Tag: $BA

Swing Trading Alert Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00 as Alerted to Member Private Feed, Trading Room and/or Reporting. #swingtrading #tradealerts

Tickers Alerted: $SQ, $MA, $APDN, $PD, $BA, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $VXX, $VIX, $OVX, $INO, $GLD, $GC_F, $SLV, $SI_F, $BTC, $STNE, $JETS, $APO, $HIIQ, $GBTC, $RCUS.

- Important Summary Detail:

- Period Swing Trade Alert Return (ROI) = 127.34% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=454676&investmenttime=date&investmentlength=2.5&beginbalanceday=03%2F01%2F2020&endbalanceday=03%2F31%2F2020&ctype=1&x=75&y=27

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 5, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trade Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

- Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1EOt1AkEdPchc-h_aijQ7EUzoF_uG186Uhta9Ri-9VPg/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Size | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | ||||||

| 3/31/2020 | 12:19 | Long | $STNE | 400 | 22.96 | 0 | ||||||||||

| 3/31/2020 | 11:08 AM | Trim to 75% hold 25% | $NET | 400 | 17.75 | 26.2 | 3380 | 454676 | https://twitter.com/SwingAlerts_CT/status/1245005074260164609 | |||||||

| 3/31/2020 | 10:46 AM | Trim | $NET | 200 | 17.75 | 25.7 | 1600 | 451286 | ||||||||

| 3/31/2020 | 8:07 AM | Trim 25% | $HAS | 100 | 67.69 | 73.55 | 586 | 448696 | ||||||||

| 3/30/2020 | 2;47 PM | Trim 25% | $HAS | 100 | 67.69 | 70 | 231 | 449110 | ||||||||

| 3/30/2020 | 11:04 | Long | $HAS | 400 | 67.69 | 0 | ||||||||||

| 3/30/2020 | 9:43 | Short | $APO | 300 | 34.4 | 0 | ||||||||||

| 3/27/2020 | 12:51 | Long | $JETS | 800 | 15.8 | 0 | ||||||||||

| 3/26/2020 | 10:09 AM | Trim 100 of 400 | $SQ | 100 | 43.62 | 59 | 1530 | 448879 | ||||||||

| 3/25/2020 | 12:26 PM | Trim 50% 100 hold 100 | $BABA | 100 | 174.05 | 194.05 | 2000 | 447349 | ||||||||

| 3/25/2020 | 11:35 AM | Trim 12.5% hold 12.5% | $BA | 25 | 107.7 | 166.8 | 1477.5 | 445349 | ||||||||

| 3/24/2020 | 6:35 PM | Trim 25% hold 25% | $BA | 50 | 107.7 | 139.75 | 1602.5 | 443862 | ||||||||

| 3/24/2020 | 12:26 PM | Trim 50% | $INTC | 150 | 48.42 | 53.32 | 735 | 442260 | ||||||||

| 3/24/2020 | 12:25 PM | Trim 50% | $BA | 100 | 107.7 | 123.17 | 1547 | 441525 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% swaps | $BTC | 150 | 5900 | 6557 | 9855 | 4399778 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% (5 x 5000 ounce contracts) | SI_V | *5 | 12.7 | 13.94 | 31000 | 430123 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% (8 x 100 ounce contracts) | GC_F | 8 | 1516.01 | 1619.27 | 82608 | 399123 | ||||||||

| 3/23/2020 | 10:11 | Long | $INTC | 300 | 48.42 | 0 | ||||||||||

| 3/23/2020 | 9:59 | Long | $BABA | 200 | 174.05 | 0 | ||||||||||

| 3/23/2020 | 9:23 | Long BTC adds swaps | $BTC | 200 | 6200 | 0 | ||||||||||

| 3/23/2020 | 9:23 | Long Silver | SI_F | 10 | 12.7 | 0 | ||||||||||

| 3/23/2020 | 9:21 | Long Gold | $GC_F | 16 | 1516.01 | 0 | ||||||||||

| 3/20/2020 | PRE | Long | $SQ | 400 | 43.62 | 0 | ||||||||||

| 3/20/2020 | PRE | Long 200 | $BA | 200 | 107.7 | 0 | ||||||||||

| 3/19/2020 | Trim 200 for 400 held | $APDN | 200 | 3.01 | 9.48 | 12940 | 316515 | |||||||||

| 3/15/2020 | 5:13 PM | Adds swaps | $BTC | 100 | 5409 | 0 | ||||||||||

| 3/13/2020 | PRE | Cover 60, hold 40 | $NKE | 60 | 86.2 | 76 | 612 | 303575 | ||||||||

| 3/13/2020 | PRE | Cover 150 hold 50 | $WYNN | 150 | 100.52 | 71.08 | 4416 | 302973 | ||||||||

| 3/13/2020 | PRE | Long 100 | $COST | 100 | 277.6 | 0 | https://twitter.com/SwingAlerts_CT/status/1235724000808112128 | |||||||||

| 3/13/2020 | 14:30 | Add 400 for 600 held | $APDN | 400 | 2.3 | 0 | https://twitter.com/SwingAlerts_CT/status/1229993709732876290 | |||||||||

| 3/12/2020 | 10:26 | Long | $PD | 600 | 17.2 | 0 | ||||||||||

| 3/12/2020 | 9:54 AM | Cover 25% | $MA | 150 | 322.3 | 246 | 11445 | 298557 | ||||||||

