Blogs

Premarket Notes: EIA, Fed, Volatility, Time Cycles, Swing Trade Set-Ups and more.

RE: Premarket Notes

Good morning traders,

This morning is the EIA oil report at 10:30. We also have the VIX peak time cycle to consider in to Oct 21 and the Fed with their QE to the moon (that’s not really QE).

Caution, caution, caution.

In advance of October 21 I want to start doing daily (if not daily near so) swing trade set-up reviews in the main trading room. So that our positions and set-ups for on the other side of Oct 21, 2019 in to March of 2020 time cycle are clear and our clients can take full advantage.

We are expecting (if our models are correct) a significant bull run during that period in specific sectors and equities.But it will be volatile, so it will be a key period of time.

I am going to do these as time allows starting today. The time of day will vary that the review in the trading room will occur. I will send the swing trade reviews done daily to members on email every night they are done so if you cannot be in the trading room it is no problem.

If you missed the report last night (a summary review) it is here;

Protected: Swing Trading | Premium, Oct 8: Part 3d Summary Review $VIX, $OVX, $SPY, $XLE, $OIH, $TREX, $CLX, $USO, $FLWPF, $DVA, $CL_F, $GLD, $SLV, $DXY, Crude Oil

Password: SUM

Our positions have been correct in to this VIX time cycle peak, we have taken our foot off the gas at the right time with equity positioning and volatility bias etc, but soon it will be time to be bullish again in equities, but first we need to deal with Oct 21.

Also, we have had some issue with our mail servers so if you receive reports in duplicate my apologies, this may continue for some time.

If you miss a report you see released (didn’t receive on email) please let me know.

Have a great day,

Curtis

Crude Oil Trading | Strategies, Alerts, Charts, Algorithm, Trading Room, P&L | Premium | Sept 29, 2019

Crude Oil Trade Report Sept 29, 2019.

Trade Strategies for Crude Oil (CL) Day Trading, Trend and Swing Trading. Intra-Day, Daily, Weekly, Monthly Time-Frames.

The CL trade strategies that include alerts, charts, algorithm models, signals, price targets and guidance included below are suitable for actionable mechanically executed trading and are also the models our coding team reference for our crude oil machine learning trade development.

You will find below a well developed, time-tested proven rules based system for crude oil trading that is one of the best available. You have to use all the models together as a structured system of trade for it to work to your best advantage.

With each chart model we may include “best-use” trade strategy notes and/or “rules-based trade indications” for your consideration. The oil trading room is your best resource for real-time learning.

For perspective, review historical reporting on our blog and the various videos we have published to the Compound Trading YouTube channel.

Much of the structured model discipline developed in our system is similar in concept as discussed in this video; Mathematician Who Cracked Wall Street.

Our “How to Trade Crude Oil” Recommendations.

Crude oil price moves within structured areas (ranges) of trade represented on charting on various time frames (different time cycles of trade).

The structure oil price moves within (the range of price) can be one minute charting (and more recently some machine trade is as low as 15 second time-frame) timing through to monthly charting.

Time-frame set-ups / strategies below are charted as conventional chart set-ups and/ or algorithmic chart set-ups (structures).

Understanding and having each chart time-frame at your immediate access (both conventional and algorithmic) will increase the probability of profitable trading.

You will find in reviewing the raw recorded video feed or in attending the live oil trading room that in the morning a lead trader will often review on mic the various levels of support and resistance on various oil trade time-frames on the charting to establish my most probable areas of trade for my strategy of trade. The lead trader will also check with all the chart time-frames prior to entering a daytrade at various times through the day.

Our use of this proven crude oil trading system (and obviously the use of our V3 machine learning software executing to this system) has provided an oil trade win-rate above 90% and currently we are returning over 148% ROI per year (win rate and ROI vary depending on time frame and version of software).

When multiple time-frames agree to support or resistance areas on the charting this becomes your highest probability area of trade execution, we have found this to be one of the best oil trading strategies.

