The Crude Oil Machine Trading Software Is Complete.

The information below (in advance of the official white paper) provides a summary of the development process to date, the rule-set (strategies) the code executes oil trades to, what the oil trade alerts will look like on your feed, returns expected on accounts traded and what we have planned in future.

June 13, 2019

As noted above, we have now completed the main structure of the coding for our crude oil trading.

We have previously messaged that we were either close or right at being complete only to find ourselves back down another rabbit hole. This time is actually different, we are done the primary architecture coding, we only have updates (tweaks) remaining. We expect the bulk of that to last at most ninety days.

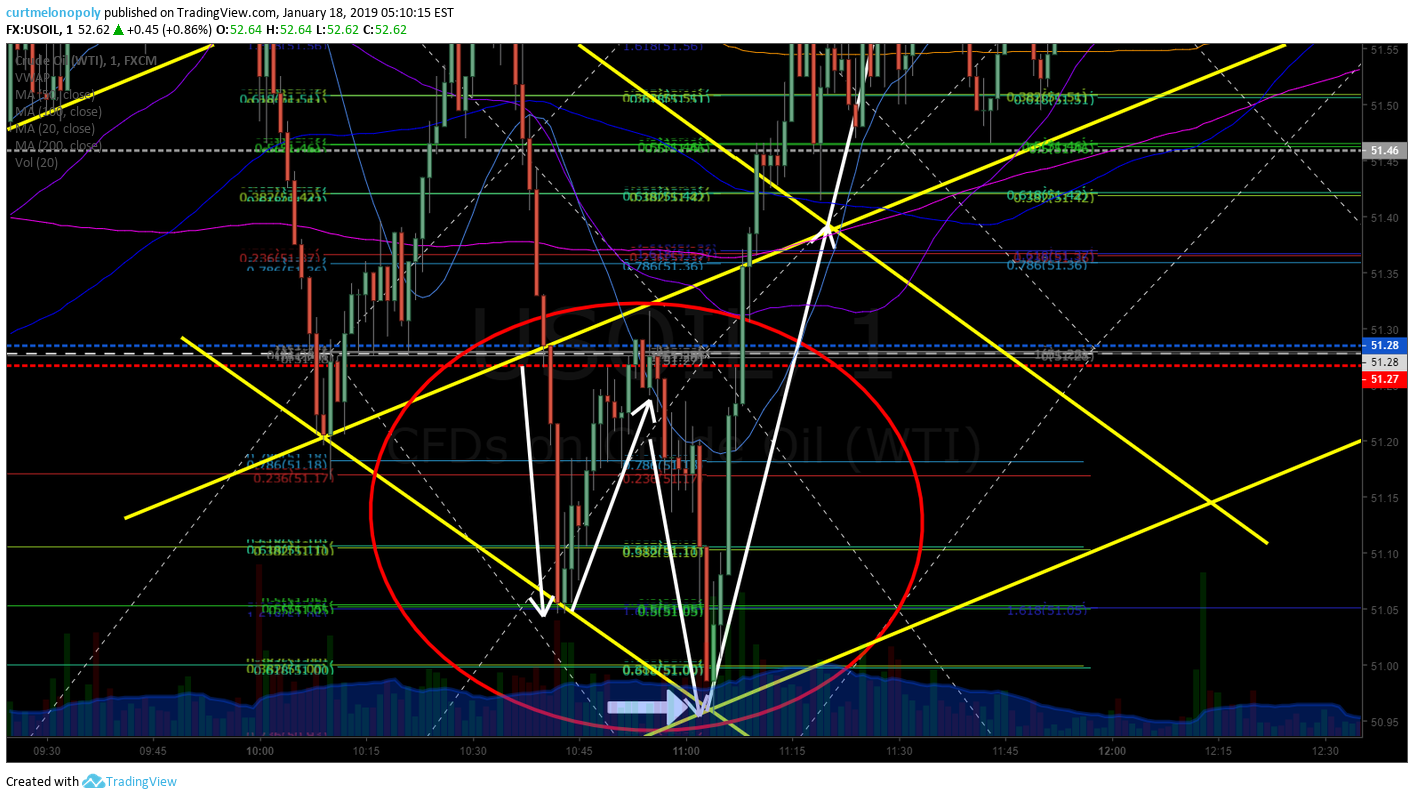

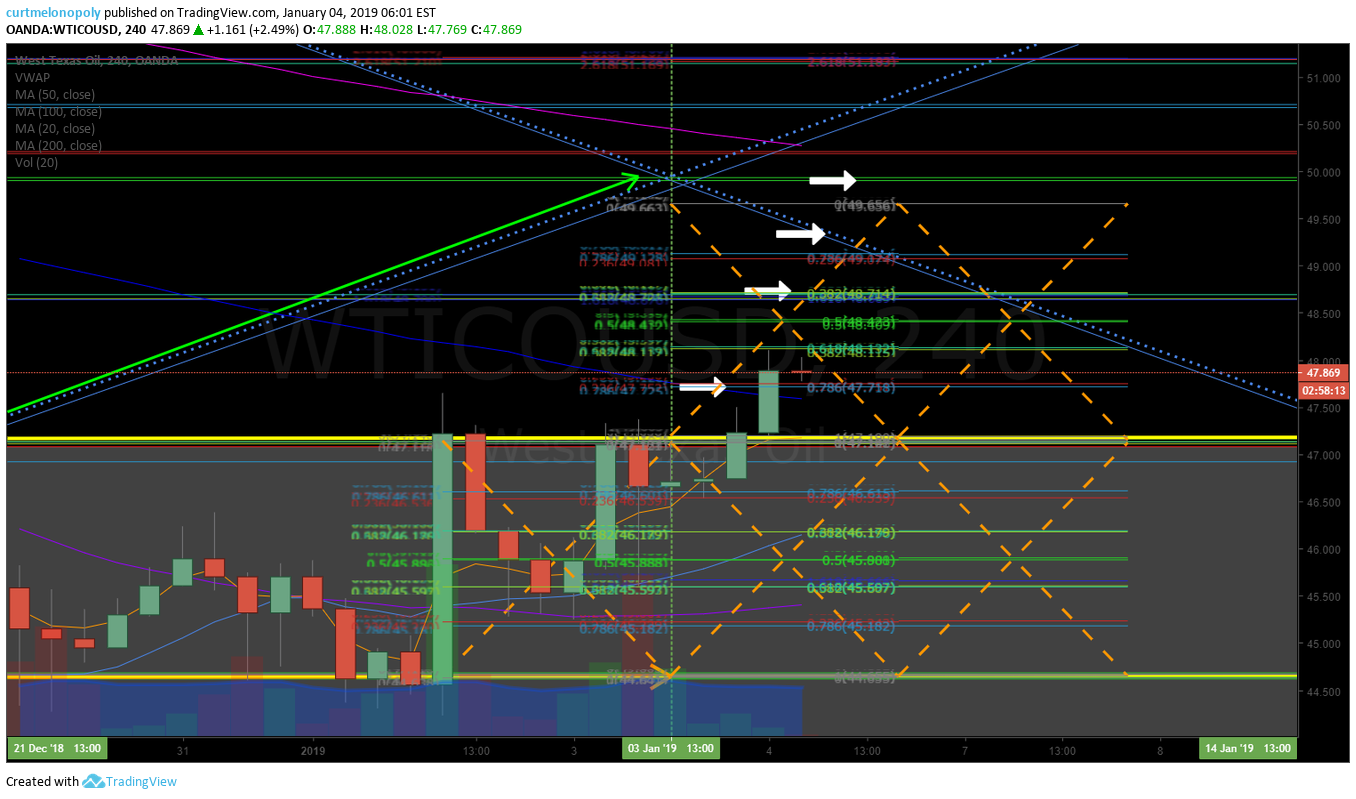

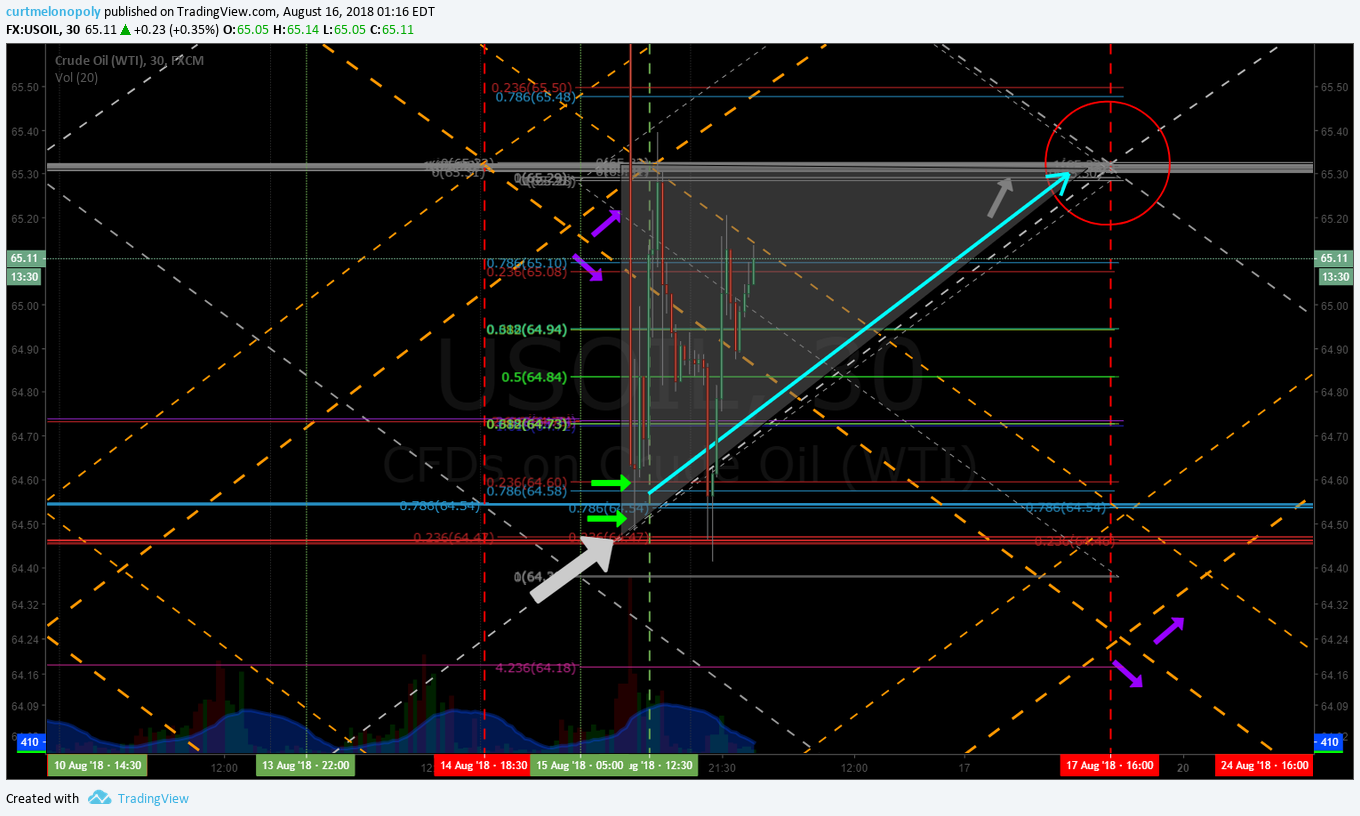

The software includes eighteen structured algorithmic models (representing time frames from 1 minute charting to weekly), specific high probable trade set-ups, trade sequences within set-ups, order flow analysis, trend (channel) structures on each time-frame and range structures on each time-frame.

The trends (channels) and range trade structures are given the most weight within the decision process of the rule-set. The larger the structure (time-frame) the more weight for sizing and stop loss range. The models, set-ups. sequences and order flow have much less weight in the code.

