Tag: Daytrading

White Paper Updated Dec 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

85%+- Returns: Real-World Trade Performance and Why ROI Is Expected to Grow.

December 29, 2019 2:35 PM EST EPIC v3 Oil Trading Software Update.

Updates for this document series can be found here:

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

Draft white paper outlining key reasons EPIC v3 oil futures machine trading software outperforms conventional trading methods:

- Lightening Fast Decisions. EPIC crude oil trading software executes trades to over 8700 weighted decisions instantly. The instructions provided within the architecture is growing daily. A human trader cannot make decisions as quickly, cannot process the data required for most intelligent trading probabilities and cannot execute trades as precisely.

- Algorithmic Chart Models. The EPIC software includes over thirty proprietary algorithmic chart models and the catalogue is growing. The algorithmic models have been designed, tested and refined in real-world trade for over 3 years by a team of day traders, each with over 20 years of experience. The oil trading models represent all time-frames from 15 second to monthly time-frames of trade. The algorithmic models have been back-tested to sixty months historically.

- Conventional Charting. The software includes conventional charting structures on all time-frames, also back-tested sixty months.

- Common Trade Set-Ups. Included in the software are common trade set-ups that oil day traders implement. This is dynamic and additions are made regularly to the software code reflecting current structured trade set-ups.

- Order Flow. EPIC IDENT™ is data-driven order flow intelligence in real-time to achieve best outcomes.The software includes and executes to a proprietary order flow identification system that tracks behavior (specifically isolating other market machine liquidity) and weighs identified entities and historical trade patterns to its trade decisions (instructions). EPIC IDENT™ increases its intelligence as it gathers data intra-day specific to liquidity flow, historical patterns, time of day, volatility, various preferences, latency, rejects and more. The method is similar to back-testing charting, however, the process is real-time. In short the software is looking for “fingerprints” within market liquidity. We cannot back-test 60 months as with charting but back-testing from date of software inception is possible.

- Time Cycles. Time cycles are within all algorithmic and conventional trading model structures, order flow also has identified time cycles and other time cycle events such as weekly reporting in oil markets such as API, EIA and rig counts. Additionally there are time-of day market time cycles around the world. Time-cycles are included in the software architecture.

- ROI Trajectory “Game”. The software has a “game” element in that it is designed to continue its most recent ROI trajectory (or return to its trajectory of ROI should it have a draw-down period). In other words, if the trajectory of ROI is for example 100% and it draws-down to 80% it then will “weigh” trade decisions more to the most probable trade set-ups until the ROI trajectory is returned. It also will push its decision “weight” to exceed the current ROI trajectory to establish a better ROI to which it is then “obligated” to maintain and correct to, hence the expectation that the ROI will continue to improve over time. This is the “machine learning” component of development. We are finding that the software is discovering increasingly more creative ways to “game” the ROI return trajectory. This Sept 4, 2019 document details an insider look at this topic within development. Edited Sept 5, Draw-Down Oil Daytrading Session: Question and Answer Review | EPIC V3 Crude Oil Machine Trading Software.

Combined, these advantages enable the EPIC v3 Crude Oil Trading software to outperform conventional trading methods.

Introduction.

The world of public market trade is rapidly changing. It is estimated (depending on source) that over 80% of crude oil futures are not traded by humans and are now traded by machine.

Machine trade may be simple bot style software, high-frequency software or more sophisticated architecture as with the EPIC v3 class of algorithm.

Our team commenced the oil trading software development journey four years ago with algorithmic chart model development. From day one we employed computer scientists to work with us on a daily basis to build software emulating our trading methods.

Over time the software started to win more trades than our traders and today we rely almost solely on the software to execute trades. We simply “tweak” the software at each trade sequence to improve performance.

EPIC v3 software is our 3rd generation oil trading software. EPIC v1 tested returns at about 20% per annum, EPIC v2 at 40% per annum and EPIC v4 architecture was too aggressive for our risk threshold. We settled on EPIC v3 about ten weeks ago and have been refining its code trade by trade since.

The current EPIC v3 win-rate consistently comes in at +-90% per trade sequence (variable by +-7%).

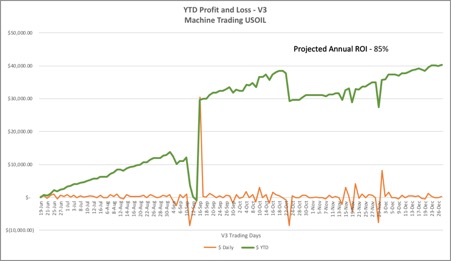

The current EPIC return is projected at 85% per year (and has been as high as 140%) – based on real world performance (audited trades available) and is expected to increase over time. The current period of time spans approximately six months and includes hundreds of trade executions (nearing thousands).

For December 27, 2019 Profit & Loss Daily =$331. YTD +$40,275. Projected $84,973 or 85% Per Annum. EPIC v3 Oil Machine Trade 100k Sample Account (live video, time stamped alerts, v3 audited P&L available) #OOTT $CL_F $USOIL $WTI $USO #oiltradingroom #oiltradealerts

https://twitter.com/EPICtheAlgo/status/1211013973329485824

For October 4, 2019 Profit & Loss Daily +$1,838. YTD +$34,218. Projected $140,331 or 140% Per Annum. EPIC v3 Oil Machine Trade 100k Sample Account (live video, time stamped alerts, v3 audited P&L available) #OOTT $CL_F $USOIL $WTI $USO #oiltradingroom #oiltradealerts

Account Size – ROI and Draw-Down Volatility.

The smaller the account size traded the more difficult it is for the software to limit risk to down-side and provide optimum returns, however, most recently considerable advancements in the software should limit the draw-down with smaller accounts considerably.

The software is designed to trade within a sequence of trade within structures or set-ups. As the oil market price changes, the software trading logic uses all the different data to update the decision tree utilizing the instruction rule-set.

You can imagine this as a dot plot process similar to the game “go” – not exactly, but the concept helps to visualize how the software plots a sequence plan for trade.

The “ebb and flow” of regular oil market trade allows opportunity for the software to plot a plan of trade within a sequence, the larger the account the more dots can be plotted (trades can be “bite sized” entries within an “ebb and flow”).

The sample account size for the purpose of this document is at the smallest range, being 100,000.00. A 1,000,000.00 account would expect approximately half the volatility / draw-down exposure and up to 50% more return. A 10,000,000.00 account would be considerably more stable to draw-down risk and potential returns and so on.

Draw-down Protocol.

During any particular 24 hour trading period the EPIC v3 software protocol (as of October 6, 2019 updates) expects on average draw-down no more than as follows;

- Account size and average 24 hour drawdown 10,000,000.00 = 1.5 %, 1,000,000.00 = 3%, 100,000.00 = 6%, 50,000.00 = 12%, 25,000.00 = 24%.

Hard stop architecture is also available, however, the annual expectation of returns would be significantly less than represented in the current real-world trade example above.

Real-World Trader / Investor Use.

In real-world examples the EPIC v3 oil trading software is being used daily by oil traders as an additional indicator and / or as an auto trading mechanism.

Examples include the Compound Trading Group live oil trading room (live broadcast of trades via voice and charts), live alert service via Twitter and Discord private server feeds and regular Oil Trading Reports that include algorithmic and conventional chart structures and guidance.

Additionally, SOVORON™ uses our data flow to integrate to their platform. SOVORON™ ‘Algorithmic machine trading of your personal Crude Oil Futures exchange account’. See www.sovoron.com for information.

Architecture of API Trade.

EPIC v3 software is designed to be deployed remotely – accessing an account and executing trades. This provides the account holder with ultimate control. The account holder grants the software access and the software executes machine trades to the account. The account holder can turn on or off access at any time. Architecture provides opportunity for decentralized platform integration.

Documentation.

Video. Our team traders and engineers have live video recording of the trading sessions with EPIC v3 software within a trading room environment.

Trader and Developer Repository. We provide guidance to our subscriber (paywall) clients in a Discord private server (charts and trade set-up explanations) in a real-time environment. The private server acts as a repository for our developers and our trading service (paywall) clients.

Live Trade Alerts. All trades have been broadcast over mic in a live trading room (recorded as mentioned above) and most have been alerted by way of text instruction to the Discord private server and/or private Twitter feed for time-stamped evidence.

Broker Accounts. The EPIC v3 trades are real-world trades and as such broker profit and loss statements can be made available.

Client Reporting. We provide regular reporting to our trading service clients (paywall) that explains the process of execution by the software. Examples of the guidance provided, trade alerts issued, Discord private server discussions and live trading room video can be found in this document (which is one of many published) Daytrading Crude Oil in Oil Trading Room: 6 Trades, 6 Wins. How We Did It | Alerts, Strategies, Video, Charts. This document provides a standard update document provided to our clients Protected: Crude Oil Trading Report Strategies | Alerts, Signals, Charts, Algorithms, Trading Room, P&L | Premium | Sept 2, 2019 use password CLTRADER.

Conclusion.

This paper outlines the opportunity that change in machine trade within global finance markets presents.

Competitors within the machine trade industry are becoming more and more refined / successful – the best in class are assumed to be winning a larger portion of proceeds.

The most significant immediate challenge developers face in machine trade within financial markets is building a product that can win within a prescribed threshold of stability limiting down-side and yet over-perform conventional trading methods.

Soon thereafter the challenge becomes competing against “like-kind” machine trade peers and being best in class.

It is our expectation that fewer and fewer competitors will achieve more of the proceeds (as a whole of trade in public markets) at an exponential rate, which does provide urgency to development and deployment.

The EPIC v3 trading software achieves consistent, predictable and very adaptable architecture that provides exceptional ROI potential.

Business Inquiries.

For information about oil trade alerts, oil trading room and oil trade reporting contact Compound Trading Group at [email protected].

For information about automated machine trading platforms contact our agent representative Richard Regan as follows:

CONTACT US

Email [email protected]

Phone 1-849-861-0697

Follow

document revised September 24, 2019 9:22 PM EST

document revised October 6, 2019 2:00 PM EST

document revised December 29, 2019 2:35 PM EST

Others in this document series can be found here:

- December 10, 2023: EPIC Update: v6.1.1 Machine Learning Trade Software – Final Protocol Real World Results

- June 3, 2023: EPIC v4.1.1 Crude Oil Machine Trade Software White Paper | June 3, 2023

- March 28, 2022: EPIC v3.3 Crude Oil Machine Trade Software White Paper | March 28, 2022 Update

- January 7, 2021: EPIC v3.1.5 Crude Oil Machine Trade Software White Paper | Updated January 11, 2022 w/ Trade Execution Data

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

- December 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading

Article Topics; Crude, Oil, Trading, Algorithm, Machine Learning, DayTrading, Futures, EPIC, Trade Alerts, Oil Trading Room, $CL_F $USO

Edited Sept 5, Draw-Down Oil Daytrading Session: Question and Answer Review | EPIC V3 Crude Oil Machine Trading Software

Summary Review – Answers For Questions Received About EPIC V3 Draw-Down in Oil Trading Room Today.

Please Note: There is an edit revision below that includes a question and answer session for Sept 5, 2019 that provides significantly more detail.

As the trading day progressed and we broadcast our trades in the live oil trading room today we received a number of questions by way of email and direct message. Below is an oil trading room review summary.

We did not have time to respond to the questions during the trading day as we were working with the machine trading software (coding).

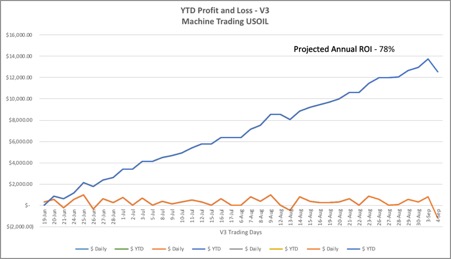

Today the software had a larger than normal draw-down shorting against a rally in crude oil trade. Below is the daily profit and loss chart.

For September 4, 2019 Profit & Loss Daily -$1,205 YTD +$12,559 Projected $77,696 or 78% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts

The sequence the software was triggering trades to was a new sequence. When a new sequence activates the first go-round is often a loss, albeit normally less than today’s.

On the second or third go-round you will find that the software will win and continue to win better each time or it simply will not re-engage that same sequence.

The draw-down amount will normally be less as I mentioned, however, draw-downs will occur.

Nevertheless, the EPIC v3 crude oil trading software is extremely stable for a number of reasons, below are some of those reasons.

- If you look at the ROI trajectory for the software you will find that when draw-downs occur that the software will self-adjust its risk threshold to maintain the minimum trajectory.

- The software catalogs its trading set-ups, some set-ups it near never loses, some rarely, some not so rare. The point is, the software is coded to self adjust its minimum achieved ROI trajectory (correct it) as needed. In other words, it is coded to correct its minimum achieved trajectory by way of risk-threshold. To be more clear, it will be sure it self adjusts (wins) and how it is coded to do that is to bias its trade executions to its more probable set-ups.

- Its current ROI trajectory is between 80% – 90% approximately, you will see the software self-adjust its trade executions to more probable set-ups until that minimum trajectory is returned.

- Each time the trajectory is returned to the minimum average it will engage higher risk to learn trade set-ups. This process will continue and repeat over and over again. Over time the trajectory should increase on average as a result.

- The risk threshold of v3 vs v4 is much less aggressive (draw-downs and gains are considerably less volatile) and days like today will be few and far between because (as explained above) it will self-adjust back to the minimum ROI trajectory via the most probable trade set-ups of which it has some now that literally it very never loses if at all. It can rely on the catalog of those set-ups to adjust.

I can’t stress enough that the v3 software is not anywhere near similar in aggressiveness to the v4 version. This version is coded to avoid volatility, avoid large draw downs, and self adjust its risk threshold via high probable set-ups to snapiback to its minimum ROI trajectory as needed.

Watch the software over the next number of days and you will see it return to its minimum average trajectory and then you will see it take new sequence trade set-ups and the process will continue to repeat over and over.

If the software did not have trade set-ups (sequences) that it wins at near 100% of the time none of the above would apply.

Any questions about the detail of code architecture feel welcome to send us questions anytime so we can publish responses for our stakeholders to review as needed.

Below is an update. After the original blog post was released we had a few more questions come in that I would add answer to below. What I have done is copy and pasted the conversation below.

September 5 2019 Update: Oil Trading Room Review: Question and Answers EPIC V3 Software Protocol

[6:54 PM, 9/4/2019] Question: I still don’t understand that in some of the big moves the software fires opposite to the direction of the move but something we can talk about on Saturday

[7:22 PM, 9/4/2019] Answer: easy answer

[7:22 PM, 9/4/2019] Answer: if you look at the chart the price has come way off

[7:22 PM, 9/4/2019] Answer: software had order flow right

[7:23 PM, 9/4/2019] Answer: execution of sequence needs tweaking

[7:23 PM, 9/4/2019] Answer: same as when it gets the bottoms in sell offs, it used to struggle with that

[7:23 PM, 9/4/2019] Answer: as far as why it didn’t trigger with the rally….

[7:24 PM, 9/4/2019] Answer: thats simple too

[7:24 PM, 9/4/2019] Answer: order flow is random in a rally like that, it will near never trigger mid rally in rally’s induced by news, no predictable order flow data

[7:24 PM, 9/4/2019] Answer: short covering and retail daytrader trade causes the majority of the rally, no structure

[7:25 PM, 9/4/2019] Answer: so the key is it triggering on the predictable wins to maintain ROI trajectory and as time goes on slowly learning other set ups

[7:25 PM, 9/4/2019] Answer: i should have put this in the original blog post report

[7:26 PM, 9/4/2019] Answer: i will do an addendum / update report

[7:27 PM, 9/4/2019] Question: I understand why it would not fire in the big moves because of lack of structure and order flow

[7:27 PM, 9/4/2019] Question: I just don’t understand why when there is a big move down it is firing long and when there is a big move up it fires short

[7:27 PM, 9/4/2019] Answer: we tried to code a trajectory trade sequence for rally’s on news but we couldn’t get the code, too random

[7:28 PM, 9/4/2019] Question: Yes that makes sense to me

[7:28 PM, 9/4/2019] Answer: because its catching the end of the move to turn the other way, next in the code is to get it to hold some size through the reversal

[7:29 PM, 9/4/2019] Answer: the essence of the development right there, step one is code the reversal step two code the middle of the move, the middle is much more complicated to code

[7:30 PM, 9/4/2019] Question: Ahhh okay

[7:31 PM, 9/4/2019] Answer: the order-flow at the reversal is where the trading edge is…. seeing the order-flow pattern of the other machine liquidity on the IDENT program starting to turn for the reversal, thats why the machine trade software nails near 100% of the turns up in price on intraday trade after a sell off, but to get the sell-off you have to get the reversal like it was trying to do today and then you’re golden

[7:31 PM, 9/4/2019] Question: Okay yes I understand that now

[7:31 PM, 9/4/2019] Answer: its all about being able to get the reversal first, thats where the predictability is

[7:32 PM, 9/4/2019] Answer: once you have the sequence for the reversal then you can start on the middle core of the trade, we have the sell off reversal perfected and now we’re working on the middle of the move

[7:32 PM, 9/4/2019] Answer: the reversal after a rally to the short side still needs work, they’re different (reversal at top and reversal at bottom intraday)

[7:34 PM, 9/4/2019] Answer: without the reversal right its impossible to get the rest, the reversal is where you have to plant your trade, start your trade for high win rate probability, nothing else provides a high probability scenario that can be duplicated time after time

[7:34 PM, 9/4/2019] Answer: hope that helps

[7:34 PM, 9/4/2019] Question: Yes I get that now

[7:34 PM, 9/4/2019] Answer: good questions for the report update, doesn’t hurt to share

[7:35 PM, 9/4/2019] Question: You want to get the top of the rally

[7:35 PM, 9/4/2019] Answer: what happens in the middle is too random so if you get the top of a rally or the bottom of a sell off for the reversal and get your size in place then you have the trend to make the next turn

[7:36 PM, 9/4/2019] Question: But what is telling the software it is at the top when it really isnt and so it keeps firing short when the rally has not ended. That’s what I wanted to understand

[7:36 PM, 9/4/2019] Answer: its the bottoms and tops that have clear predictability, hence why we have the near 100% win rate on sell off reversals, but the rally tops are a different sequence that we’re working on

[7:37 PM, 9/4/2019] Answer: it was firing in to the top today, it nailed the top of the rally, it was firing 56.12 to 56.50, and then it came off to 55.90, its the same as the sell off bottoms, it trades them the same way, same concept, different sequence

[7:38 PM, 9/4/2019] Answer: that wasn’t the problem

[7:38 PM, 9/4/2019] Question: That makes sense. Because I remember you working on the bottoms of the sell off and now have that nailed

[7:38 PM, 9/4/2019] Answer: the problem is the sequence that it uses to gain size at the top and hold for the sell off reversal after the rally is the challenge we were working on

[7:38 PM, 9/4/2019] Answer: the sequence at tops is different than at bottoms

[7:39 PM, 9/4/2019] Question: Yes that makes sense to me

[7:39 PM, 9/4/2019] Answer: we have the bottom sequence perfected for the turn up after the sell-off, in that scenario we are now working on the sizing so that it holds some in the reversal rally

[7:39 PM, 9/4/2019] Answer: but the secret is this…

[7:40 PM, 9/4/2019] Answer: the only way the code wins near 100% of the time, the only way that is possible is at the reversals, reversal of a rally or reversal of the sell off

[7:40 PM, 9/4/2019] Answer: thats how the others that are winning have done it, we can see it in the order flow, its precise and repeatable over and over again

[7:41 PM, 9/4/2019] Answer: the middle of the move isn’t that way, it is random

[7:41 PM, 9/4/2019] Question: Okay I understand much better now

[7:42 PM, 9/4/2019] Answer: so if you have an ROI trajectory at say 85% and your code is nailing every bottom the only way to increase the ROI is to nail the tops or get your size better at bottoms for more profit in the move

[7:42 PM, 9/4/2019] Answer: so slowly we’ll work on nailing the tops for reversals and slowly work on holding more size when we’ve nailed the bottom reversals to increase ROI

[7:43 PM, 9/4/2019] Answer: when we lose as we develop those scenarios those trades won’t trigger (the software learning will stop) and the predictable set ups only will trigger to keep the 85% ROI at minimum (or whatever the ROI trajectory is at)

[7:44 PM, 9/4/2019] Answer: we have more than just the bottom reversals after a sell off in the ammo, but i think you get my point

[7:44 PM, 9/4/2019] Answer: there’s daytrading set ups it triggers to all the time, small wins intraday

[7:44 PM, 9/4/2019] Question: Makes sense

[7:45 PM, 9/4/2019] Answer: its just that today was a mathematically very large rally to which you see a larger than average loss, thats why i know that scenario will be very few and far between, very rare

[7:46 PM, 9/4/2019] Question: Yes that was an unusually large move in price

[7:46 PM, 9/4/2019] Answer: so its about risk management when it goes wrong and when it does the software / development team stopping the learning and software only trades what we know wins until trajectory of ROI is back in play (returned to its regular trajectory)

[7:46 PM, 9/4/2019] Answer: 3 days of trading and the previous ROI trajectory will be back at 85% – 90% and then as it learns the trajectory will turn up because the software now has more set-ups to trigger on that it wins consistently, at current level it is maxed out at about 90% ROI so it needs to add to its catalog of set-ups to increase ROI trajectory, the learning is where you will have short term draw-downs

[7:46 PM, 9/4/2019] Question: Yes that’s good

And remember, if you are struggling with your trading and need some trade coaching go to our website and register as needed.

Email me as needed [email protected].

Best and Peace,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Oil Trading Newsletter (Member algorithmic and conventional charting).

Oil Trading Alerts (Private Twitter feed and Discord server).

Oil Trading Room (Bundle: newsletters, trading room, charting and real-time trading alerts).

Commercial / Institutional Multi User License (For professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, profit loss, coding, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL