Tag: Crude

Crude Oil Trading Strategies: Sell-Off in to Oil Futures Settlement – 190 Point Snap-Back Trade w/Video #OOTT $CL_F $USO $USOIL

How to Trade an Oil Price Sell-Off in to Futures Settlement at 2:30 PM EST for Reversal.

This Reversal (Snap-Back) Crude Oil Trade Provided a 190 Point Range for Our Oil Trading Room Traders.

One of the best ways to increase your oil trading profit is with reversal trading. Crude oil can be difficult to trade, so knowing where reversals in price are likely to occur (support areas of charting) greatly helps a trader with winning trade signals.

A Warning! In a reversal trade it is important to manage your stops, bias, trade size in accordance to your account size.

The example below is of a 30 contract size (possible) oil trading account used by our software EPIC V3.1.1.

I personally didn’t take the trade because I was tired and I had a few other reasons. But it cost me some excellent profit because the price of oil then reversed and rallied near 200 ticks – it would have been a great win for me.

Some of our traders in our oil trading room did get the win so that was great, so I learned a lesson for next time.

The biggest lesson being that when EPIC V3.1.1 alerts an oil trade and the signal is “in-play” it is best for me to get with it and take the trade because the software has been winning non stop since it’s “black swan” code updates.

The oil charts below are models developed by our trading team that are proprietary to our oil trade alert and trading room members, however, if you know how to properly chart conventionally you can also take advantage of this set-up.

Let’s start with the set-up for the possible reversal trade on the one hour chart model. The one hour oil chart suggests that a turn in price, or a topping, is near (refer to the curved grey arch on the chart).

More specifically to this trade set up, the yellow trend lines (algorithmic trend lines) provide for a possible area on the charting for intra-day support in a possible sell-off scenario in to futures settlement at 2:30 PM on Thursday May 7, 2020.

The alert went out to the oil trading room and trade alert feed as follows;

You can see on the oil chart below that price was crashing at 12:18:17 EST time (or 12:18 PM) so the possible set-up for a bounce after oil settled at 2:30 PM was setting up.

If you’re thinking of swinging crude oil for a bounce, we’re getting closer to support areas.

Intra-day time cycle on crude oil is 1:45 P.M. for a possible bounce (reversal), careful with expecting VWAP to hit with some funds turning short.

The chart below and guidance provided to subscribers was also that at 1:45 PM a time cycle intra-day was possibly at an inflection point (or peak / bottom) and this was reason to be on high alert.

Screen capture of oil trading alert feed telling oil trading room position started.

Then at 2:44, so 14 minutes after crude oil officially settled for the day the alert went out that we were opening our trade position long at 8/30 size at 24.67 and the screen image below shows some of the other alerts and comments as the trade was going well and in a winning position.

Long 8/30 24.67 FX USOIL WTI trade on CL — EPIC.

Screen capture image of oil trading room when I alerted the trade position opened and discussing trading strategies.

One of the things we do in the oil trading room is provide charting and as much trade strategy guidance for our subscribers as possible.

This image below is a screen shot of the Discord room where we’ll chatter and share ideas and there is also a live mic and charting trading room where I walk our traders through the trades on voice broadcast live and share the charts we are using – both run at same time..

If the trade works, the price target would be Friday 3:00 PM EST ish for 29.00 ish.

The guidance provided to the trading room after we entered the trade was the price targets and time of the targets possibly coming in to affect. The chart below shows an arrow that provides our traders with a trajectory of trade should the plan being working.

The crude oil one hour chart with symmetry time cycles has been an amazing model, working very well, details on video.

The image below shows the 1 hour algorithmic model and the symmetries in crude oil trade, time cycles and price targets. The reference to “the video” is that we record all trading sessions and make them available to our subscribers for $STUDY and review.

The Live Oil Trading Room Raw Video Feed

At 1:12:40 on the video timer is where the oil trade starts, you can see and hear the actual trade guidance for the signals I am providing our traders as the trade sets-up.

There isn’t a lot of trade guidance on mic because much of it was provide in advance in the trading room and on alert feeds, but you can idea of how it works in the trading room on the video. There is also a time stamp at near bottom right of screen in the video on the chart itself.

