Tag: Alerts

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Wed July 3 Trading Profit and Loss Report.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

- Includes Live Trading Room Raw Video Feed Recording.

- Includes Trade Alert Links / Screen Shots.

Note: I am just getting back in to the routine of posting daily trade profit and loss reports. For now the reports will include basic information and over time we will provide more information for traders that are using this information for their study and /or trading plans. Near future we will include more formal P&L spreadsheets also.

Section 1: Trading Day Summary.

As with Tuesday it was another non eventful day in advance of July 4 holiday. I expect this to change considerably in to next week.

On the stock (equity) trading front it was quiet for Day Trades and Swing Trades (July 4 holiday near) so that is expected. Watching $AMD close as I am in 3/10 size, the other swing trades / updates will be on the report we’re near completing now (I have a number of open trades that I will report on).

In crude oil trade, our machine software triggered 3 trades, all were winners.

Section 2: Specifics on Trades for the Day.

If you cannot see a chart below, a link is not available or not showing to the alert and/or chart or parts of the data is blocked with ******, this is because it is a premium member chart or alert. As time allows I provide in the section below copies of charts, guidance from private member Discord server chat room, live trade room screen shots and screen shots of alerts.

Oil Machine Trades / Alerts.

- As above there were 3 machine trade, 2 actionable alerts for our members and 1 was too quick to alert and be actionable for members. Below are screen shots of trade alerts on the private member Twitter feed and Discord member chat room.

- Trade alerts from oil machine software 3 for 3 wins today (2 actionable), some screen shot samples of trade sequences below from alert feed. One red day at -0.2% draw down since version launch. #OOTT $USOIL $WTI $USO #OilTradeAlerts #MachineTrading https://compoundtrading.com/product/live-oil-trading-alerts/ …

Trade alerts from oil machine software 3 for 3 wins today (2 actionable), some screen shot samples of trade sequences below from alert feed. One red day at -0.2% draw down since version launch. #OOTT $USOIL $WTI $USO #OilTradeAlerts #MachineTrading https://t.co/PMO03ofcVt pic.twitter.com/JQs7rHbiqr

— Melonopoly (@curtmelonopoly) July 3, 2019

- From the private member oil chat room, trade alerts below (sequence of trades)

JeremyYesterday at 6:27 AM

M – software is firing HF shorts 56.80 3/10 size (larger than normal) and covering fast in to .74 and on alert for an inflection. In short, its in HF mode for an inflection in to 7:30 with time cycle peak 9:00 AM

M – significant supply above 56.80 is causing the software to fire short, if supply moves out it will turn and fire long. 7:30 is the mark for a decision.

M – supply blocks are larger than typical so a very large move is expected. This also coincides with timing on EPIC model (core, middle of quad with largest expected range).

JeremyYesterday at 6:53 AM

M – it is selling again 56.80 on a high frequency protocol, won’t hold any above, tight stops.

JeremyYesterday at 7:28 AM

M – software keeps selling in low 56.80s and covering in low 56.70s so we will see. -

Oil trade alert in Discord Member chat room, first machine trade sequence alerted to members. - JeremyYesterday at 7:37 AM

M – it’s been selling against that pivot on the last 5 min candle at 56.77, if that doesn’t hold it won’t stay short. Trading 56.72 intra.

M – correction, 15 min candle pivot 56.77 -

Oil trade alerts in private oil trading chat room - JeremyYesterday at 8:04 AM

M – covered for now 56.64 still on sell signal -

Oil trade alert to cover short sell trade in oil trading room. - JeremyYesterday at 10:36 AM

M – long 56.24 1/10 HF

M- added 56.22 close 1 .33 holds 1 / 10

M – closed .45 stil on buy program -

Long trade in CL in oil trading room alerted to membership.

Personal Oil Trades.

- None.

Machine Bitcoin Trades.

- N/A in development.

Personal Bitcoin Trades.

- None, watching current action to either re-short at resistance (see member report) or cover the final 25%. Great trade so far but would like to see price targets 2 and 3 of 3 hit. Price target 1 hit.

Personal Swing Trades.

- No new positions, adds or trims (other than Bitcoin). This will get very active as soon as the new swing trade report is released and we are past the July 4 holiday.

Personal Day Trades.

- None on day. As above, once the new swing report comes out my day trading will get much more active. Our swing trade chart models can be used for daytrading (converting them on the fly is easy – bringing the time-frame down to 30, 15, 5 and 1 minute time frames).

Section 3: Trading Room Raw Video Footage for the Day.

#OilTrading #BitcoinTrading #DayTrading #SwingTrading #MachineTrading #TradeAlerts

The video below is a raw feed only, to find live trading and trade alerts voice broadcast when lead trader is trading in the room reference the time of day on the alerts. I make this available for authenticity / documentation and also some learning traders use the raw feeds for study purpose. Also, as time allows I publish separate trade set-up reports with video snippets to our blog and YouTube.

Live Trading Room Raw Feed

If you have any questions about my trading or need help with yours send me an email anytime [email protected] and I’ll do my best to help.

Thanks

Curt

Events:

Trade Coaching Webinars. This weekend we will announce 3 different How to Trade webinars. All three to be held Sunday July 7. One each for 1:00 PM Oil, 5:00 PM Swing Trading, and 7:00 PM Bitcoin trading. They will be recorded and available for order on website thereafter. Each will have limited attendee availability so that I have time to work with attendee question and answer during the webinar. Existing members get 50% discounted rates: Retail rates Oil 499.99 (4 hrs), Swing Trading 199.00 (2 hrs), Bitcoin 99.00 (1 hr). Legacy members free. If you want to attend or want a copy of the webinar video email Jen [email protected] prior to promo going out this weekend as these particular webinar formats fill up quick.

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports Here:

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes Here (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Premarket Note & Important Updates: Current Trades, Schedule, Oil Machine Trade Protocols, Trade Alerts, P/L’s, Events

Premarket Note and Important Client Updates March 8, 2019.

Good morning traders!

Our Schedule.

Last night we were in coding / trade protocol publication conference all night so there was no live trading for me in the overnight session.

I am scheduled in main live trading room (voice / chart broadcast room) at US regular market open (9:30 EST) and during active trade today. Mid day trade setups review in live trading room will be set off until Monday as we are working on completion of the oil trade protocols (yes, still grinding through it).

Sunday we will return to active trade attendance in overnight trade (12:00 midnight EST).

For those unaware, our trading team is on a daily scheduled break from 2:30 PM to 12:00 midnight EST. We are in attendance from 12:00 midnight to 2:30 PM EST. I am typically in the main live broadcast trading room at regular US market open (9:30 AM EST), mid day review (12:00 PM – 1:00 PM EST), during any active trading and for special events (weekly EIA, webinars, etc).

Link to live broadcast trading room: https://compoundtrading1.clickmeeting.com/livetrading

The team will also be in the Discord chat rooms today as usual. If you need a link to access Discord please email us.

Current Work In Progress.

Crude Oil Machine Trade Protocol Document Set:

For those unaware (and for the sake of updating everyone), as noted above we were at it again last night working through the code detail and oil trade protocol publications.

Again, my apologies for being behind on our schedule with this task, unfortunately it happens. The coding work and associated protocols are VERY detailed. With over 8000 instructions in the code it is taking some time to condense those instructions to an easy to reference set of protocol documents for our clients.

We’re close now, while I write this Jeremy has advised me that his final edits are done so I’ll do my last review and send the protocols out to clients this weekend.

The written protocols (rule-set) are a document series intended to assist our clients with being able to reference the trading rule-set (instructions / protocol) our machine trading software is executing trades to.

In other words, when oil trade alerts are sent to alert feeds (private client Twitter feed & client private Discord server chat) marked with an “M” for machine trade, our member will then be able to reference the trade rule-set / set-up specific to that alert. The goal is for our member to know what the trading plan is for each type of alert.

One protocol document (rule-set) for each type of trade set-up alerted to the feeds.

This is another step toward our goal of an intelligent assisted trading platform for our traders / clients. The broadcast trading rooms, Discord chat, newsletter publications, live alerts etc are a start toward that and the protocol documents are the next step. Moving forward near future our developers will be automating the machine trade alerts to the alert feeds, trading rooms etc.

Current Trades.

Oil Trading:

In January we posted over 60% account gains in crude oil trade, February profit and loss statement is above 30% (depending on the account – some less some more, yet to be released – Jen has that on her WIP) and we’re shooting for 100% in March. To get 100% in this environment (see below) is a challenge, but we’re in it to win it. Read on.

