Blogs

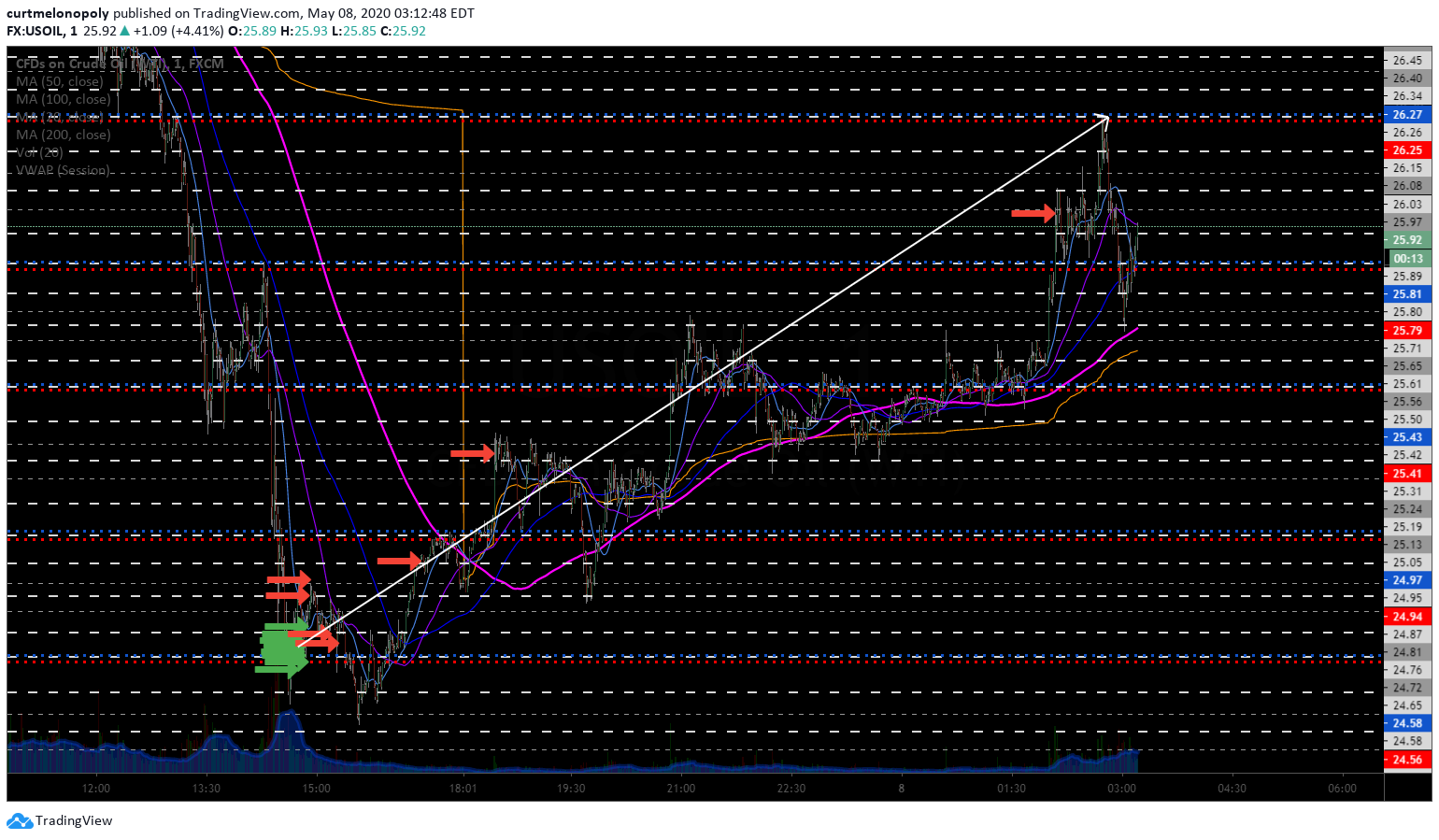

Simple Crude Oil Intraday Trading Strategy – Trading Bullish Trend Line Resistance Break-Out. #OOTT $CL_F $USO #CrudeOilTradingStrategies

Trading the Trend Line Break-Out for an Intra-Day Run-Up of 200 Points Happened Today in Oil Markets.

Below is a Step by Step Simple Guide of How To Trade this Strategy in Crude Oil.

Today crude oil broke out bullish in intra day trade of a trend line resistance. This simple step by step guide will help you get the big wins when they count.

I didn’t take the trade. I had alerted the trade set up to our oil trading room members on the alerts feed, and DID NOT TAKE THE TRADE, ugh.

But, not every trader takes every trade.

Below is a screen capture of the oil trading alerts feed – one of the intraday communications to our members about the intraday bullish set-up developing.

“So what I’m saying is I don’t think intra day shorting is a best practice idea while this possible squeeze is threatening shorts, it could be very bad for shorts, especially with a blow off in to 30 31s possible, see upper arches (gray).”

Below are the tips and steps for you to follow.

Part 1 of this article explains the conventional charting for this set up and how to trade the basics of the strategy.

Part 2 provides further technical insight for our oil trading room and alert members – it will be sent out to members in about an hour. Part 2 also includes algorithmic levels, price extensions, Fibonacci levels, price targets and time cycles.

First, lets look at the trend line set-up trade on an oil chart.

CHART – Simple Crude Oil Intraday Trading Strategy

Steps to Trade an Intra Day Crude Oil Trend-Line Break Out:

- Chart the Set-up.

- Oil traders should be constantly charting trend lines on whatever time-frame they are trading. In this instance I charted the trend line resistance on a one hour chart.

- Three Possible Trade Scenarios When Price Breaks Out.

- The break out fails. This is possible so be sure to use stops or reverse your trade if the break out of resistance fails.

- The break out succeeds and price keeps running without a retest of previous resistance (now support). If price does not come back to test support of the trendline then you have to be prepared to take the trade long and go with price action.

- And finally, price breaks out of resistance and then comes back to retest the new support (which was previously the resistance of the trendline structure).

- Trade Price Action.

- In this example, crude oil price intraday broke out of the trend line resistance and then retested the level and then continued for a bullish 200 point run up in price. When the retest happened and support held, this was your golden opportunity for massive gains to your P&L.

So that is what a simple strategy in crude oil intraday trading looks like.

It comes down to always be charting your intraday price action and learning how these set-ups work. And then simply managing your trade execution with trade size management, technical levels, stops and sound thinking.

As a last side-note, I will say that ideally you want to get the trade started at the support of the actual structure of the set-up (as shown in the EPIC tweet below), however, this is more advanced and I will discuss in detail in Part 2 of this article.

Power of trend line price breakouts from a trading structure support, crude oil intraday near 200 points from oil trade alert buys earlier #OOTT $CL_F $USO #oiltradealerts EPIC V3.1.1 software was in deep at 24/30 size in position trading, very large size. Lead trader was also.

https://twitter.com/EPICtheAlgo/status/1260875628502491143

This trade set-up strategy was the day after the EIA report on Wednesday, for other simple intraday strategies visit our website. For a more in depth look at intraday crude oil trading strategies try this article (click here).

Thanks for joining us in our trading journey, we endeavor to build the best winning oil trading alerts and oil trading room service for oil traders.

Part 2 of this article is here:

Any questions please send me a note via email [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; simple oil, intraday, strategies, trend line, break outs, trade, day trading, crude oil, trade alerts.

Premarket Trading Notes: $APDN, $CL_F, $USO, $DXY, US DOLLAR, CAD, Stocks on Watch, #DayTrading, #SwingTrading, #TradeAlerts, #Premarket

Good morning traders!

RE: Premarket Trading Notes

Good times, things are setting up exactly as we thought for the time cycles in to 2025. This time cycle in to end of August 2020 be safe at inflections, working on a time cycle within time cycle model for you now.

If you missed the beach side video last night I discussed the US Dollar / CAD and this morning on Swing Trade alert feed I sent out some thoughts on Gold trade.

What a day⚠️🗡️🎯🏹🐋💙🌴 https://t.co/jx9JUjXRVc

— Melonopoly (@curtmelonopoly) May 13, 2020

Day trades are setting up here, I may start a few today (I will alert to day trade alerts feed) and possibly transition them to the Swing Trading Alert platform if I can get on the right side.

A few day trades on watch: $APDN $BPMX $AIM $NVUS $IMUX $ALLO $TLSA $NBY $RIOT $CODX $WISA $ALT

Below is a list from Benzinga fyi

32 Stocks Moving in Thursday’s Pre-Market Session $APDN $BIOC $BPMX https://benzinga.com/z/16029951#.Xr04YFcqZvt.twitter #premarket #daytrading

32 Stocks Moving in Thursday's Pre-Market Session $APDN $BIOC $BPMX https://t.co/d6pNSUczeC #premarket #daytrading

— Day Trading Alerts (@DayTrade_Alert) May 14, 2020

The intense oil daytrading yesterday that continued in to the night and premarket today ended up on our side – a really nice trade for our oil trade alerts feed.

Since the black swan updates I don’t think EPIC has lost a trade, very little if any.

EPIC V3.1.1 was in deep at support at 24/30 size, that is deep for the software, anyway it worked out well for the oil trade alerts members (I got a number of Whatsapp messages and we were intensely working through member trades live on Whatsapp messaging).

I also got a nice win there too so that helped. If you’re a member and not connected to me on Whatsapp do so by emailing cmpoundtradingofficial.com so we can connect.

Power of trend line price breakouts from a trading structure support, crude oil intraday near 200 points from oil trade alert buys earlier #OOTT $CL_F $USO #oiltradealerts EPIC V3.1.1 software was in deep at 24/30 size in position trading, very large size. Lead trader was also.

https://twitter.com/EPICtheAlgo/status/1260875628502491143

The swing trade service got a big win this morning in $APDN on the news, really nice trade from lows, another multi bagger. I may do some daytrading in $APDN yet today also.

Another beauty of a trade on our swing trading alert platform $APDN #swingtradealerts

Applied DNA Receives FDA Emergency Use Authorization for COVID-19 Diagnostic Assay Kit

Another beauty of a trade on our swing trading alert platform $APDN #swingtradealerts

Applied DNA Receives FDA Emergency Use Authorization for COVID-19 Diagnostic Assay Kithttps://t.co/iyKCYoNjbQ pic.twitter.com/viyfI7Rpvl

— Swing Trading (@swingtrading_ct) May 14, 2020

Trump train trading will be awesome here forward, what an opportunity!

This is a strong signal imo. Inflection time. Looks like a man preoccupied with off-screen furback rats scurrying… no point for this public education – they've hit max opportunity of those that will get it, have it now and those that don't, oh well. Fireworks here fwd likely. https://t.co/490KOejSS5

— Melonopoly (@curtmelonopoly) May 11, 2020

I did say something about the tone represented the other day at the WH briefing – that I wouldn't want to be on the opposing team considering, here we go kids🪓⛓️🪝 https://t.co/YeVboLTSnj

— Melonopoly (@curtmelonopoly) May 14, 2020

While CNBC has been flashing

"MARKETS IN TURMOIL"

We been raising the dead and banking the living.

Couldn't have been a better time cycle and the next will be better than the last and the next and the next. Historic opportunity for traders.#premarket pic.twitter.com/QYgi57w5VX

— Melonopoly (@curtmelonopoly) May 14, 2020

Any questions let me know!

Curt

Previous Premarket Trading Notes for review on set-ups etc.

Article Topics; $APDN, $CL_F, $USO, $DXY, US DOLLAR, CAD, Stocks on Watch, #DayTrading, #SwingTrading, #TradeAlerts, #Premarket

Premarket Trading Watch List: $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY, Fauci and more.

Premarket Trading Watch List

Good morning Traders,

With stocks to watch and trades in play, on day trade alert side I’d like to see TL (diagonal trendline) on $OSTK break for a run. Also the overhead horizontal resistance on $AKBA for a run. We got the $IQ yesterday and first part of $OSTK and $AKBA. Check your charts sent out.

Congrats to $MARK longs, I didn’t get it but here’s your key resistance.

Your resistance mark on $MARK should be 200 MA on weekly (pink) just over 3.00 per beach side video last night #daytrading #premarket https://t.co/Xh0NxErgbn pic.twitter.com/xnpXlMEC4W

— Day Trading Alerts (@DayTrade_Alert) May 12, 2020

On swing trade alert side resistance over head near on $SPY model and $AAPL chart models. Of course we’re swing trading $AKBA and $OSTK also. Managing many others, nothing specifically yet today for new entries, after oil reports API EIA we expect more swing trade positioning / entries. $VIX and $OVX are on close watch for long starts soon-sh (see Sunday Swing Trade $STUDY Webinar video for more). There are countless plays on watch and many in play right now.

Also the $NTRA break out set-up is super interesting here, really strong yesterday – also see the weekend $STUDY videos for this and chart model sent out on Swing Trade Alert feed.

Oil trading alerts Sunday overnight and Monday were super quiet for both myself and EPIC V3.1.1, however, I expect this to change at latest after API could be sooner, for now see hourly for range trade – it’s a range trade because of the time cycle rounding the trajectory per model.

We do have Fauci speak today so go easy.

Will be in live room and will get on mic if active trade starts.

Beach Side Video from yesterday with some comments to above trading.

Beautiful day🙏🌴 $AKBA $IQ $OSTK $AAPL $MARK $$TLRY $GLD $SLV $BTC $$SPY $VIX $TSLA Trade size P&Ls Sunday Swing $STUDY

and more https://t.co/AAfsJkiPq3— Melonopoly (@curtmelonopoly) May 11, 2020

Any questions let me know!

Curt

Article Topics; premarket, stocks, commodities, watchlist, $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY

Crude Oil Trading Strategies: Sell-Off in to Oil Futures Settlement – 190 Point Snap-Back Trade w/Video #OOTT $CL_F $USO $USOIL

How to Trade an Oil Price Sell-Off in to Futures Settlement at 2:30 PM EST for Reversal.

This Reversal (Snap-Back) Crude Oil Trade Provided a 190 Point Range for Our Oil Trading Room Traders.

One of the best ways to increase your oil trading profit is with reversal trading. Crude oil can be difficult to trade, so knowing where reversals in price are likely to occur (support areas of charting) greatly helps a trader with winning trade signals.

A Warning! In a reversal trade it is important to manage your stops, bias, trade size in accordance to your account size.

The example below is of a 30 contract size (possible) oil trading account used by our software EPIC V3.1.1.

I personally didn’t take the trade because I was tired and I had a few other reasons. But it cost me some excellent profit because the price of oil then reversed and rallied near 200 ticks – it would have been a great win for me.

Some of our traders in our oil trading room did get the win so that was great, so I learned a lesson for next time.

The biggest lesson being that when EPIC V3.1.1 alerts an oil trade and the signal is “in-play” it is best for me to get with it and take the trade because the software has been winning non stop since it’s “black swan” code updates.

The oil charts below are models developed by our trading team that are proprietary to our oil trade alert and trading room members, however, if you know how to properly chart conventionally you can also take advantage of this set-up.

Let’s start with the set-up for the possible reversal trade on the one hour chart model. The one hour oil chart suggests that a turn in price, or a topping, is near (refer to the curved grey arch on the chart).

More specifically to this trade set up, the yellow trend lines (algorithmic trend lines) provide for a possible area on the charting for intra-day support in a possible sell-off scenario in to futures settlement at 2:30 PM on Thursday May 7, 2020.

The alert went out to the oil trading room and trade alert feed as follows;

You can see on the oil chart below that price was crashing at 12:18:17 EST time (or 12:18 PM) so the possible set-up for a bounce after oil settled at 2:30 PM was setting up.

If you’re thinking of swinging crude oil for a bounce, we’re getting closer to support areas.

Intra-day time cycle on crude oil is 1:45 P.M. for a possible bounce (reversal), careful with expecting VWAP to hit with some funds turning short.

The chart below and guidance provided to subscribers was also that at 1:45 PM a time cycle intra-day was possibly at an inflection point (or peak / bottom) and this was reason to be on high alert.

Screen capture of oil trading alert feed telling oil trading room position started.

Then at 2:44, so 14 minutes after crude oil officially settled for the day the alert went out that we were opening our trade position long at 8/30 size at 24.67 and the screen image below shows some of the other alerts and comments as the trade was going well and in a winning position.

Long 8/30 24.67 FX USOIL WTI trade on CL — EPIC.

Screen capture image of oil trading room when I alerted the trade position opened and discussing trading strategies.

One of the things we do in the oil trading room is provide charting and as much trade strategy guidance for our subscribers as possible.

This image below is a screen shot of the Discord room where we’ll chatter and share ideas and there is also a live mic and charting trading room where I walk our traders through the trades on voice broadcast live and share the charts we are using – both run at same time..

If the trade works, the price target would be Friday 3:00 PM EST ish for 29.00 ish.

The guidance provided to the trading room after we entered the trade was the price targets and time of the targets possibly coming in to affect. The chart below shows an arrow that provides our traders with a trajectory of trade should the plan being working.

The crude oil one hour chart with symmetry time cycles has been an amazing model, working very well, details on video.

The image below shows the 1 hour algorithmic model and the symmetries in crude oil trade, time cycles and price targets. The reference to “the video” is that we record all trading sessions and make them available to our subscribers for $STUDY and review.

The Live Oil Trading Room Raw Video Feed

At 1:12:40 on the video timer is where the oil trade starts, you can see and hear the actual trade guidance for the signals I am providing our traders as the trade sets-up.

There isn’t a lot of trade guidance on mic because much of it was provide in advance in the trading room and on alert feeds, but you can idea of how it works in the trading room on the video. There is also a time stamp at near bottom right of screen in the video on the chart itself.

The Chart Below Shows Trade Long Entries (green arrows) and Take Profit Areas Selling (red arrows).

Crude Oil Trade Alerts dot plotted on 1 minute grid chart of EPIC V3.1.1 trade from oil trading room earlier today.

The trade on the 60 min symmetrical time cycle model (white arrow), long position after sell-off in to daily settlement.

The reversal trade works really well for oil traders as long as you manage the trade size according to your account size and be sure to stop out if you are on the wrong side of the trade.

Oil can trend down or up for weeks so staying on the wrong side of an oil trade can cost you your whole trading account.

So if you know your areas of support on the most dominant time frames (in this instance the 1 hour charting) and you execute your long trade after it looks like the sell-off has stopped then it becomes simply managing the ebb and flow of trade according to your personal style thereafter.

BUT IF IT FAILS, my best suggestion to you is to close the trade sooner than later.

I’ve also written other articles on intra-day reversal oil trades – they are more in-depth and a tad technical, but if you want to dig deeper in to this topic here are a few recent articles:

- Buying Support in to the Plunge During Crude Oil Intra-Day Sell-Off | Oil Trading Room Video, Alerts, Strategy.

- 134 Ticks in 1 Hour (Post EIA). Crude Oil Trading Tips: A Simple Intra-Day Reversal Strategy..

My tweet summarizing the oil trade on my personal Twitter feed (shows alert screen shots);

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn’t follow… EPIC got it Direct hitFireBow and arrow I didn’t – in hindsight, likely cause I was tired. Good lesson.

#OTTT $CL_F $USOIL $WTI #OilTradeAlerts

When crude oil sold off in to 2:30 settlement yesterday, EPIC V3.1.1 machine protocol went in deep long for swing trade, I didn't follow… EPIC got it 🎯🔥🏹 I didn't – in hindsight, likely cause I was tired. Good lesson. #OTTT $CL_F $USOIL $WTI #OilTradeAlerts #MachineTrading pic.twitter.com/bcNUzTTER5

— Melonopoly (@curtmelonopoly) May 8, 2020

In the tweet below, I was explaining that oil traders would want to be focusing on trades that are on the outside extreme ranges in price.

The reason for this is that oil recently rallied off lows and we have a time cycle and price targets that see oil topping near – term. When oil starts to top or bottom in a wider time-frame it is then best to trade the range of trade on lower time-frames (such as the 1 minute, 5, 15 or 30 minute charting) until the larger trend is formed.

Oil traders, they’ll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

Oil traders, they'll want to take the trades on the extremes the next two weeks #OOTT $CL_F $USO The whippy extremes will provide the best risk reward for oil traders.

— Melonopoly (@curtmelonopoly) May 6, 2020

So that’s the reversal snap-back trade in crude oil futures that you can either consider as a day trade or an intra-week swing trade. There are of course many other considerations we use (our software has over 9000 rules in its instructions), but for the purposes of a human trader, the above article should help get you started.

We endeavor to develop the best winning oil trading alerts and oil trading room service for oil traders.

Any questions please send me a note via email [email protected].

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; oil, strategies, reversal, trade, swing trading, day trading, crude oil, oil trading room, oil trading alerts.