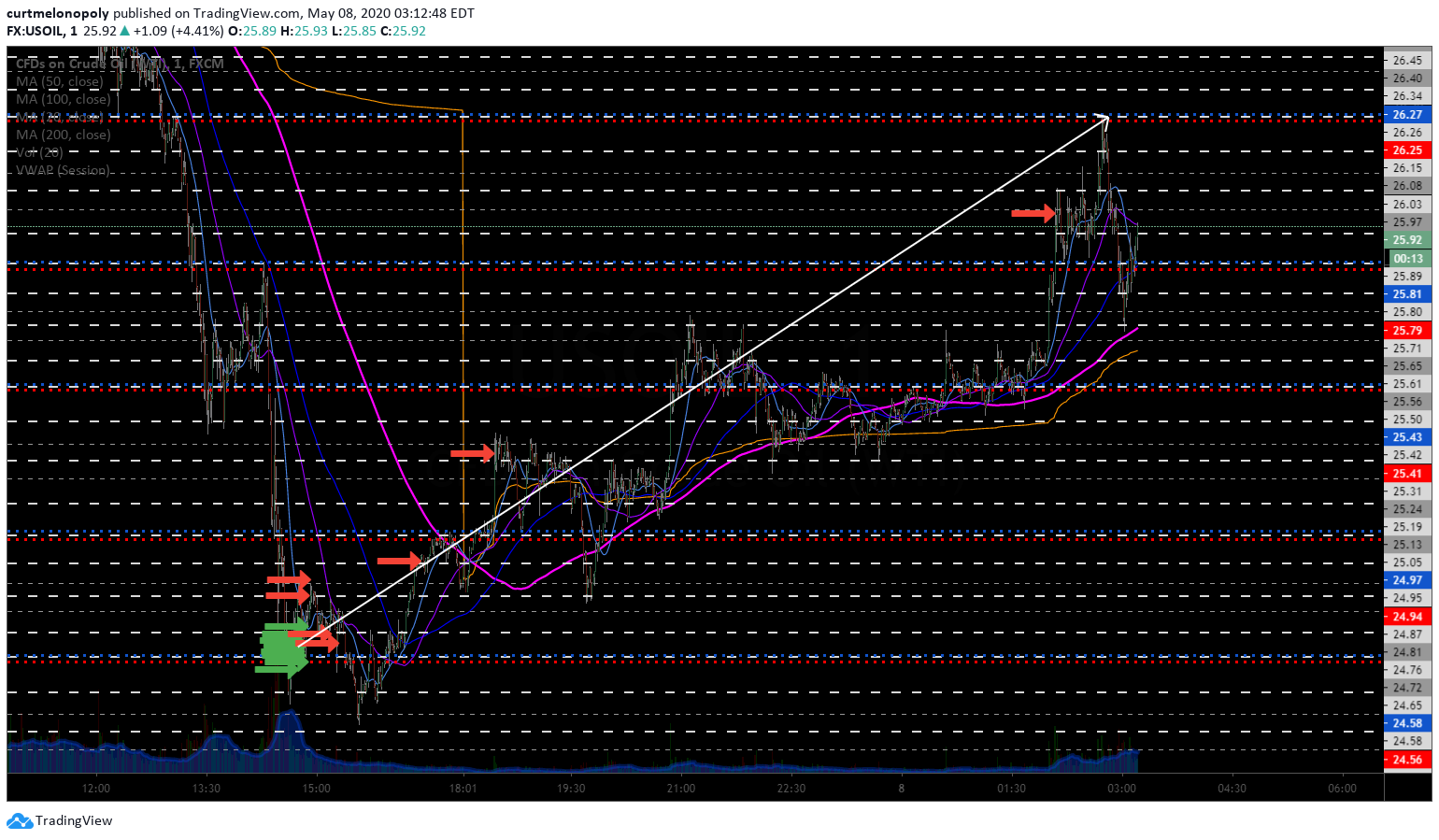

The Chart Below Shows Trade Long Entries (green arrows) and Take Profit Areas Selling (red arrows).

Crude Oil Trade Alerts dot plotted on 1 minute grid chart of EPIC V3.1.1 trade from oil trading room earlier today.

The trade on the 60 min symmetrical time cycle model (white arrow), long position after sell-off in to daily settlement.

The reversal trade works really well for oil traders as long as you manage the trade size according to your account size and be sure to stop out if you are on the wrong side of the trade.

Oil can trend down or up for weeks so staying on the wrong side of an oil trade can cost you your whole trading account.

So if you know your areas of support on the most dominant time frames (in this instance the 1 hour charting) and you execute your long trade after it looks like the sell-off has stopped then it becomes simply managing the ebb and flow of trade according to your personal style thereafter.

BUT IF IT FAILS, my best suggestion to you is to close the trade sooner than later.

I’ve also written other articles on intra-day reversal oil trades – they are more in-depth and a tad technical, but if you want to dig deeper in to this topic here are a few recent articles:

- Buying Support in to the Plunge During Crude Oil Intra-Day Sell-Off | Oil Trading Room Video, Alerts, Strategy.

- 134 Ticks in 1 Hour (Post EIA). Crude Oil Trading Tips: A Simple Intra-Day Reversal Strategy..

My tweet summarizing the oil trade on my personal Twitter feed (shows alert screen shots);

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn’t follow… EPIC got it Direct hitFireBow and arrow I didn’t – in hindsight, likely cause I was tired. Good lesson.

#OTTT $CL_F $USOIL $WTI #OilTradeAlerts

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn't follow… EPIC got it 🎯🔥🏹 I didn't – in hindsight, likely cause I was tired. Good lesson. #OTTT $CL_F $USOIL $WTI #OilTradeAlerts #MachineTrading pic.twitter.com/bcNUzTTER5

— Melonopoly (@curtmelonopoly) May 8, 2020

In the tweet below, I was explaining that oil traders would want to be focusing on trades that are on the outside extreme ranges in price.

The reason for this is that oil recently rallied off lows and we have a time cycle and price targets that see oil topping near – term. When oil starts to top or bottom in a wider time-frame it is then best to trade the range of trade on lower time-frames (such as the 1 minute, 5, 15 or 30 minute charting) until the larger trend is formed.

Oil traders, they’ll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

Oil traders, they'll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

— Melonopoly (@curtmelonopoly) May 6, 2020

So that’s the reversal snap-back trade in crude oil futures that you can either consider as a day trade or an intra-week swing trade. There are of course many other considerations we use (our software has over 9000 rules in its instructions), but for the purposes of a human trader, the above article should help get you started.

We endeavor to develop the best winning oil trading alerts and oil trading room service for oil traders.

Any questions please send me a note via email [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; oil, strategies, reversal, trade, swing trading, day trading, crude oil, oil trading room, oil trading alerts.

“Excuse Me, While I Kiss The Sky”. Part 2 Insider’s Look at How We Daytrade Crude Oil (w/ real-time alert screen shots from oil trading room).

Part Two of What They Won’t Tell You and How We Daytrade Crude Oil Against the Machines

Below is another daytrading session disclosure of real-time oil trade alerts from our oil trading room and alert feeds.

Many in the markets will tell you that there are no crystal balls in the stock market (in this instance in commodity markets). Others will tell you that order flow is key, or storage, OPEC or whatever else. And sure, on broad time-frames there are many different indications of oil price direction that provide clues.

But when daytrading crude oil, everything, and I mean everything other than what the machine trading liquidity dominant players are doing is relavent.

Below you will see real time oil trading alerts from our private member feed, and real time guidance I provided to the oil trading room while I was trading and even public faxing tweets from my personal Twitter feed.

Sometimes I will tweet on my own public facing feed in an effort to show the trading world what is really happening to our markets, but cognitive dissonance keeps most bound to what the shiny balls on TV have to say. So I am not sure whether I’ll continue much longer in that because it’s a lot of effort and you feel like you get nowhere.

Anyway, enough of that, I’ll let the real-time alerts and trading room discussions below do the talking.

Take the time to read this carefully and the previous post you can find here:

When done think about it, spend some time reflecting on what this means for the future of the markets. Beyond just winning and having the best daytrading oil strategies there are real ramifications here.

Okay, good luck with your $STUDY, let me know if you need anything after you have reviewed the documentation below.

Let’s start here, when daytrading crude oil the most important thing you can do is know where you are in the playing field – the structure of crude oil trade within the dominant time cycle. This is key. If you know the time cycle that the dominant players (liquidity) are trading on then you can then trade along with them. This is by far the best oil trading strategy you will ever find.

From yesterday’s article (part 1) I had shared the one hour crude oil chart model and showed you exactly what the structure was and what the TIMING of the price target the dominant daytrading liquidity was targeting. This is the key to successful crude oil daytrading.

Below is the updated 1 hour daytrading oil chart. Take a look at today and yesterday (in part 1). And then read yesterday’s article closely and you will see that we knew exactly where the price of oil was going to be, in advance.

But first, the oil chart.

Crude oil price target met on 1 hour time frame, should see our pull back now for final run tomorrow.

You can see how the machine dominant liquidity has traded very technically toward the price target at 1:00 PM Thursday. What determines if the price target is met? At each decision along the way if retail order flow follows the dominant machines, the machines simply take price to the next decision most efficiently. It’s that simple.

So as you can see in the chart below, the daytrading action in oil has been consistently toward the price target within the chart structure.

Okay, now that you have “perspective” of the arena or battleground, let’s look at the real-time charting, trade alerts and commentary from the alert feed and oil trading room:

Below are only highlights and snippets of the discussion and guidance I provided to the oil trading room, private Twitter alert feed, charting and even public facing personal Twitter feed. To keep this article as short as possible I provide only highlights of the trade sequence below.

Screen shot of oil trading room lead trade alerting initial trade position in crude oil futures with guidance.

“Curt MelonopolyYesterday at 9:21 PM

Long 16.10 2/10

personal trade will advise

order flow progressive I’m going to go with it, over 16 resistance on hourly model

I don’t like this time of day, but I’m going with order flow over 16.00 resistance on hourly crude oil model, long 2-% size 16.10 #oiltradealerts

Curt MelonopolyToday at 9:44 PM

this trade could easily come back to 15.67 before bullish continuation imo so i’m being cautious, its the 30 min EPIC model that concerns me a bit

but the 1 hour has been so strong i’m going with a possible run up with bulls, basically managing that RR

and on hourly 15.74 is the diagonal TL support

so in short, if it pulls back i’ll hold 2/10 re-hit 15.64 area if it gets there with an add 2/10 if that fails cut the loss, but i’m going to play it for the possible run up in to Thurs mid day

so there’s some risk but possible reward is significant

potential run is about 140 ticks up and risk is 60, so there’s different ways to manage that i suppose

easier to manage this type of trade with CFDs than CL contracts, I may take on CFDs in near futures as an addition to my personal trading for these scenarios.”

Screen shot of oil trade alerts member Twitter feed of initial entry in crude oil by lead trader.

Charting shared to oil trading room.

“I don’t like this time of day, but I’m going with order flow over 16.00 resistance on hourly crude oil model, long 2/10 size 16.10 #oiltradealerts”

What the trade looks like on crude oil 1 minute chart time frame.

Entries in crude oil futures are the green arrows and the red are when the trades are closed on the daytrading time-frame charting.

Another screen shot of oil trading room and the guidance I’m providing to the daytraders as we progress through trade.

Will trim at .30 if we get it here, trading 16.25 —-> Trim 1/10 16.30 hold 1.10

took the trim i want the breathing room

not an easy trade

16.30 is mid range on 1 min machine model and 16.48 is top range on 1 min

My stop on the 1/10 is at entry now

What the trade looks like on crude oil 1 minute chart time frame #oiltradealerts

The intra day crude oil trade as represented on the 1 minute chart.

Oil trading room discussion where I am explaining where I may close this part of the trade intraday.

“I may close 16.47 if we get it, 16.45 HOD so far, don’t like the tight trading here.

Closing 16.45 hold 0

chickened out don’t like the action

20 ticks on the 1/10 and 35 ticks on the 2nd 1/10 isn’t so bad for this time of night i suppose

The intra day crude oil trade as represented on the 1 minute chart #oildaytrading

this is double top on 60 min here

Here’s your 60 min double top test on the 60 minute crude oil time frame #oildaytrading”

Here’s your 60 min double top test on the 60 minute crude oil time frame.

Oil trading room discussion explaining the technical levels to watch on a daytrading basis.

“Machines will want that next where two or more trend lines meet price target at 17.41 for a blow through, if retail goes with them that will happen #oiltradealerts

if that happens that will be volatile there

I may re hit a long if price meets 200 MA at 1 min support per chart, doesn’t look like I will get it though #oiltradealerts”

Machines will want that next where two or more trend lines meet price target at 17.41 for a blow through.

Another screen image of the crude oil trading room explaining machine order flow buying oil intraday.

“Jeremy is reporting micro programs buying all opportunities at weekness all the way through intra day so far #oilttrading

problem is timing intra day, they only have so much time to move this

I would say that by midnight Eastern it gets more difficult in their code to get where two TLs meet price on that 1 hour price target above.”

I may re hit a long if price meets 200 MA at 1 min support per chart.

I would say that by midnight Eastern it gets more difficult in their code to get where two TLs meet price on that 1 hour price target above.

okay, here it is, this is their push to force the squeeze intraday in to the price target in the time cycle peak.

You can see how they’re grinding away at each half range tier on the 1 minute oil trade time frame intraday.

Air is thin up here, this is double top on 5 min machine model – see extension arrow.

So on the 5 min timeframe bulls have lost their edge but on hourly I think they still have 20 mins.

Here’s your 1 hour time frame view, looks like bulls still have some time, hard to be exact on larger timing.

And on 1 minute yet another half range zone grind through supply for continuation.

Excuse me while I kiss the sky, yet another price target in the grid complete, AI power on display.

Said climax brings time cycle intraday in to completion, if retail wants it to move now they’ll have to go alone.

Crude oil price target met on 1 hour time frame, should see our pull back now for final run tomorrow.

Retail left naked in the time cycle and have no idea why the air just came out.

And on my personal Twitter feed (public facing) sometimes I’ll let the world know we’re trading to show folks how the oil trading room and alerts work.

Below is a link and if you open the link you will find the thread on Twitter, it was real-time also.

As with the charts, live trading room discussion and private Twitter alert feed above, I show only some highlights, there is much more guidance on all than you see here in this article.

“AI school in session

#OOTT $CL_F $USOIL $USO”

AI school in session #OOTT $CL_F $USOIL $USO

— Melonopoly (@curtmelonopoly) April 30, 2020

“So the game is find the time-frame and use the model they’re using, but it’s all done with machines making those decisions and computer scientists constantly updating code, its a massive war game of techies competing for dominance, that’s oil trade in today’s world #OOTT $CL_F

its a massive game of go on various time-frames with entities competing with various amounts of liquidity all competing for dominant positioning, the dominant teams determine the time frame in play through liquidity, they’re in control,”

so the game is find the time-frame and use the model they're using, but it's all done with machines making those decisions and computer scientists constantly updating code, its a massive war game of techies competing for dominance, that's oil trade in today's world #OOTT $CL_F

— Melonopoly (@curtmelonopoly) April 30, 2020

“i know, i know, there are no crystal balls in the markets

none of that just happened

#OOTT $CL_F $USO”

i know, i know, there are no crystal balls in the markets

none of that just happened#OOTT $CL_F $USO

— Melonopoly (@curtmelonopoly) April 30, 2020

And earlier in the day I was attempting to explain to the Fintwit world what is actually moving and controlling oil price day to day.

“Most conventional market thinkers say that you cannot predict the future

what they won’t tell you is there are a select few that do actually predict it with a very high degree of accuracy

but it takes time to confirm and verify

and this is how the mass con keeps you bound.”

most conventional market thinkers say that you cannot predict the future

what they won't tell you is there are a select few that do actually predict it with a very high degree of accuracy

but it takes time to confirm and verify

and this is how the mass con keeps you bound

— Melonopoly (@curtmelonopoly) April 29, 2020

“Predicting with a rate of accuracy and trading it are two totally different things

it’s obvious in a machine driven world, with machine instructions that predictability will increase

if you know the rule-set instructions where the majority of machine flow resides.”

predicting with a rate of accuracy and trading it are two totally different things

it's obvious in a machine driven world, with machine instructions that predictability will increase

if you know the rule-set instructions where the majority of machine flow resides https://t.co/2oWquQiNjV

— Melonopoly (@curtmelonopoly) April 29, 2020

I am hoping that with part 1 of this series and this part 2 article of exactly how we are daytrading this next leg in crude oil price from our oil trading room that you can see better how to day trade crude oil with success.

As I said in article 1 of this series:

My goal is to build the best oil trading room and alerts service in the world for traders, it is a large task, but the hardest part of our mission is done, we can trade with the best machines in the world now. The rest should be easier.

Any questions please send me a note via email [email protected].

Thank you.

Curt

Part One of this article here: What They Won’t Tell You – How We DayTrade Crude Oil Against The AI’s in the Markets, A Sneak Peak. #OOTT $CL_F $USOIL $WTI

Part Three of this article here: BOOOM! Price and Time Exactly as Predicted Days in Advance | Part 3 – How We Daytrade Crude Oil #OOTT $CL_F $USOIL $WTI $USO

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; oil trading room, daytrading, crude, oil, strategies, oil trade alerts

A Real-Time Example of How Time-Cycles Work in Crude Oil Trade 🎯🔥🏹 #OOTT $CL_F $USO $USOIL $UCO $SCO #oiltrading #tradealerts 👇

Real Time Crude Oil Trade Alerts, How Time-Cycles Work – Crude Oil Day-Trading Strategies April 22, 2020.

Daytrading crude oil is not easy, having an edge helps. Time cycles are an edge and algorithmic models also help considerably.

Below is a documented real-time oil trade I took earlier this morning – alerting the trade, charting and guidance to our oil trading room members with a series of trade alerts.

The actual oil trade alerts, oil trading room discussion, guidance and charting is below.

The charting includes our EPIC v3 Machine Trading 30 minute algorithmic model and the 1 minute daytrading chart model that our software uses.

In this instance this was a day trade intended to develop in to an intra-week swing trade.

This trading set-up and the strategy itself is in play live right now.

Oil traders may find this interesting for Wednesday April 22,2020 trade.

See below.

A real-time example of how time-cycles work in crude oil trade Direct hitFireBow and arrow

#OOTT $CL_F $USO $USOIL #timecycles

A real-time example of how time-cycles work in crude oil trade 🎯🔥🏹#OOTT $CL_F $USO $USOIL #timecycles 👇

— Melonopoly (@curtmelonopoly) April 22, 2020

Curt MelonopolyToday at 3:14 AM

Starting a swing long 1/10 size 11.00 with stop 10.39 (on FX USOIL WTI) traded on CL, entering other side of quad on EPIC 30 Min – Curt Personal intraday swing trade.

Will advise.

obviously a high risk trade

Curt MelonopolyToday at 3:14 AM

Starting a swing long 1/10 size 11.00 with stop 10.39 (on FX USOIL WTI) traded on CL, entering other side of quad on EPIC 30 Min – Curt Personal intrad day swing trade.

Will advise.

obviously a high risk trade pic.twitter.com/ccjdMukzym— Melonopoly (@curtmelonopoly) April 22, 2020

30 min quad, hoping to get turn up here

30 min quad, hoping to get turn up here pic.twitter.com/jyOUwmAOMi

— Melonopoly (@curtmelonopoly) April 22, 2020

If I actually get my way here I will trim 25% at 11.39, 11.62, 11.87 and have stop just above entry hoping the 25% remaining gets the turn up for more.

There, got my profit trims and holding 25% of position with stops above entry #oiltradealerts That worked well.

If I actually get my way here I will trim 25% at 11.39, 11.62, 11.87 and have stop just above entry hoping the 25% remaining gets the turn up for more.

There, got my profit trims and holding 25% of position with stops above entry #oiltradealerts That worked well. pic.twitter.com/DfucPyh9Kl— Melonopoly (@curtmelonopoly) April 22, 2020

Full move through the EPIC 30 min quad fast there and the swing trade in crude oil is well positioned in time cycle #oiltradealerts

Full move through the EPIC 30 min quad fast there and the swing trade in crude oil is well positioned in time cycle #oiltradealerts pic.twitter.com/LQIUQ1Ifjc

— Melonopoly (@curtmelonopoly) April 22, 2020

The power of time cycles and algorithmic trading. #OOTT $CL_F $USOIL $USO #machinetrading #oiltradealerts

The power of time cycles and algorithmic trading. #OOTT $CL_F $USOIL $USO #machinetrading #oiltradealerts

— Melonopoly (@curtmelonopoly) April 22, 2020

Any questions please send me a note via email [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; Crude, Oil, Trading, Strategies, time-cycles, crude oil trade, oil trading room, #OOTT, $CL_F, $USO, $USOIL, $UCO, $SCO, tradealerts, Swing Trading, daytrading, FX, USOIL, WTI

EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

EPIC V3.1 Crude Oil Machine Trading Software Code Upgrade Details | White Paper Update

April 19, 2020

EPIC crude oil machine trading software is a proprietary software development project with an aim to trade crude oil futures. Historical reference can be found at the linked document below.

Click here for the original white paper drafts for EPIC V3 Crude Oil Machine Trade Software.

This white paper update is specific to the EPIC V3.1 software coding update completed for live trade use commencing April 19, 2020.

Purpose of Software Update

In recent crude oil futures trade, specifically since the COVID-19 black swan event, the trading price range and volatility of oil trade (OVX) has been divergent of historical structure.

See chart below: Crude Oil Volatility Index (OVX) chart showing oil trade volatility spiking from the 20s to 330s during black swan event.

Impact to Software

The volatility in trade and the range of price negatively impacts the smaller range of accounts our software may trade at any given time. More specifically any account trading CL futures less than 10 contracts or approximately 100,000.00 in size is at significant risk. At 10 contract size to 30 contract size the risk is considerably mitigated but still present and at 30 contract size or greater the risk is almost completely eliminated.

While markets are functioning within historical normal trading ranges this is not the case, a 10 contract size account is at very low risk with EPIC V3 software and micro accounts (anything smaller than 10 contracts) there is moderate to considerable risk (the smaller the account the more risk).

Remedy of Risk

Our coding team has performed an update to the EPIC V3 software to trade a base account size of 30 contracts (300,000.00 USD or greater) to allow for greater range of trading price and volatility.

The software instructions for the most part have not changed, the original EPIC V3 protocols remain per previous white paper linked above – at the start of this document.

What is different is simply the size of account as the base case instructional presumption within the code which allows for the software to trigger in smaller “dot plots” within various trading ranges and structure.

Projected Returns

The projected returns annually are expected to drop to a base case scenario of +-40% in an extremely volatile market as we are witnessing since the on-set of COVID-19, however, in times of less volatility we expect this will significantly advantage the EPIC V3.1 updated software and annual returns are expected to well exceed EPIC V3 software coded for a 10 contract base case scenario.

Put simply, the larger the account the more advantaged (refer to the original white paper for further code instruction detail).

At times when crude oil trading price range and volatility return to “normal” conditions we expect returns to easily exceed 100% per annum, however, all return expectations at this juncture are only predicted results based on in-lab testing and not real-world trade. All return estimations and projections are simply theoretical until proven otherwise.

Our oil trade alert clients can refer to the document below for more detail pertaining to the alerts service;

Business Inquiries.

For information about oil trade alerts, oil trading room and oil trade reporting contact Compound Trading Group at [email protected].

For information about automated machine trading platforms contact our agent representative Richard Regan as follows:

CONTACT

Email [email protected]

Phone 1-849-861-0697

Follow

Others in this document series can be found here:

- December 10, 2023: EPIC Update: v6.1.1 Machine Learning Trade Software – Final Protocol Real World Results

- June 3, 2023: EPIC v4.1.1 Crude Oil Machine Trade Software White Paper | June 3, 2023

- March 28, 2022: EPIC v3.3 Crude Oil Machine Trade Software White Paper | March 28, 2022 Update

- January 7, 2021: EPIC v3.1.5 Crude Oil Machine Trade Software White Paper | Updated January 11, 2022 w/ Trade Execution Data

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

- December 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

Article Topics; Crude, Oil, Trading, Algorithm, Machine Trading, DayTrading, Futures, EPIC, Trade Alerts, Oil Trading Room, $CL_F, $USO, $USOIL

EPIC v3 Software Code Updates

RE: EPIC v3 Software Protocol Code Updates

When developing the software our team back tested 60 months (per white paper).

Today we spent significant time back testing further than 60 months. The most recent market event (Corona) more resembles 2008.

In short, even the most “throttled” of the EPIC v3 software protocols is not “tight” enough for “market events”. Specifically I am referring to the positioning protocol v3 has to fire within.

We have further adapted the software to only fire on a daytrading (intra-day) protocol.

Specifically this means that all indicators EPIC v3 uses to fire will remain the same, see white paper here:

But the hold area of trade (the positioning draw-down threshold) becomes one range on the 1 minute chart. In other words, EPIC v3 will fire but will fire only within the current 1 minute model range and will not hold anything below a one minute range support.

In practical terms this means that all trades will be high frequency intra day mode when firing and there will be no holds. No holds on weekends and holds end of day will occur but only within the 1 minute range.

In summary the “positioning” part of the code has been removed completely and only the intra day high frequency remains. The code is in essence the same with the exception of the “positioning” component.

A detailed update will follow in a white paper update in editing now.

Watching the alerts over the next few days and attending the live trading room will give you a better idea than this letter will.

Any questions let me know,

Thanks

Curt

EPIC v3 Crude Oil Code Updates: Drawdown Protocols vs Expected Return (follow-up to Feb 2 note) #machinetrading #oiltradealerts

EPIC v3 Crude Oil Trading Software Updates, A Follow-Up to Last Week’s Note on February 2nd.

RE: Software Drawdown Protocols vs Expected Returns and Oil Trade Alerts.

Good day traders,

Last weeks note (if you have not read it) can be found here;

EPIC v3 Crude Oil Code Updates: Drawdown & Short Selling Protocols $CL_F $USO #machinetrading

Since the Feb 2 note I have had some questions from our clients that I suspect others have also, so I a summarizing responses from those questions below.

Our Primary Objective

The goal in our development is now limiting draw-downs, we know the software works and that is not at issue, at issue is the size of potential draw-down.

Our primary objective is to find the range of “throttle” in the software that provides a consistent return with the least volatility in ROI.

Draw-down Protocol “Events”

The software is designed to trade on historical structures, trade set-ups, order flow and more – find details in the most recent white paper update can be found here.

Specifically to draw-down protocols, in my last note I described the change in code to be throttled 50% (limiting potential downside to 50% of what is described in the white paper). I also explained that if required we would throttle it again another 50% of its most recent setting.

Last week crude oil seemed to be basing from a technical perspective and the software (considering the chop) did well, however, we were not comfortable with the potential draw-down risk in the “event” driven chop.

At issue specifically are market “events”, such as with the recent virus event out of China. Event periods will potentially cause draw-downs, our objective is to avoid this volatility.

As of today we have done that – throttled the draw-down protocol again.

The reason is simple, our objective now is to limit unnecessary draw-down percentages to the point that we can allow the software to run without concern to draw-downs even if that limits potential returns. For now this is the case and as explained previously if we open the throttle at all we will advise our clients well in advance.

In practical terms this means that the software size held is limited intra-day when in draw-down and the range is limited. The range is not changed from previous, being one full “quad” and/or “channel” range on the EPIC Algorithm Model but the size held is limited to near 1/10 size. The size can very from approximately 1/10 to 3/10 size but the software will “flash” in and out any adds with near zero range stops executing at each key support in a draw-down.

Oil Trade Alerts

This will at times cause the oil trade alerts feed to be very active but yet at times will be very silent as the software will only execute the highest probability trades also.

This represents the tightest throttle possible in our code.

Expected Returns vs. Draw-Down Risk

Through development we have had plateaus of code structure ranging from 20% – 150% ROI expectation and we even looked toward 300% being possible.

However, there is a volatility to potential draw-down that comes with higher expectation of ROI. This has to be balanced with account size and risk tolerance.

Our objective is to code software that has limited draw-down with highest ROI on specifically 10 contract size accounts. As explained previously, 30 contract and higher accounts this is much different.

At the current throttle setting our estimation of returns is somewhere between 40 – 80% per year (likely closer to 40%) with very littler risk to the down-side as we have run the software in this throttle range prior for some time and this is the ROI expectation. The variance in ROI expectation (40%- 80%) is in consideration of market conditions and not how we expect the software to run.

After the software has run for a considerable time at this level of “throttle” we will look at releasing the “throttle”, but this will be only considered after some time and again I emphasize that our clients will be notified well in advance.

Being as transparent as I can, the reason for this is motivated by the fact that we have been in development for near 4 years and there is a point where returns need to be the norm and not volatility in development. We need to run a low risk environment for some time now as development has been costly. When we have recouped development costs and put some profit back in to the project we can then look at further development and associated risk.

Our next white paper update will reflect the content of these updates notes.

Any questions please send me a note via email [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article topics; crude, oil, trading, machine trading, algorithm