Tag: Daytrading

Daily Trading Profit & Loss (Alerts) Report: July 1, 2019 $AMD, $KOOL, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Profit and Loss Summary for Personal Day and Swing Trades, Oil and Bitcoin Trades, Machine Trades and Alerts. Includes Live Trading Room Video and Alert Feed Screen Shots.

I recently posted to my Twitter feed that I would start providing daily trade profit and loss summaries and also posted some info on our goals for our machine trading / alert compound gains. Thread is below.

Compound Trading

100k at 0.6% gain day compound 23 mos= 1,000,000.00

Mon July 1, 19 100,000.00

Sun May 16, 21 1,000,737.00

Trading Days Yr 252

Annual ROI 151%

Monthly ROI 13.2%

Daily Target 0.6%#MachineTrade #Oil #Bitcoin #OOTT #Crypto $USOIL $WTI $CL_F $USO $BTC $XBT_F $XBTUSD— Melonopoly (@curtmelonopoly) June 30, 2019

This is the first profit and loss post, this will for now be basic and over time we’ll get more info and more formal (with proper P&L spreadsheets). Below is what time allows for today.

Oil Machine Trades / Alerts

There were four oil trades, all winners, the target (goal) for the day was exceeded by the machine trade.

3 of 4 of the trades were alerted. Alerts went to private Discord server, private member oil alert feed, were broadcast (my voice with charting) in the live trading room. 1 of 4 was only alerted live in trading room.

Personal Oil Trades.

None, however, I will be trading along side the machine trade alerts going forward now that our coding is mostly complete for oil.

Machine Bitcoin Trades.

N/A in development.

Personal Bitcoin Trades.

I shorted Bitcoin at 1/10 size, it went well and I covered 50% of the trade holding half at this point. Looking for a bounce to add to the short or if price gets to the price target I will close the short and re short after a bounce. Members can refer to the alert feed and / email sent out explaining the charting and trading plan for this short.

Personal Swing Trades.

The one swing trade was long AMD, which was a 2/10 size intended as an add to the current swing position (initial position at channel) and the other portion of the 2/10 size was to be a day trade, however, the day trade didn’t work so I am 3/10 long AMD.

Members can check to the private member swing trade alert feed on Twitter and recent reports for all current swing trades (there’s a new consolidation report on deck coming also).

Personal Day Trades.

As above the AMD day trade, it went against me and the only reason I held it is because I’m in an AMD swing trade and because my sizing is correct. When you have a swing trading plan and you’re also day trading a stock then this becomes an option for a trader. This is why we first start with the larger structure of the financial instrument and put together a trading plan for the swing trade and then perhaps also day trade the stock. You can take any of the swing trade charting in the reports and bring it down to a day trading time frame. If I day trade a stock that we do not have models for I would never hold the trade whether it goes well or not.

Historical Profit and Loss Trading Statements.

Jen is currently reconciling all the trading profit and loss statements for the purpose of review and study. The most recent working document update is available here:

Protected: Swing Trading Profit & Loss Report | Swing Trade Alerts Nov 2016 – June 26, 2019

Password: 4321 (if asked)

Take a look at recent premarket note for more about what we’re up to with our trading here:

Trading Room Raw Video Footage on Day:

#OilTrading #BitcoinTrading #DayTrading #SwingTrading #MachineTrading #TradeAlerts

The video below is raw feed only, to find live trading and trade alerts voice broadcast when lead trader is trading in the room reference the time of day on the alerts.

Live Trading Room Raw Feed $AMD $USOIL $WTI $CL_F $BTC $XBT_F

Supporting Trade Alerts and Charting on Day:

If you cannot see a chart below, a link is not available or not showing to the alert and/or chart or parts of the data is blocked with ******, this is because it is a premium member chart or alert.

Crude Oil Trade Alerts.

3 for 3 for machine trade alerts today. Exceeding .6% daily 151% per annum goal. #OOTT FX $USOIL $WTI $CL_F $UWT $DWT #OilTradeAlerts #machinetrading https://twitter.com/curtmelonopoly/status/1145164315726684161 …

3 for 3 for machine trade alerts today. Exceeding .6% daily 151% per annum goal. #OOTT FX $USOIL $WTI $CL_F $UWT $DWT #OilTradeAlerts #machinetrading https://t.co/sjrecbrb1p pic.twitter.com/ofpx0tP5mS

— Melonopoly (@curtmelonopoly) July 1, 2019

Machine trade caught the bottom turn today again. #OOTT FX $USOIL $WTI $CL_F $USO $UWT $DWT #OilTradeAlerts #MachineTrading

Machine trade caught the bottom turn today again. #OOTT FX $USOIL $WTI $CL_F $USO $UWT $DWT #OilTradeAlerts #MachineTrading pic.twitter.com/4jgRW2UoXp

— Melonopoly (@curtmelonopoly) July 1, 2019

Bitcoin Alerts.

Short Bitcoin 10640s for price target 1 at ****** area then possibly on to two other targets in trend noted $BTC #tradealerts

https://twitter.com/SwingAlerts_CT/status/1145671162950799362

50% profit trim 10319.00 $XBTSUSD $BTC #Bitcoin 20 ma support test on Daily #tradealerts

https://twitter.com/SwingAlerts_CT/status/1145708849728540672

BITCOIN (BTC) Short term trading plan, short or long at each arrow, timing on lower time frames $BTC #tradingplan

BITCOIN (BTC) We have met all targets now since buy alert (green arrow), trajectory early, what’s next on deck in new charting and report due later today. $BTC #Bitcoin

https://twitter.com/SwingAlerts_CT/status/1145610739991883777

DayTrade & Swing Trade Alerts.

Long $AMD 31.89 (already in swing, so partial is swing add and partial day trade), day trade partial. Resistance / price targets 32.58 trading box, 32.89 trendline diagonal, 33.64 mid quad, 34.29 trend line diagonal, 34.65 trading box final target. #daytrade #swingtrade #alerts

https://twitter.com/SwingAlerts_CT/status/1145668110147563520

ADVANCED MICRO (AMD) up nice from channel alert, trading 31.89 premarket, watch marked areas for resistance #swingtrade #daytrade $AMD

https://twitter.com/SwingAlerts_CT/status/1145665998453952513

ADVANCED MICRO (AMD) Nice bounce off channel support and above trading box res, trim in to key resistance add above in trajectory #swingtrade $AMD

https://twitter.com/SwingAlerts_CT/status/1143884167882727424

If you have any questions about my trading or need help with yours send me an email anytime [email protected] and I’ll do my best to help.

Thanks

Curt

Additional Info:

Master Trade Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Crude Oil Machine Trade Software Complete | Rule-Set Strategies, Alerts, Accounts Traded, What’s Next?

The Crude Oil Machine Trading Software Is Complete.

The information below (in advance of the official white paper) provides a summary of the development process to date, the rule-set (strategies) the code executes oil trades to, what the oil trade alerts will look like on your feed, returns expected on accounts traded and what we have planned in future.

June 13, 2019

As noted above, we have now completed the main structure of the coding for our crude oil trading.

We have previously messaged that we were either close or right at being complete only to find ourselves back down another rabbit hole. This time is actually different, we are done the primary architecture coding, we only have updates (tweaks) remaining. We expect the bulk of that to last at most ninety days.

The software includes eighteen structured algorithmic models (representing time frames from 1 minute charting to weekly), specific high probable trade set-ups, trade sequences within set-ups, order flow analysis, trend (channel) structures on each time-frame and range structures on each time-frame.

The trends (channels) and range trade structures are given the most weight within the decision process of the rule-set. The larger the structure (time-frame) the more weight for sizing and stop loss range. The models, set-ups. sequences and order flow have much less weight in the code.

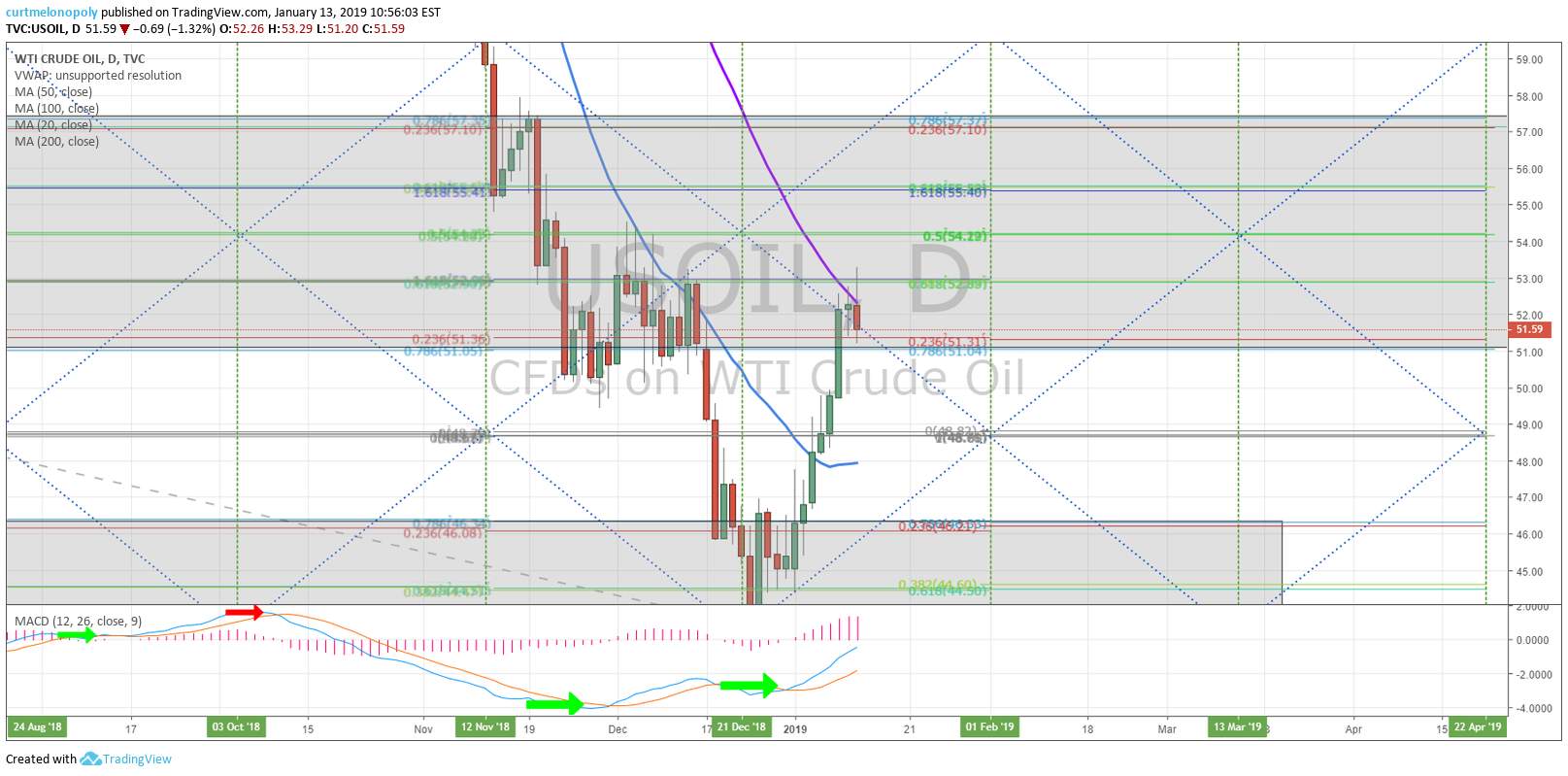

This (the weights) described above will manifest in trade activity in such a way that trade will become more active and in greater size with the larger the structure. For example, the trending channel from late December 2018 to recent would be a considerable structure within the code and as such the code would size in to that channel at the support and resistance widths of range.

The white paper that we will publish soon will detail the rule-set in such a way that our clients will be able to follow along with the machine trade and understand the protocol that it is executing. This is the first stage for the architecture needed for our trader digital dash board we intend to develop soon.

As the days and weeks go on the software will fire more regularly and will begin to size considerably more than right now because it is coded to weigh decisions within trade trends, structures etc. As the trade set-ups develop the code will fire on them. Obviously the largest structures will be at the end of this start up process. The last few days it has been firing on 1 min, 5, 15 and 30 minute structures.

At first we expect the returns to be approximately .5% per day (if averaged over 30 trading days) increasing to well over 1% per day at most 90 trading days in to the launch. We have tested the code in advance and are confident with this. Depending on our success with “tweaks” the returns could escalate to near 3% per day, we are however more conservative and expect 1%-1.5%.

We are significantly more confident with this version of code simply because we have been down the rabbit hole on every time frame, in every structure, every set up, every order flow sequence on all time cycles competing with the best machines in the world.

We have been there, we went to battle in every arena, we know where we can win and where we cannot. The final version of code will only fire in arenas that we expect 80% + win rate. The larger the structure the larger the return as the software fires through the sequence with the structure.

We tested code on every time frame, in every algorithmic model, every order flow structure and so on and so on. We left no stone unturned.

There are areas of trade in the oil markets (smallest time frames) that are so competitive it would dazzle your mind. The AI’s that are firing in the smallest of time frames are doing so in a way that no trader can imagine. Every time we completed a sequence of trade in the most competitive areas (time-frames) we were schooled in the most advanced AI machine trade the world has to offer. It is manifested in a way no trader would ever expect. Here’s a hint, imagine getting beat every time, in a new way every time and every new way you got beat was a structured, logical, mathematically sound way and the ways seem endless.

Our final crude oil trade code is well outside those areas of competition.

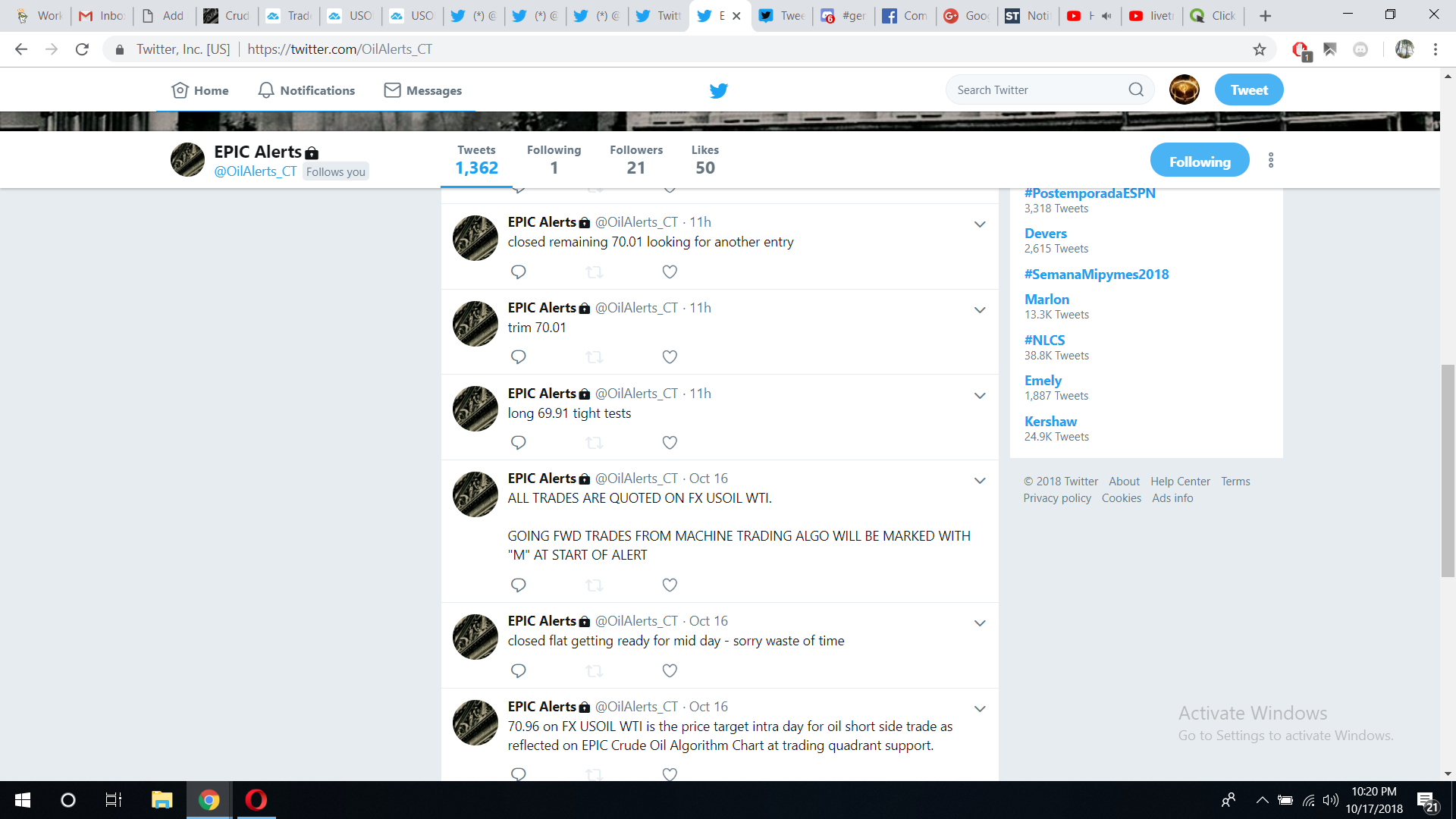

The alerts on the Twitter client feed, in the oil trading room and on the private Discord server will continue to have “M” in the alert if it is a machine driven trade and if I (Curt) am trading I will also identify the alert detail as such. As the days go on the protocol (trade set up) detail will get more and more detailed so that our clients can follow along with clarity.

See also:

Press: SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

What’s next?

The next ninety days is for tweaking the code – refining the execution of sequences within structures of trade.

Then near term we will be looking at the trader’s digital platform and API’s etc and then….

AND THEN…. YES, WE HAVE DECIDED to BUILD SOFTWARE FOR BITCOIN MACHINE TRADE.

This will obviously lead our developers in to other crypto-currencies also.

Any questions send me an email [email protected].

Thanks

Curt

Oil Trading Academy:

If you would like to learn more about how to trade oil, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Updates Distributed Weekly).

Real-Time Oil Trading Alerts (Oil Trade Alerts via Private Twitter Feed and Discord Private Chat Room).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (Weekly Newsletter, Trading Broadcast Room, Chat Room, Real-Time Trade Alerts).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: AI, machine trading, trade, software, crude, oil, BTC, Bitcoin, Oil Trading Room, Oil Trade Alerts, Strategy

Follow:

Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance

Crude Oil Day Trade Strategies Session With Our Lead Trader Jan 14, 2019 for Intra-Day Trading and Forward Guidance for Week of Jan 13, 2019. Video.

Video starts at 00:45.

1:00 I will look at crude oil trade first and then cover the other algorithm models and equities we follow.

1:38 Time cycles. Last week was first full week post holiday and time cycle completion week. This week we expect oil time cycle to start to form out.

If you consider where oil recently peaked, this could be the short term top per previous guidance (for retrace down).

At 2:30 is a sizing chart we are using for our machine trading software development (a doodle chart).

The downward channel in a reversal explained on this chart and the upward channel in continuation of recent trend from daily chart bottom is explained on this chart.

Support and resistance for uptrend and downtrending trade for daytrading and sizing swing trades is explained here on this chart.

At 5:55 I explain two areas of daytrading crude oil strategeis (setups) that I missed and how. It’s a learning lesson for chart setup strategies in crude oil.

At 7:20 the weekly crude oil trading chart is reviewed. The weekly Fibonacci support and resistance areas are reviewed. This is very important for swing trading range in this area of oil trade. There is resistance at 200 MA, diagonal Fib line and trading box over head resistance. The trading zone is highlighted here for visual understanding.

I am short term bearish now at resistance on this chart and bullish at support on this chart. Very, very important chart if you’re trading crude oil.

At 10:15 the daily chart diagonal Fib decision area is important as outlined as its a time cycle completion (small), 50 MA resistance also. 48.80 is a target and 54.17 up top both for Feb 1 depending on direction here forward.

At 11;15 on weekly Trend Line resistance is a little higher and support makes sense on daily quadrant lower support outlined on vid.

12:28 240 minute chart, 20 MA was touched and price backed off. It didn’t get to its upper price target and that was a signal of a pull back in play.

At 14:30 on the 1 minute daytrading chart the structure, support and resistance, trading box areas are reviewed. Trade intraday has been sloppy. Time frame sizing is the point of this modeling.

Machine trading has been coming back in to market but still quite vacant post holiday and model anomalies.

At 17:10 the algorithm model is reviewed. Resistance and support of the trading channel in an uptrend or downtrend on the weekly time frame is discussed.

There are a number of price targets and trade action guidance for day trading and swing trading the weekly trade in crude oil on this part of this video.

#crudeoil #daytrading #strategy

Further Learning:

If you would like to learn more click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our lead traders that include learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Crude, Oil, Day Trading, Guidance, Strategy, USOIL, WTI, CL_F, USO

Follow:

Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

A Real-Life Simple to Reproduce, Consistent Example of a Winning Crude Oil Day Trading Strategy From Our Lead Trader.

How Algorithmic Trading Can Help You Win Consistently (from our trading room on Friday). Man and Machine.

Day trading crude oil futures is not easy… but it is at the same time. The most difficult for me is executing trades based on what I know is right – the most probable winning trade set-ups for buy/sell signals as provided by our algorithmic oil trading model.

This is why I always tell our clients to study the rule-set and use trade alerts only for a heads-up and to use your own trading plan based on your understanding, sizing, comfort area etc. Behind the alerts is a real trader too (at least as it applies to my alerts, our machine trading alerts are a different story going forward).

The buy/signals provided by our algorithm provide structured day trading that increases my win rate greatly – but only when I respect the rules of the model.

I have published a number of articles now detailing the basic rules of the model to assist traders with a better win rate. My personal win rate went from (at best) 60% to approximately 90% (it fluctuates between 80%-95% on an annual basis – there is an ebb and flow). All time stamped live trade alerts.

In our oil trading room last Friday I was triggering trades as was our machine trading technician – man vs. machine (again).

The bottom line: the machine (without effort) won (following the rule-set), and I won – that is until I got greedy.

Both the machine trading technician and I were triggering long side positions near the same time in to the Friday regular market open (my long entries were adds to the previous night futures trade I was already in).

The trade worked well and when the trade met its price target area of the algorithmic model structure (resistance) the machine trade trimmed and then closed on some pull-back and I closed completely.

But I started looking for a further break-out above the algorithmic model signal of resistance as provided by EPIC the Crude Oil Algorithm (after I already had a winning trade). This was the error.

But I started looking for a further break-out above the algorithmic model signal of resistance as provided by EPIC the Crude Oil Algorithm (after I already had a winning trade).

So yes, my day was affected negatively (not that bad because I recovered some by trading bounces during the intra-day reversal sell off), but not good because my trading day could have been very positive vs. negative / stressful on the day.

There is a low stress easier way – just follow the rules of the model. The algorithmic trading model provides a consistent, simple, highly profitable structure for day trading (and even swing trading) crude oil.

Below I explain what I did right and what I did wrong, how easy it is to trade crude oil using proven strategies (with EPIC Oil Algorithm) and how easy it is to get greedy – hopefully my real-life experience helps your trading.

#CrudeOil #AlgorithmicTrading #TradingStrategy FX: $USOIL $WTI $CL_F $USO

The Trade Details (actual screen shots of the alert feed, charting and commentary).

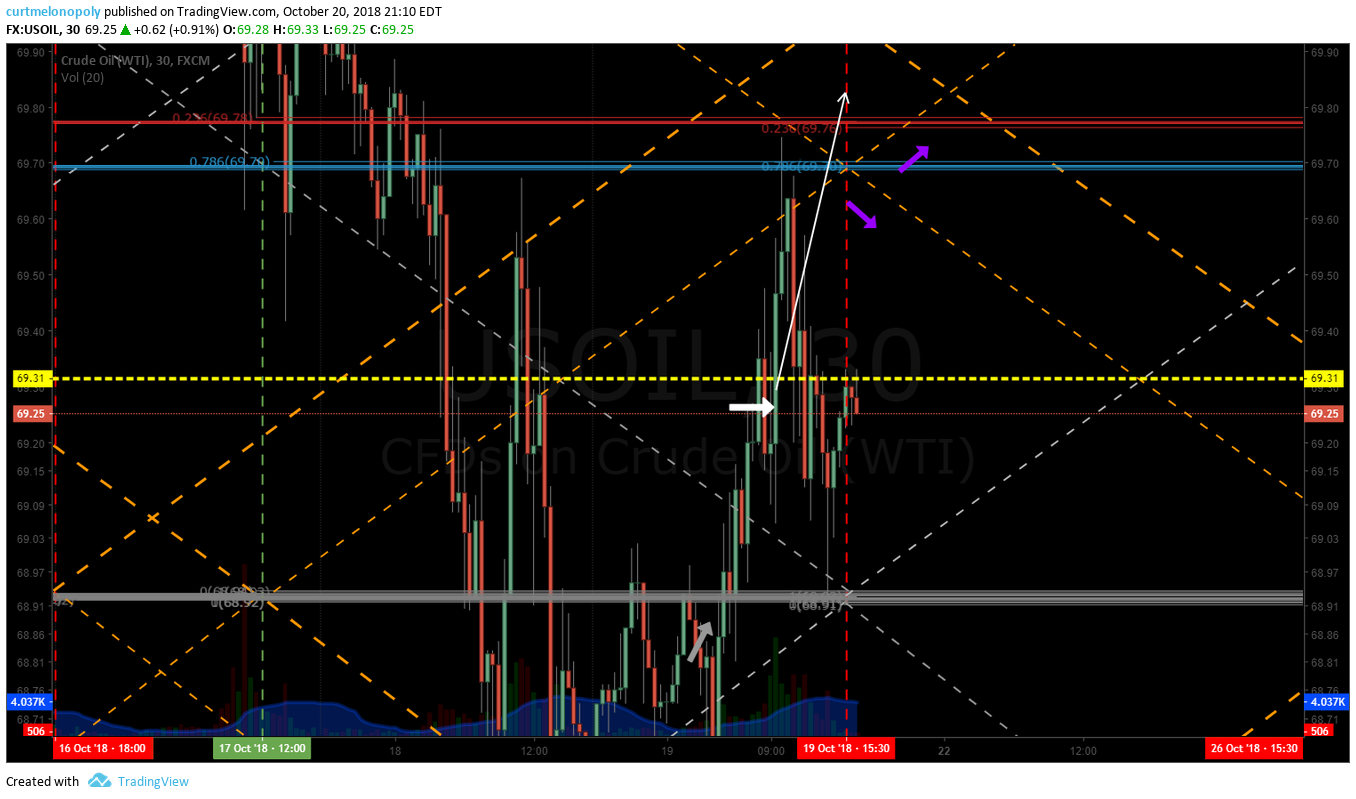

Below is the initial alert (screen shot from our trade alert feed on Twitter) by our oil machine trading technician at 9:17 AM on Friday October 19, 2018. The technician alerted a trade signal long machine buy program in to the regular market open at 69.25 on the algorithmic charting.

Our algorithmic charting is produced on crude oil FX USOIL WTI and this can be used for trading oil futures CL, ETNs / ETFs such as United States Oil Fund (USO), SCO, UCO, UWTI, DWTI and more.

At 9:20 PM October 18, 2018 in futures trade the night prior (Thursday night) I alerted to the feed a long side trade entry at 68.93 as a test trade for the break of upside resistance area. So at this point I was in at 68.93 long and the technician was in the trade at 69.25 the next morning.

Less than one minute later (after the technician alerted) I was alerting adds to my existing trade (we were obviously loading our trades and alerts at near the exact same time).

The Buy Signals Triggering a Long Oil Trade Alert:

On a conventional crude oil 1 minute chart for FX USOIL WTI, the long side trade entry alert signal sent out to members of our oil trading service was based on a number of signals that combined (in momentum and confirmed with the algorithm model) provide high probability to a winning day trade – the signals are as follows:

- Intra day trade in to regular market open breached the Fibonacci trend-line resistance (grey dotted line),

- Trade breached the trading box to the upside (red box on chart),

- The Squeeze Momentum Indicator turned green again,

- The MACD turned up again,

- The Stochastic RSI had turned back up after near bottom (the closer to bottom the better in most instances),

- Trade was above the 200 MA (moving average) having just retested its support (pink on chart),

- Trade was above VWAP (orange on chart),

- Trade was above the intra-day trend support line (yellow line on chart).

- Positive buy flow volume was increasing in to open (volume bars on chart with blue highlights),

- The momentum of trade was subsequently on the bullish side,

- The algorithmic model was also in agreement (shown below and to understand the model takes some study).

On the crude oil algorithmic charting model the following reasons were in play to confirm the long trade:

- The upside price target area on the chart that had a time cycle concluding on Friday at 1:00 PM (see white arrow on chart) was most probable considering the fact that trade was above the mid trading quadrant horizontal support line (thick grey horizontal line). Which in this instance was also a primary support line for the wider time-frame for swing trading oil (which makes it a significant support area on the chart).

- In futures trade the night before, oil trade had broke to the upside of the mid quad resistance area (grey horizontal line as described above and shown on chart below).

- There was a hidden pivot (not shown on the algorithm charting but highlighted here for demonstration purposes in bright yellow – horizontal dotted yellow line on chart). The idea being that if trade momentum was turned up in to open that this hidden pivot was likely to be breached to the upside and would then become yet another support confirming the bias to the upside target on the model.

The algorithmic charting model price target described above is the “easy” trade signal I refer to in the title of this post. At any given time of trade intra-day we can provide the most probable price target for the coming time cycle conclusions. I won’t go in to detail here (that is a completely different article). You can read our other oil trading posts, become a member, watch our videos on how to use the oil algorithm, get some trade coaching or attend a boot camp for more details to this process.

The algorithmic charting model price target described above is the “easy” trade signal I refer to in the title of this post.

Another thought (off-topic a tad), consider the trading quadrant – there were four or five excellent long and short entry points on the model at the quad wall resistance and support areas. This week our machine trading technician is alerting to the EPIC Private Member Twitter Feed those trades (I will also continue as normal).

AND if you look at my original long entry the night prior in futures trade, that trade signal is an even easier trade signal – price was breaching the mid pivot on the trading quad of the model (gray line) which is also the wide swing trading support and resistance area of the charting.

I then provided our members with the trade strategy (guidance) with price targets at 69.70, 69.78 and 69.80 at 9:24 AM (right after the market opened). The price targets are where there are resistance areas of the algorithm chart provided above.

At 9:35 AM I provided further trade strategy / guidance explaining that I was looking for a reversal in the recent trend of crude oil trade (I had distributed a 4 hour chart to our membership by email the night before that I reference in the alert).

At 9:40 I publish the 4 hour oil chart with intra day trade and the two trend line support areas of the chart I was watching. Providing trade guidance that if the current support was lost in trade that we were likely turning down to the next support area on the chart in the 67’s.

Below is the 4 hour USOIL WTI chart provided to members that shows the general trend line support area of crude oil trade.

At 9:42 AM Oct 19, 2018 (25 minutes after the trade alert long oil) the machine trading alert was posted to the Twitter feed with guidance to trim at 69.58 in trade and then possibly add to the long position at 69.58 (obviously if the indicators provided a buy signal).

The reason for the trade alert issued to members to trim long positions on oil algorithm was that trade intra-day was nearing the Fibonacci trend-line resistance area on chart model (trading quadrant wall). Trade was also nearing the peak of the algorithm trading range intra-day (the apex of the model.) These are the same reasons I exited my long trade as provided below in the next section.

Notice on the chart below trade had hit 69.75’s and the trade alert (as above) price targets for the trade strategy for the day in crude oil based on the algorithmic model were published as “price targets for day trade 69.70, 69.78, 69.80 in upside scenario.”

At 9:45 AM I closed my trade at 69.57. Not a bad trade considering my entries at long crude oil at 68.93 with adds in 69.25’s. A 45 tick trade average in oil is a decent day trade (450.00 on 1 contract or in this instance about 4x that).

At 9:58 the technician trade closed on a pull back (the other half of the trade) at 69.43 – a 26 tick average. A decent trade profit, especially considering it lasted just over 30 minutes and it was low stress. It took me 12 hours to close a 45 tick trade and the tech 35 minutes to close a 26 tick trade – obviously the technician’s use of time was more efficient.

It gets worse for me though, because I thought I’d try and get a break upside primary resistance on the algorithmic oil charting. The technician followed a simple rule-set (wait for trade to prove out and then enter) and didn’t follow me in to my trade (he can’t because he is obligated to a specific rule-set for triggering trades).

The additional trade I entered I won’t detail here with screen shots etc, but I will say that it turned against me almost immediately and I should have exited the trade immediately.

As oil sold off some intra-day I held my position and added on a bounce and sold on the bounce and chiseled my way to a small loss – but a loss nonetheless. It was a waste of time.

The two primary mistakes I made in my second trade:

- I entered a long trade at the resistance of the algorithmic trading model. That is not a correct way to position a trade. I closed the previous trade properly but did not start the new trade properly.

- When intra day trade went against my position I should have closed for a small loss, but I did not.

There are other details and reasons for the trading decisions that were made, however, for simplicity and to keep this instructional post to a digestible size I will leave it here.

To increase your crude oil trading skill-set we have a number of tools you can use.

- There is a link below to our oil trading academy page that has a number of links to articles on our site,.

- You can book private online trade coaching via Skype.

- Join our live trading room.

- Sign on to our oil trading alert feed subscription, (alerts are on a private member Twitter feed).

- Sign on to our weekly algorithm reporting that provides the algorithm model, conventional charting, guidance for the week etc.

- Attend a trading boot camp (in person or online).

- Request via email the videos of our most recent trading boot camp or the master class series videos (both sets are approximately 20 hours each). They are available only by email request at this time by emailing [email protected]. Soon they will be posted to our shop on website.

Thanks

Curt

Any questions let me know!

Further Reading On Our Website That Will Help You Trade Oil Successfully:

Find more posts like this one on our Oil Trading Academy Page – there you will find links to numerous oil trade strategy reports.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow:

Article Topics: Crude Oil, Algorithmic, Trading, Strategy, Day trading,Trading Room, Alerts, Signals, USOIL, WTI, CL_F, USO

Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Crude Oil Day Trading Strategies From Our Oil Trading Room Video Footage.

If there is one thing we have seen time and time again in our crude oil futures daytrading room (see previous articles) is that our EPIC Oil Algorithm model and day traders can pin-point the buy sell signals for the reversal for intra-day trend to capture a reversal in trade.

The focus of this post is to teach you how to find the intra-day bottom when daytrading crude oil. Step by step the lead trader explains what signals to watch for to simplify the process and ensure your winning strategy.

It is important to learn how to catch the bottom of sell-offs to increase your ROI on trades and capture the next move. You may have to enter a number of trades with tight stops to get a position that is set for the move, but it is worth the time if you learn how.

#DaytradingOil #OilTradingStrategy #TradeReversal # FX: $USOIL $WTI $CL_F $USO

Main Points of Trade Strategy Covered in this Article:

- Day trading oil signals covered in the video and post below:

- EPIC Crude Oil Algorithm Charting.

- Conventional Oil Charting.

- Charting Indicators; Moving averages, squeeze momentum, MACD.

- Time Cycles.

- Price Targets (intra-day and weekly).

- Trading Boxes.

- Charting Time Frames.

- Order Volume.

- Short cover rally intra-day.

- Entries around the edge of range.

Video Date and Description: October 17, 2018 10:25 AM – EIA Petroleum Report Live Trading Session.

Voice broadcast starts at 2:10 minutes on video.

Video Transcript Summary Highlights:

At 2:20 on video FX USOIL WTI trading 70.73 at the beginning of the session, trading on top of support at top of trading box at down side channel support.

The down channel in trade is confirming per the most recent guidance in recent reports and I am expecting that in to end of October and then up in to Christmas.

Resistance points on algorithmic model short side is most probable for winning in down trend (retracement) – areas to short pointed out on charting at 3:05 on video.

Bias was a long intra-day when report was released, but there was a surprise build today.

I usually don’t trade the first 5 mins after the EIA crude inventory numbers are released.

Example of EIA report data as posted on EPIC’s Twitter Feed:

#WeeklyPetroleumStatusReport for week ending 10/12/18 posted https://go.usa.gov/xPRx3 #oil #gasoline #diesel #heatingoil #propane #OOTT

https://twitter.com/EPICtheAlgo/status/1052567708473032704

3:40: On the oil algorithm there is a buy trigger signal intra-day at 69.97 at the mid channel support test for a daytrade.

3:50: Symmetry chart has a buy signal at 70.19 at top of oil trading box.

4:08 Trade on monthly chart is still between the 100 MA and 200 MA and I expect a break to upside or downside early November and my bias is to upside.

4:14 On the weekly wedge chart 70.00 watch very close at top of trading box, end of October time-cycle peak to bottom of wedge on chart 68.42 – that is possible.

4:45 On the daily oil chart trade intra-day is right at the pivot. 50 MA is just under price and to the upside the price intra-day was rejected at the pivot.

Don’t miss the last report on oil trade guidance I provided that guides on signals from now in to early 2019 on all charting.

5:10 Charting trend lines reviewed with time cycle peak early December in 76.00 region.

7:20 on video #EIA report comes out.

7:27 the sell-off on oil is apparent in trade with stops in oil getting taken out.

I start reviewing oil charting at this point on video for various supports to possibly take a position long.

8:50 6.5 million barrel build in crude oil inventories is discussed. 69.50 possible low in oil trade is discussed here.

9:40 Trading 73.00. Any long positions be sure to keep your position with tight stops until down to the 69.50 support range.

Top of trading box on the weekly wedge support at 69.99 is considered.

11:15 Watching chart indicators; MACD, Squeeze Momentum and Stochastic RSI on 1 minute time frame here as price is getting in to the first signal for a possible buy zone daytrade at support.

11:40 I explain that I am looking for a short cover rally for the oil daytrade and then shorting the resistance. As shorts cover price goes up, this occurs when the sell-off on the day comes to an end as oil shorts cover positions.

11:50 I explain that trade is down 3% on the day and that this is typically the area of the short covering and reversal intra-day.

12:40 As price bounces I start to look toward the upside 20 MA resistance on the 1 minute chart.

13:35 I provide guidance that we are possibly looking at 69.00 area and even 68.46 on the wedge chart.

14:50 My daytrade plan for support area and resistance areas and the intra day time cycle confirmation of up or down channel for trade is reviewed on the oil algorithm charting.

17:10 Watching the possible buy zone and 1 min chart for squeeze momentum to turn.

20:20 We are watching the pressure in oil trade in to the bottom of the trading box on the 1 minute chart and considering more stops to get ta’ken out if trade goes below the support on the trade box.

22:20 15 minute candle expires (important point of time to watch trade closely). The bottom of the trading box then is lost.

23:50 I discuss the problem created with governments manipulate price in markets (such as Trump with oil) and what will likely happen with the price of oil when the anomaly will cause a sever snap back trade in oil (also referenced earlier in video). Essentially the structure of the natural trading range of a financial instrument is manipulated.

26:00 oil starts to trade up and I’m watching for the 20 MA upside resistance test.

27:00 I explain that many traders would have taken the buy signal at the mid channel line on the chart and that I likely should have.

28:10 After 20 MA resistance has occurred and price is on the way back down to the next support and I explain where that is and that it is my possible buy area on chart.

29:25 The buy side for oil comes in and I explain that I’ve now missed two buy triggers.

42:00 I am long crude oil futures at 69.91.

44:19 I explain the 5 min candles and a place to trim the position at top of the trading box and alerting that I have trimmed my long position at 70.01 and advise that the 50 MA on the 1 min is coming. Ten minute candle expiry on watch.

45.40 I alert that there is resistance heavy intra day 70.28 range.

46.55 I close the remainder of the daytrade and look for another entry.

Below is the screen shot of my trade alert for the day trade in crude oil on the long side and my closing the position. This reflects what it looks like when you try and catch the reversal on intra-day trading.

There is more to the video, with various discussion on daytrading crude oil with what signals to watch for and there is another trade on the video also.

See video for more on related discussions.

Below is the guidance in given to the oil trading room with charts at the start of futures trading later that day.

Price targets for 900 AM Oct 18 price cycle completion intraday crude oil trade.

Buy sell trade signals at each highlighted trendline (yellow) on chart.

Signals for end of week price targets. Upper target bias – lead trader.

Thanks

Curt

Any questions let me know!

Further Reading:

5 Steps to Making a Profit in Crude Oil Trading.

https://www.investopedia.com/articles/investing/100515/learn-how-trade-crude-oil-5-steps.asp

What is a ‘Trade Signal’:

A trade signal is a trigger for action, either to buy or sell a security or other asset, generated by analysis. That analysis can be human generated using technical indicators, or it can be generated using mathematical algorithms based on market action, possibly in combination with other market factors such as economic indicators. https://www.investopedia.com/terms/t/trade-signal.asp

Other Crude Oil Trading Reports & Videos:

Learning to Trade Oil Links on our Site and/or YouTube.

Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video).

Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

Oil Trading Room – How to Use EPIC the Oil Algorithm June 21, 2017 (video).

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades June 29, 2017 (video).

Here we unlock historical member reports at intervals after time cycles have expired for traders that are learning to trade oil. When you clock on link scroll down at landing page on blog section you will be transferred to so that you can get to reports that are unlocked over time: https://compoundtrading.com/category/epic-the-oil-algo-chart-report/

Subscribe:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow:

Article Topics: Daytrading, Crude Oil, Strategy,Trading Room, Alerts, Signals, USOIL, WTI, CL_F, USO

Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Daytrading Stocks Isn’t Easy, But You Can Increase Your Win Rate When Trading Momentum Stocks Using Technical Analysis Along With A Catalyst Thesis.

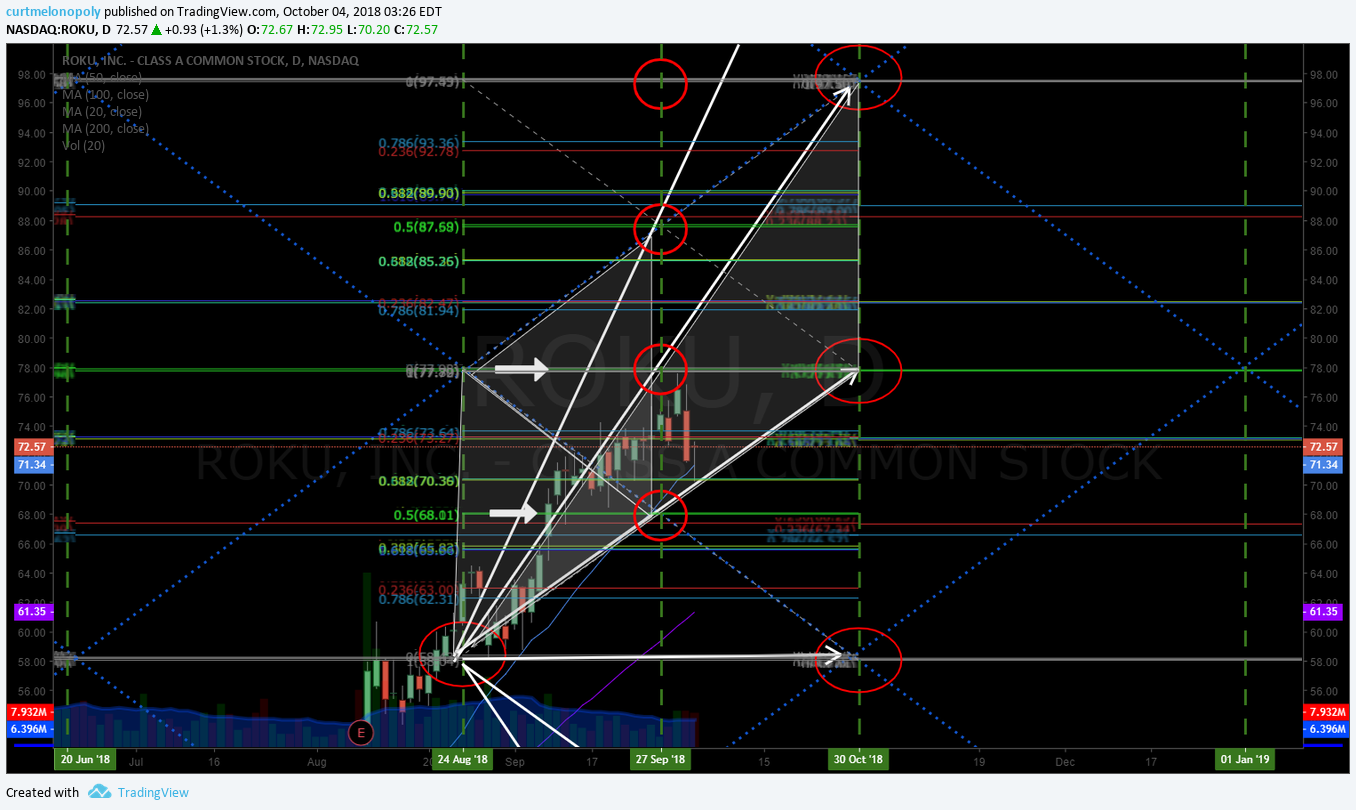

In this post I use the market open trade in $ROKU as an example (live raw trading room footage is below) to teach you how to daytrade stocks that have a catalyst (in this case an upgrade in ROKU by a well known market analyst that morning) and using technical analysis to structure the trade (long trade entry point on chart, where to trim the position and where to close the position at key resistance).

My trade was clean, without stress, I alerted the trade live on the live trade alerts feed and traded it live in the trading room. When I alerted the trade I also gave our members a price target for closing the trade.

Hopefully my experience in using technical analysis while daytrading stocks will help you win more and lose less when you lose.

Live Trading Room Raw Video and Transcript Highlights Detailing Trade Entry, Price Target, Trims and Closing Trade.

The video below is the raw live trading room video feed that includes review of various trade set-ups in premarket and market open. The summary of the ROKU trade is below the video with points of reference on timing on video for easy reference.

At 5:55 on video: In premarket I explain to the trading room that ROKU is my primary watch (the others I also reviewed on the video) on the day on the analyst upgrade. ROKU trading up 2% at 74.63 premarket. Over 77.62 is an add (to those already in the swing trade). For the longer term than daytrading 93.93 is a possible price target in a bullish scenario and 87.58 is more likely and 78.00 most likely for the target date on the chart at the time cycle peak.

The points of support and resistance on the charting that I reference follow a process of technical analysis that we use on all of our algorithmic charting.

ROKU trade is following trajectory. Be sure to trim trade positioning in the resistance areas on the chart and add above (or alternatively add at pull backs).

I also how 5 minutes in to open is an important area to watch and how I am cautious Monday mornings, but on this Monday premarket trading was bullish.

At 9:12 on video: Market open at 9:30 Eastern time. ROKU trading 74.72 at open, over 77.62 is a buy / add to any existing swing trade position. Support on ROKU intra day is at 73.15 – 73.20. Buy side coming in at this point and 3 – 4 dollar day trade range possible prior to resistance over head.

At 13:44 on video: Watching the market open first 5 minute candle conclusion. Over high of day (HOD) ROKU could run in to 77.70 price target. At this point in the trading session I explain that I may run the trade with the market to the price target. Trading 75.65 intra-day looking for 76.00 for a long entry for daytrade now.

At 14:41 on video: At this point I alert that I am long ROKU at 76.00 with a tight stop bias with price target for ROKU daytrade of 77.50. I would trim heavy in to that price target and possibly add above.

At 17:28 on video: Just about triggered an add to my long position in ROKU at 75.82, probably should have. Watch next 5 minute candle completion.

At 18:40 on video: ROKU is strong in to 5 minute candle switch. Now I have a stop at entry 76.00. If it dumps (sells-off) beyond my entry price at 76.00 I may re-enter.

At 21:01 on video: Trimming my position at 50% size at 76.69. Decent little day trade. It’s strong. Nice buys there.

At 25:15 on video: We’re getting pretty close to my price target.

At 25:50 on video: Trimming 25% of position 77.16 – likely early but….

At 27:10 on video: This is going to be an important candle turn. If a daytrade is going to soften (fade) it is likely to do that in to 10:00 AM, so I am watching the 10 minute point candle prior to the turn at the top of the hour at 10:00 AM.

At 28:28 on video: In to the candle turn I am watching the bottom of the candle body close. At candle turn watch for bullish or bearish trade action for a clue of how the next candle is going to trade. At this point ROKU is trading bullish trading near high of day. Looking for trade in next candle to hold the top of the body of the previous candle.

At 29:38 on video: Getting close to price target now it trade 77.29 there. 77.16 closed last 25% of the daytrade in ROKU.

The Catalyst: Analyst Upgrade on ROKU:

“Shares of Roku Inc (NASDAQ:ROKU) gapped up prior to trading on Monday after Needham & Company LLC raised their price target on the stock from $60.00 to $85.00. The stock had previously closed at $71.24, but opened at $73.03. Needham & Company LLC currently has a buy rating on the stock. Roku shares last traded at $76.48, with a volume of 8448678 shares”.

Article Here: Shares of ROKU Gap Up After Analyst Upgrade.

The Original Alert That Put ROKU on Watch for a Trade for our Members:

Below is a screen shot of the original trade alert posted on the swing trading alert feed (a copy was also posted to our daytrading alert feed on Twitter) that ROKU was on watch with a time cycle peak nearing (if you need to learn how to chart and/or trade time cycles reach out for some trade coaching, get access to trade coaching boot camp videos or spend some time in our live trading room).

It is important to note here that with the alert we also posted the link to the live chart on Trading View. This is important when you are harnessing your trade thesis in technical analysis, our members do not have to do the charting on their own, we provide that service as part of the platform.

Another important note is that when we are alerting day trades or swing trades for equities or commodity, crypto or currency trades… in most instances our members already have the technical charting models from previous analysis done for members in previous trade alerts or newsletters etc.

ROKU (ROKU) near short term time cycle, on watch for a daytrade and possibly swing long in to timing $ROKU #daytrading #tradealerts

https://twitter.com/SwingAlerts_CT/status/1044978728110100481

Day Trading Alert Feed.

Below are the screen shots for the actual trade entry, trimming the trade, where the stop on my trade was set and the price target for the trade on the day.

Day Trading Chat Room

And below is the screen shot of the trade alert in the daytrading chat room on Discord.

If you have any questions about the trade alert detailed in this article reach out! You can get me on email [email protected] or private message me on any of my social media accounts.

Trade safe and cut losers fast!

Curt

Subscribe:

Need help learning to trade set-ups like the one included in this post? Visit our trade coaching page.

If you are serious about learning in depth technical analysis and algorithmic charting and how to trade with that knowledge for a much higher win rate we have a master class video series that is approximately 20 hours of in depth teaching by our lead trader that retails for 1499.00. The master class trade coaching series is only available at this point by request by emailing our office at [email protected]. The unedited raw master class videos are now available and the most recent trade coaching event videos are included as an added bonus (usually another twenty hours or so of teaching).

Interested in our live trading room, swing trading newsletters or trade alerts? Visit our menu of trading services.

Subscribe to Live Trading Room.

Subscribe to Live Day Trading Alerts.

Subscribe to Swing Trading Alerts.

Article Topics: daytrading, learn to trade, momentum, stocks, technical analysis, ROKU, trade alerts, catalyst

Best Trading Week in Months! Trade Alert Set-Ups: $NBEV, $CRON, Oil, $AAPL, $NFLX, $FB, $AMD, $BABA, $BLDP, $CARA, $EDIT, $BZUN and more.

Trade Alerts. Trade Set-ups Report and Video from Live Day Trading Room September 20: $NBEV, $CRON, Oil, $AAPL, $NFLX, $FB, $AMD, $BABA, $CARA, $BLDP, $EDIT, $BZUN and more. #daytrading #swingtrading

#TradeAlerts

Trading alerts and Swing Trading and Day Trading set-ups raw video from Live Trading Room mid-day review Sept 20, 2018. Some of the trade set-ups in this video are from the Trading Boot-Camp.

Stocks and Commodities Reviewed: Crude Oil Trading Algorithm, $WTI, $CL_F, $USOIL, $USO, SP500, $SPY, $AAPL, $NFLX, $FB, $EDIT, $CRON, $NBEV, $BLDP, $BZUN, $AMD, $OSIS, $CARA, $BABA, $LVEB, $XBIO, $NIHD, $ICCC and more.

It has been excellent this week! I had reported last week that I seen an inflection coming early this week and we nailed it! Continued market momentum if very possible in to next week. Many of the set-ups I have been posting the last week are firing trade signals consistently.

ITS SEEMS WE HAVE SOLVED THE BROADCASTING ISSUES WITH HARD WIRED FIBER INTERNET.

BE SURE TO LOOK AT THE CHART DATE AND TIME IN TOP LEFT HAND CORNER OF EACH CHART.

September 20, 2018

Crude Oil Trading Update ($USOIL, $WTI, $CL_F, $USO) – I review the crude oil algorithm on the video. Twice this week I took trades that I closed only to have them run after closing (I was away from monitors at each time). Execution of trades at the support and resistance of the crude oil trading algorithm (EPIC) has been excellent.

The weekly oil price targets from the weekly crude oil trading report and the charting provided in the reports have been really predictable lately also.

The crude oil trading alerts feed has been quieter this week because the trading plan in oil was to take the trades at the wider ranges to leg in to the trades, I did however alert the channel support and channel resistance and following through those trades would have been very profitable for oil trading members.

SP500 $SPY $SPXL $SPXS – On the SPY algorithm charting for 60 minute time-frame I have been watching for a break over the test area resistance 291.60 (trade alert on SPY went to swing trading alerts feed). Sept 24 time cycle 288.88 283.77 and uptrend 299.50 would be most bullish scenario. 294.33 resistance intra and main support on SPY intra-day 293.00.

APPLE $APPL – Apple’s stock is over 50 ma on 240 minute chart, trade alert went out on swing trading alert feed for Apple today. Testing the 20 MA, 224.70 resistance, 229.70 resistance, 236.75 is heavy resistance. Support 215.60 area intra-day and 219.02.

NETFLIX $NFLX – The long side trade that alerted that some members took has been very good at main support on the Apple chart. The trading support and resistance areas are discussed on video. Review of the chart model and video are important to understand the trading signals for Apple. 364.00 362.14 support areas, 395.59 397.90 are resistance areas. Really important to look at the chart and video explanation however.

FACEBOOK $FB – One of my favorite trade set-ups, especially for wash-out snap back trades. Facebook is currently under significant government pressure now so I am not expecting the same as previous. The horizontal red and blue support and resistance areas (forming the test area box on the charts) is reviewed and the diagonal Fibonacci trend lines. Here again review of the video and chart is really important. 167.51 mid quad resistance caution here, 100 MA resistance 169.40, diagonal Fib resistance, 173.51 is upside possible, 169.03 downside possible. The trading box is reviewed on the model. Buy sell triggers for trading signals on Facebook are also reviewed.

There is a previous special report on how to trade Facebook on our website.

EDITAS $EDIT – The value of structured set-ups with symmetry in the algorithmic stock chart models is discussed here. Examples are $GDX, $BLDP, $NBEV, $AGN, $EDIT and many more. The symmetry on EDIT chart has hit five times and typically you will see it stretched at that point. A trade alert went out today on $EDIT to watch closely going in to this time cycle. The video explains the details.

CRONOS $CRON – I have reviewed CRON chart set-ups many times this week. There is a light sidewinder trade set-up with the 50 MA and 20 MA on the CRON charting. You can expect a fairly decent move when the 20 MA breaches the 50 MA upside. It’s a lower time-frame being on a 240 minute chart, but it still may be enough to get price over that key resistance area reviewed on the chart and video. Pivots support and resistance areas also reviewed on video.

NEW AGE BEVERAGES $NBEV – I put out a special report to members today on NBEV and the trade has been fantastic since. The resistance areas and time cycles are reviewed on the video. The testing area (trading box) are reviewed. Also the price extensions (price targets) are reviewed. If price holds and price moves bullish in to time-cycle discussed on video the upside price targets for NBEV are extremely positive and reviewed on video. 9.38 is a very critical resistance and support area in to the key time cycle peak on the NBEV chart.

BALLARD POWER $BLDP – On the swing trading alert feed today a special alert went out on the fact that the last five time cycle completions in Ballard Power stock charting the price reversed in trade of Ballard. This is a symmetrical stock trade set-up that traders should not ignore. BLDP trading 4.50 up 7.42% intra-day spiking in to time cycle completion Oct 10, resistance 4.50 and the test range on the chart is reviewed.

BOAZUN $BZUN – Holding key support intra-day, if it holds a run up in price is possible. Termination of time cycle on 4 hour chart is near so get ready soon. High probability set-up. Details of trade set-up for BZUN reviewed in video. My bias is that this runs up.

ADVANCED MICRO $AMD – key support hit on chart and bounced, Oct 2 price target in bullish scenario is 33.62 and bearish scenario 22.87 in sell-off, mid quad on chart is discussed on video with various price target scenarios like 31.40 range being indecisive price target on Oct 2.

OSI SYSTEMS $OSIS – trading 77.55 testing 50 MA and key Fibonacci resistance on diagonal Fibonacci trend line, price target 84.21 Dec 28 is possible in uptrend trading. Resistance and support lines and how to trade the chart is reviewed on the model in video.

CARA THERAPEUTICS $CARA – I knew this one was going to get going, you don’t get many trade set-ups this strong.

There is a trade coaching bit of advice at this point on the video with reference to trading structured charting and its benefits to traders. Also market inflections and how to trade for your profit and loss and associated sizing in market inflections is also reviewed.

CARA is a great case study, going back to NBEV chart is reviewed on video – how price was getting bullish in to time cycle and how that relates to symmetry and price targets that can be traded.

28.20 is very likely fast in CARA trading if trade gets above key resistance. I put a trade alert out while recording video.

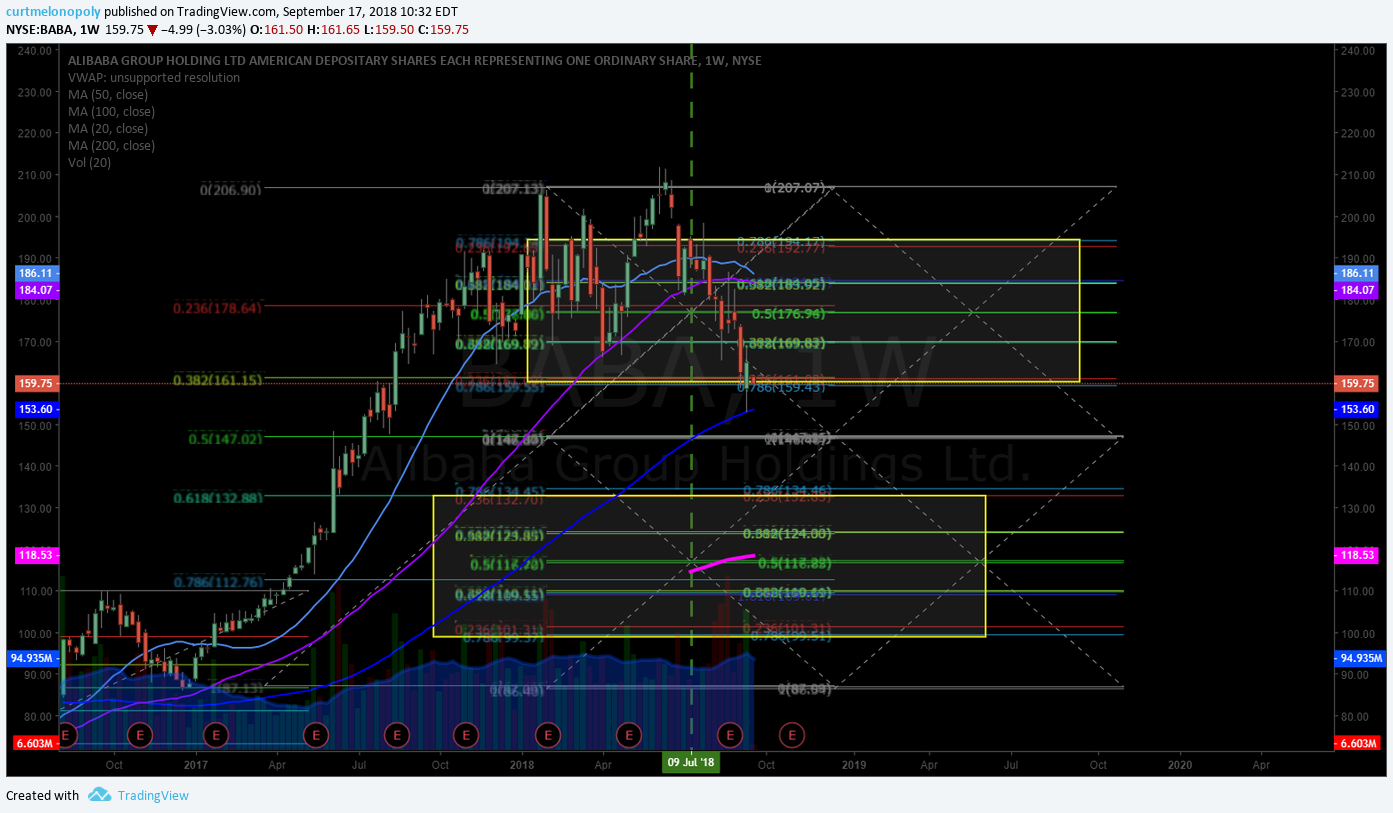

ALIBABA $BABA – this is the swing trade that I was under water on, bounced of 100 MA, now back in it’s structure, has a number of tests, 206.85 price target to upside with 237.62 most bullish scenario May 27, 2019. See chart review in video.

LEVEL BRANDS $LVEB – anything over 6.00 will confirm an upside trend and if that triggers we’ll structure the charting for you and go from there.

ALTIMMUNE $ALT – hit 50 MA resistance today, alarmed for a breach above the 50 MA and a possible run to 100 MA. Will alert the trade in ALT if it breaches the 50 MA and structure the chart model for members.

$CRBP – chart is too choppy.

COOL HOLDINGS $AWSM – garbage chart.

$YGYI – trade never holds gains.

$AYTU – choppy trading, garbage chart.

XENETIC BIOSCIENCES $XBIO – there is a special trade set-up report out on this set-up in XENETIC BIOSCIENCESS (XBIO) chart, trading up 23% today.

$OSN – over 200 MA, no good, no structure.

NII HOLDINGS $NIHD – up 19% in trading today, aggressive chart, bounced off 20 MA, trading 5.06, good argument 5.60 as a watch area on other side of the bowl, 6.25 is a safer region to look at a possible big run to 9.00. A double upside extension is possible. It is a structured trading chart. I alarmed NIHD for a trade.

$ICCC – trading 9.13 up 20%, swing trading service provider dream, signal long when price is over 200 MA and win almost every trade, you would take the odd cut but the moves would make up any cuts taken.

$VXRT – trading 2.85, terrible chart.

$COE – bad chart.

$KNDI – not a bad chart, testing the 50 MA, over 200 MA you could start to look at it, this will likely go on a run upside over 200 MA, possible reversal setting up on this chart.

$FTNW – bad chart.

$COCP – bad chart.

$LOMA – bad chart.

TRADING ROOM VIDEO Trade Alerts: #daytrading #swingtrading

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Trading, SwingTrading, DayTrading, Chart, Trade, Set-Ups, Signals, Price Targets, $NBEV, $CRON, Oil, $AAPL, $NFLX, $FB, $AMD, $BABA, $BLDP, $CARA, $EDIT, $BZUN

Trade Alerts (w/ video): $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP #daytrading #swingtrading

Trade Alerts Report and Video from Live Day Trading Room: $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP, OIL, $DXY, $SPY #daytrading #swingtrading

#TradeAlerts

Trading alerts and trading set-ups raw video from Live Trading Room mid-day review Sept 18, 2018. Some of the trade set-ups in this video are from the Trading Boot-Camp.

Stocks Reviewed: $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP, OIL, $DXY, $SPY and more.

Sept 18, 2018 Mid Day Trading Room Review.

Again, the sound upload quality struggled, today we’ll test the hardwired set-up and see if it’s better.

Reviewed the PL for 2017 and 2018 along with goals for Q4 2018 and Q1 2019 – gearing up for a big Q4 this year and Q1 2019 (getting back to basics of trading vs software development because development funds come from trading of course).

BE SURE TO LOOK AT THE CHART DATE AND TIME IN TOP LEFT HAND CORNER OF EACH CHART.

Crude Oil $WTI $CL_F $USO – review of crude oil algorithm and crude oil trading alert at channel support that I should have held, anyway I cut and missed it. Also the top channel resistance crude oil trade set-up was good (missed it, but some of the members reporting they nailed it). Opportunities this week with trading range and EIA reviewed. Crude oil machine trading price targets reviewed also (for last week’s trade). Only 1 minute chart below showing intra day resistance on second trade attempt on day (algorithm models not below).

VIKING THERAPEUTICS $VKTX – we had this lined up in premarket, retraced intra-day.

TILRAY $TLRY – trading at only 420 x earnings or something like that. Weekly chart gap on gap on weekly body of candles. Only way I would long this is on short time frames, and I likely will when the pot stocks settle a bit – working on the charting for all the pot stocks right now (hopefully released this weekend in prep for a sector pull back when it happens).

SP500 $SPY $SPXS $SPXL – 60 minute chart reviewed, over 291.70 is the upside break resistance, above the box price targets for Sept 27 reviewed on video, various support and resistance areas reviewed.

MOMO $MOMO – signalling a long or add long over 48.50 (if it holds, you always trim in to resistance areas and then add above or wait for a pull back and add to your long trade), expected trading trajectory reviewed on video, price targets for between now and Feb 5, 2019 large time cycle peak conclusion reviewed on video. This is a very structured chart.

https://www.tradingview.com/chart/MOMO/zkLs91ot-MOMO/

22nd Century Group $XXII – price targets reviewed on video. Very structured equity that has excellent ROI ROE. Not a chart or trade set-up to ignore IMO.

SHOPIFY $SHOP – bulls pressing the upside diagonal Fibonacci resistance, price targets reviewed. Great alert from Sean for an excellent swing trade. Could see previous highs in 177.00s really fast.

CEL SCI Corp $CVM – targets at 5.00 and 6.00 reviewed on chart on video and more is possible, liquidity is my issue. A double upside extension move is possible with this bullish scenario, bottom bounce structure coming out of bowl.

ROKU $ROKU – was at resistance 73.55 and price targets reviewed on video. As price nears the peak of the time cycle on the chart prepare for possible double extension blow-through on this one.

https://www.tradingview.com/chart/ROKU/7dzcNyBE-ROKU/

Note: CARA, BOX, BABA, POQR, SSW, VIX, OIL, SPY and others reviewed on yesterday’s video BTW.

CARA THERAPEUTICS $CARA – price targets etc reviewed on yesterday’s video.

https://www.tradingview.com/chart/CARA/DtYzRa8p-CARA/

US Dollar $DXY – decision October 3, 2018 that is important on the US Dollar DXY charting (parallel to many other peak time cycles in broad markets). Probability is up at or prior to time cycle completion.

$RLM – no.

$OASM – if you’re a risk taking trader this is a real aggressive chart structure, top of bowl is where it is trading now but it has a nature of coming off hard and it is thinly traded.

$NBEV NEW AGE BEVERAGES – weekly chart over 50 MA targeting 100 MA not a great ROI there in that set-up, chart is hard read. On daily up over 200 MA, does respect the 200 MA on daily, Showing bullish initial signals of a return. This one should go. Volume is good, Initial view I was not too interested but as I looked closer at the NBEV chart I realized this on should be on high watch. I went in to great detail of the pivots on the chart, buy sell triggers and price targets for NBEV.

NEW AGE BEVERAGES (NBEV) Above 2.80, targets 3.27, 4.17, 4.89.

$BHTG – no.

$RDCM – sitting on previous trading range support. 16.00 is reasonable, decent chart.

CRONOS GROUP (CRON) $CRON – reviewed on video, on the fly chart structure model reviewed. On high watch, expect a possible upside trading scenario with CRONOS. A trendline resistance was reviewed and important support and resistance and price targets reviewed on video (while we are processing this report the morning of Sept 19 it is moving in premarket trading up 8.39% at 12.53 in premarket this morning nearing its upside trading test area, the trendline resistance was broke to upside and the 13.00 area resistance in next). Over trendline sees the next test fast and the other price targets reviewed on video.

Updated set-up and trade alert for $CRON in premarket today while we process this video report.

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket https://www.tradingview.com/chart/CRON/klRhec02-CRONOS-per-yesterday-s-trade-alert-and-review-video-over-trend/

AVON – Daily chart for AVON reviewed, likes the 200 MA with some room, testing resistance right now, I can’t touch it until it’s up for 3.00, needs to see recent highs first and then still some challenges.

$PYX – weekly chart reviewed, no structure I can work with.

$NVTA – aggressive structure, 18.90 alarmed on chart, has potential for a rip upside.

$EPM – not enough there. Doesn’t have margin, widths.

$CL – bad structure on chart.

YELP $YELP – technical bounce off 200 MA on the weekly chart in to resistance area on chart, if you’re long go to previous steps shown on chart in video, not taking the trade but it may work, not my thing – not enough range for ROI ROE for me.

$SRT – no.

$JONE – no.

$DEQ – no.

CANOPY GROWTH $CGC – had the opportunity to be in ground floor of this industry in Canada and turned it down jeez, getting close to previous candle high on weekly chart, could see a large a move there. Chart for Canopy Growth reviewed on the video. Can’t chase it here where it is on the chart and I’ll watch. Working on the structure of all the charts on our equities covered in our swing trading platform and when we’re done I’ll get more day trade aggressive.

CALIFORNIA RESOURCES $CRC – Aggressive chart and trade set-ups, coming out of bowl, 39.32 an 39.86 pivots on chart reviewed on video. Start watching it at 40.00 and see how it does.

THOR INDUSTRIES $THO – resting on the 200 MA trading about half way between it and 100 MA, it will likely turn here, price above moving averages on chart with 20MA breaching the 50 MA is a good entry long on this chart. The sidewinder set-up will be key on this one (reviewed on video) – that’s where the good returns are.

$MRSN – no chart structure, junk.

DIGITAL ALLEY $DGLY – trading 4.05, daily chart, getting in to diagonal trendline resistance at 12.20 right now, over 12.31 is a nice confirmation to the long side of this trade. Nice chart.

$CCXI – swing traders service type of trending stock that has way to many steps and not enough ROI, the step type that chop up a trader I’m not interested in.

$MHLD – no.

$BRID – no.

$NXIO – chart structure can get aggressive, gapping through chart structure makes me nervous.

There were many more of the momentum stocks for the day reviewed and the stocks selling-off on the day were also reviewed.

TRADING ROOM VIDEO Trade Alerts: #daytrading #swingtrading

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Trading, SwingTrading, DayTrading, Chart, Trade, Set-Ups, Signals, Price Targets, $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP, OIL, $DXY, $SPY

Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Trade Alerts Report and Video from Live Day Trading Room for: $VIX Volatility $WTI $CL_F Oil $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

#TradeAlerts

Trading alerts and trading set-ups raw video from Live Trading Room mid-day review Sept 17, 2018. Some of the trade set-ups in this video are from the Trading Boot-Camp.

Tickers reviewed: $VIX $WTI $CL_F $USO $PROQR $CARA $BOX $BABA $SSW $DXY $SPY $GTHX $FB $FF $SENS and more.

I apologize for the sound interference – at times it was just awful, we’ll re hard wire the set-up again soon here and get that fixed. In tomorrow’s mid day I will hard wire that one computer to modem and you can let me know if it is any better please.

Voice broadcast does not start until 3:18 on video.

Market discovery theme on day.

Volatility $VIX – time-cycles reviewed in to Dec 24 beyond and inflections in markets, market open, futures and account return expectations over next two trading quarters or so.

Crude oil trading $WTI $CL_F $USO – review of crude oil algorithm, machine trading model, charting, price targets for time cycles this week reviewed.

PROQR Therapeutics $PROQR – Excellent chart set-up, one of my favorite trades of late. Buy sell trading signals reviewed. Bounced at support at previous trade alert now at key resistance, trim in to resistance and over 22.70 targets 24.85 then 27.50. Watch the diagonal trend line (quad wall). Careful shorting this stock, 18.05 possible.

US Dollar $DXY – Review of US Dollar Algorithm charting. Lower support trend line and upper trend line, support and resistance areas to watch. Review of structure.

$CARA Therapeutics – testing previous highs, testing other side of bowl and a full extension is possible here, structured chart trading signals reviewed, Target Dec 10 30s or 38.00s if it breaks out. Pull back to 16.36 support, look for a bounce there if it sells-off. 19.70 is near term support for a test long also.

https://www.tradingview.com/chart/CARA/DtYzRa8p-CARA/

BOX $BOX – previously provided upside targets, down side scenario on video 22.32 good support, 50 MA support is good, intra day in down trajectory lines, 10.36 is a downside sell-off target that is possible in a panic. Channel symmetry also reviewed.

SEASPAN $SSW – keeps hitting resistance, simple short at each, looking for a long over resistance in trajectory on video. Upside 10.18 first target, best scenario Nov 11.93 and 18.30 best best not probable.

G1 Therapeutics $GTHX – pullback in price here doesn’t surprise me, candle body is in current bullish trajectory lines on chart, review of downside supports and upside price targets. 76.00 – 80.00 (up over 69.62 is a trigger). All areas reviewed on video.

SHOPIFY $SHOP – chart pivot acting as support (red line) Oct 10 166.72 price target, holding key support, working up against a quad wall (diagonal Fib resistance), 154.35 buy side comes in at that area. Pull back support is 50 MA primary for a long side test trade.

SP500 $SPY – the box test area reviewed, above box is a long and under is a short. 283.93 278.47 Sept 1 are downside targets in a sell-off. Other trade signals and price targets reviewed on video.

ALIBABA $BABA – underwater a bit on this swing trade in BABA, I’m in 1/10 sizing now. Bounced off 100 MA, trading right at box support, Dec 17 trade price targets discussed to low side. Adds at each support is the trading plan for ALIBABA should sell-off continue.

https://www.tradingview.com/chart/BABA/gKTnmCkK-BABA/

FACEBOOK $FB – 20 MA upside resistance trade alarm set for possible turn on the snap-back trade I’m looking for. 240 min chart.

Top momentum stocks for the day reviewed;

$OTM 20 MA resistance on weekly, above will target the 50 MA. It respects the 50 MA and 200 MA on weekly chart. Trading plan reviewed on video.

$LEU – stay away from

$FF – Currently at support and resistance area, price extensions for a possible run are reviewed on video. Targets 23.67 in a bullish scenario, trading 17.63.

$TAHO – junk

$GHG – junk, no structure

$CEL – not a good chart

$CWH – terrible

$SPA – at previous lows, bounced there before…. but…. no structure

$SUPV – junk

$TGS – bounced off 200 MA support, good example of a bullish run out of the bowl for multiple extensions up on the chart.

$WAB – not interested

$AG – on 200 MA support, not interested.

$SENS – support 3.97 trading 4.16, looking for a bounce. The trade set-up will be on the upcoming swing trading report.

Others were also reviewed.

VIDEO Trade Alerts: $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Voice broadcast does not start until 3:18 on video.

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Trading, $VIX, $WTI, $CL_F, $USO, $PROQR, $CARA, $BOX, $BABA, $SSW, $DXY, $SPY, $GTHX, $FB, $FF, $SENS, swingtrading, daytrading