Sizing trades appropriate to your trading account, probability of support or resistance (multiple oil chart time-frames in agreement) and time frame for each set-up is a positive strategy.

Using the correct chart time-frame specific to your trading strategy is critical. Generally, the lower (smaller) the time frame the less predictable the support and resistance areas (or structure) of the chart will be. However, the larger time-frames (monthly, weekly, daily) may also have significant “slippage” but the primary structure will often remain intact.

Generally, the idea is to enter your positions based on the structure for the specific time frame you are wanting to trade referencing the other time frame support and resistance or range within the trend. The basic method is to understand the range of trade and execute trade long bias when price is near support for the appropriate time frame / structure and the opposite is true for short trades.

Our staff use the thirty minute model structures (range within trends) most often for primary areas of support and resistance trading signals referencing all other time-frames in their trading strategy. More recently the 60 minute time-frame (view simple algorithmic model below) is being used by our staff as it provides a wider view of the current structure of oil trade.

Trade positions should be significantly biased to the trending range of trade. For more information about trend identification for trading various time-frames refer to this article on Investopedia; Multiple Time Frames Can Multiply Returns.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

The recently released white paper about EPIC v3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

If you have questions about the models below please email us at [email protected].

Not all charts are updated every week and some concept or test charts are added or deleted on occasion.

Be sure to check the time-stamp of each chart below as the preparation of charts and/or models can take days prior to publication and distribution of this report.

If you are a new client that would like to review historical reports that are still locked on the blog from public view please email the office with your request and we will send you recent report credentials for unlocking reports for review.

Please note, chart links that support the models below are now distributed specific to each user or small group of users. If you are using more than one device to access the charting, to avoid disruption of service, please email us a simple / general description of those devices to assist in controlling dissemination.

EPIC Crude Oil Algorithm Model. 30 Minute Oil Chart Structure.

The EPIC algorithm model chart below is a proprietary structure that has been back tested sixty months on thirteen time-frames. The model represents the most probable areas of support and resistance in oil trade within this specific time-frame.

This (the EPIC 30 Minute Oil Algorithm Chart Model) is our most proven oil trading structure / strategy.

The levels noted on the EPIC model are to be used as important areas of consideration for support and resistance (trade signals) for your trading strategy when using conventional charting set-ups / structures and/or other algorithmic charting.

Resistance and support areas on the thirty minute oil trade structure chart are at each line on the algorithmic chart. The primary areas of support and resistance are;

- Outer quadrant walls / also used as channel support and resistance (orange dotted diagonal lines), the half way point between each is often an executable buy or sell trigger in trade (not shown on model below),

- Mid channel line for uptrend and down trend (white dotted diagonal),

- Mid quad horizontal (not marked but is at the mid point of the quad),

- Fibonacci levels (various horizontal colored lines),

- Historical areas of support and resistance (purple horizontal).

- The intra-week swing trading range is from thick horizontal gray line to the next (commonly becomes a pivot area of trade).

- The important historical diagonal trend-lines (conventional trend lines) are represented on the chart as thick white lines.

- Also of note are the price targets for Tuesday 4:30 PM (API), Wednesday 10:30 AM (EIA) and Friday 1:00 PM (Rig Count). The Tuesday and Wednesday targets hit significantly more often than the Friday target (red circles with red or green vertical dotted lines intersecting).

- At times other indicators are added to the chart such as important trend lines “in play”, moving averages and more.

The video at this link explains How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, #OIL, #Trading, #Algorithm, #OOTT as does this video Oil Trading Room – How to Use EPIC the Oil Algorithm Model Chart June 21 #OIL #OOTT and this Webinar 1: EPIC the Oil Algorithm.

When conventional crude oil charting coincides (or agrees) with the EPIC algorithmic model support and resistance this is then considered a significant buy or sell trigger (signal) for crude oil trade.

Be aware (at minimum) of the primary support and resistance areas on the larger time-frames (lower time frames are not as critical) – in this instance (when trading the 30 min time frame) the 1 hour, 4 daily, weekly and monthly charting should be considered when sizing your trades.