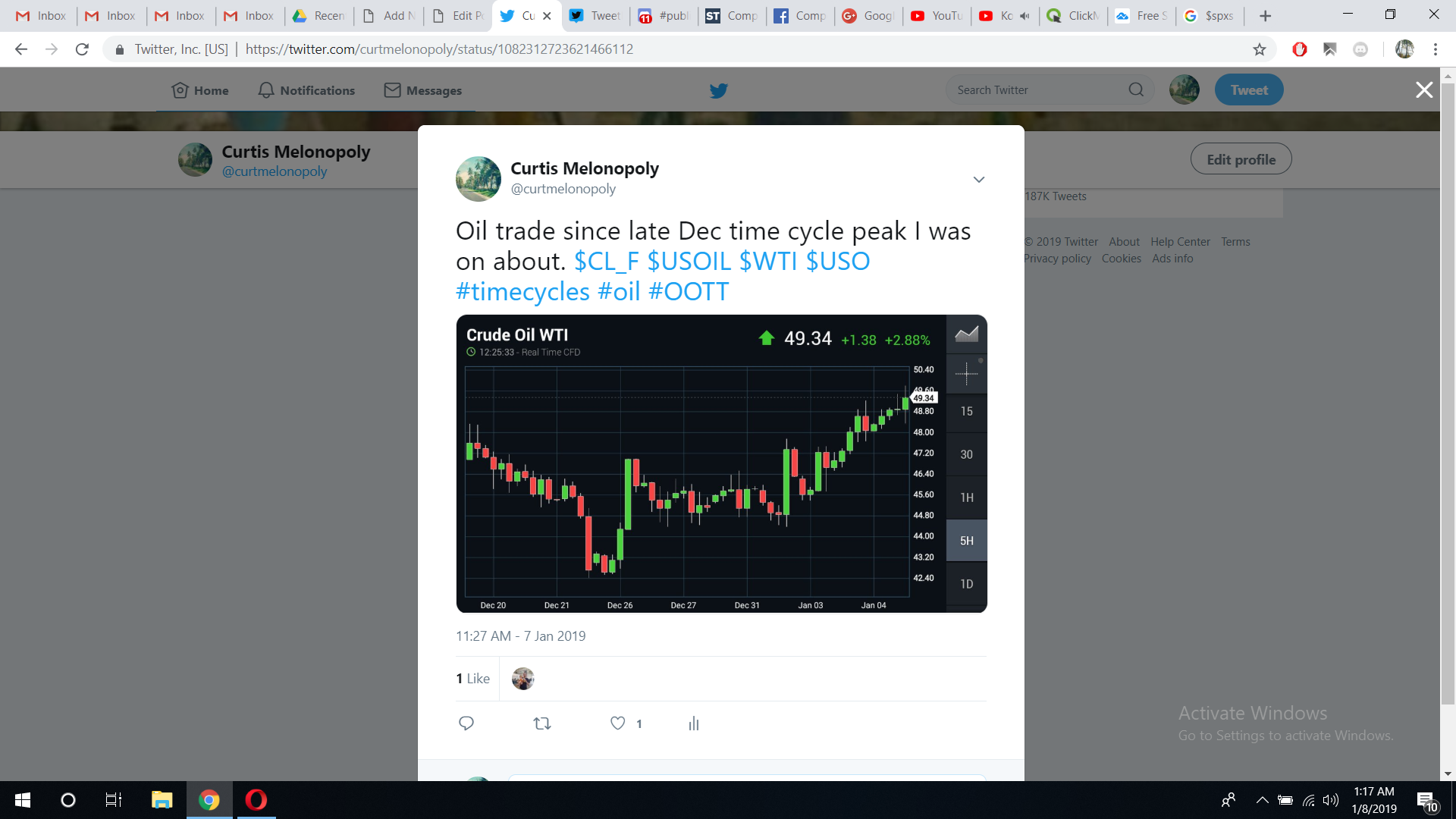

This (the weights) described above will manifest in trade activity in such a way that trade will become more active and in greater size with the larger the structure. For example, the trending channel from late December 2018 to recent would be a considerable structure within the code and as such the code would size in to that channel at the support and resistance widths of range.

The white paper that we will publish soon will detail the rule-set in such a way that our clients will be able to follow along with the machine trade and understand the protocol that it is executing. This is the first stage for the architecture needed for our trader digital dash board we intend to develop soon.