| 3/12/2020 | 9:51 AM | Cover 25% | $WYNN | 150 | 100.52 | 69.78 | 4611 | 287112 | ||||||||

| 3/12/2020 | 8:51 AM | Cover 25% 100, hold 100 | $NKE | 100 | 86.2 | 76.9 | 9700 | 282501 | ||||||||

| 3/12/2020 | 10:32 AM | Trim 150 of 450 held | $VXX | 150 | 18.2 | 48.2 | 4500 | 272801 | ||||||||

| 3/11/2020 | 11:31 AM | Cover 50% 200 of 400 | $NKE | 200 | 86.2 | 82.17 | 860 | 268301 | ||||||||

| 3/11/2020 | PRE | Short 400 | $NKE | 400 | 86.2 | 0 | https://twitter.com/SwingAlerts_CT/status/1237697839129649152 | |||||||||

| 3/10/2020 | 3:44 PM | Trim 150 of 600 held | $VXX | 150 | 18.2 | 34.64 | 2466 | 267441 | ||||||||

| 3/9/2020 | 2:04 PM | Long 200 | $INO | 200 | 11.03 | 0 | https://twitter.com/SwingAlerts_CT/status/1237076932057075712 | |||||||||

| 3/9/2020 | 9:30 AM | Trim 150 of 500 | $WYNN | 150 | 100.52 | 84 | 2478 | 264975 | ||||||||

| 3/9/2020 | 10:19 AM | Sell 11/12 approx | $OVX | *11 / 12 | 35.8 | 139 | 55728 | 262497 | https://twitter.com/SwingAlerts_CT/status/1237018625191673856 | https://twitter.com/SwingAlerts_CT/status/1236994259607265281 | https://twitter.com/SwingAlerts_CT/status/1231427689703231488 | https://twitter.com/SwingAlerts_CT/status/1188897285385703424 | https://twitter.com/SwingAlerts_CT/status/1192794697569320966 | |||

| 3/5/2020 | 10:45 | Short 500 | $WYNN | 500 | 100.52 | 0 | ||||||||||

| 3/5/2020 | 10:31 | Long 200 | $GBTC | 200 | 10.72 | 0 | ||||||||||

| 3/3/2020 | 3:51 PM | Sell 200 of 200 | $HIIQ | 200 | 18.6 | 31 | 2480 | 206769 | ||||||||

| 3/3/2020 | PRE | Trim 100 of 600 | $RCUS | 100 | 15.5 | 17.59 | 209 | 204289 | https://twitter.com/SwingAlerts_CT/status/1234722519187435520 | https://twitter.com/SwingAlerts_CT/status/1230924666665078785 | https://twitter.com/SwingAlerts_CT/status/1250841232366088192 | |||||

| 3/2/2020 | PRE | Trim 100 of 300 | $APDN | 100 | 4.44 | 8.52 | 4080 | 204080 | ||||||||

| 200000 | ||||||||||||||||

|

*The goal has been to keep the alert feed simple to allow traders (subs) to structure their own trades, sizing, instruments etc, however, we will be transitioning to a more specific detailed alerting process in 2020 (digital auto platform).

|

||||||||||||||||

|

*Run the trades, win rate avg return range you see alerted on the spreadsheet with your preferred sizing, risk tolerance, instrument type and see what your returns would be based on the swing alerts of our platform.

|

||||||||||||||||

|

*The trade alert links in spreadsheet will only open for premium subscribers (for use of reference) if you would like a tour of the feed to view the time stamped alerts contact us – the P&L represents alert feed as it was alerted.

|

||||||||||||||||

|

*Subscribers can click on alert link for details of alert and also see charting and links to live Trading View charting, structured models, etc for each set up.

|

||||||||||||||||

|

*See addendum documentation for; Volatility derivative options trading structures/strategies used for $OVX $VIX $USO $SPY $SPX Gold Silver Crude Oil Bitcoin.

|

||||||||||||||||

|

*Many trades in Volatility, Indices, Commodities, Crypto etc are structured as futures or ETF options or lev swaps that take time to detail at intraday alert level – soon trade alerts will include more detail with digital traders platform launch.

|

||||||||||||||||

|

*For these P&Ls (until strategy structures include more detail n alerts) we have kept the entries as simple as possible so traders can execute on the actionable set-up.

|

||||||||||||||||

|

*Crude oil: lead trader primarily uses a 10 bet position trading strategy on day trades and a 30+ bet system on swings (max size can vary) and EPIC V3.1.1 machine trading a fixed 30 bet system on either.

|

||||||||||||||||

|

*Swing clients know in 9/10 trade set ups when lead trade executes a position a profit trim is taken if on right side of trade and then if price returns to buy lead trader has stops there (unless otherwise noted).

|

||||||||||||||||

|

*For specific or itemized trade set-up strategies or instrument stuctures as needed for any of the trades in progress email Jen & Curt at [email protected] or clients can Whatsapp Curt direct.

|

||||||||||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Stocks, Commodities, Crypto, $SQ, $MA, $APDN, $PD, $BA, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $VXX, $VIX, $OVX, $INO, $GLD, $GC_F, $SLV, $SI_F, $BTC, $STNE, $JETS, $APO, $HIIQ, $GBTC, $RCUS.

Market Report: Premarket $TSLA, $BA, $AAPL, $INTC, FOMC, API Crude Oil, EIA, Oil Trade Alerts, $CL_F, $USO, Swing Trading, Day Trading, Time Cycles

Market Update: Premarket Trading

Morning traders,

Monday was quiet for us, most of the portfolio rising, some trimming of profits of course, best swing run in our history.