30 Minute EPIC Algorithm Crude Oil Trade Charting Model.

EPIC 30 Min Crude Oil Trading Algorithm 911 PM Sept 29 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Per recent;

EPIC 30 Min Crude Oil Trading Algorithm 810 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

15 Second Oil Day Trade Chart Model – Concept Model in Testing.

The 15 second chart model below has Fibonacci structures, horizontal and diagonal as well as the cloud and a chart bot for buy and sell signals.

This model allows for the discipline of symmetrical price extension moves to be measured easily as the chart has grid type features.

All levels are in test phase so use the model with care.

You can shut off the cloud and/or chart bot if either distract you.

This model is likely to change many times before we are done.

15 Second Crude Oil Trading Chart Model (day trading) Sept 29 1047 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

One Minute Oil Day-Trading Time-Frame Chart Model. Ideal for Intra-day Crude Oil Trade.

How to trade oil on one minute charting time-frame “best use” rules-based trading:

The one minute oil chart time-frame is one of the best for day-trading crude oil.

The one minute oil trading chart time-frame model provides for pinpoint trade entry, sizing and exit points for day-trading oil.

It is also used for squeeze scenarios in oil day trading. The main range is between the red / blue areas with thicker dotted white lines. The range is considerably more predictable in a squeeze scenario.

In a non squeeze scenario the one minute chart is best used as a grid tool for measuring day trade extensions in price. Refer to lead trader, trading room videos, reports, Discord server previous trading days, trade coaching for how to trade intra-day with one minute oil trading model using price extensions on the grid to your advantage. This is a considerable edge if you learn how to utilize this method.

Diagonal channel / trend lines may or may not be included with this chart, if so, they are recent trend lines of importance for day-trading levels also.

Again, be sure to reference other oil chart time-frames to ensure your highest probability of trade success (when two or more time-frames agree your success in trade – probability of winning, will go up significantly).

One Min Crude Oil Trading Model (day trading grid) Sept 29 927 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

One Minute Crude Oil Trading Model (day trading) Sept 2 842 AM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

5 Minute Charting.

Also used for day-trading crude oil, the five minute chart time-frame is a key area of trade (signal) for oil day traders.

The five minute oil trading strategy chart below includes a form of an Elliot impulse 5 wave component for when oil is predictably trading intra-day on this time frame. The diagonal sloping up-trending green lines can be used as support and resistance decision areas.

Intra-day time cycle peaks can also easily be identified and important with trade execution timing and size considerations. The vertical lines are time cycle peaks / inflections. Depending on intra day trend you will find half-time to be also of importance and even quarter time.

Here also, on the 5 minute model symmetrical price extensions within the structure of the model are key to levels of support and resistance in each wave of price within intra-day trading structure.

5 Min Crude Oil Trading Time-Frame Chart Model 1028 PM Sept 29 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

5 Minute Crude Oil Trading Time-Frame Chart Model 849 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

15 Minute Charting.

The 15 minute trading time-frame helps oil traders see a larger picture than the 1 and 5 minute time-frames.

The algorithmic chart model below is an abstract model that has a number of indicators within its structure. It helps oil traders determine areas of inflection, time cycles, channels and various other trends within oil trade.

When you get to the 30 minute, 60 minute, daily, weekly and monthly chart models further down in this report you will find we return to more conventional chart structures for wider time-frame strategy perspective.

15 Minute Crude Oil Trading Time-Frame Chart Model 1245 M Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

15 Minute Crude Oil Trading Time-Frame Chart Model 855 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

30 Minute Charting.

The thirty minute crude oil trading time-frame charting is critical for oil traders. The 30 min chart below is in addition to (complimentary to) the EPIC 30 Minute model above.

It is a noisy chart with many trend-lines (red, black are primary), price extensions (green arrows), time cycle inflections (blue dotted vertical), Fibonacci levels and more. It is more a “work-sheet” than it is a specific structured model. Because of this it becomes important for daytraders to reference regularly. We send updates to our subscribers on a regular basis, this allows for our clients to identify with short term trend channels and trends.

The key areas of support and resistance on the chart below are noted with thicker lines. The thicker the line in the chart the more important it is for your trading strategy and consideration for trade.

30 Minute Crude Oil Trading Time-Frame Chart Model 804 PM Sept 29 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

30 Minute Crude Oil Trading Time-Frame Chart Model 908 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

60 Minute Charting.

The 60 minute oil chart model below is a much cleaner and more simple model that references key support and resistance decisions for crude oil trade on the sixty minute time-frame.

The way to use this trading signal is for key areas of support and resistance on a weekly trend / reversal thinking strategy. Because the model is so clean and charts a larger structured time-frame, the levels indicated on the chart model should be considered heavily within trading strategies for the trader.

No oil day trader or swing trader should go with-out considering this chart before executing short term or mid term timing of trades.

The model includes time cycle peaks (vertical lines), quadrant support and resistance (diagonal Fibonacci trend-lines) and horizontal Fibonacci support and resistance.

60 Minute Crude Oil Chart Model 131 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

60 Minute Crude Oil Chart Model 924 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil

Daily Charting.

The daily oil chart time-frame provides a larger structure to consider. The diagonal Fibonacci lines are important as are the mid quad horizontal lines. The moving averages (especially the 200 MA) should be considered in your trade strategy. The MACD is a common indicator on the daily oil chart for forward positioning and trend bias.

The most recent daily model is a busy chart with many trend-lines and such (first chart below) and then the simpler “Keep It Simple” Daily Chart is also included below. The more simple Keep It Simple Daily chart model is excellent for trade strategy perspective.

Daily Crude Oil Chart Model Swing Trade Range 139 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Daily Crude Oil Chart Model with Fibonacci Channels 143 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Daily Crude Oil Chart Model with Fibonacci Channels 656 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Keep it Simple Daily Crude Oil Chart 156 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Keep it Simple Daily Crude Oil Chart 858 PM Sept 1 FX USOIL WTI $USO $CL_F #Crude #Oil

Weekly Charting.

The weekly charting below should be used for perspective and/or or swing trading crude oil.

Keep it Simple Weekly Crude Oil Chart 201 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Keep it Simple Weekly Crude Oil Chart 707 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Monthly Charting.

The monthly oil charting below is similar to the weekly charting in that it provides a simple perspective for primary support and resistance in crude oil trade for your strategy. You will find that oil is currently trading mid-range within its current structure, caution is warranted at mid range. The 200 day moving average is well above so if opportunity to trade long at the chart support occurs this would be a sound strategy for oil traders within this current set-up.

Keep it Simple Monthly Crude Oil Chart 206 AM Sept 30 FX USOIL WTI $USO $CL_F #Crude #Oil

Per recent;

Keep it Simple Monthly Crude Oil Chart 709 AM Sept 2 FX USOIL WTI $USO $CL_F #Crude #Oil

Crude Oil Trading Room, Profit and Loss, Trade Alerts, Special Reports, Trading Strategies and More.

Recently we have written a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles below at the “Crude Oil Trading Academy” link videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are serious about learning how to trade oil you will find that the report you are reading, along with the various articles below and review of the live trading room (specific to around the times of trade) that your oil trading returns and win rate will increase significantly.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Anything else we can do to assist you in your trading journey please email us at [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Trading Room, Futures, Strategy, Signals, Alerts, USOIL, WTI, CL_F, USO

Follow:

White Paper Updated Dec 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

85%+- Returns: Real-World Trade Performance and Why ROI Is Expected to Grow.

December 29, 2019 2:35 PM EST EPIC v3 Oil Trading Software Update.

Updates for this document series can be found here:

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

Draft white paper outlining key reasons EPIC v3 oil futures machine trading software outperforms conventional trading methods:

- Lightening Fast Decisions. EPIC crude oil trading software executes trades to over 8700 weighted decisions instantly. The instructions provided within the architecture is growing daily. A human trader cannot make decisions as quickly, cannot process the data required for most intelligent trading probabilities and cannot execute trades as precisely.