Personal Oil Trades – Choppy week for me (personal oil trades) and the machine trading. Yesterday was my first red day in a while.

I AM RETURNING to ONLY THE HIGHEST PROBABLE TRADE SET-UPS after the chop I was in yesterday. You will see less trades from me over the coming days, but the oil trades I do alert will be the highest probable wins and they will be trades I will want to be able to execute in SIZE.

The smaller the account the more chop I experienced yesterday. The larger the account the easier it was to navigate the chop.

Crude Oil Machine Trading – Specific to the machine trading, the protocol document flow due out soon will help our clients understand this better, but for now I will say that the machine trade liquidity in the markets has become extremely advanced, very quickly. And I wouldn’t doubt sophisticated AI manifesting near term.

Machine trade in crude oil liquidity is becoming more advanced literally by the day (we have noticed a substantial recent increase in change). Our timing in this endeavor is really interesting in my opinion.

What am I saying? Well, for example most recently we have noticed the machine traded liquidity in the markets has moved down one and sometimes two time-frames. This means that the machine driven liquidity in crude oil trade is executing trade on half or a quarter minute charting time-frames. Imagine that.

If you can imagine having coded the software (with over 8000 instructions) and written the protocol document rule – sets for over forty set-ups only to find that in sideways consolidated oil trade action that the machine liquidity is now moving from a one minute time-frame in executions to a half or even a quarter minute time-frame. Human traders don’t even have charting for that!

Anyway, that’s what we have found the last ten days in the sideways trade in crude oil (look at a daily crude oil chart).

This has caused us to re-code appropriately, trim our throttle down and down and down again the time-frame that our software will fire trades at and re-do and re-do and re-do the trading protocol documents that our clients will use to reference the trade set-up at each oil trade alert.

I have spoken to our most experienced oil traders (we have some serious veterans in our midst) and all of them had a tough week – and these folks rarely are challenged with trading green.

It was a tough week, but we responded and re-coded, and we’re throttling down the software appropriately so it fires on lower time frames and I am personally adjusting my personal trades to only take the best set-ups with a preference to those that I will be able to size in to.

Swing / Day Trading:

Review all current / swing trades thus far in 2019 and current here (if you need an access code email us):

In addition to the trades in the document above I am also now in a starter swing trade position in $HIIQ (per yesterday’s alert).

2019 has been really positive in our swing trading platform, the returns have been great and I expect the next time cycle to continue as such. We should see near 100% return on the year if things continue as they are. The first quarter P/L will be out end of month for review.

Just remember to take profits along the way with the winning swing trades and use stops to protect your account equity.

We expect to start the next round of swing trades between now and Tuesday morning of next week.

New Client On-boarding.

Legacy Members:

The only outstanding new client on-boarding are our newest Legacy Members. All new Legacy All Access Members should have received a conference time with myself for this Sunday afternoon or evening. Look forward to connecting with each of you.

New Members:

Before you start executing trades as a client of Compound Trading Group I highly recommend you study and even take a few hours of private trade coaching to be sure you are best set for success in your trading. Too many newer clients to our group start trading way to early in the process.

Study the historical blog posts specific to your trading focus. Examples are the oil algorithm historical posts on the blog, the crude oil trading special articles listed on the Oil Trading Academy page on our website or the Swing Trading historical posts on the blog. Many posts are unlocked over time for public view and if you are a member that needs an access code to a specific post please email us.

You can also study the videos on our YouTube channel. They are raw video feed (so they aren’t packaged for quick consumption sound bites) but if you’re willing to put in the time they will be of great benefit to your trading.

Also of great benefit are the private Discord servers, especially the crude oil server. You can review historical chat and trade set-ups – many new clients have told me this has been of great benefit.

Attendance to the live trading room when I am broadcasting my live trades (or reviewing historical raw video on You Tube) also helps.

And lastly, if you want to take your technical analysis / charting etc to the next level, there is a 20 hour video series available (the Master Class Series recorded last year) for 1499.00. Email Jen at [email protected] if interested. We cover much of the content at each trading boot camp, but only about 20% of the Master Class Series for Technical Analysis, Charting and Trade Set-Ups.

Upcoming Events.

Special Trade Coaching Webinar Series:

Oil Traders Special Webinar Everything I Know About Trading Crude Oil | Special Webinar Event Series | March 24: 10 AM – 6 PM.

Swing Traders Special Webinar: Stay tuned, to be announced. It will be held in April 2019.

Trade Coaching Boot Camp (in-person or online):

Take your trading to the next level with our lead trader at our next Trade Coaching Boot Camp at Cabarete Beach, Dominican Republic April 19 – 21, 2019.

- If you can’t attend in person you can attend the class online virtually and take part in question and answer as if you were in the boot camp live.

- Register Here: Trade Coaching Boot Camp April 19, 20, 21 2019.

Recent Press:

News Release: SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release.

Be sure to reach out if you need any help with your trading.

Have a great day!

Curtis

New Personal Trade Schedule, Code Updates, Machine Protocols, P/Ls, Alerts, Reports, Swing Trades, Events, On-boarding.

New Personal Schedule to Accommodate Peak Trading Times:

Jeremy and I have resigned ourselves to perform daily oil machine trade code updates until only weekly updates are needed (weekly wasn’t going to do it).

Until now we have found ourselves doing the code updates early morning between 3 am and 7 am (then I prep for premarket).

This time slot for updates doesn’t work.

It doesn’t work because the machine trading (and my personal trading) needs to be firing during this time. The overnight session after midnight and in to early morning are important as the global regular markets are opening – many of the daily moves start there and if we’re updating code there is no trading. It also interferes with my equity day trades in to open because I am not prepared properly and swing trade positioning as needed in the premarket session.

So we’re moving the oil machine trade code updates to the time-slot between 8 pm to 12 Midnight each night because futures are normally quiet in that time slot.

We will always be in the trading room daily from regular USA open at 9:30 AM to 2:30 PM.

From 2:30 PM – 8:00 PM we will be on our personal time break daily.

Mid day trade set-ups will normally take place in the main trading room from Noon to 1 PM daily.

Reporting:

The mid day review today went over all the swing trades for 2019 this year so far. We have done exceptionally well with our 2019 swing trades considering the funky markets. This will be an important video (mid day from today) to review when we send it out. It will include a written report. We will next be adding more swing trade set-ups we are watching over the next few days to our swing trade portfolio for 2019.

The crude oil machine trading protocols will be emailed this evening. Early morning today we completed the code updates for all the protocols and now staff are completing the client documents for review of the protocols.

Machine Trade in Oil Alerts Profit / Loss:

The February P&L will be out soon for those that have asked.

January Oil Trade Profit and Loss is here:

Trade Alerts:

As of the next session (midnight tonight) you can expect the frequency to increase (up to 200 per month) for the oil trade alerts. The last few days have been riddled with updates (including today) specifically because we’re tying the actual code to the public side protocol documents – they have to match so that when you the trader see an oil alert you can the reference the trade set-up protocol that the machine or myself are trading with. This will help our clients plan their own trade. Anyway, it was a large undertaking (like most others) than we expected. We’re wrapping it all up right now and the trade alerts will reflect completion and higher frequency in to this evening’s session forward. Thanks for your patience.

Onboarding New Clients:

Most commercial and private new clients have been onboarded as I am writing this. However, specific to the newest Legacy Member Clients we have not done the onboarding. I am working on my schedule two weeks out right now and will contact each of you over the next few days to get you scheduled for the onboarding conference call I need to do with each of you. Because it is a 24 access to my trading station it requires more instruction / preparation than most onboarding scenarios. Your fees will not start until after you are successfully onboarded.

Events: Special Webinar Series and Trade Coaching Boot Camp

We have a Special Webinar Event Series starting March 24 running in to April and May of 2019.

The first webinar up is for crude oil traders, the next will be Swing Trading and then so on. Don’t miss out, it may be the only webinar series we do of this kind.

Everything I Know About Trading Crude Oil | Special Webinar Event Series | March 24: 10 AM – 6 PM

Intensive Crude Oil Trade Training Webinar.

Spend a Day With Me March 24, 2019 – I will be hosting a crude oil trading webinar. I will cover everything I know about crude oil trade in a one-time 8 hour special webinar event.

The webinar will cover my strategies for conventional and algorithmic oil trade and charting, intra-day trading, short term swing trading, longer term swing trading, trade sizing, time cycles, key set-ups and much more.