The Boeing $BA trade below is an example of the time cycle we’ve had on the swing trading platform:

What a great trade, more than a double in Boeing $BA from 107s to 231s, holding some profit runner 🎯🏹🔥

#swingtrading

What a great trade, more than a double in Boeing $BA from 107s to 231s, holding some profit runner 🎯🏹🔥#swingtrading pic.twitter.com/mnsoSxstIY

— Melonopoly (@curtmelonopoly) June 8, 2020

Still have many profit runners and new positions start over the next 7 or 8 trading days for the cycle in to end of August – watch the swing trade alerts feed for new positions as we come out of this time cycle inflection.

$AAPL $INTC – Apple announcing Mac chips at WWDC – Bloomberg https://seekingalpha.com/news/3581457-apple-announcing-mac-chips-wwdc-bloomberg?source=tweet #swingtrading

$AAPL $INTC – Apple announcing Mac chips at WWDC – Bloomberg https://t.co/RA5Kzcr8zy #swingtrading

— Swing Trading (@swingtrading_ct) June 9, 2020

Today is soft so far, except some highly speculative day trader stocks $IDEX $IZEA $EYES $AQMS etc wow. Watching close.

Going to short TESLA $TSLA to the moon and back when the time is right

“I would like to be able to get more money to buy more

@Tesla

actually,” says legendary investor Ron Baron. $TSLA

"I would like to be able to get more money to buy more @Tesla actually," says legendary investor Ron Baron. $TSLA pic.twitter.com/sCt9dr4mDu

— Squawk Box (@SquawkCNBC) June 9, 2020

We’re in live trading room, EPIC oil trading software active so the live oil trading alerts are also, likely some day trades firing in to open and swing trading reporting coming today with a number of set-ups, time cycle inflection last week this week so we’ll see how that goes.

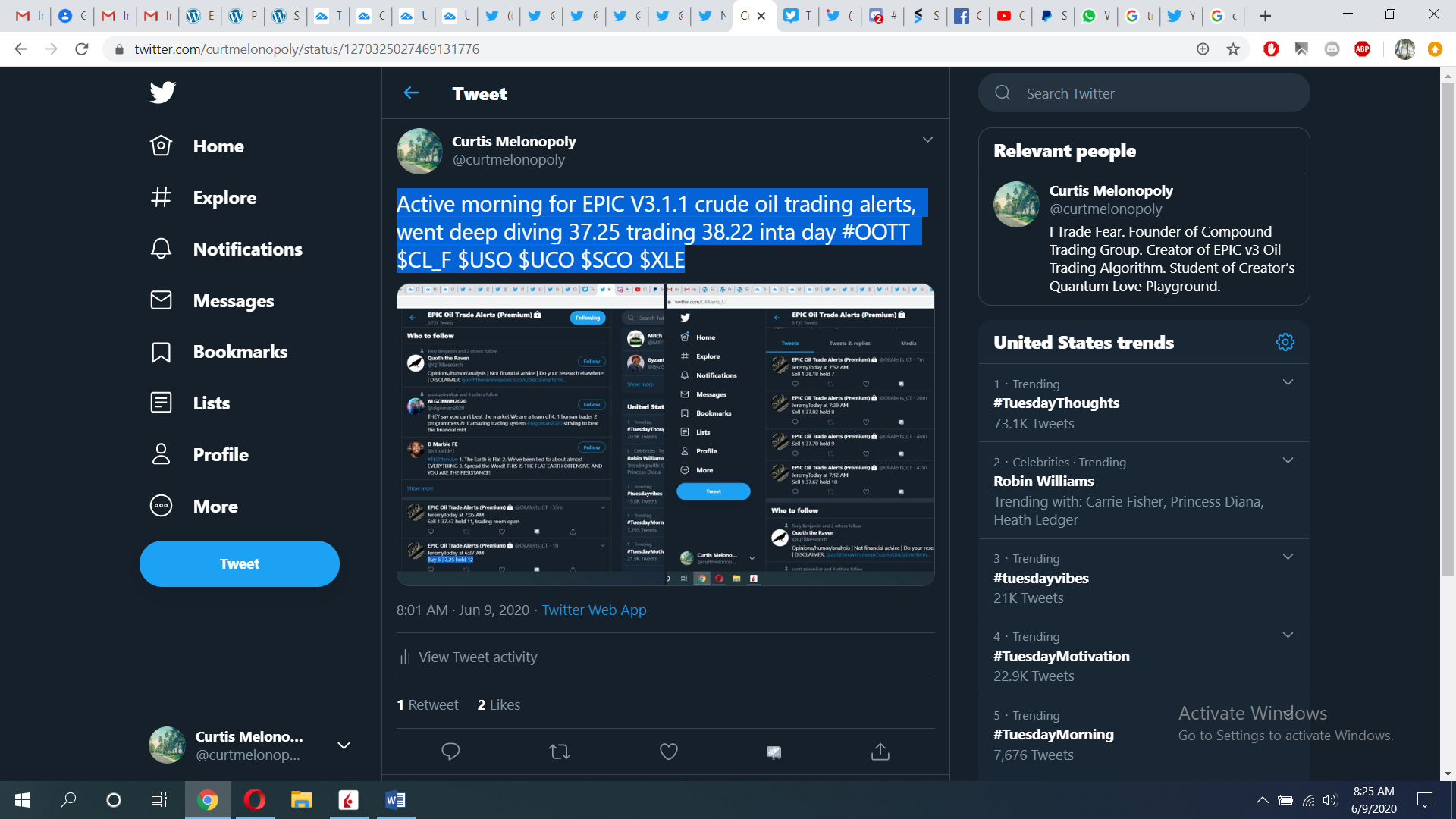

Active morning for EPIC V3.1.1 crude oil trading alerts, went deep diving 37.25 trading 38.22 inta day #OOTT $CL_F $USO $UCO $SCO $XLE