- Algorithmic Chart Models. The EPIC software includes over thirty proprietary algorithmic chart models and the catalogue is growing. The algorithmic models have been designed, tested and refined in real-world trade for over 3 years by a team of day traders, each with over 20 years of experience. The oil trading models represent all time-frames from 15 second to monthly time-frames of trade. The algorithmic models have been back-tested to sixty months historically.

- Conventional Charting. The software includes conventional charting structures on all time-frames, also back-tested sixty months.

- Common Trade Set-Ups. Included in the software are common trade set-ups that oil day traders implement. This is dynamic and additions are made regularly to the software code reflecting current structured trade set-ups.

- Order Flow. EPIC IDENT™ is data-driven order flow intelligence in real-time to achieve best outcomes.The software includes and executes to a proprietary order flow identification system that tracks behavior (specifically isolating other market machine liquidity) and weighs identified entities and historical trade patterns to its trade decisions (instructions). EPIC IDENT™ increases its intelligence as it gathers data intra-day specific to liquidity flow, historical patterns, time of day, volatility, various preferences, latency, rejects and more. The method is similar to back-testing charting, however, the process is real-time. In short the software is looking for “fingerprints” within market liquidity. We cannot back-test 60 months as with charting but back-testing from date of software inception is possible.

- Time Cycles. Time cycles are within all algorithmic and conventional trading model structures, order flow also has identified time cycles and other time cycle events such as weekly reporting in oil markets such as API, EIA and rig counts. Additionally there are time-of day market time cycles around the world. Time-cycles are included in the software architecture.

- ROI Trajectory “Game”. The software has a “game” element in that it is designed to continue its most recent ROI trajectory (or return to its trajectory of ROI should it have a draw-down period). In other words, if the trajectory of ROI is for example 100% and it draws-down to 80% it then will “weigh” trade decisions more to the most probable trade set-ups until the ROI trajectory is returned. It also will push its decision “weight” to exceed the current ROI trajectory to establish a better ROI to which it is then “obligated” to maintain and correct to, hence the expectation that the ROI will continue to improve over time. This is the “machine learning” component of development. We are finding that the software is discovering increasingly more creative ways to “game” the ROI return trajectory. This Sept 4, 2019 document details an insider look at this topic within development. Edited Sept 5, Draw-Down Oil Daytrading Session: Question and Answer Review | EPIC V3 Crude Oil Machine Trading Software.

Combined, these advantages enable the EPIC v3 Crude Oil Trading software to outperform conventional trading methods.

Introduction.

The world of public market trade is rapidly changing. It is estimated (depending on source) that over 80% of crude oil futures are not traded by humans and are now traded by machine.

Machine trade may be simple bot style software, high-frequency software or more sophisticated architecture as with the EPIC v3 class of algorithm.

Our team commenced the oil trading software development journey four years ago with algorithmic chart model development. From day one we employed computer scientists to work with us on a daily basis to build software emulating our trading methods.

Over time the software started to win more trades than our traders and today we rely almost solely on the software to execute trades. We simply “tweak” the software at each trade sequence to improve performance.

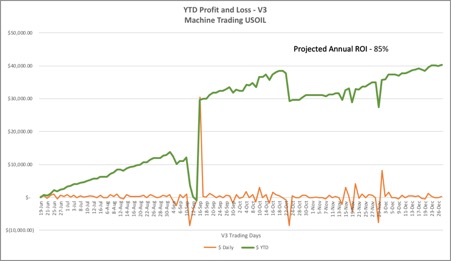

EPIC v3 software is our 3rd generation oil trading software. EPIC v1 tested returns at about 20% per annum, EPIC v2 at 40% per annum and EPIC v4 architecture was too aggressive for our risk threshold. We settled on EPIC v3 about ten weeks ago and have been refining its code trade by trade since.