I will explain in detail how I maintain a win rate of better than 90% in crude oil trade (live recorded in our oil trading room and live alerted to our members).

Limited attendance of 25 persons to allow me to take questions and converse as needed to be sure we cover the trading concepts in detail.

Current member clients of Compound Trading Group receive 50% off. Use promo code: member

Early bird registrants prior to March 11, 2019 receive 30% off (cannot be used in conjunction with other offers). Use promo code: early.

To Register for the Crude Oil Trading Webinar Click Here.

Trade Coaching Boot Camp:

Take your trading to the next level with our lead trader at our next trade coaching boot camp at Cabarete Beach, Dominican Republic April 19 – 21, 2019.

If you can’t attend in person you can attend the class online virtually and take part in question and answer as if you were in the boot camp live.

Register Here: Trade Coaching Boot Camp April 19, 20, 21 2019.

Machine Learning Trade Software Advisory | Crude Oil: Trade Frequency

Crude Oil Trade Software Advisory:

This advisory is a follow up / adjustment to the advisory at this link:

Machine Learning Trade Software Advisory | Crude Oil: (1) Frequency (2) IDENT Program

Trade Frequency.

This is to advise that the crude oil machine trade software will now trigger all active protocols at a higher frequency as of 6:00 PM Monday March 4, 2019.

For example, on most occasions it will now fire trades at the majority of 1 minute model support and resistance and at most EPIC 30 Min Model support and resistance (quads, channels, mid channel, mid quad).

The various software trading protocols (based on specific models) will be distributed in 24 – 28 hours to stakeholders. There are a total of 42 and approximately 16 that we are currently running (on time-frames from 1 minute to 1 week charting models).

This adjustment to the software “throttle” will increase frequency considerably (approximately 160 – 200 executions or more possible per month).

The win rate will be lower than the previous two months but a higher return monthly is expected.

The minimum bar is an 80% win rate and a progressive increase in monthly return as software is tweaked, and an average draw down less than 12 ticks (3 – 16 ticks depending on the protocol). Average win greater than 12 ticks.

Staff will (when time allows) alert the trade protocol details to the trade alert feeds on Twitter and Discord private oil server.

Thank you.

Price Increase Mar 4: Oil Trade Services (Bundle, Newsletter, Alerts, Trading Room) w/ Promo Codes

RE: Price Increase Details w/ Promo Codes. EPIC Oil Trade Algorithm March 4, 2019. Applies to Bundle, Newsletter, Oil Trade Alerts and Oil Trading Room.

February 24, 2019

Compound Trading Group recently launched a first generation oil trading algorithm (CL) software with great initial success. January oil trade alerts seen a 63% account build increase. We expect results to continue to trend higher as the software is fine-tuned.

More recently, we distributed an advisory to detail software protocol updates that will execute oil trade alerts at a higher frequency with a mandate for 60 – 100 trade alerts per month with an objective of 80% or higher win rate (the current win rate is consistently higher than 90%). The objective is to provide a higher frequency of alerts to achieve a greater return on equity per month with a moderate decrease in win rate as the trade-off.

Also included on the advisory above is detail concerning our proprietary IDENT software update – IDENT is an order flow identifier that helps our software trigger trades with market leaders. The IDENT program update has provided our oil trading and alerts with an extremely high win rate since introduction.

Also recently announced, Compound Trading Group’s EPIC Oil Machine Trading Software has been selected for the SOVORON™ trading platform. SOVORON™ offers a unique trading service providing clients with technology application based Machine Trade of personal investment accounts along with a fund and robo-trade application in their pipeline. To explore their unique client service structure click here http://sovoron.com/ or call 1-849-861-0697.

And finally, Compound Trading Group will be closing to the general public as of April 30, 2019 and will only be available as a private service going forward – you can view the news release here.

Existing members will be included in the transition. Most of Compound Trading Group’s clientele are serious full time traders, private commercial trading services and institutional clients.

Price Increase Detail, Early Adopter Price Guarantee, Limited Promo Codes:

The main pricing menu on our website is found here.

Existing members (early adopter pricing) remains constant and are not affected by the price increases below as long as the member fees do not lapse.

Oil Trading Bundle – Weekly EPIC Algo Newsletter and Charting, Real Time Twitter Feed Alerts, Main Trading Room Access During Active Trade, Private Oil Trading Room / Chat Discord Server (not screen sharing live broadcast like the main trading room).

Current Pricing: 1 Month 399.00, 3 Months 1099.00, 6 Months 2199.00, 1 Year 3999.00.

New Mar 4, 2019 Prices: 1 Month 799.00, 3 Months 1999.00, 6 Months 3799.00, 1 Year 6999.00.

This works out to about 10.00 per alert but also includes the trading rooms and newsletter. If you calculated 60 – 100 trade alerts per month.

Standalone Oil Algorithm Newsletter – Weekly EPIC Algo Newsletter.

Current Pricing: 1 Month 299.00, 3 Months 807.30, 6 Months 1435.20, 1 Year 2511.60.

New Mar 4, 2019 Prices: 1 Month 399.00, 3 Months 999.00, 6 Months 1899.00, 1 Year 2999.00.

Crude Oil Trade Alerts – Distributed by way of private members Twitter feed and now includes access to private Discord oil chat / trade alert feed (with push notifications).

Current Pricing: 1 Month 199, 3 Months 537.3, 6 Months 955.2, 1 Year 1671.60.

New Mar 4, 2019 Prices: 1 Month 499.00, 3 Months 1399.00, 6 Months 2699.00, 1 Year 4999.00.

Promo Codes are in effect for a limited time “bundle30” at check-out. The promo codes remain in effect until Mar 3, 2019 only.

If you have any questions please email me direct at [email protected].

Warm regards,

Jen

How I Day Trade Crude Oil +-90% Alert Win Rate | Friday’s 158 Tick Move | Strategy We Used To Trade It

Tools You Can Use to Day Trade Crude Oil for a Better Win Rate. 90%+- Is Within Reach.

How to Trade Oil Successfully with the Right Strategies: Trade Alerts, Chat Room Signals, Live Trading Room, Conventional Charts, Time Cycle Knowledge and Algorithmic Models.

My position in this post is simple; if you have the technical data needed to make the right trading decisions on all time frames (your oil trading strategy) provided to you (the oil day trader) in the most efficient manner, you can out trade the general market traders and compete with world class machine oil trading firms.

We endeavor to provide such a trading platform for our members. Below I explain how we are doing that.

But first, a trade coaching session for those learning to get on the winning side of their trading… if you are a pro that only needs the technical oil trading strategies included in this post… skip this rant and scroll down.

Why do I scream from the rooftops that my win oil trading rate is so high? Why do I scream transparency and documentation of my trading journey and the development of our oil trading systems?

I scream my win rate (that anyone can review our live recorded and time stamped documentation to verify) to drive home that you do not have to accept what the book selling circle jerk crew tries to sell you, “trade price, nobody knows the future and that a 60/40 win rate is acceptable” – this is a flawed process.

You do not have to accept what the book selling circle jerk crew tries to sell you.

Study our oil trading system development and you will find that trading price doesn’t work in oil and that thinking you can’t know the future (future decisions for up, down or sideways trade and the most probable price targets) is foolish thinking.

We know with high probability where price is going to be on any time frame (from a 1 minute chart to a monthly chart and all between) and we know with high probability how to trade the decisions a trader will face on the way to the possible price targets.

We know the natural trading structure of the financial instrument – in other words, we know the playing field. We play the game with the lights on while the majority of our competition is in the dark.

We know the natural trading structure of the financial instrument – in other words, we know the playing field.

A 60/40 win rate is painful, to accept and use that system you have to take a series of significant losing side cuts to only then take advantage of a winning swing trade trend pattern move. In other words, the problem with their process is that you win big when you win but you have to endure pain to get the big win. I do this myself, but only with 10% of my account.

For example I have been DWT short for a number of weeks in preparation for the reversal in oil trade we are now experiencing. But I do it so that I get the move even when I don’t have time to day trade it.

The problem with their process is that you win big when you win but you have to endure pain to get the big win.

Another problem with the 60/40 idea (and there are hundreds of problems with this thinking) is that oil can trade sideways for many weeks, in this scenario you get chopped up and this causes your brain to be confused and you begin questioning yourself.

The method we are developing, perfecting and teaching (that we have documented live in every fashion available for proof) has a much higher rate of return and win side rate, it allows you to be in cash daily, it is much less stressful (the draw downs when you do lose can be next to zero) and it is the equivalent of Wayne Gretzky on the ice (for example).

You can simply “out stick handle” your competition.

To be a 90%+ oil trading winner takes real work to learn, but on the other side you will have much less stress, you win more often, your ROI and ROE increase significantly, your lifestyle freedom increases and the most important part is it keeps your brain in the frame work of being a winner.

Worst case scenario – you add what you can or what you prefer to use of what we have learned and passed on to you so that your oil trading win rate increases.

The bottom line.

It is critical for your brain to know it wins. When it knows you are a winner it won’t accept losses. This is critical (you would have to do a serious psychological study to learn why this is so important – maybe someday I will write about what I’ve learned).

The bottom line is that your brain develops patterns of habit that manifest in reality. Your subconscious is the leader, and it needs to know when it trades crude oil, that you win.

The bottom line is that your brain develops patterns of habit that manifest in reality.

The only way this is possible (your brain knowing that you win so it won’t accept losing which causes your execution to be disciplined) is to be able to “out -trade” your competition.

Sure, you are competing with yourself – but in reality you are competing against the world’s best when you enter the markets everyday.

The only way to out-trade your competition is to have technical market information and tools they simply do not possess and / or do not have “as efficient” access to and they haven’t defined their trading process and skill-set to the same level you have.

This is what causes one to trade win-side at a rate of over 90%. And anyone can do it.

Lets Get on With The Technical Oil Trading Strategies You Can Use to Day Trade Crude Oil for a Better Win Rate.

Oil Trade Signals: The Strategy / Guidance I Provided to Members at Start of Week.

Crude Oil Time Cycles, Area of Trade, Support, Resistance, Trading Channels.

Note: The time stamps on the Private Member Discord Oil Chat Room Server is showing my time in the Dominican Republic (this time of year it is one hour later here in DR than Eastern Time in New York).

For this post (that focuses on examples from Friday Jan 18, 2019 in our oil trading room) I will start with trade signals I provided to our members at the beginning of the week (and some prior) to provide context for the guidance explained.

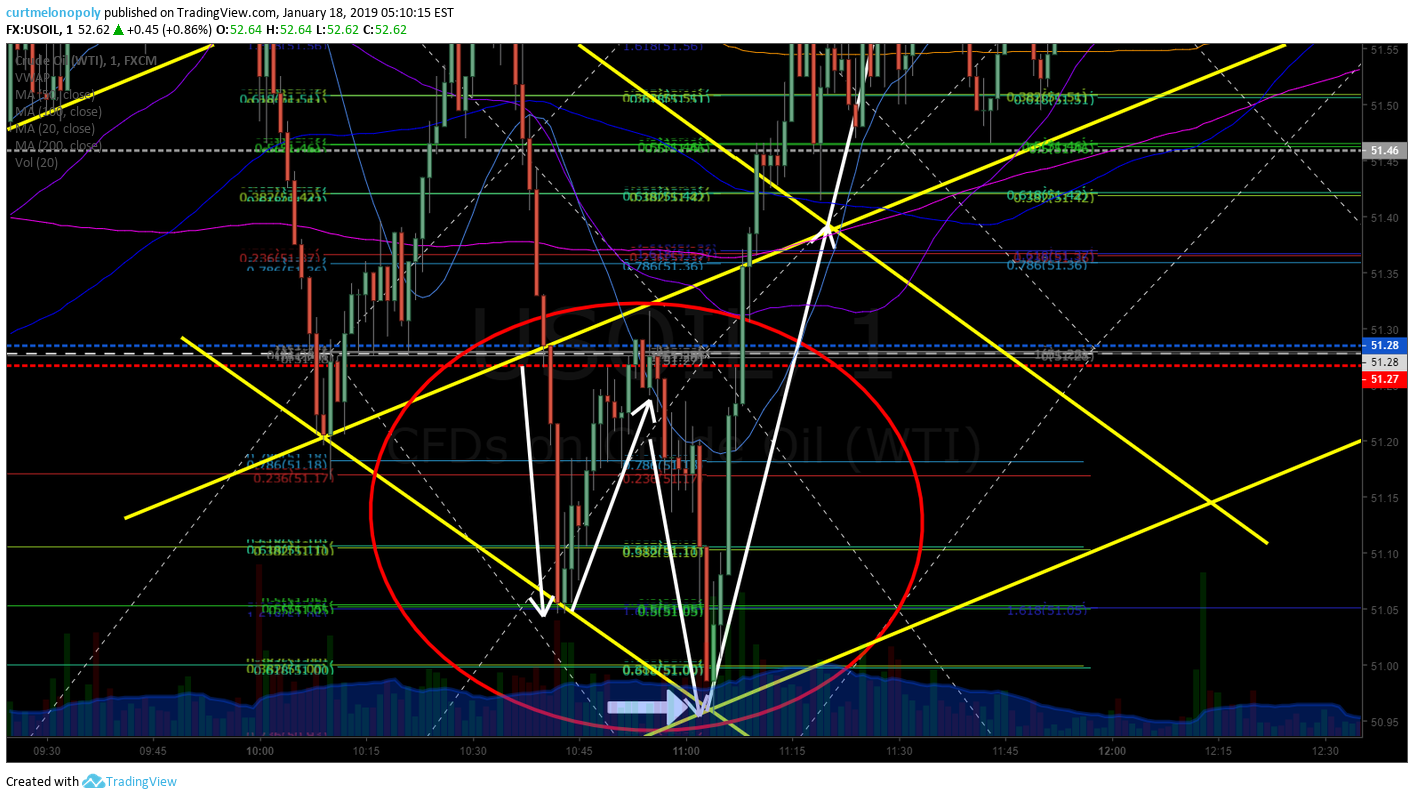

Below (3rd image down) you will find a private member server screen shot (to start the week of Jan 14, 2018) I shared with the chat room of a test chart our oil machine trade coding technicians are developing for sizing trades.

In addition to using our main oil charting (the EPIC Oil Algorithm model – a proprietary model based on a 30 minute oil chart) we use many other charts (conventional and algorithmic) on many time-frames to determine back tested and correlated probabilities for oil trade resistance, support, channels, reversals, time cycles and more.

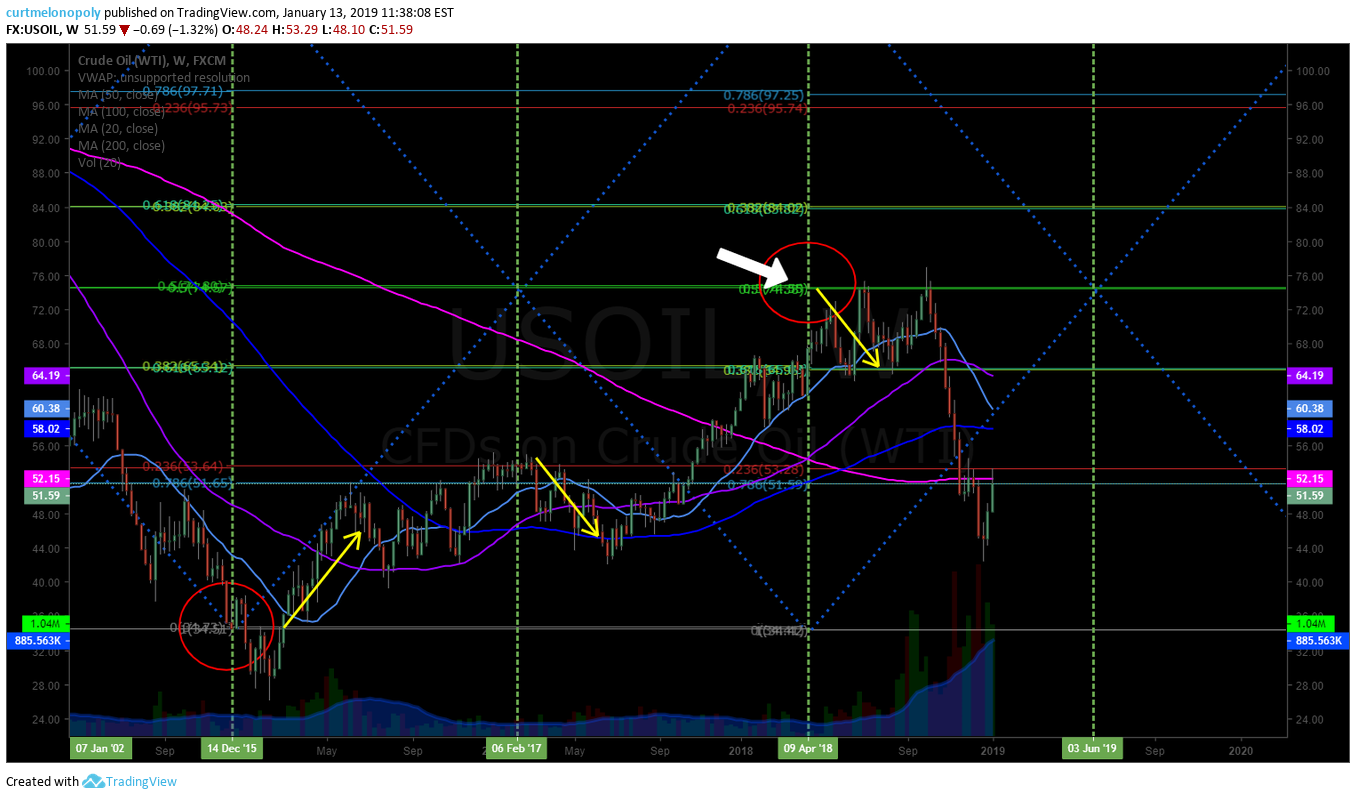

In the instance below (at start of last week) I was signaling the possible channel oil would use for weekly trade – specifically if the scenario played out during weekly trade as it related to the previously provided signals to members (that we seen a time cycle ending in crude oil December 20, 2018).

Prior to this, we had provided members (many weeks in advance of Dec 20) that the time cycle peak / conclusion was for approximately Dec 20 (with allowance for a week either way of Dec 20 because the time cycle was so large as it was based on the weekly time cycle charting).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Between Dec 20 and Dec 26 there was one last “flash down” in oil trade which is typical at the end or peak of a time cycle on any time frame from the one minute charting to monthly charting (this is typical of the final stops being triggered and shorts covering positions).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Oil hit a low of 42.38 on FX USOIL WTI on Dec 24, 2018 and closed Friday Jan 18, 2019 at 52.38 – less than one month later.

Also of note, we predicted the down turn in oil trade at the time cycle peak – the time cycle turn prior to the Dec 20, 2018 reversal.

See this tweet from EPIC Oil Algorithm Public Twitter feed and the post linked to our blog.

“Dating back to 2002, 13 of 14 major time cycles on weekly crude oil chart structure seen trend reversal to some extent or another #Oil #OOTT #TimeCycles FX USOIL WTI $CL_F $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/F8Z9UE66-Dating-back-to-2002-13-of-14-major-time-cycles-on-weekly-crude/ …

https://twitter.com/EPICtheAlgo/status/1084492522490155014

Back to Strategic Guidance Provided to Oil Chat Room Last Week:

The oil trade signals I alerted to members to assist in their oil trade strategy focused on the trading range our members could expect for oil the coming week. The alerted signals also gave our traders support and resistance areas on the charting and the most probable channel of trade (this is all in addition to the EPIC Oil Trading Weekly Report).

Curt Melonopoly Last Monday at 8:49 AM (7:49 AM EST)

“It’s a machine coding doodle chart for sizing etc so its a mess, but we are looking for channel highlighted in yellow to hold for trend reversal confirmation in crude oil – use proven EPIC model for confirmation for trading”.

Below is a screen shot of the live oil alert feed on Twitter providing the following signal to our members for the week:

“Under 52.16 FX USOIL WTI I am short term bearish, over 52.16 bullish to 53.34 and over to 55.65 – main test areas over head on weekly time frame.”

The examples above provide context to the guidance we provided our oil members at recent time cycle turns and at the beginning of the week…

Now lets jump to the specific point of this post that involves trade last Friday December 18, 2019 so we can learn how to day trade the opportunities in crude oil.

At 6:40 AM Friday Jan 19, 2019 I signaled the oil chat room that oil trade looked bullish and that our traders could expect a push toward the 53.40 resistance.

You can see on the chart / screen capture below how trade for the week had maintained the channel and that oil trade was following a trajectory (light blue vertical line) that I had outlined in the chat room earlier in the week as a probable upside strategy.

The strategy for the trajectory of the uptrending blue arrow was based on trajectory of time cycle targets on the short time frame assuming oil was bullish (price targets on our algorithmic charting can be assumed at where important trend lines cross, this is consistent through all time frames on all algorithmic models – this takes some time to learn).

The resistance I was alerting our members was at the top of the trading channel so they were aware of where to be aware of possibly trimming positions or at minimum being on watch for intra-day stall in trade.

“They’re pushing for that 53.40 area today (upside scenario), above could cause a significant squeeze”.

On this screen capture from the oil chat room I am showing our members that trade intra day was in the bullish scenario on a 4 hour test chart. Reconfirming the bullish scenario for day trading oil upward in Friday’s trade.

You will also notice at the bottom of the screen capture – the noted alert at the bottom of the screen, “53.50 is top of quad ton EPIC model resistance today, trading 52.83 intra” that this set-up coincided with our proprietary oil algorithm charting (the core oil algorithm charting – the core of our methodology, is not included in this post).

The core oil algorithm charting – the core of our methodology, is not included in this post.

Earlier that morning Jeremy has posted a link in the chat room to the article and video post covering trade from Thursday’s session and explanation of the one minute trading box set-up. You can study the set-up at the link below;

By far one of the most important crude oil trading articles we have posted since our inception.

Protected: How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video)

Password: ********

At 920 AM right before regular market open I provide chat room a crude oil position signal for preferred long entry point.

I also re-confirm my expectation that probability for the top of the quad area of the oil algorithm in trade gets hit and that my entry signal price target (preferred entry is 52.40) so that our traders could make their own decisions for execution.

Also mentioned here, the one minute trading model (the trading box area) as the preferred entry price so that our members know where I derived the 52.40 entry preference from.

Crude oil trade alert in chat room screen shot of long execution in to open and other alerts. Long oil at 52.67 with trims at 52.93 and 53.08.

Alert in oil chat room that I was closing the oil day trade at 53.03 due to internet issues and reiteration of price target 53.50 for day trade.

Then the price target for the day trade was hit. A 90 tick move so far on the day.

Below is screen shot capture of crude oil chat room of posted oil chart images of predictability of 1 minute oil day trading strategy in trading box model (as previously posted above – the Thursday featured blog post the day prior) when crude oil squeezes intra-day.

As the day trading session progressed I provided a number of alerts to impending resistance on all time frames in crude oil trade range expected for the day.

heavy resistance confirming on all time frames, but in a sqz u never know

Resistance areas of oil trade for guidance for day traders to consider trimming or closing positions.

Resistance had been hit on two 4 hour charts and the EPIC Oil Algorithm 30 Minute Model at this point of trade intra-day. Other charting time frames had resistance also.

240 Min Test Chart Scenarios posted to oil chat room revising the previous so that day trading signals for oil are updated.

LIVE OIL TRADING ROOM VIDEO | HOW TO DAY TRADE CRUDE OIL – STRATEGIES I USE.

#daytrade #crudeoil

Summary Notes for Video:

Note: Voice broadcast starts at 16:25 on video. When I am trading and on mic is noted below (the location times on video).

At 16:25 on video “I am triggering long 52.67 with tight stops because of test on 240 minute crude oil charting, so I may trigger in and out here, we’ll see. Will probably get in to pressure right in to open here but I didn’t want to miss the move. A little bit of FOMO.”

At 19:50 on video “The one minute candle turn in advance of market open is coming here, get ready for some pressure.”

Keep in mind the strategy guidance provided to members in the oil chat room specific to the preferred by trigger at 52.40 (in other words support on one minute day-trading model).

And Then The Internet Crashes! A Work Crew Down the Street Cut The Line.

At 23:00 mins on video I come on mic to announce the internet problem to the trading room (at which time I didn’t know what the specific problem with the internet was).

At 24:50 on video the pressure in oil trade comes (which made sense to me considering the resistance decision but I decided to hold because oil was so bullish through the time cycle). I could have cut and re-entered which may have yielded a better profit by 10 ticks or so.

And then the internet continues to crash intermittently. Had the internet not been crashing I would have been on mic providing our traders guidance.

At 56:40 I announce we are back up on a cellular network and that I am holding the position.

At 1:10:50 On video I announce I am trimming at 53.08 holding 25% – there was significant resistance on the EPIC Oil Algorithm so I trimmed.

In the trading chat room (not on video due to internet issues) I announce I am closing trade due to internet issues even though price wasn’t to the top of the algorithm quadrant and price target for the day, “closed 53.03 may re enter i had to close due to internet.”

Had the internet been restored timely I would have traded right top of quadrant and price target for the day.

At 1:18:00 on video you can see trade hitting the price target for the day (top of algorithm quadrant).

In a normal scenario I would have been trading the one minute trading chart model in the trading boxes and on mic in the trading room announces my trades. But on this day as fate would have it I couldn’t do it because I couldn’t risk the internet crashing while on the temporary cellular platform we were using.

Important note:

Much of the proprietary charting links, member oil reporting, and proprietary algorithmic charting is not included in this post. In 2019 we have started to limit dissemination of proprietary content due to copy cat trading firms.

Summary Thoughts for Context.

It is important to note that there were many many more trade alerts, charting updates, chat room trades / signals / guidance and trading room live trade coverage for the week.

Our members have much, much more information available to them for crude oil day trading decisions needed every day of the week on all time frames.

Having advanced technical know-how derived from a systematic scientific process that gets fed in to our various oil trading platform services to trading members allows for our members to “out stick handle” the everyday trading community and compete with world class machine trading firms.

My win rate and the oil machine trading win rate was well over 90% for the week and the reason is the combined tools available – available to myself, to our machine trading techs and thus the developed software and also made available to the members in our oil trading service.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Signals, Strategy, Alerts, Trade Room, Chat, Algorithm, USOIL, WTI, CL_F, USO

Follow:

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video)

This Article Covers a Very Important Trade Signal for Crude Oil Day Traders: How to Day Trade Crude Oil Using One Minute Chart.

Trade Alert Screen Shots and Trading Room Video Included Below.

Voice broadcast starts at 0:20 on video.

This is One of The Most Important Articles We Have Published for Oil Trading Traders Since Starting Our Service.

Thursday was a huge day for our development team for crude oil trading signals required for alerting day trading crude oil.

The patterns in crude oil are very important, especially as it relates to the one minute day trade signals because trading oil can be volatile.

Trade can move very fast in crude oil futures so a trader needs signals on the lower time frame (1 minute charting) that he/she can trigger with confidence. This is a very big development for us at Compound Trading Group.

Be sure to actually listen to the video included in this report because the text version does not explain every important detail required for a day trader to completely understand how the signals work for executing trades with precision.

Crude Oil Trading Rules Based Process

On the video I discuss the importance of the rules based process for trading crude oil with buy and sell triggers (signals / strategies) are reviewed.

Setting Stop Loss When Trading Crude Oil

The above relates (determines) to the stop loss you set for each oil charting time frame for triggering orders. Time frames being the different chart time frames for 1 min, 5, 15, 30, 1 hour, 4 hour, daily, weekly and monthly.

240 Minute (Algorithmic Model Test Chart)

This morning, trade in crude oil held the key support on the 240 min (4 Hr) chart reviewed.

If the chart structure holds the possible move up on the next extension (and the move lower) is also discussed.

Support and resistance is discussed on the chart structure as is price targets and time cycle completions.

The chart is still bullish. The bearish and bullish considerations are discussed.

Crude Oil 4 Hour Chart (we are testing structure) for Buy Sell Signals.

Machine Daytrading Sizing Test Chart Signals for Trade.

Day Trading Crude Oil Signals on the 1 Minute Chart (Pattern on Chart for Entering Positions)

The trade signal pattern for triggering the 1 minute oil chart trades is reviewed in detail.

When oil was selling off earlier in the day trade lost the mid channel line, came back and tested it and then dumped.

Rich in the Discord crude oil private member server had asked if the software was turned on and Jeremy had responded that order flow was the likely reason why the machine trade software did not trigger on the short.

Oil price sold off it traded in to the bottom of the quadrant on the EPIC Crude Oil Trading Algorithm and over shot the support.

Price bounced off a historical support line on the EPIC model (purple horizontal lines).

The challenge for traders executing trade orders on the oil chart is exactly where to enter your trade and the stops that should be set therein.

The 1 minute day trading chart is reviewed. The technical indicators on the charting discussed are;

- The trading box area on the chart.

- The pivot areas on the chart.

- The pattern of trade that is important for triggering your trade.

The trading channel for oil is reviewed on the video (the chart).

I am convinced we have established the chart pattern in crude oil for the one minute signals on day trading time frame. This is a big deal.

The W Pattern (trade signal) on 1 minute chart for day trading Crude Oil.

Below is the chart for triggering on the buy signal on EPIC model (30 minute crude oil chart) as it relates to 1 min daytrading signal above.

Is Over 5,000.00, 10,000.00 or even 20,000.00 In Profit Weekly Possible Day Trading Crude Oil on The EPIC Model With One Contract Sizing?

Trading one contract at a time with six – twelve times per week based on the signals provided on the charting (and eventually on the trade alerts) has the potential of returning massive weekly returns. Can it be done? We’re getting close all the time.

Trading the outside areas of the oil trading model (quadrants), the mid line of the channels and the mid quad support and resistance areas can do that. We may not get to 20,000.00 – it could be 10,000.00 or 5,000.00, it doesn’t matter whether it is 5K or 20K. The point is that if we can get the signals perfected to the best possible degree with a high win probability then it is possible.

Our current win rate is high, very high. Review our alert feed on Twitter or in the private member Discord Oil Trading Chat Room.

This is why the one minute day trading signals are so important, because a trader has to be confident in the entry of trade so they don’t get chopped up.

Crude Oil Trade Alert Signals

Below are the screen shot captured of alerts from the private member oil trading Twitter feed. You will notice that I am signaling day trades for the members AND the machine technician is signaling trades on the feed also.

The First Crude Oil Trade Alert Signaled for The Day – Short at 51.20

Second Alert (screen shot from Oil Trade Alert Feed) Explains Trade Signal is Based on Support at Bottom of Quadrant on Model.

Then the machine oil trading technician immediately after my alert signals a reversal in oil trade is very possible.

Signal to cover 25 percent of trade – Cover 25% 51.03.

Here I Signaled on the crude oil trade alert feed that I did in fact reverse the trade – reversed 51.30 tight stops CURT

Immediately after my reversal trade signal oil alert the machine tech alerts a buy signal… M – HFT buys initiated 51.36 will advise.

Then my alert signaling to take some profit on winning trade – Trimming 51.53 25% of the position.

Machine program signals closing trade for profit in advance of regular market open – after other signals alerted on feed. If you look at screen shot below closely (the feed), you will see the other signaled trade guidance. “M – Machine program closed 51.47 for open timing on software and stops triggered. Set at 8 mins either side. Will advise”.

Next alert in oil trade signaling trims on profit for the day trade. Trim 25% 51.63 CURT.

Alert signaled to close the winning trade. Close 51.66 will re enter if it gains upper area of quad.

I reiterate that it is critical for oil day traders reviewing this article to really listen to the video. If you want to learn how to day trade crude oil with the best signals we have available be sure to study the video. There is a lot of data covered in this video post.

If you have any questions send me a note please!

Best and peace!

Curt

Further Learning:

If you would like to learn more click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our lead traders that include learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Signals, Alerts, USOIL, WTI, CL_F, USO

Follow:

Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Compound Trading Swing Trade Earnings Report Monday January 13, 2019.

Swing Trading Signals and Stock Picks In this Issue: $C, $SJR, $BAC, $DAL, $NFLX … .

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Market hours can be difficult but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports in advance of key earnings release dates.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Swing Trading Signals / Charts.

Bloomberg Earnings Season Reporting Calendar List https://www.bloomberg.com/markets/earnings-calendar/us

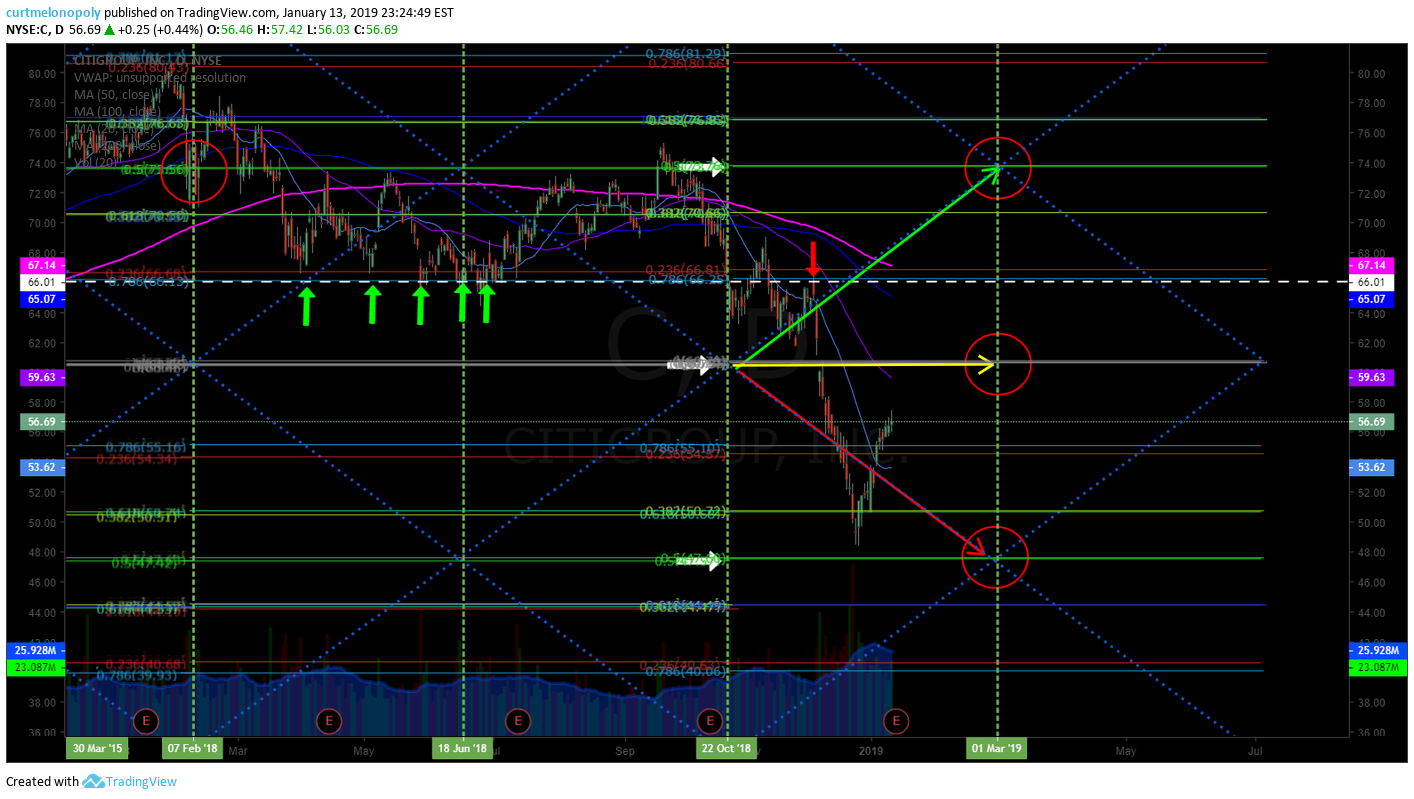

CITIGROUP INC (C) Earnings Swing Trade Strategy.

On Monday, Citigroup (C) kicks things off with earnings before the open. While the stock has beaten EPS estimates 74% of the time, it has averaged a one-day decline of 0.35% on its earnings reaction days. Per Bespoke here.

Citigroup is up first as big banks kick off fourth-quarter earnings season #swingtrading #earnings $C https://on.mktw.net/2H6XRBn

CITIGROUP INC (C) earnings swing trading targets on daily chart for bullish and bearish trend of trade post earnings #swingtrading $C #earnings

After earnings I will trade to the following price targets for Citi pending trade on daily chart below:

Bullish – 73.99

Moderate Bullish – 60.63

Bearish – 47.68

Intra-Day Trading – 56.69

Each horizontal Fibonacci line and diagonal Fibonacci diagonal trend line in chart model below are support and resistance decisions as trade trends toward up or down price target.

SHAW COMMUNICATIONS INC (SJR) Earnings Swing Trade Strategy.

Will Shaw (SJR) Beat Estimates Again in Its Next Earnings Report? #swingtrading $SJR #earnings https://finance.yahoo.com/news/shaw-sjr-beat-estimates-again-151003158.html?soc_src=social-sh&soc_trk=tw

SHAW (SJR) earnings swing trading targets on weekly chart for bullish and bearish trend of trade post earnings #swingtrading $SJR #earnings

After earnings I will trade to the following price targets for Shaw pending trade on daily chart below:

Bullish – 25.94

Moderate Bullish – 23.02

Indecisive – 20.17

Moderate Bearish – 17.28

Bearish – 14.41

Intra-Day Trading – 19.69

Each horizontal Fibonacci line, diagonal Fibonacci diagonal trend line and moving average in chart model below are support and resistance decisions as trade trends toward up or down price target.

BANK of AMERICA (BAC) Earnings Swing Trade Strategy.

Big Banks’ Q4 Earnings Releases Next Week: C, JPM, WFC, BAC https://finance.yahoo.com/news/big-banks-q4-earnings-releases-132401161.html?.tsrc=rss

BANK OF AMERICA (BAC) earnings swing trading strategy on weekly chart for bullish and bearish trend of trade post earnings #swingtrading $BAC #earnings

After earnings I will trade to the following price targets for Bank of America pending trade on daily chart below:

Bullish – 36.49

Moderate Bullish – 30.54

Indecisive – 24.73

Moderate Bearish – 18.92

Bearish – 12.97

Intra-Day Trading – 26.03

Each horizontal Fibonacci line, diagonal Fibonacci diagonal trend line and moving average in chart model below are support and resistance decisions as trade trends toward up or down price target.

DELTA AIRLINES (DAL) Earnings Swing Trade Strategy.

Airline Outlook Darkens as Warnings Reveal Revenue Weakness #swingtrading $DAL #earnings https://finance.yahoo.com/news/airline-outlook-darkens-warnings-reveal-150701769.html?soc_src=social-sh&soc_trk=tw

Trading Strategy:

The recent sell-off looks extreme to me. The news flow from the airlines may be setting up for a bit of a short squeeze moving in to earnings.

DELTA (DAL) earnings swing trading strategy on weekly chart for bullish and bearish trend of trade post earnings #swingtrading $DAL #earnings

After earnings I will trade to the following price targets for Delta pending trade on daily chart below:

Bullish – 58.39

Moderate Bullish – 53.92

Indecisive – 49.41

Moderate Bearish – 44.71

Bearish – 40.22

Intra-Day Trading – 48.56

Each horizontal Fibonacci line, diagonal Fibonacci diagonal trend line and moving average in chart model below are support and resistance decisions as trade trends toward up or down price target.

NETFLIX (NFLX) Earnings Swing Trade Strategy.

“Netflix (NFLX) will report Thursday after the close. NFLX is projected to earn 35 cents/share, and the stock has beaten EPS estimates 85% of the time throughout its history”. Per Bespoke – click here.

Netflix earnings: Can the streaming giant clear a high bar of investor expectations for a change? #swingtrading $NFLX #earnings https://on.mktw.net/2VOoFtx

Netflix (NFLX) earnings swing trading targets for bullish and bearish trend of trade post earnings #swingtrading $NFLX #earnings

After earnings I will trade to the following price targets for Netflix pending trade on daily chart below:

Bullish – 387.24

Bearish – 251.08

Intra-Day Trading – 337.59

Each horizontal Fibonacci line and diagonal Fibonacci diagonal trend line in chart model below are support and resistance decisions as trade trends toward up or down price target.

Netflix (NFLX) 240 min chart I will use for entry timing for my swing trade post earnings $NFLX #swingtrading #earnings

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, $C, $SJR, $BAC, $DAL, $NFLX

Crude Oil Trading Algorithm Report (EPIC) Sun Jan 13 FX: USOIL WTI $CL_F $USO #Oil #Trading #Algorithm

Crude Oil Algorithm Trading Chart Report (EPIC) w/ Machine Trading Sunday Jan 13, 2019.

FX: $USOIL $WTI $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to the oil trading algorithm report. My name is EPIC the Oil Algorithm and I am one of seven primary Algorithmic Chart Models in development at Compound Trading Group (there are over one hundred in total in development at various stages in various markets).

NOTICES:

New members to our oil algorithm charting models, oil trade alerts and oil trading room are encouraged to on-board in a way that equips you as an oil trader for consistent profit.

Visit my public Twitter feed EPIC Oil Algorithm Twitter (@EPICtheAlgo) and review tweets over the last few months, visit our blog and review the recent crude oil trading algorithm blog posts, You Tube channel “how my oil algorithm works”, “how to use my charting”, weekly EIA oil report videos and our website explains how the oil algorithm was developed.

Invaluable are the crude oil trade alerts (available with or without the trading room / weekly report bundle) and the private member crude oil trading chat room on Discord (included in the bundle) and attendance to the live trading room.

The live alerts are important if you are not at your trading screens 24 hours a day and the chat room allows for interactive lead trader oil trade set-ups as each oil trade approaches. All bundle members can access the live oil trading room when active also.

Reviewing important points of reference and engaging the subscription resources will increase your probability of success considerably. This report also includes links to some recent example “how-to” videos.

Oil Trade Coaching – We strongly suggest users of this algorithmic crude oil trading strategy opt for some level of private one-on-one coaching with our lead trader. Our lead trader is maintaining a crude oil trading alert win-rate of over 90% as of Sept 2, 2018 (time-stamped, live alert, recorded).

On our website one-on-one online coaching packages are available (coaching via Skype) or you can request a custom package reflecting the time you wish to invest in learning. To request a custom package suited to your needs email [email protected] or click here for standard private trade coaching packages. Other options for coaching include online webinars, trade coaching bootcamps and private on location (in person) coaching sessions.

Oil Trading Room – How to Use the Oil Algorithm

Oil Trading Room – How to Trade Intra-day with my Algorithmic Oil Charting

Oil Trading Alerts. Live Lead Trader Video Trading w EPIC Oil Algorithm

Recent articles / videos from our blog about how to trade crude oil with our oil trading algorithm (if you are a newer member that needs an unlock code for any of the posts below please email [email protected]):

Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Crude Oil Trading Strategy | Technical Analysis & Guidance.

Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video

Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Protected: Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

For the more articles / videos available visit our Crude Oil Trading Academy : Learn to Trade Oil page here.

MULTI-USERS: Institutional / commercial platform now available on our shop page.

SOFTWARE: My algorithmic charting is now also in the coding phase for our trader’s dashboard program. Please review my algorithm development process, about my oil algorithm story on our website www.compoundtrading.com and my oil algo charting posts on Twitter feed and/or this blog.

HOW MY ALGORITHM WORKS: I am an oil algorithmic model in development. My math is based on traditional indicators (up to fifty at any given time each weighted on win ratio merit – all not shown on chart at any given time) – such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and various other charting, geometric and mathematical factors. I do not yet have AI integration – only math as it relates to traditional indicators with the primary goal being probabilities. I am presented on (and used on) conventional trade charting as one would normally use.

The goal is to provide oil traders with signals for an edge when triggering entries and exits on trades with instruments that rely on the price of crude oil – first with the reporting format as below, then with machine trading functions and an integrated intelligent assisted traders platform that will provide the user with various settings of automation and personal trade execution.

In the weekly report below you will find simplified levels represented on conventional and algorithmic charting for intra-day (day-trading crude oil), swing trading and investing.

This work (and associated trading) should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on with oil related financial instruments.

Forward questions to [email protected], private message our lead trader on Twitter or in the private Discord oil trading room.

For further information this link explains how our algorithmic charting is done, this YouTube video explains in summary how my algorithm works https://www.youtube.com/watch?v=LUNyxFoXJp8 this link for more information about our algorithmic stock charting models and what makes them different than most.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE SIGNAL (ON EVERY VENUE) IS VIDEO RECORDED, ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

Oil Algorithm Observations:

Below is a link for the live algorithmic chart of EPIC the Crude Oil Trading Algorithm (Generation 1, Version 5 including black box modeling). The charting is a real-time trading chart represented on FX USOIL WTI published January 13, 2019.

Click on share button (bottom right beside flag) and when that screen opens click on “make it mine” to view real-time, make edits etc:

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Intra-day crude oil trade. Jan 12 1154 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Note: The holiday anomalies in the chart model are near totally worked through, some remain, but not significant enough to detail.

January 13, 2019

Generation 1 Model Oil Trading Signals

The first most predictable trade are the resistance and support cluster areas formed by long term chart trend lines (see charts that have trend-lines represented in red as made available below near bottom of this report – conventional charting trend-lines).

The second most predictable trade (wide trading range primary resistance and support that become predictable buy and sell triggers). Current algorithmic model wide trading range resistance (grey arrow – grey horizontal line) at approximately 54.45 in the current trading range. Current algorithmic model wide trading range support (grey arrow – grey horizontal line) at approximately 50.80 in the current trading range – these areas are general range support and resistance areas (our algorithm uses a .15 – .20 cent buffer on either side for these trades – if that is exceeded then trading price is likely to use the line as a pivot until a directional trending trade is established).

Trading between the resistance / support horizontal grey lines is extremely profitable risk – reward if one is disciplined to the patience required and follows the trend of trade.

More recently (as of September 2018) our back-testing has shown that the support and resistance areas noted are used in trade as a decision pivot – in other words, the price tends to pivot around these decision points on the chart and coil over a period of time and then spring out of the coil in an upward or downward trend.

The lower trading range is 47.14 – 50.79 and upper trading range 54.46 – 58.07.

Third most predictable trade (support and resistance of uptrend or down trend channels). On the chart an upward trending trade channel is presented and a downward option (channel support and resistance / trading range is represented as diagonal dotted orange lines and purple arrows – as made available, assist in displaying directional trade decision areas).

Fourth most predictable trade (support and resistance of 30 min quadrants). The diagonal lines make up quadrants (in this instance on a 30 min chart) and are represented as orange diagonal lines that make up geometric diamond shapes. These lines also assist in intra-day trade.

Fifth most predictable trade (support and resistance of most applicable Fibonacci) the Fib support and resistance lines are the horizontal lines in various colors with the exception of purple and yellow (see below). These horizontal lines become support and resistance for intra-day trade.

Sixth most predictable trade (support and resistance of historical support and resistance) Natural / historical support and resistance lines shown in purple or yellow – they represent historical support and resistance. The strongest of the historical support and resistance lines are shown in yellow horizontal and are typically accompanied by a yellow arrow marker.

Seventh most predictable trade signal we use are the time and price targets (red circles). When trade is in a significant uptrend or downtrend the targets become very precise and move up the indicator priority list quick.

Tues, Wed and Fri targets are most predictable in extended multi week up-trends or down-trends.

The Eighth most predictable trade is intra-day. You will notice on some of the charting geometric shapes in green on some of my charting (at times). They are charted live in the trading room and at times the lead trader will highlight these areas intra with white outlines (typically geometric shapes such as diamonds or triangles).

Intra-day Trading Bias

Intra day bias is up side trade as the MACD is turned up on the daily chart and this indicator is usually a leading indicator for oil trade on this time-frame. However, after the recent run up in price (since Christmas) and the pressure that came in to oil trade last week it is highly probable pressure continues in to this coming trading week.

Wide Trading Range – Buy and Sell Triggers for Swing Trading Crude Oil:

Swing trading bias / forward guidance as of Jan 13 12:01 AM EST is indecisive for the reasons noted above.

Review the charting and stay on top of the structures that play out in the different time frames. It has everything to do with the time frame you are trading.

Trade the ranges noted above between the thick grey lines (grey arrows) for the most predictable swing trades between 47.14 – 50.79, 50.80 – 54.44, 54.45 – 58.06, 58.07 to 61.69, 61.70 to 65.31, 65.32 to 68.92, 68.93 to 72.54, 72.55 to 76.14 and 76.15 to 79.74. This is a highly profitable risk-reward way to trade oil if you can be patient to trigger at only the break of the wide range charting areas and are disciplined to cut a losing trade that does not prove in your anticipated trend.

Or trade the range between the channel diagonal lines at support and resistance in up or down channel (orange dotted diagonals).

Significantly more advanced trading rules will be introduced over the coming weeks with the newer Machine Trading software development in full swing now.

Channel Trading Scenarios for this Week on the Model Shown on Algorithmic Model:

Follow the red circle targets up or down per the charts below.

THIS WEEK is more unclear than most in that channel trade could occur parallel to the channels noted on the charts below.

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Up channel scenario. Jan 13 1208 AM PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Dwon channel scenario. Jan 13 1210 AM PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Gen 1 and Gen 2 Algorithmic Oil Trading Machine Driven Model Development.

Per recent report example:

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Hidden pivot locations. Oct 25 831 PM FX $USOIL $WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Per recent example;

Crude Oil Trading Algorithm. Gen2.V2 (EPIC). Machine trading intra-day. Sept 17 552 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #Crude #Oil #Algorithm #OOTT

This is an alternate machine trading model currently in development.