Active morning for EPIC V3.1.1 crude oil trading alerts, went deep diving 37.25 trading 38.22 inta day #OOTT $CL_F $USO $UCO $SCO $XLE pic.twitter.com/CLLa0TseqW

— Melonopoly (@curtmelonopoly) June 9, 2020

Oil down on stronger dollar, oversupply concerns https://reut.rs/2Ygx7DV #OOTT $CL_F $USO $USOIL Thread https://twitter.com/davidgaffen/status/1270322515047481346

https://twitter.com/EPICtheAlgo/status/1270328242520670211

Some on schedule:

FOMC

FOMC decision: What to know in the week ahead

https://twitter.com/CompoundTrading/status/1270322725735804928

8:55

Redbook

10:00

Wholesale Trade

JOLTS

4:30

API Crude Oil Data with EIA 10:30 Wed

LIVE: President

@realDonaldTrump

holds a news conference

LIVE: President @realDonaldTrump holds a news conference https://t.co/qfXa9nMlTD

— The White House 45 Archived (@WhiteHouse45) June 5, 2020

Thanks

Curt

Swing Trading Earnings Special Report (Members) Mon Aug 6 $BABA, $BA, $ARWR, $EDIT, $C, $DIS, $PSTG, $MXIM, $ATHM, $BWA, $LIT, $FB more.

Swing Trading Report. In this Special Earnings Season (Member Edition) Monday Aug 6, 2018: $SPY, $VIX, $DXY, $GTHX, $ARWR, $EDIT, $C, $DIS, $PSTG, $MXIM, $ATHM, $BWA, $LIT, $BA, $BABA, $FB and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from July 31 mid day review, published August 6, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

June 27 Swing Trading Regular Report is referenced in this special earnings report. Members can reference that report for charts you may need (or review the video) as all the charting is not included in the report below due to weekly reporting time constraints.

Tickers covered; $SPY, $VIX, $DXY, $GTHX, $ARWR, $EDIT, $C, $DIS, $PSTG, $MXIM, $ATHM, $BWA, $LIT, $BA, $BABA, $FB

SP500 $SPY 278.71 support, 283.71 288.91 resistance.

Volatility $VIX – End of time cycle week, ish On watch.

US Dollar $DXY – 95.62 Aug 28 upside target and 93.50 Aug 28 in bearish scenario.

$GTHX – Price targets in bullish scenario 53.64 58.09 Aug 27, and downside scenario on same day 44.42 and 40.04.

$ARWR – Lost mid quad support, price target 16.00 ish Nov 26 23.88 in more bullish scenario or 8.93 in a sell-off.

$EDIT – 27.87 22.93 18.12 are downside targets and 48.00 ish is most bullish scenario with other targets on way up. Sept 21 time cycle completion. Trading plan detail on video.

CitiGroup $C – Hit support numerous times, at 200 MA on daily, 86.40 upside price target Oct 17, lower target is 73.80 60.37 Oct 17. Over 73.70 is long side trade alert pivot.

Disney $DIS – In to a resistance cluster. Excellent upside trade trajectory, very predictable in structure. Trade alerts from reports has been excellent – fantastic trade. 117.34 upside price target scenario 110.46 bearish same day Sept 6 time cycle peak. Video details the trading plan.

Pure Storage $PSTG – Earnings in 26 days, current trading structure explained on video. Price targets are 15.96, 19.23 in a sell-off 22.68 for Oct 1, bullish 25.85 and then 30.00 range same day. Over 22.58 is a long.

MAXIM $MXIM – Red lines on chart are historical support and resistance, over 65.00 long side trigger, main resistance 74.80, downside support 50 MA or 56.50 ish.

Autohome $ATHM – near support 92.20, time cycle just ending, careful with this one, not easy where it is, trading 96.44 intra 110.18 main resistance, downside sell off target scenario 74.25 area on chart and upside most bullish target possible is 110.50 and 128.40 Apr 2019 in large structure.

$BWA – Last report I alerted that the sell-off should be finished. Technically a perfect trade. Price target has been hit. Trading plan is other side of earnings a 46.60 trade alert alarm set for over 45.60 ish targeting 54.20 Jan 8, 2019 and to downside 42.81 is price target and 38.86 in a complete sell-off.

Global Lithium $LIT – Pinched between 20 MA and 100 MA and under main pivot. Possible sidewinder set up that is explained in video in large chart structure.

Boeing $BA – It is n the other side of earnings, threatening break-out but price is so far above 200 MA on weekly chart, so I don’t like it so much. However, Stochastic RSI is trending up again but MACD is not. Set alarm trade alert for when MACD turns for a review.

$BABA – Earnings in 23 days, price near structural pivot, SQZMOM green Stoch RSI trending down and a decision has to be made at 200 MA. 177 ish is downside price target in a sell-off scenario in advance of earnings which is very possible considering the last earnings dump (in to earnings). Trading plan details in video. No algorithmic model built for this yet however we are planning to when in next trade (when we get a retrace we will enter this trade). All equities we follow will get models in advance of machine trading for each.

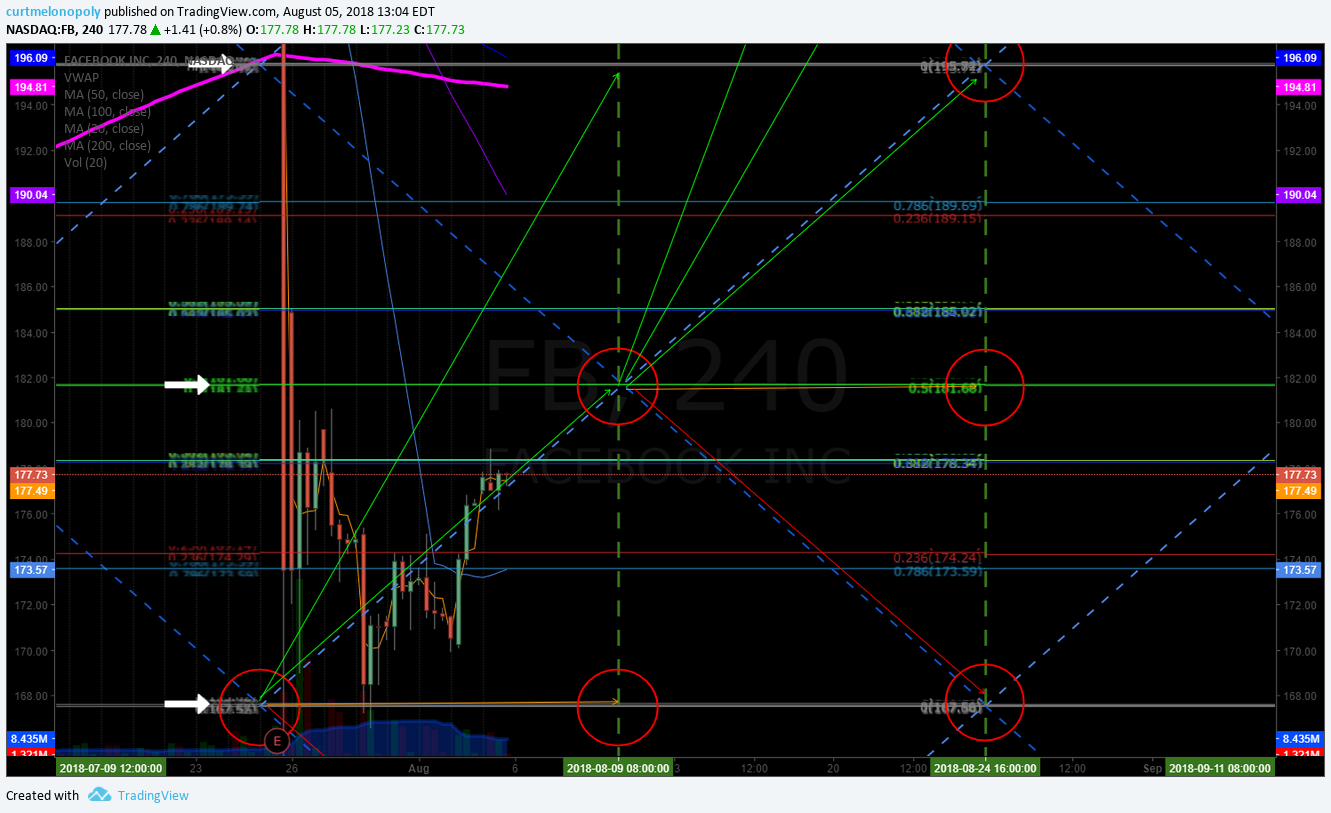

Facebook $FB – Last sell-off earlier in year we nailed it, it is again doing the same thing it did last time. Trading plan reviewed on video. Personal target 181.63 Aug 9. Various support and resistance levels on chart discussed on video.

#swingtrading #earnings #tradealerts

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me:

PreMarket Trading Plan Fri July 6: $NOC, $LMT, $SATS, $F, $TSLA, $BIIB, $BA, #OIL, $WTI, $USOIL, $NFLX more.

Compound Trading Premarket Trading Plan & Watch List Friday July 6, 2018.

In this edition: $NOC, $LMT, $SATS, $F, $TSLA, $BIIB, $BA, #OIL, $WTI, $USOIL, $NFLX and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

A light report today…. we’re working on the next gen models (the first machine coding models – exciting times) for release near end of July and a massive amount of swing trading updates (we wanted to wait for today’s economic scheduled news to roll out for the large part of swing updates).

The Cabarete Sept trade coaching event is near booked out FYI.

There will be increased alerts next week with Swing, Oil and Crypto as the coding team nears full integration.

Scheduled Events:

- Daytrading room now re-open to daytrading members as lead trader alerts via email. If you are not receiving notices please email us at [email protected].

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

https://twitter.com/CompoundTrading/status/1012166019765370881

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

18 Stocks Moving In Friday’s Pre-Market Session https://benzinga.com/z/11985592 $ANW $BIIB $VC $RGLS $PSMT $ABUS $GCI

18 Stocks Moving In Friday's Pre-Market Session https://t.co/tDbUIEhxhO $ANW $BIIB $VC $RGLS $PSMT $ABUS $GCI

— Benzinga (@Benzinga) July 6, 2018

Stocks making the biggest moves premarket: NOC, LMT, SATS, F, TSLA, BIIB, BA & more https://www.cnbc.com/2018/07/06/stocks-making-the-biggest-moves-premarket-noc-lmt-sats-f–more.html?__source=twitter%7Cinternational

Stocks making the biggest moves premarket: NOC, LMT, SATS, F, TSLA, BIIB, BA & more https://t.co/Ly4rsR8GSb pic.twitter.com/PnZCCfQl0S

— CNBC International (@CNBCi) July 6, 2018

Market Observation:

Markets as of 8:50 AM: US Dollar $DXY trading 94.10, Oil FX $USOIL ($WTI) trading 72.33, Gold $GLD trading 1254.64, Silver $SLV trading 15.98, $SPY 273.22, Bitcoin $BTC.X $BTCUSD $XBTUSD 6572.00 and $VIX trading 14.9.

Momentum Stocks to Watch: $ANW $BIIB $VC $RGLS

News:

Biogen Rallies On Positive Alzheimer’s Drug Trial https://benzinga.com/z/11985494 $BIIB

Recent SEC Filings:

Recent IPO’s:

Earnings:

$XPLR (rescheduled) $AYI $MLHR $ISCA $AZZ $PSMT

http://eps.sh/cal

We did not send an email out this morning because there are only a handful or so companies scheduled to report #earnings this week. $XPLR (rescheduled) $AYI $MLHR $ISCA $AZZ $PSMT https://t.co/lObOE0dgsr pic.twitter.com/VXjB1KD7Cj

— Earnings Whispers (@eWhispers) June 30, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

Members were told to expect pain and it played out almost exactly per guidance.

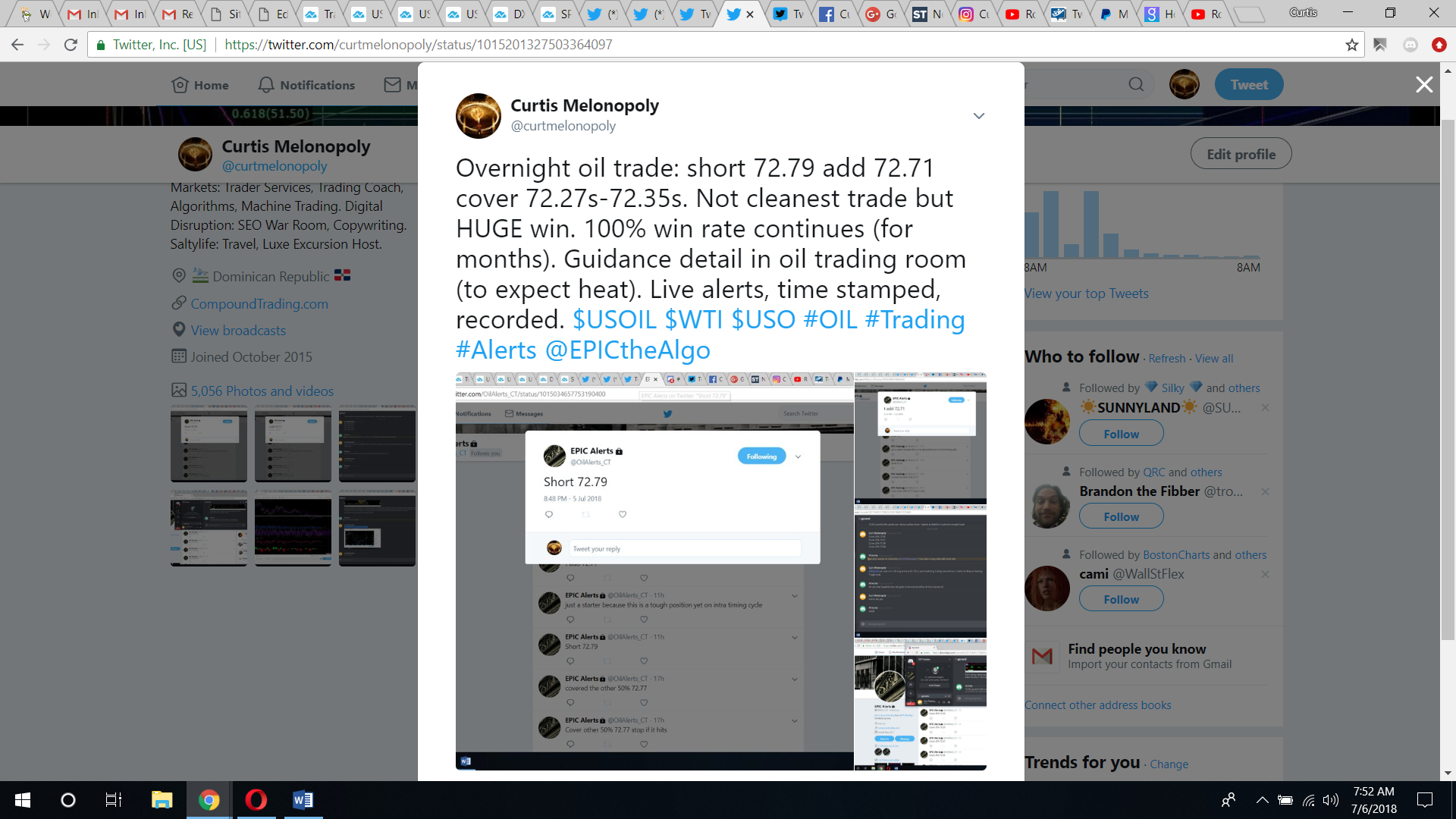

Overnight oil trade short 72.79 add 72.71 cover 72.27s to 72.35s. Not cleanest trade but HUGE win. 100% win rate continues $USOIL $WTI $USO #OIL #Trading #Alerts

74.60 area has been a challenge last few days for the oil bull. Hit 74.77 backed off trading 74.26 in premarket this morning. FX $USOIL $WTI $USO $CL_F $UWT $DWT #OilTrading #EPIC #OilAlgorithm

Member guidance "74.60 hits and i turn short term short bias" FX $USOIL $WTI hit 74.43 and in overnight futures has traded as low as 72.57. Trading intra 73.13. #crude #oil #trading #algorithm pic.twitter.com/InZFDh18Z6

— Melonopoly (@curtmelonopoly) July 2, 2018

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

AMERICAN EXPRESS (AXP) With the 50 MA coming to meet price, will price retrace like it did previous or break out. $AXP

VALEANT (VRX) Time cycle concludes July 9, time to have next trajectory on watch and trade it. $VRX #swingtrading #daytrading

Gold chart monthly – trade over 50 MA but out of simple structure to bearish side.

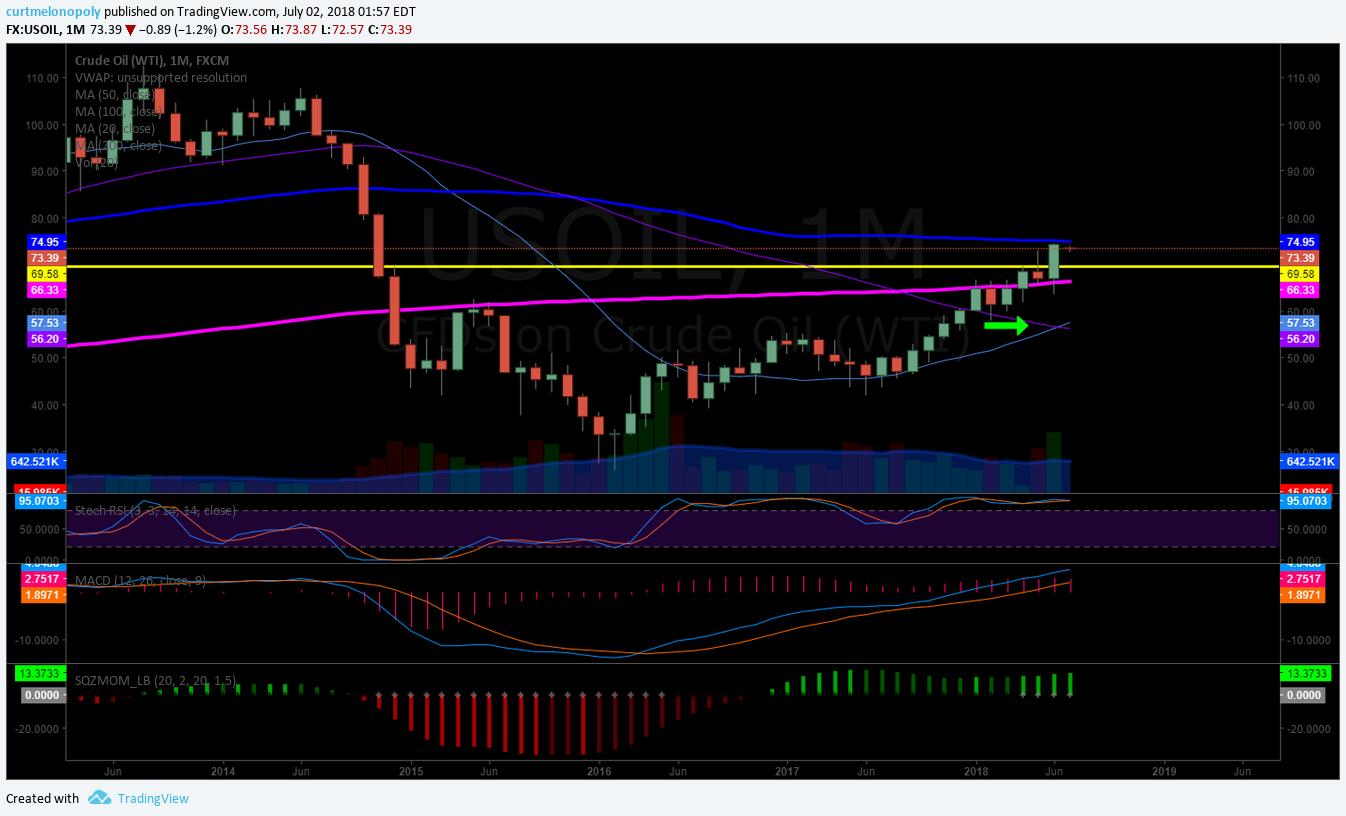

Oil Chart (Daily). K.I.S.S. chart MACD turned up and price above 50 MA (bullish). July 2 153 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Oil Chart (Monthly). Trade above pivot near 100 MA resistance July 2 157 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

SPECTRUM PHARMA (SPPI) Had a great day up 15.5% trading 21.90. Entries at the arrows. Long play. $SPPI #SwingTrading

DISNEY (DIS) Held mid quad support in sell off, bounce here targets 110.66 Sept 5. On high watch. $DIS #swingtrading

KARI THERAPEUTICS (AKTX) Under 200 MA but significant volume last few days. On high watch. $AKTX #stock #chart

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Friday

Economic Data Scheduled For Friday pic.twitter.com/ctqwGndGCG

— Benzinga (@Benzinga) July 6, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $BIIB $ITUS $ANW $AVXL $BBOX $HDP $TOPS $DCIX $RGSE

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $MANT $BIIB $SBUX

(6) Recent Downgrades: $CCL $COST $GCI $SLCA $PTEN $HCLP $CVIA $CJ $LKSD $ABUS

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $NOC, $LMT, $SATS, $F, $TSLA, $BIIB, $BA, #OIL, $WTI, $USOIL, $NFLX

PreMarket Trading Plan Thurs July 5: #OIL, $GBR, $DFBG, ,$ERJ, $BA, $TSLA, $NFLX more.

Compound Trading Premarket Trading Plan & Watch List Thursday July 5, 2018.

In this edition: Oil, $USOIL, $WTI, $ERJ, $BA, $TSLA, $NFLX, $GBR, $DFBG, $FCAU, $QRVO, $VALE, $ZYNE, $AMSC, $INFY, $SNE and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Daytrading room now re-open to daytrading members as lead trader alerts via email. If you are not receiving notices please email us at [email protected].

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

https://twitter.com/CompoundTrading/status/1012166019765370881

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

28 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/11980086 $GBR $DFBG $FCAU $QRVO $VALE $ZYNE $AMSC $INFY $SNE

https://twitter.com/CompoundTrading/status/1014851246619090944

Stocks making the biggest moves in the premarket: $ERJ, $BA, $TSLA, $NFLX & more https://www.cnbc.com/2018/07/05/stocks-making-the-biggest-moves-in-the-premarket-erj-ba-tsla-nflx-.html

https://twitter.com/CompoundTrading/status/1014852983606083584

Market Observation:

Markets as of 8:50 AM: US Dollar $DXY trading 94.23, Oil FX $USOIL ($WTI) trading 74.18, Gold $GLD trading 1255.64, Silver $SLV trading 16.04, $SPY 272.35, Bitcoin $BTC.X $BTCUSD $XBTUSD 6339.00 and $VIX trading 15.1.

Momentum Stocks to Watch: $GBR, $DFBG, ,$ERJ, $BA, $TSLA, $NFLX

News:

Recent SEC Filings:

Recent IPO’s:

Earnings:

$XPLR (rescheduled) $AYI $MLHR $ISCA $AZZ $PSMT

http://eps.sh/cal

We did not send an email out this morning because there are only a handful or so companies scheduled to report #earnings this week. $XPLR (rescheduled) $AYI $MLHR $ISCA $AZZ $PSMT https://t.co/lObOE0dgsr pic.twitter.com/VXjB1KD7Cj

— Earnings Whispers (@eWhispers) June 30, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

74.60 area has been a challenge last few days for the oil bull. Hit 74.77 backed off trading 74.26 in premarket this morning. FX $USOIL $WTI $USO $CL_F $UWT $DWT #OilTrading #EPIC #OilAlgorithm

Member guidance "74.60 hits and i turn short term short bias" FX $USOIL $WTI hit 74.43 and in overnight futures has traded as low as 72.57. Trading intra 73.13. #crude #oil #trading #algorithm pic.twitter.com/InZFDh18Z6

— Melonopoly (@curtmelonopoly) July 2, 2018

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

AMERICAN EXPRESS (AXP) With the 50 MA coming to meet price, will price retrace like it did previous or break out. $AXP

VALEANT (VRX) Time cycle concludes July 9, time to have next trajectory on watch and trade it. $VRX #swingtrading #daytrading

Gold chart monthly – trade over 50 MA but out of simple structure to bearish side.

Oil Chart (Daily). K.I.S.S. chart MACD turned up and price above 50 MA (bullish). July 2 153 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Oil Chart (Monthly). Trade above pivot near 100 MA resistance July 2 157 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

SPECTRUM PHARMA (SPPI) Had a great day up 15.5% trading 21.90. Entries at the arrows. Long play. $SPPI #SwingTrading

DISNEY (DIS) Held mid quad support in sell off, bounce here targets 110.66 Sept 5. On high watch. $DIS #swingtrading

KARI THERAPEUTICS (AKTX) Under 200 MA but significant volume last few days. On high watch. $AKTX #stock #chart

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

INTRA CELLULAR (ITCI) Trading at key support (mid quad Fib) watch for directional swing trade to next target $ITCI #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Thursday

Economic Data Scheduled For Thursday pic.twitter.com/1MrJi42gjM

— Benzinga (@Benzinga) July 5, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ANW $DFBG $XPLR $GBR $LBIX $VLRX $SBOT $KL $MNGA $HMNY $MXC $ISCA $FTK $SAEX $FCAU $BBVA $AU $AXON $GSV $TKC $VEON $DB $TEF $MU

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $HLX $FCAU $ZNH $CEA $QRVO $KOS $BIP $AEIS $KOS $HXL

$FB Facebook stock gains after BTIG hikes target to $275

(6) Recent Downgrades: $CLNE $NEP

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Oil, $USOIL, $WTI, $ERJ, $BA, $TSLA, $NFLX, $GBR, $DFBG, $FCAU, $QRVO, $VALE, $ZYNE, $AMSC, $INFY, $SNE