The current EPIC v3 win-rate consistently comes in at +-90% per trade sequence (variable by +-7%).

The current EPIC return is projected at 85% per year (and has been as high as 140%) – based on real world performance (audited trades available) and is expected to increase over time. The current period of time spans approximately six months and includes hundreds of trade executions (nearing thousands).

For December 27, 2019 Profit & Loss Daily =$331. YTD +$40,275. Projected $84,973 or 85% Per Annum. EPIC v3 Oil Machine Trade 100k Sample Account (live video, time stamped alerts, v3 audited P&L available) #OOTT $CL_F $USOIL $WTI $USO #oiltradingroom #oiltradealerts

https://twitter.com/EPICtheAlgo/status/1211013973329485824

For October 4, 2019 Profit & Loss Daily +$1,838. YTD +$34,218. Projected $140,331 or 140% Per Annum. EPIC v3 Oil Machine Trade 100k Sample Account (live video, time stamped alerts, v3 audited P&L available) #OOTT $CL_F $USOIL $WTI $USO #oiltradingroom #oiltradealerts

Account Size – ROI and Draw-Down Volatility.

The smaller the account size traded the more difficult it is for the software to limit risk to down-side and provide optimum returns, however, most recently considerable advancements in the software should limit the draw-down with smaller accounts considerably.

The software is designed to trade within a sequence of trade within structures or set-ups. As the oil market price changes, the software trading logic uses all the different data to update the decision tree utilizing the instruction rule-set.

You can imagine this as a dot plot process similar to the game “go” – not exactly, but the concept helps to visualize how the software plots a sequence plan for trade.

The “ebb and flow” of regular oil market trade allows opportunity for the software to plot a plan of trade within a sequence, the larger the account the more dots can be plotted (trades can be “bite sized” entries within an “ebb and flow”).

The sample account size for the purpose of this document is at the smallest range, being 100,000.00. A 1,000,000.00 account would expect approximately half the volatility / draw-down exposure and up to 50% more return. A 10,000,000.00 account would be considerably more stable to draw-down risk and potential returns and so on.

Draw-down Protocol.

During any particular 24 hour trading period the EPIC v3 software protocol (as of October 6, 2019 updates) expects on average draw-down no more than as follows;

- Account size and average 24 hour drawdown 10,000,000.00 = 1.5 %, 1,000,000.00 = 3%, 100,000.00 = 6%, 50,000.00 = 12%, 25,000.00 = 24%.

Hard stop architecture is also available, however, the annual expectation of returns would be significantly less than represented in the current real-world trade example above.

Real-World Trader / Investor Use.

In real-world examples the EPIC v3 oil trading software is being used daily by oil traders as an additional indicator and / or as an auto trading mechanism.

Examples include the Compound Trading Group live oil trading room (live broadcast of trades via voice and charts), live alert service via Twitter and Discord private server feeds and regular Oil Trading Reports that include algorithmic and conventional chart structures and guidance.

Additionally, SOVORON™ uses our data flow to integrate to their platform. SOVORON™ ‘Algorithmic machine trading of your personal Crude Oil Futures exchange account’. See www.sovoron.com for information.

Architecture of API Trade.

EPIC v3 software is designed to be deployed remotely – accessing an account and executing trades. This provides the account holder with ultimate control. The account holder grants the software access and the software executes machine trades to the account. The account holder can turn on or off access at any time. Architecture provides opportunity for decentralized platform integration.

Documentation.

Video. Our team traders and engineers have live video recording of the trading sessions with EPIC v3 software within a trading room environment.

Trader and Developer Repository. We provide guidance to our subscriber (paywall) clients in a Discord private server (charts and trade set-up explanations) in a real-time environment. The private server acts as a repository for our developers and our trading service (paywall) clients.

Live Trade Alerts. All trades have been broadcast over mic in a live trading room (recorded as mentioned above) and most have been alerted by way of text instruction to the Discord private server and/or private Twitter feed for time-stamped evidence.

Broker Accounts. The EPIC v3 trades are real-world trades and as such broker profit and loss statements can be made available.

Client Reporting. We provide regular reporting to our trading service clients (paywall) that explains the process of execution by the software. Examples of the guidance provided, trade alerts issued, Discord private server discussions and live trading room video can be found in this document (which is one of many published) Daytrading Crude Oil in Oil Trading Room: 6 Trades, 6 Wins. How We Did It | Alerts, Strategies, Video, Charts. This document provides a standard update document provided to our clients Protected: Crude Oil Trading Report Strategies | Alerts, Signals, Charts, Algorithms, Trading Room, P&L | Premium | Sept 2, 2019 use password CLTRADER.

Conclusion.

This paper outlines the opportunity that change in machine trade within global finance markets presents.

Competitors within the machine trade industry are becoming more and more refined / successful – the best in class are assumed to be winning a larger portion of proceeds.

The most significant immediate challenge developers face in machine trade within financial markets is building a product that can win within a prescribed threshold of stability limiting down-side and yet over-perform conventional trading methods.

Soon thereafter the challenge becomes competing against “like-kind” machine trade peers and being best in class.

It is our expectation that fewer and fewer competitors will achieve more of the proceeds (as a whole of trade in public markets) at an exponential rate, which does provide urgency to development and deployment.

The EPIC v3 trading software achieves consistent, predictable and very adaptable architecture that provides exceptional ROI potential.

Business Inquiries.

For information about oil trade alerts, oil trading room and oil trade reporting contact Compound Trading Group at [email protected].

For information about automated machine trading platforms contact our agent representative Richard Regan as follows:

CONTACT US

Email [email protected]

Phone 1-849-861-0697

Follow

document revised September 24, 2019 9:22 PM EST

document revised October 6, 2019 2:00 PM EST

document revised December 29, 2019 2:35 PM EST

Others in this document series can be found here:

- December 10, 2023: EPIC Update: v6.1.1 Machine Learning Trade Software – Final Protocol Real World Results

- June 3, 2023: EPIC v4.1.1 Crude Oil Machine Trade Software White Paper | June 3, 2023

- March 28, 2022: EPIC v3.3 Crude Oil Machine Trade Software White Paper | March 28, 2022 Update

- January 7, 2021: EPIC v3.1.5 Crude Oil Machine Trade Software White Paper | Updated January 11, 2022 w/ Trade Execution Data

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

- December 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

Article Topics; Crude, Oil, Trading, Algorithm, Machine Learning, DayTrading, Futures, EPIC, Trade Alerts, Oil Trading Room, $CL_F $USO

Premarket WatchList $VIX $BTC $SPY $GLD $SLV $DXY $WTI $USO #timecycles #swingtrading

Premarket WatchList $VIX $BTC $SPY $GLD $SLV $DXY $WTI $USO #timecycles #swingtrading

Good morning traders,

All trade set-ups on watch or alerted are starters in to time cycles that may or may not run in trajectory to bias, they can go completely the opposite direction, hence the “starter” positioning until said trades develop. Different trades / instruments have different time cycles, refer to historical swing reporting as needed for various notes and charting models. We have been working on the report all night and will release it when it is ready, until then the alerts are flowing. Lots of caution with the upcoming time cycles because everything cray cray everywhere (not just me), the world is not amenable to the buy and hold conventional thesis in my opinion, going forward. We see range, lots of range coming.

We cover over 200 equities, many of which will be in play, on watch etc that we will alert.

Have a great weekend, hug em tight and buckle up.

Anything I can do shoot me a note.

Best and peace.

Curt

Swing trade time cycle magic rolling out now for new time cycles, ask for a personal tour of the time stamped alert feed and tell me i'm wrong, tell me we don't have a crystal ball, but don't cry when you miss $VIX $BTC $SPY $GLD $SLV $DXY $WTI $USO #timecycles #swingtrading

— Melonopoly (@curtmelonopoly) September 20, 2019