Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00 as Alerted to Member Private Feed, Trading Room and/or Reporting. #swingtrading #tradealerts

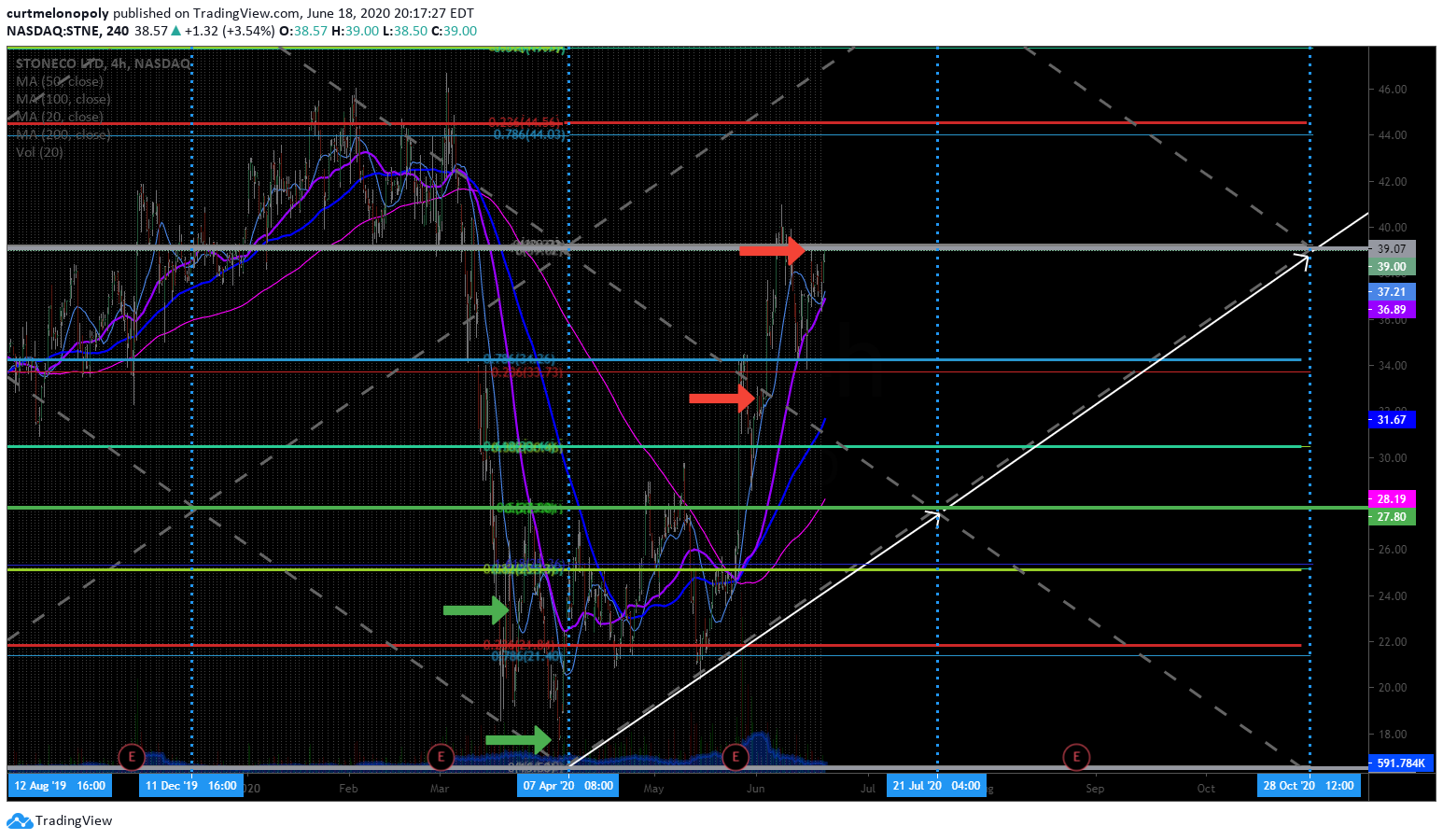

Tickers Alerted: $SQ, $MA, $APDN, $PD, $BA, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $VXX, $VIX, $OVX, $INO, $GLD, $GC_F, $SLV, $SI_F, $BTC, $STNE, $JETS, $APO, $HIIQ, $GBTC, $RCUS.

- Important Summary Detail:

- Period Swing Trade Alert Return (ROI) = 127.34% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=454676&investmenttime=date&investmentlength=2.5&beginbalanceday=03%2F01%2F2020&endbalanceday=03%2F31%2F2020&ctype=1&x=75&y=27

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 5, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trade Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

- Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1EOt1AkEdPchc-h_aijQ7EUzoF_uG186Uhta9Ri-9VPg/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Size | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | ||||||

| 3/31/2020 | 12:19 | Long | $STNE | 400 | 22.96 | 0 | ||||||||||

| 3/31/2020 | 11:08 AM | Trim to 75% hold 25% | $NET | 400 | 17.75 | 26.2 | 3380 | 454676 | https://twitter.com/SwingAlerts_CT/status/1245005074260164609 | |||||||

| 3/31/2020 | 10:46 AM | Trim | $NET | 200 | 17.75 | 25.7 | 1600 | 451286 | ||||||||

| 3/31/2020 | 8:07 AM | Trim 25% | $HAS | 100 | 67.69 | 73.55 | 586 | 448696 | ||||||||

| 3/30/2020 | 2;47 PM | Trim 25% | $HAS | 100 | 67.69 | 70 | 231 | 449110 | ||||||||

| 3/30/2020 | 11:04 | Long | $HAS | 400 | 67.69 | 0 | ||||||||||

| 3/30/2020 | 9:43 | Short | $APO | 300 | 34.4 | 0 | ||||||||||

| 3/27/2020 | 12:51 | Long | $JETS | 800 | 15.8 | 0 | ||||||||||

| 3/26/2020 | 10:09 AM | Trim 100 of 400 | $SQ | 100 | 43.62 | 59 | 1530 | 448879 | ||||||||

| 3/25/2020 | 12:26 PM | Trim 50% 100 hold 100 | $BABA | 100 | 174.05 | 194.05 | 2000 | 447349 | ||||||||

| 3/25/2020 | 11:35 AM | Trim 12.5% hold 12.5% | $BA | 25 | 107.7 | 166.8 | 1477.5 | 445349 | ||||||||

| 3/24/2020 | 6:35 PM | Trim 25% hold 25% | $BA | 50 | 107.7 | 139.75 | 1602.5 | 443862 | ||||||||

| 3/24/2020 | 12:26 PM | Trim 50% | $INTC | 150 | 48.42 | 53.32 | 735 | 442260 | ||||||||

| 3/24/2020 | 12:25 PM | Trim 50% | $BA | 100 | 107.7 | 123.17 | 1547 | 441525 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% swaps | $BTC | 150 | 5900 | 6557 | 9855 | 4399778 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% (5 x 5000 ounce contracts) | SI_V | *5 | 12.7 | 13.94 | 31000 | 430123 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% (8 x 100 ounce contracts) | GC_F | 8 | 1516.01 | 1619.27 | 82608 | 399123 | ||||||||

| 3/23/2020 | 10:11 | Long | $INTC | 300 | 48.42 | 0 | ||||||||||

| 3/23/2020 | 9:59 | Long | $BABA | 200 | 174.05 | 0 | ||||||||||

| 3/23/2020 | 9:23 | Long BTC adds swaps | $BTC | 200 | 6200 | 0 | ||||||||||

| 3/23/2020 | 9:23 | Long Silver | SI_F | 10 | 12.7 | 0 | ||||||||||

| 3/23/2020 | 9:21 | Long Gold | $GC_F | 16 | 1516.01 | 0 | ||||||||||

| 3/20/2020 | PRE | Long | $SQ | 400 | 43.62 | 0 | ||||||||||

| 3/20/2020 | PRE | Long 200 | $BA | 200 | 107.7 | 0 | ||||||||||

| 3/19/2020 | Trim 200 for 400 held | $APDN | 200 | 3.01 | 9.48 | 12940 | 316515 | |||||||||

| 3/15/2020 | 5:13 PM | Adds swaps | $BTC | 100 | 5409 | 0 | ||||||||||

| 3/13/2020 | PRE | Cover 60, hold 40 | $NKE | 60 | 86.2 | 76 | 612 | 303575 | ||||||||

| 3/13/2020 | PRE | Cover 150 hold 50 | $WYNN | 150 | 100.52 | 71.08 | 4416 | 302973 | ||||||||

| 3/13/2020 | PRE | Long 100 | $COST | 100 | 277.6 | 0 | https://twitter.com/SwingAlerts_CT/status/1235724000808112128 | |||||||||

| 3/13/2020 | 14:30 | Add 400 for 600 held | $APDN | 400 | 2.3 | 0 | https://twitter.com/SwingAlerts_CT/status/1229993709732876290 | |||||||||

| 3/12/2020 | 10:26 | Long | $PD | 600 | 17.2 | 0 | ||||||||||

| 3/12/2020 | 9:54 AM | Cover 25% | $MA | 150 | 322.3 | 246 | 11445 | 298557 | ||||||||

| 3/12/2020 | 9:51 AM | Cover 25% | $WYNN | 150 | 100.52 | 69.78 | 4611 | 287112 | ||||||||

| 3/12/2020 | 8:51 AM | Cover 25% 100, hold 100 | $NKE | 100 | 86.2 | 76.9 | 9700 | 282501 | ||||||||

| 3/12/2020 | 10:32 AM | Trim 150 of 450 held | $VXX | 150 | 18.2 | 48.2 | 4500 | 272801 | ||||||||

| 3/11/2020 | 11:31 AM | Cover 50% 200 of 400 | $NKE | 200 | 86.2 | 82.17 | 860 | 268301 | ||||||||

| 3/11/2020 | PRE | Short 400 | $NKE | 400 | 86.2 | 0 | https://twitter.com/SwingAlerts_CT/status/1237697839129649152 | |||||||||

| 3/10/2020 | 3:44 PM | Trim 150 of 600 held | $VXX | 150 | 18.2 | 34.64 | 2466 | 267441 | ||||||||

| 3/9/2020 | 2:04 PM | Long 200 | $INO | 200 | 11.03 | 0 | https://twitter.com/SwingAlerts_CT/status/1237076932057075712 | |||||||||

| 3/9/2020 | 9:30 AM | Trim 150 of 500 | $WYNN | 150 | 100.52 | 84 | 2478 | 264975 | ||||||||

| 3/9/2020 | 10:19 AM | Sell 11/12 approx | $OVX | *11 / 12 | 35.8 | 139 | 55728 | 262497 | https://twitter.com/SwingAlerts_CT/status/1237018625191673856 | https://twitter.com/SwingAlerts_CT/status/1236994259607265281 | https://twitter.com/SwingAlerts_CT/status/1231427689703231488 | https://twitter.com/SwingAlerts_CT/status/1188897285385703424 | https://twitter.com/SwingAlerts_CT/status/1192794697569320966 | |||

| 3/5/2020 | 10:45 | Short 500 | $WYNN | 500 | 100.52 | 0 | ||||||||||

| 3/5/2020 | 10:31 | Long 200 | $GBTC | 200 | 10.72 | 0 | ||||||||||

| 3/3/2020 | 3:51 PM | Sell 200 of 200 | $HIIQ | 200 | 18.6 | 31 | 2480 | 206769 | ||||||||

| 3/3/2020 | PRE | Trim 100 of 600 | $RCUS | 100 | 15.5 | 17.59 | 209 | 204289 | https://twitter.com/SwingAlerts_CT/status/1234722519187435520 | https://twitter.com/SwingAlerts_CT/status/1230924666665078785 | https://twitter.com/SwingAlerts_CT/status/1250841232366088192 | |||||

| 3/2/2020 | PRE | Trim 100 of 300 | $APDN | 100 | 4.44 | 8.52 | 4080 | 204080 | ||||||||

| 200000 | ||||||||||||||||

|

*The goal has been to keep the alert feed simple to allow traders (subs) to structure their own trades, sizing, instruments etc, however, we will be transitioning to a more specific detailed alerting process in 2020 (digital auto platform).

|

||||||||||||||||

|

*Run the trades, win rate avg return range you see alerted on the spreadsheet with your preferred sizing, risk tolerance, instrument type and see what your returns would be based on the swing alerts of our platform.

|

||||||||||||||||

|

*The trade alert links in spreadsheet will only open for premium subscribers (for use of reference) if you would like a tour of the feed to view the time stamped alerts contact us – the P&L represents alert feed as it was alerted.

|

||||||||||||||||

|

*Subscribers can click on alert link for details of alert and also see charting and links to live Trading View charting, structured models, etc for each set up.

|

||||||||||||||||

|

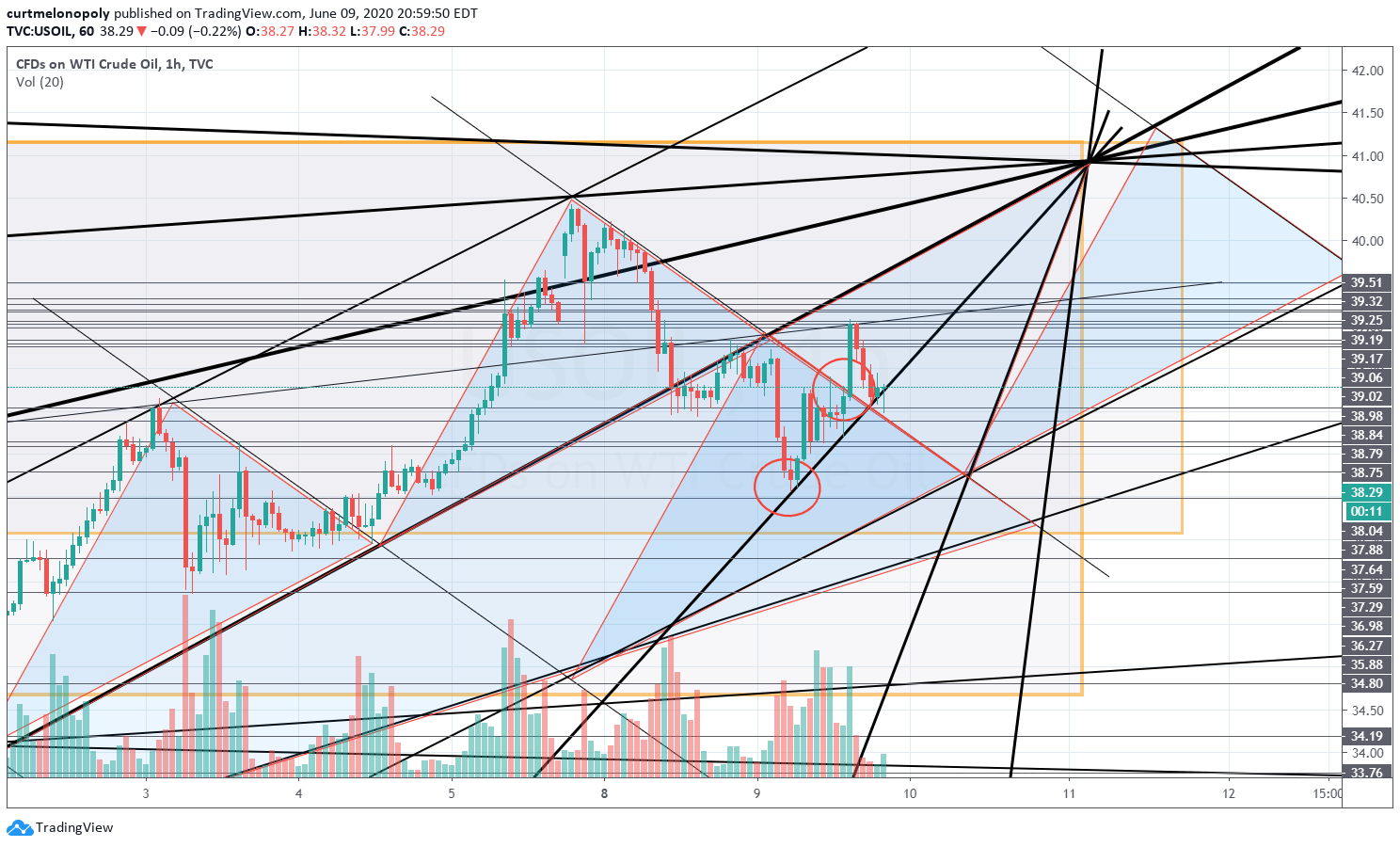

*See addendum documentation for; Volatility derivative options trading structures/strategies used for $OVX $VIX $USO $SPY $SPX Gold Silver Crude Oil Bitcoin.

|

||||||||||||||||

|

*Many trades in Volatility, Indices, Commodities, Crypto etc are structured as futures or ETF options or lev swaps that take time to detail at intraday alert level – soon trade alerts will include more detail with digital traders platform launch.

|

||||||||||||||||

|

*For these P&Ls (until strategy structures include more detail n alerts) we have kept the entries as simple as possible so traders can execute on the actionable set-up.

|

||||||||||||||||

|

*Crude oil: lead trader primarily uses a 10 bet position trading strategy on day trades and a 30+ bet system on swings (max size can vary) and EPIC V3.1.1 machine trading a fixed 30 bet system on either.

|

||||||||||||||||

|

*Swing clients know in 9/10 trade set ups when lead trade executes a position a profit trim is taken if on right side of trade and then if price returns to buy lead trader has stops there (unless otherwise noted).

|

||||||||||||||||

|

*For specific or itemized trade set-up strategies or instrument stuctures as needed for any of the trades in progress email Jen & Curt at [email protected] or clients can Whatsapp Curt direct.

|

||||||||||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Stocks, Commodities, Crypto, $SQ, $MA, $APDN, $PD, $BA, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $VXX, $VIX, $OVX, $INO, $GLD, $GC_F, $SLV, $SI_F, $BTC, $STNE, $JETS, $APO, $HIIQ, $GBTC, $RCUS.