42.36 per barrel, the price recovered to $66.60 in April and fell to a low at $50.52 last week. At $54.50 on the nearby September NYMEX crude oil futures contract on August 9, the price is at the midpoint of the trading range since December 2018. https://seekingalpha.com/article/4284072-crude-oil-monkey-middle

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, strategies, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL, how to trade, alerts, trading room