Tag: time cycles

Premarket WatchList $VIX $BTC $SPY $GLD $SLV $DXY $WTI $USO #timecycles #swingtrading

Premarket WatchList $VIX $BTC $SPY $GLD $SLV $DXY $WTI $USO #timecycles #swingtrading

Good morning traders,

All trade set-ups on watch or alerted are starters in to time cycles that may or may not run in trajectory to bias, they can go completely the opposite direction, hence the “starter” positioning until said trades develop. Different trades / instruments have different time cycles, refer to historical swing reporting as needed for various notes and charting models. We have been working on the report all night and will release it when it is ready, until then the alerts are flowing. Lots of caution with the upcoming time cycles because everything cray cray everywhere (not just me), the world is not amenable to the buy and hold conventional thesis in my opinion, going forward. We see range, lots of range coming.

We cover over 200 equities, many of which will be in play, on watch etc that we will alert.

Have a great weekend, hug em tight and buckle up.

Anything I can do shoot me a note.

Best and peace.

Curt

Swing trade time cycle magic rolling out now for new time cycles, ask for a personal tour of the time stamped alert feed and tell me i'm wrong, tell me we don't have a crystal ball, but don't cry when you miss $VIX $BTC $SPY $GLD $SLV $DXY $WTI $USO #timecycles #swingtrading

— Melonopoly (@curtmelonopoly) September 20, 2019

PREMARKET NOTES: EIA, FOMC, Time Cycles, Leaks, Lambos and Fine Cigars.

PREMARKET NOTES

RE: EIA, FOMC, Time Cycles, Leaks, Lambos and Fine Cigars.

Good morning traders!

It’s EIA day with 10:30 crude inventories, FOMC crazy and me fightin’ with GuruLeaks1 again.

Swing reporting did not get completed, yes once again sorry, but Jen and Nikki have committed their evening to be sure I don’t get distracted again and we’re going to finish up the new set ups for this time cycle tonight. Many thanks for your patience.

Don’t believe anything I put out to the world on my personal Twitter, we appreciate each and one of you and are grateful for you choosing us.

I just don’t like everyone else much.

Time to make some money, buy a new lambo, buy some fine cigars, and rock this thing.

See ya in the trading room but likely won’t be trading until EIA rings the bell of the sardines caught in the headlights of the casino lights at 10:30 AM.

On mic in room when actually trading and just prior to regular US open at 9:30.

Big day, yuge time cycle and we’re pumped for battle.

I feel 19 again.

Best and Peace,

Curt

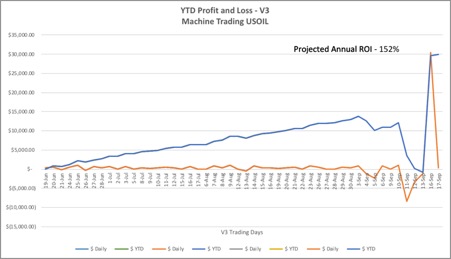

For September 17, 2019 Profit & Loss Daily +$346 YTD +$29,916 Projected $151,659 or 152% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded, live video, alerts, broker statements available) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts pic.twitter.com/dRnvTTaNA3

— Melonopoly (@curtmelonopoly) September 18, 2019

Important Premarket Trade Room Schedule / Market Time-Cycle / Alerts / Reporting Notes

Important Premarket Trade Room Schedule / Market Time-Cycle / Alerts / Reporting Notes

Morning traders,

Live trading room will be down until some time later today (internet company has to move our fiber line, they were to be here Saturday but put us off to Monday). Location move delay. The minute the line is in we’ll be up live and I’ll send out an alert to members. ETA 1:00 PM EST today. Alerts and machine trade are not affected. We’re on back-up mobile system until they arrive.

Remember this week is time cycle peak (allow a week either side) and the next is Oct 21. Watch the trend coming out of this week.

Swing trade reporting will consistently increase now outside of Sept 9 week in to next time cycle. It is possible the direction of trade / trajectory of implied models will be completely opposite in this cycle so watch the alerts / reporting closely. Either way, its a significant cycle.

Go easy today, my suspicion is that whipsaw will be the theme during this time cycle peak for about a week.

Any questions let me know,

Thanks!

Curt

Important Market and Service Updates: Webinars, Reporting, Time Cycles, Live Room, P&L’s, Promos Etc…

Good afternoon Traders,

As we gear up for another trading week in advance of our larger prep for the fall season I thought it best to provide you a quick update on our plans, scheduling etc.

We see a significant opportunity (time cycles) from now and in to the late fall 2019 season in Equities, Commodities, Bitcoin etc. The reporting schedule and webinars we are hosting should do well to prepare our members to take full advantage of it.

Reporting Schedule This Week (estimated release dates for premium member reporting, dates are evening of in to next morning).

Aug 18 – VIX (including time cycles)

Aug 18 – SPY (including time cycles)

Aug 18 – Swing Trading (swing trade members will also receive various other time cycle reporting as it comes available).

Aug 18 – Feature Oil Trading Strategy Article

Aug 19 – Crude Oil (EPIC Algorithm regular report)

Aug 19 – Feature Oil Trading Strategy Article

Aug 20 – Bitcoin (including time cycles)

Aug 20 – Feature Oil Trading Strategy Article

Aug 21 – Gold (including time cycles)

Aug 21 – Silver (including time cycles)

Aug 21 – Feature Oil Trading Strategy Article

Aug 22 – DXY US Dollar (including time cycles)

Aug 22 – Feature Oil Trading Strategy Article

The week of Aug 18 and in to fall will also bring various other various swing trade and time cycle reporting to the various services.

Upcoming General Public Free Webinars.

Crude Oil Webinar – Machine Trade Informational. Topics Include; YTD Machine Trade Profit and Loss Performance, Development Process and What Is Planned Going Forward. 7:00 – 7:45 PM EST Sunday August 25. Register by emailing [email protected].

Crude Oil Webinar – How to Use Our Platform. Oil Trade Alerts, Live Trading Room, Private Discord Server Oil Trade Set Up Guidance, Algorithm Models & Conventional Charting. 8:00 – 8:45 PM EST Sunday August 25. Register by emailing [email protected].

Upcoming Premium Member Only Webinars.

Crude Oil Trade Strategy Webinar – A Review of Oil Trade Set Ups for The Week. 9:00 – 9:45 PM EST Sunday August 25. Register by emailing [email protected]. No cost to and access only to premium Crude Oil service members.

Swing Trading Set-Ups Webinar – A Review of Swing Trading Setups for The Upcoming Week (including time cycles). 10:00 – 10:45 PM EST Sunday August 25. Register by emailing [email protected]. No cost to and access only to premium Swing Trading service members.

Members that cannot attend live will receive a video copy and featured report of the webinar.

Trading Profit and Loss Updates.

2019 Swing Trading Status: Our swing trading platform has had an exceptional year, we’re running our regular 100%+ annual returns (over last 3 years) varied depending on the type/ category of swing trade, Jen has a full report in the works for members to review. As mentioned above, with the large time cycle peaks coming in to the fall we expect a bang up fall swing trade season.

V3 EPIC Oil Algorithm Machine Trade P&L Status: We couldn’t be more pleased with the v3 oil machine trade software. It has been running for about 5 weeks and it is exceeding our expectations. The most encouraging part is that its code is still in its early stages of real-world testing – the projected ROI trajectory is expected to continue to turn-up with no additional downside risk – v3 is an extremely stable machine trading architecture. As we near the 8 week real-world running time-line the mathematical probability of it having any notable issues are near zero (at 5 weeks we’re near there now). It took some time, grit and investment, but we’re there now.

“For Aug 15, 2019 Profit & Loss: Daily +$355 YTD+$9,185 Projected $85,958 or 86% Per Annum. v3 Oil Machine Trade 100k Test Account (v4 period excluded) #OOTT $CL_F $WTI $USO #machinetrading #oiltradealerts”

For Aug 15, 2019 Profit & Loss: Daily +$355 YTD+$9,185 Projected $85,958 or 86% Per Annum. v3 Oil Machine Trade 100k Test Account (v4 period excluded) #OOTT $CL_F $WTI $USO #machinetrading #oiltradealerts pic.twitter.com/WlVVCbOlqZ

— Melonopoly (@curtmelonopoly) August 15, 2019

Password Access to Trading Rooms, Private Alerts, Discord Servers.

We have been slowly changing / updating passwords and access to various services. If you are a premium member and you are locked out of any service you are subscribed to (trading room, alert feed, private server, etc) or do not receive a report that you see posted to main Compound Trading Twitter feed (that you should be receiving), please let us know so we can rectify.

Promotions.

There is a current promotion running for new member trials, receive 50% off first month of any service list price. Use promo code “TRIAL50” when checking out (if you have issue with the promo code email us and we’ll send you another by email). If you have registered recently at full price and did not take advantage of this email Jen [email protected] and she will invoice your next month renewal at 50% off. This is only available to first time subscribers and cannot be used with other discounts.

If you need some trade coaching go to our website and register for a minimum 3 hours – it usually books out for the fall so register soon if you’ve been throwing the idea around.

Email me as needed [email protected] and remember, the webinars listed above require you to register in advance by sending us an email of your interest in attending.

Thanks,

Curt

Subscribe:

Click Here for Subscription Service Price Tables.

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Crude Oil Trading Academy: A Selection of Unlocked Oil Trade Strategy Articles from Our Traders:

Recent Swing Trade and Day Trading Reports (charts can be brought down to Day Trading time frame):

Recent Premarket Notes (published as time allows):

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Machine Trade, Alerts, Swing Trading, Live Trading Room, Oil, BTC, SPY, VIX, DXY, GOLD, SILVER, Webinars, Promos, Reporting, ROI, Profit & Loss, Time Cycles, Trade Coaching

How to Trade US Dollar Index (DXY) Large Time Cycle in to Week of August 5 #USD $DXY $UUP #tradealerts #swingtrading

Trading Strategy for US Dollar Trade Alert Issued This Morning in Premarket for the Swing Trade Positioning in to Week of August 5, 2019 Time Cycle.

This a very important trading opportunity not just for the US Dollar, but many other instruments of trade on the equity, commodity and currency markets are affected by the price of the US Dollar. Below is your complete trading strategy for the time cycle peak coming in the Dollar.

On public facing Twitter feeds the alert reads;

“Member Alert: Large US Dollar Index (DXY) time cycle week of Aug 5, 2019 (extends 7 trading days either side). Trade Set Up detail to your email in today’s premarket. #timecycles $DXY $UUP #USD #SwingTrading”

Member Alert: Large US Dollar Index (DXY) time cycle week of Aug 5, 2019 (extends 7 trading days either side). Trade Set Up detail to your email in today's premarket. #timecycles $DXY $UUP #USD #SwingTrading

— Melonopoly (@curtmelonopoly) August 1, 2019

On the private member alert feed the alert reads;

“US Dollar Index (DXY) Long trade likely to turn short other side of Aug 5 week, watch for report with all signals $DXY $UUP #swingtrade #USD”

https://twitter.com/SwingAlerts_CT/status/1156872463273402369

Below is the chart and link for the US Dollar (DXY) time cycle alert;

US Dollar Index (DXY) Long trade likely to turn short other side of Aug 5 week, watch for report with all signals $DXY $UUP #swingtrade #USD

How to Trade the US Dollar (DXY) Time Cycle Peak.

The trading strategy for the US Dollar Index is simple if you use the model chart provided above.

In early 2018 we had alerted that the US Dollar was divergent to the downside and that a run in the dollar was imminent. The US Dollar traded up since that time from sub 90.00 to currently trading at 99.91.

When the US Dollar traded higher (after our alerts) it then reached the area of the main pivot (shown on chart above with horizontal red dotted line). The Dollar then traded around that pivot for some time. The trading pivot is important in your trading plan.

Simple Chart Symmetry and Price Targeting (price extensions) for this time cycle says to measure from the recent lows (trading just under 90.00) to the pivot area of 96.64 (about 7.00) and add the 7.00 approximately to 96.64 and you get about 103.50 ish. There are different ways to measure this – you can take the hard and fast support and resistance lines on the chart and measure from there or use exactly what price action said. In other words, the chart says support was 90.00, but the Dollar traded under 90.00 before it turned back up and got bullish. Depending on how you use those numbers this then determines your extension to the top. Lets call it 103.50 and use that for this example for your trading strategy.

The charting says the time cycle peak is the weak of Aug 5, 2019. This is a large time cycle so you have to allow for a week or so either side of the weak of the peak. Coming out of the other side of that peak the trade action (trading trajectory) will be key. You will either see a continuation of the current bullish trend or a turn to the bearish trade side. Probability says the price of the US Dollar will turn down. However, this is not always the case.

The chart says that 102.92 is your peak resistance price, but this can be extended up some for two reasons. One reason is the price extension you may measure from the previous lows, in this instance you would see the Dollar trade in to the 103s or 104s before turning. The other reason for a price higher than 102.92 is a simple over trade extension that happens at large time cycle tops and bottoms in trade – an over exaggerated move.

If the trade trajectory continues bullish then you simply extend the price up one structure above the current area of trade (see chart below). This is an unlikely scenario but it may occur. This bullish run would then peak in to the week of March 30, 2020 (this can change as we come near to the date, watch for charting updates). The price target in this scenario is 109.30 for March 30, 2020.

US Dollar Index (DXY) Bullish trading strategy for 109s in to Mar 30 2020 $DXY $UUP #swingtrade #USD

The Bear scenario to short the US Dollar is more likely, below is your trading strategy.

As noted above, simply wait for the week of August 5, 2019 and watch trade the week on the other side. Watch the key resistance areas on the chart. Early on in to the time cycle start to size your trade and continue sizing the trade (in my case it will be short $UUP likely) and then start to take profit at each support on the way back down as the US Dollar trades lower in to March 30 of 2020.

It is important to get your full size in early enough but not too early so you get caught on the wrong side.

If you need help with the trade let me know.

Watch the chart resistance close as we trade the markets over the coming few weeks, watch the apex of the quad the US Dollar is trading in currently on the chart. Watch for the inflection points. You can also bring your time down to a daily or 4 hour chart to get a better feel for what trade is doing.

Also, be sure to watch our trade alerts on our alert feeds and in live trading room. If you need some coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Other Reading:

US Dollar Index on Market Watch https://www.marketwatch.com/investing/index/dxy

Dollar hits two-year high after Federal Reserve cuts interest rates by a quarter point as expected https://cnb.cx/2MsfQn1

Recent Swing Trade and Day Trading Reports (charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: US Dollar, USD, Trading, Strategy, Charts, Algorithm, Currencies, Alerts, $DXY, Swing Trade, $UUP, time cycles