EPIC v3 Crude Oil Trading Software Updates, A Follow-Up to Last Week’s Note on February 2nd.

RE: Software Drawdown Protocols vs Expected Returns and Oil Trade Alerts.

Good day traders,

Last weeks note (if you have not read it) can be found here;

EPIC v3 Crude Oil Code Updates: Drawdown & Short Selling Protocols $CL_F $USO #machinetrading

Since the Feb 2 note I have had some questions from our clients that I suspect others have also, so I a summarizing responses from those questions below.

Our Primary Objective

The goal in our development is now limiting draw-downs, we know the software works and that is not at issue, at issue is the size of potential draw-down.

Our primary objective is to find the range of “throttle” in the software that provides a consistent return with the least volatility in ROI.

Draw-down Protocol “Events”

The software is designed to trade on historical structures, trade set-ups, order flow and more – find details in the most recent white paper update can be found here.

Specifically to draw-down protocols, in my last note I described the change in code to be throttled 50% (limiting potential downside to 50% of what is described in the white paper). I also explained that if required we would throttle it again another 50% of its most recent setting.

Last week crude oil seemed to be basing from a technical perspective and the software (considering the chop) did well, however, we were not comfortable with the potential draw-down risk in the “event” driven chop.

At issue specifically are market “events”, such as with the recent virus event out of China. Event periods will potentially cause draw-downs, our objective is to avoid this volatility.

As of today we have done that – throttled the draw-down protocol again.

The reason is simple, our objective now is to limit unnecessary draw-down percentages to the point that we can allow the software to run without concern to draw-downs even if that limits potential returns. For now this is the case and as explained previously if we open the throttle at all we will advise our clients well in advance.

In practical terms this means that the software size held is limited intra-day when in draw-down and the range is limited. The range is not changed from previous, being one full “quad” and/or “channel” range on the EPIC Algorithm Model but the size held is limited to near 1/10 size. The size can very from approximately 1/10 to 3/10 size but the software will “flash” in and out any adds with near zero range stops executing at each key support in a draw-down.

Oil Trade Alerts

This will at times cause the oil trade alerts feed to be very active but yet at times will be very silent as the software will only execute the highest probability trades also.

This represents the tightest throttle possible in our code.

Expected Returns vs. Draw-Down Risk

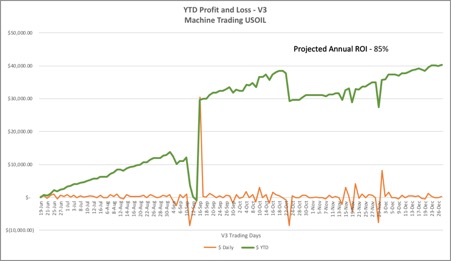

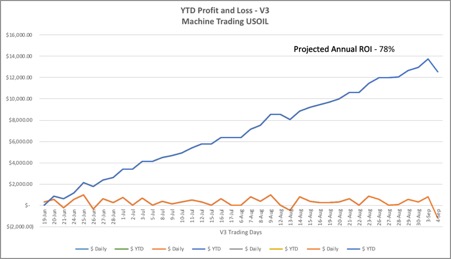

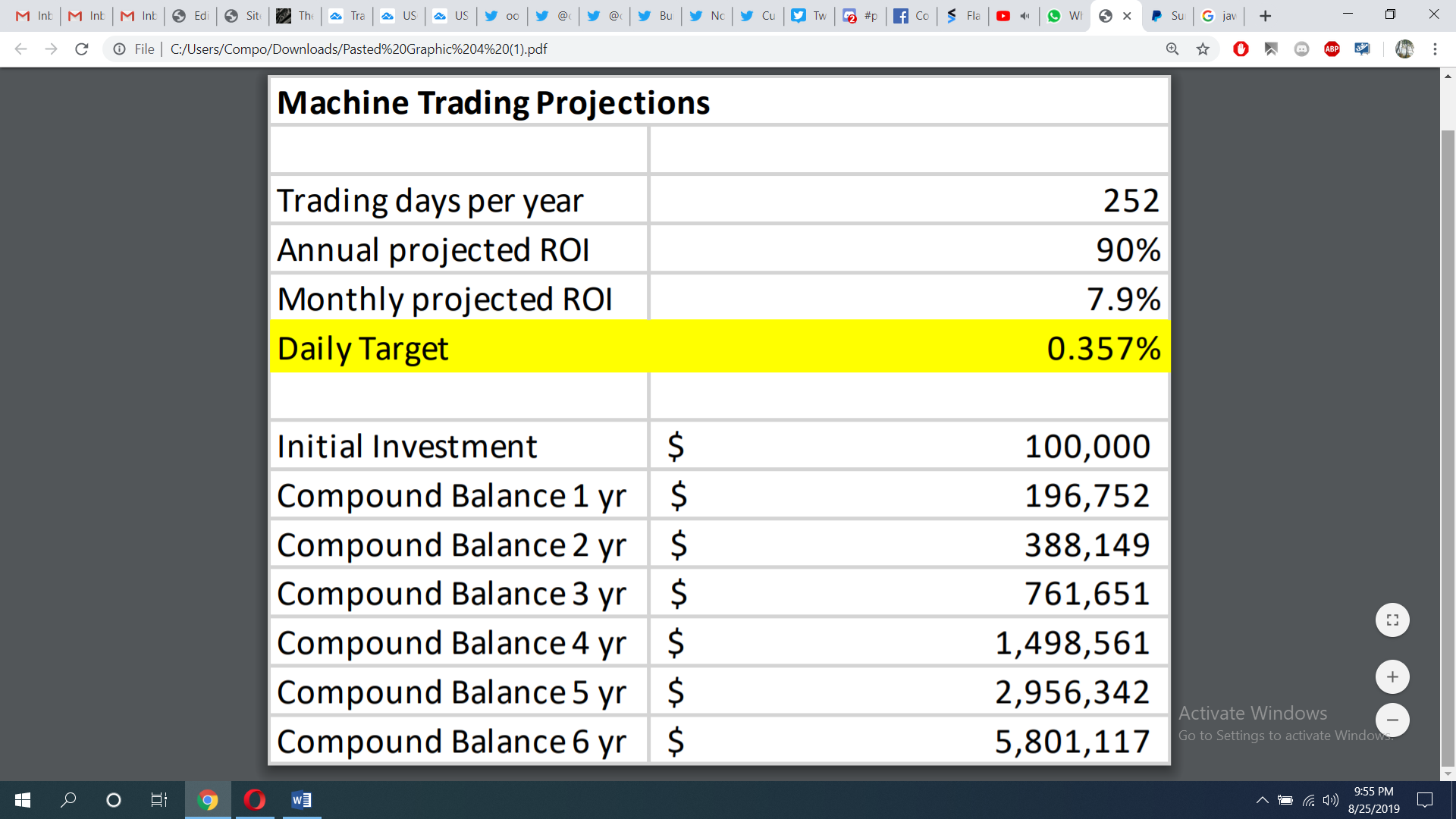

Through development we have had plateaus of code structure ranging from 20% – 150% ROI expectation and we even looked toward 300% being possible.

However, there is a volatility to potential draw-down that comes with higher expectation of ROI. This has to be balanced with account size and risk tolerance.

Our objective is to code software that has limited draw-down with highest ROI on specifically 10 contract size accounts. As explained previously, 30 contract and higher accounts this is much different.

At the current throttle setting our estimation of returns is somewhere between 40 – 80% per year (likely closer to 40%) with very littler risk to the down-side as we have run the software in this throttle range prior for some time and this is the ROI expectation. The variance in ROI expectation (40%- 80%) is in consideration of market conditions and not how we expect the software to run.

After the software has run for a considerable time at this level of “throttle” we will look at releasing the “throttle”, but this will be only considered after some time and again I emphasize that our clients will be notified well in advance.

Being as transparent as I can, the reason for this is motivated by the fact that we have been in development for near 4 years and there is a point where returns need to be the norm and not volatility in development. We need to run a low risk environment for some time now as development has been costly. When we have recouped development costs and put some profit back in to the project we can then look at further development and associated risk.

Our next white paper update will reflect the content of these updates notes.

Any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article topics; crude, oil, trading, machine trading, algorithm