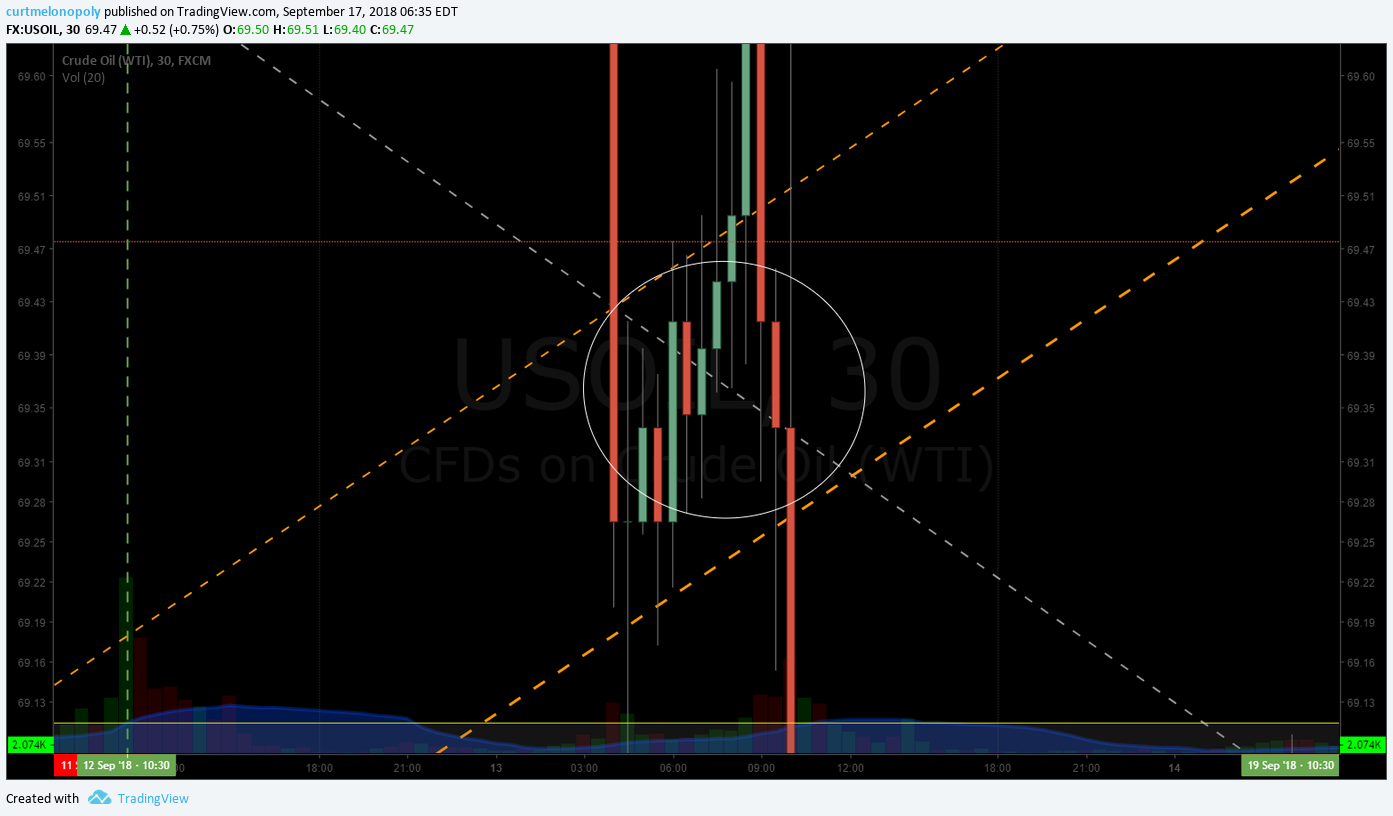

As the days and weeks go on the software will fire more regularly and will begin to size considerably more than right now because it is coded to weigh decisions within trade trends, structures etc. As the trade set-ups develop the code will fire on them. Obviously the largest structures will be at the end of this start up process. The last few days it has been firing on 1 min, 5, 15 and 30 minute structures.

At first we expect the returns to be approximately .5% per day (if averaged over 30 trading days) increasing to well over 1% per day at most 90 trading days in to the launch. We have tested the code in advance and are confident with this. Depending on our success with “tweaks” the returns could escalate to near 3% per day, we are however more conservative and expect 1%-1.5%.

We are significantly more confident with this version of code simply because we have been down the rabbit hole on every time frame, in every structure, every set up, every order flow sequence on all time cycles competing with the best machines in the world.

We have been there, we went to battle in every arena, we know where we can win and where we cannot. The final version of code will only fire in arenas that we expect 80% + win rate. The larger the structure the larger the return as the software fires through the sequence with the structure.

We tested code on every time frame, in every algorithmic model, every order flow structure and so on and so on. We left no stone unturned.

There are areas of trade in the oil markets (smallest time frames) that are so competitive it would dazzle your mind. The AI’s that are firing in the smallest of time frames are doing so in a way that no trader can imagine. Every time we completed a sequence of trade in the most competitive areas (time-frames) we were schooled in the most advanced AI machine trade the world has to offer. It is manifested in a way no trader would ever expect. Here’s a hint, imagine getting beat every time, in a new way every time and every new way you got beat was a structured, logical, mathematically sound way and the ways seem endless.

Our final crude oil trade code is well outside those areas of competition.

The alerts on the Twitter client feed, in the oil trading room and on the private Discord server will continue to have “M” in the alert if it is a machine driven trade and if I (Curt) am trading I will also identify the alert detail as such. As the days go on the protocol (trade set up) detail will get more and more detailed so that our clients can follow along with clarity.

See also:

Press: SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

What’s next?

The next ninety days is for tweaking the code – refining the execution of sequences within structures of trade.

Then near term we will be looking at the trader’s digital platform and API’s etc and then….

AND THEN…. YES, WE HAVE DECIDED to BUILD SOFTWARE FOR BITCOIN MACHINE TRADE.

This will obviously lead our developers in to other crypto-currencies also.

Any questions send me an email compoundtradigofficial@gmail.com.

Thanks

Curt

Oil Trading Academy:

If you would like to learn more about how to trade oil, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Updates Distributed Weekly).

Real-Time Oil Trading Alerts (Oil Trade Alerts via Private Twitter Feed and Discord Private Chat Room).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (Weekly Newsletter, Trading Broadcast Room, Chat Room, Real-Time Trade Alerts).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: AI, machine trading, trade, software, crude, oil, BTC, Bitcoin, Oil Trading Room, Oil Trade Alerts, Strategy

Follow: